-

Manufacturers

- ABB Advant OCS and Advant-800xA

- ABB Bailey

- ABB Drives

- ABB H&B Contronic

- ABB H&B Freelance 2000

- ABB Master

- ABB MOD 300, MOD 30ML & MODCELL

- ABB Procontic

- ABB Procontrol

- ABB Synpol D

- Allen-Bradley SLC 500

- Allen-Bradley PLC-5

- Allen-Bradley ControlLogix

- Allen-Bradley CompactLogix

- Allen-Bradley MicroLogix

- Allen-Bradley PanelView

- Allen-Bradley Kinetix Servo Drive

- Allen-Bradley PowerFlex

- Allen-Bradley Smart Speed Controllers

- 3300 System

- 3500 System

- 3300 XL 8mm Proximity Transducer

- 3300 XL NSV Proximity Transducer

- 990 and 991 Transmitter

- 31000 and 32000 Proximity Probe Housing Assemblie

- 21000, 24701, and 164818 ProbeHousing Assemblies

- 330500 and 330525 Piezo-Velocity Sensor

- 7200 Proximity Transducer Systems

- 177230 Seismic Transmitter

- TK-3 Proximity System

- GE 90-70 Series PLC

- GE PACSystems RX7i

- GE PACSystems RX3i

- GE QuickPanel

- GE VersaMax

- GE Genius I/O

- GE Mark VIe

- GE Series One

- GE Multilin

- 800 Series I/O

- Modicon 984

- Modicon Premium

- Modicon Micro

- Modicon Quantum

- Telemecanique TSX Compact

- Altivar Process

- Categories

- Service

- News

- Contact us

-

Please try to be as accurate as possible with your search.

-

We can quote you on 1000s of specialist parts, even if they are not listed on our website.

-

We can't find any results for “”.

-

-

Get Parts Quote

Excess Industrial Control Stock: Overstock Component Liquidation

If you build and modernize factories long enough, you eventually inherit a stockroom that looks more like a museum than a supply base. I have walked into panels stuffed with orphaned PLC racks after a platform migration, shelves of I/O cards for machines we retired years ago, and pallets of sensors bought “just in case” that never made it to the floor. Those parts tie up cash, create clutter, and quietly accumulate carrying costs. The good news is that surplus does not have to be a sunk cost. With a practical approach to triage, valuation, and the right liquidation channels, excess industrial control stock can be turned into working capital while strengthening uptime for what truly matters.

What “Excess” and “Obsolete” Really Mean in Control Hardware

The distinction is not academic; it drives how you recover value. Excess inventory, as described by Itemit, is stock above current demand that still retains resale potential, often moved at a discount. Obsolete inventory is stock with little to no market value and usually demands steep markdowns or disposal. Both categories absorb space and capital, but obsolete inventory is more harmful because it typically requires write-downs or write-offs and offers limited recovery. Lowry Solutions captures the tradeoff well: surplus can act as a buffer against supply disruptions and demand spikes, but unmanaged overstock erodes margins through storage, handling, insurance, and depreciation.

In real terms for industrial controls, excess might be a shelf of VFDs that are still current but overbought when a line change didn’t materialize. Obsolete could be SLC-era discrete I/O that has limited demand outside maintenance teams keeping legacy equipment alive. The financial difference is meaningful. Amplio notes that idle assets often attract maintenance and preservation costs equal to roughly 9–12% of their value annually, while holding costs can be around 20% of asset value per year when you consider space, deterioration, and administrative overhead. Add the opportunity cost of trapped cash and you see why liquidation has to be part of a professional asset strategy.

Why Overstock Happens in Industrial Controls

It is tempting to blame purchasing, but the roots are typically systemic. AR Racking highlights how poor planning, weak coordination across sales, logistics, and production, and misaligned rotation policies allow excess inventory to accumulate gradually. Forecasting is hard in plants with broad assortments and uneven demand; high service-level expectations push blanket buffers that outgrow actual variability. Multi-warehouse networks optimize locally, yet create global excess. Variable supplier lead times lead teams to over-order to avoid stockouts, and safety stock reviewed only twice a year tends to drift high. As products enter late maturity and decline, failing to taper orders or reduce safety stock invites obsolescence.

On the control side, the cycle is familiar. A platform upgrade strands perfectly good I/O cards and HMIs. A preventive maintenance philosophy multiplies identical spares across sites without cross-visibility. A commissioning schedule slips, but the expedited order for servo drives has already arrived. LSI underscores that inventory is simply cash in another form, and tightening the link between demand planning and replenishment parameters is how you keep liquidity while meeting real-world service levels.

Deciding What to Keep vs What to Liquidate

The fastest way to get pragmatic is to segment. ABC analysis from Sling, Katana, and LSI is a proven starting point. Class A is for high-value, high-impact spares where downtime is expensive; these deserve tighter controls, frequent review, and carefully right-sized safety stock. Class B is mid-tier and benefits from quarterly tune-ups. Class C is low-value, high-volume, and a popular place to find liquidation candidates once you verify cross-site reuse options. ABC, however, is a means to an end; it should inform reorder points, min/max thresholds, and audit frequency rather than sit in a spreadsheet no one opens.

Lowry Solutions recommends sizing buffer stock by item criticality and demand variability, not one-size-fits-all targets. That guidance holds especially true for controls. A single safety-rated interlock might be worth more coverage than five general-purpose proximity sensors. Pair that with cycle counting and aging reports to surface slow movers before they cross the line into obsolete. Katana and Netstock frame the broader methods well: use FIFO to avoid age-related obsolescence on items with firmware and batteries, deploy JIT only where suppliers are reliable, and use EOQ to balance order and holding costs on expensive components. In practice, this is not an accounting exercise. It is an installed-base review, a maintenance strategy conversation, and a system parameter tune-up rolled into one.

A Controls-Focused Triage Playbook

The first practical move is to create a centralized register of surplus candidates. APS Industrial Services and Workers.com both emphasize the essentials: document make, model, and serial, record condition and hours or duty cycle where applicable, attach photos, and gather manuals and service history. While you do that, map internal demand. Amplio stresses that cross-facility redeployment is one of the fastest ways to turn idle parts into uptime and avoid new purchases. As a veteran integrator, I have seen redeployment pay off in days. A plant with a downed conveyor had a compatible VFD in another site’s “just-in-case” cabinet; shipping it overnight saved a week of expedited lead-time and a lot of overtime.

When you must keep spares for risk mitigation, document the explicit rationale and the targeted quantity. Then flag the remainder for liquidation before it ages out of relevance. Tying those decisions to maintenance strategies, service-level targets, and forecasted retirements of legacy cells keeps the conversation grounded.

Valuation That Stands Up to Scrutiny

Price discovery is not a guess. RDO Equipment points to three useful appraisal anchors: orderly liquidation value when you have time to sell, forced liquidation value when you need speed, and retail pricing when you are marketing to end users. Aaron Equipment offers a practical rule of thumb many of us have seen borne out: used equipment typically sells for about half—or less—of the new price, depending on age, condition, hours, brand, and demand. For industrial controls components, there are exceptions on both sides. Late-model, sealed PLC modules in discontinued families can command premiums from maintenance teams supporting legacy lines, while commodity sensors with high new availability often trade at deeper discounts.

INV Recovery and APS Industrial Services both advocate objective valuation steps: analyze market demand and comparable sales, account for depreciation and remaining useful life, and seek third-party appraisals when the stakes are high. Preparation matters as much as price. Aaron Equipment and M&M Equipment emphasize the impact of clean presentation and complete documentation. In our projects, simple steps—replacing fans and filters on VFDs, bench-testing PLC cards with a logged pass report, and bundling mounting hardware—consistently increased recovery and buyer confidence, while reducing post-sale friction.

Selecting the Right Liquidation Channel

There is no universal best channel; there is a best fit for your constraints, asset mix, and timeline. Auctions, private sale, specialist brokers, consignment, online marketplaces, OEM trade-ins, and internal redeployment or donation each have merits. INV Recovery, Amplio, APS Industrial Services, Aaron Equipment, and RDO Equipment collectively describe how speed, recovery, effort, and compliance vary by route. The comparison below reflects those practice-based patterns.

| Channel | Typical Speed | Recovery Potential | Effort and Control | Best For | Watch-outs |

|---|---|---|---|---|---|

| Online or on-site auction | Fast, date-certain | Moderate, market-driven | Lower control; simple logistics | Mixed lots, fast timeline | Price uncertainty; fees; as-is expectations |

| Private/direct sale | Moderate | Higher with right buyer | High control; more time | High-demand PLCs/HMIs, late-model VFDs | Requires marketing, demos, negotiation |

| Specialist dealer/broker | Fast to moderate | Moderate | Low effort; predictable | Trade-ins, non-core packages | Limited upside; margin to intermediaries |

| Consignment | Slow to moderate | Often higher for niche items | Outsourced execution | Large sets, specialized controls | Longer cycle; storage fees; contract terms |

| Online marketplace | Moderate | Variable by curation | Medium effort | Sealed spares, standardized parts | Fraud risk; payment and returns handling |

| OEM trade-in | Fast when upgrading | Value in credits | Low effort; aligned to upgrades | Platform migrations | Credit use restrictions; valuation opaque |

| Internal redeployment | Immediate | Highest effective value | Cross-site coordination | Common spares with cross-compatibility | Governance needed to prevent re-hoarding |

| Donation/recycling | Immediate to moderate | Non-cash or tax benefit | Documentation needed | Usable but slow-moving items | Data sanitization; e-waste compliance |

Two practical notes apply across all channels. First, wipe configuration and data on PLCs, HMIs, industrial PCs, and IIoT gateways to protect intellectual property, as Workers.com advises; include a record of the wipe in your documentation packet. Second, quality photos, condition notes, pass/fail test results, and a clear bill of materials meaningfully increase buyer trust and reduce time-wasting back-and-forth, as M&M Equipment highlights.

Execution: From Cabinets to Cash Without Drama

A disciplined disposition plan looks simple on paper and is worth writing down. INV Recovery proposes four pillars—identify, value, select channel, execute—with controls-specific rigor layered in. Identification builds your register and surfaces redeployment. Valuation anchors expectations and informs channel selection. Channel choice balances speed and recovery with your team’s bandwidth. Execution is where you harvest value and avoid surprises.

In execution, small details matter. Bag static-sensitive components and label antistatic packaging to prevent returns from ESD damage. Include firmware versions on control modules so buyers know compatibility at a glance. Stage bundles that clear related slow movers efficiently, a tactic supported by Extensiv and Unleashed Software in the context of inventory reduction. When timelines allow, use dynamic pricing during a remarketing period to test demand, a strategy common on auction and marketplace platforms highlighted by Aaron Equipment and RDO Equipment. Most importantly, close the loop with documentation: disposal confirmations, redeployment notes, sales receipts, and donation acknowledgments need to align with finance and compliance.

Compliance, Sustainability, and Reputation

Liquidation is not just a sales activity; it is a compliance event. Chain-of-custody records protect you and the buyer. Data-bearing devices must be sanitized or destroyed according to policy. Environmental responsibility requires certified recycling for unusable e-waste. APS Industrial Services points to an upside beyond risk management: formal asset recovery programs often recapture 3–5% of annual capital spend, as reported by the Reverse Logistics Association, while supporting sustainability goals.

There is also a customer and brand dimension. Stockouts on production-critical parts undermine trust, while overstocking saps agility. Harvard Business Review research, cited by OneSilq, shows that 21–43% of shoppers switch brands during a stockout; the industrial analog is a maintenance team seeking an alternative vendor after one too many backorders. Getting safety stock right by item criticality and variability, per Lowry Solutions, threads the needle between resilience and bloat. Donating usable items to vocational programs and nonprofits offers community impact and potential tax benefits, as both INV Recovery and Amplio note, and can reduce space costs faster than a drawn-out sale on marginal items.

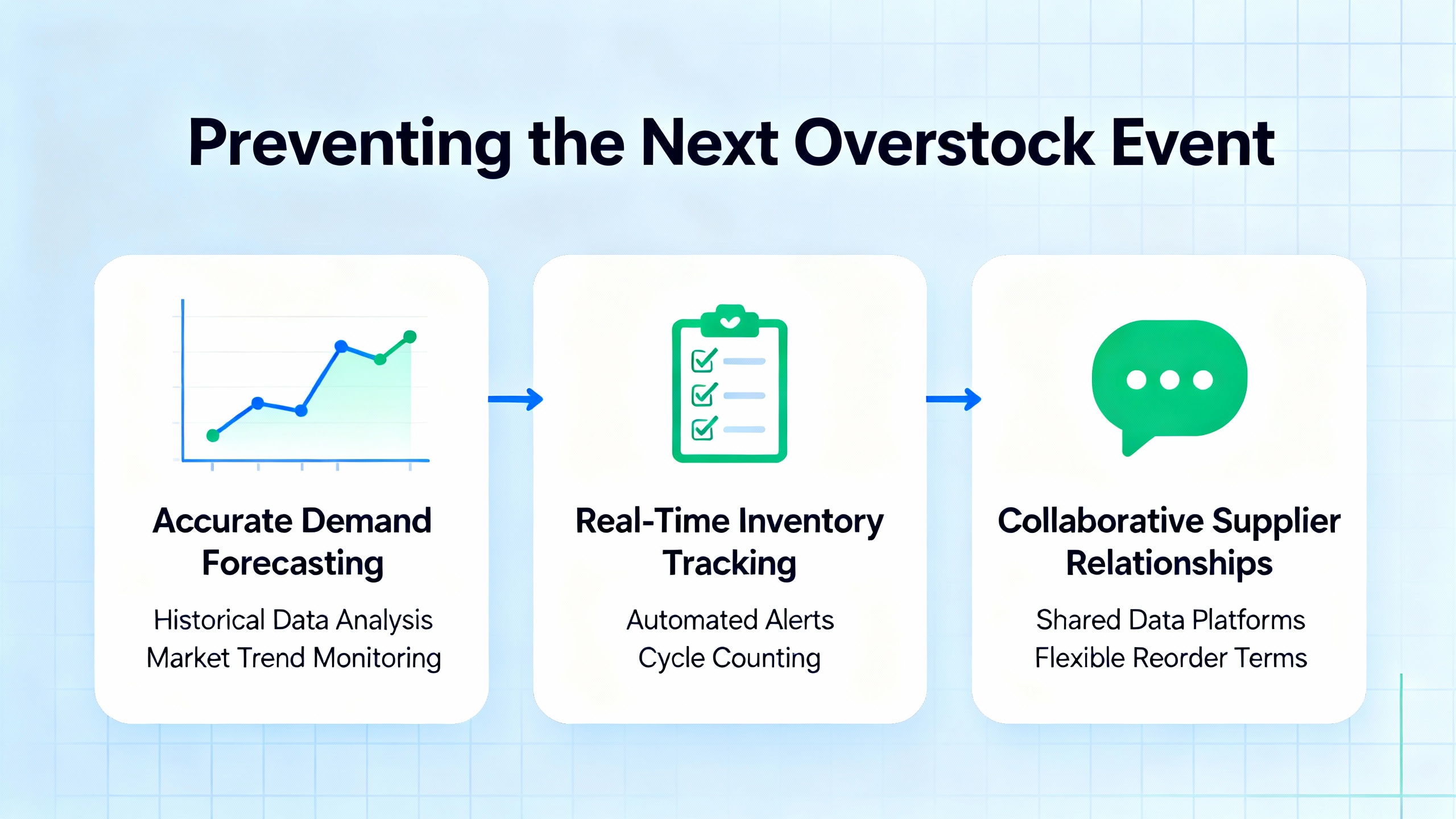

Preventing the Next Overstock Event

Every liquidation should inform prevention. Start by resetting replenishment parameters. If reorder points, min/max thresholds, and safety stock were set and forgotten, that is a root cause. Netstock and LSI recommend aligning those controls with current lead times, service targets by SKU, and real demand signals. ABC analysis should drive tighter service levels on A items and leaner rules for C items. Cycle counting and aging buckets expose slow movers early—address them with promotions, bundling to attach to fast movers, or channel shifts before they become write-offs, as Unleashed Software and Extensiv advocate.

On the methods side, keep FIFO discipline, especially for items with firmware, batteries, or feature depreciation over time, a point reinforced by Katana. Adopt JIT selectively where suppliers are truly dependable and demand is stable, because the vulnerability to disruption is real. EOQ is useful for high-cost inputs to quantify the balance between ordering cost and holding cost, but treat the math as a guide, not gospel. Consider dropshipping or vendor-managed options only for non-critical, predictable items where delivery risk is acceptable, an approach Sling and Netstock note can reduce carrying costs without creating new downtime risk.

Technology and cadence matter. A cloud-based inventory system to centralize counts, locations, and valuations reduces human error and enables real-time visibility, themes repeated by Sling, Katana, LSI, and Extensiv. Barcode or RFID tracking improves accuracy and shrinks the time between a count and a decision. Quarterly parameter reviews are often more realistic than monthly for most plants and are far better than annual resets that let buffers drift. Cross-functional tag-ups between maintenance, engineering, purchasing, and operations shorten the feedback loop when demand shifts after a line change or product mix adjustment.

Finally, recognize lifecycle inflection points. Slimstock reminds us that excess can emerge in any lifecycle stage, not just phase-out. Initial buys for new platforms should be conservative and revisited as real usage data accrues. As a product enters maturity, reduce service levels and safety stock deliberately; as decline sets in, plan the run-down and line up disposition channels early to avoid a wall of obsolescence.

Financial and Operating Metrics That Actually Drive Behavior

Measurement aligns teams and keeps surplus from creeping back. LSI proposes a practical set of KPIs, and APS Industrial Services adds asset-recovery metrics that make finance partners comfortable. The following table summarizes a control-friendly scoreboard that balances cash, service, and speed.

| Metric | What It Tells You | Why It Matters |

|---|---|---|

| Inventory turnover | How quickly stock converts to usage/sales | Higher turnover frees cash and reduces aging risk |

| Days Inventory Outstanding | Days of stock on hand | Lower DIO accelerates cash conversion and reduces carrying cost |

| Carrying cost percentage | Cost to hold stock relative to value | Forces attention on space, insurance, maintenance, and risk |

| Sell-through rate | Portion of listed surplus sold in a period | Gauges liquidation channel effectiveness |

| Aging buckets | Stock by time-on-hand segments | Flags slow movers before they become write-offs |

| Recovery vs book/fair value | Cash recovered relative to value anchors | Tests pricing, preparation, and channel selection |

| Time-to-disposition | Days from identification to exit | Highlights process friction that adds cost |

| Internal redeployment savings | Avoided purchase value from transfers | Demonstrates why reuse beats buying new |

A simple monthly dashboard, kept honest by cycle counts and validated with finance, sustains momentum. One practical discipline that has worked well in our programs is to publish a short narrative alongside the metrics, explaining wins and misses. It turns numbers into decisions and helps teams learn which levers—pricing, bundling, channel shifts—actually move the needle.

A Controls-Focused Example to Illustrate the Flow

Consider a plant family that standardizes on a new PLC platform, leaving three sites with mixed legacy racks, I/O, and HMIs. The central team builds a surplus register with photos, firmware versions, and pass-test notes for each module. Redeployment fills two urgent maintenance gaps at another facility, saving a purchase and a production delay. Items with healthy demand go to a specialist broker with a consignment agreement to maximize recovery on a longer timeline. Commodity sensors and cables move through an online marketplace with dynamic price adjustments over a four-week campaign. A pallet of worn but refurbishable VFDs routes to an auction with a date-certain sale. The finance team books credits from an OEM trade-in for a portion of the legacy upgrade, and late-cycle, marginal pieces are donated to a technical school with appropriate data sanitization and chain-of-custody. Across the portfolio, retail expectations are tempered by Aaron Equipment’s observation that used equipment typically sells for about half of new. Appraisal anchors like orderly liquidation value and forced liquidation value, as defined by RDO Equipment, help set reserves and decide where speed is worth the discount. The program recovers cash, frees floor space, and, per the Reverse Logistics Association cited by APS Industrial Services, contributes to a formal asset recovery effort that can recapture a material slice of annual capex.

FAQ

Q: How do I draw the line between excess and obsolete control components without undercutting reliability? A: Start with ABC analysis to identify the small set of parts that truly protect uptime and size safety stock by variability and criticality rather than blanket targets, as Lowry Solutions recommends. Treat the remainder as candidates for redeployment or liquidation before age and firmware drift erode value, a distinction Itemit stresses in its definitions.

Q: Should I use FIFO or LIFO in a controls environment? A: Operationally, FIFO protects against age-related obsolescence by moving older stock first, a method Katana describes as standard for items at risk of degradation. In accounting, LIFO may have tax effects, but it increases the risk that older control stock sits and devalues. Most plants favor FIFO for both operational sanity and resale potential.

Q: When is an auction better than a broker or direct sale? A: Auctions compress time and guarantee a sale date, which is valuable when you are closing a site or clearing space. Brokers and direct sales can yield higher recovery on scarce, high-demand items but demand more time and preparation. INV Recovery, Amplio, and Aaron Equipment note that a blended strategy across asset types is usually optimal.

Q: What documentation actually moves the price? A: Buyers of control hardware respond to clear photos, pass/fail bench test results, service histories, and honest condition notes, practices championed by M&M Equipment and Aaron Equipment. Include manuals, firmware versions, and mounting hardware. The presentation reduces perceived risk and supports better pricing.

Q: What risk do I run if I skip data wiping? A: Configuration files on PLCs, HMIs, and industrial computers can expose recipes, IP, and security footprints. Workers.com underscores making data sanitization part of decommissioning. It protects the business and widens your buyer pool by removing a common objection.

Closing

Overstock liquidation is not housekeeping; it is a lever for reliability and cash flow when you run controls for a living. Treat spares as strategic, put a simple disposition engine behind your surplus, and let the data tune your parameters going forward. If you want a steady partner who has cleaned more than a few cabinets and turned them into dollars, I’m ready to help you do it quickly, cleanly, and without risking uptime.

References

- https://invrecovery.org/streamlining-efficiency-best-practices-in-corporate-surplus-asset-disposition/

- https://www.theindustryleaders.org/post/how-to-manage-surplus-assets-efficiently-and-boost-your-bottom-line

- https://www.corvus-robotics.com/blog121123-5waysoptimize

- https://www.amplio.com/post/industrial-surplus

- https://www.apsindustrialservices.com/blog/asset-recovery-strategies-turn-surplus-equipment-materials-into-profit

- https://www.charcap.com/guide-managing-surplus-equipment/

- https://www.extensiv.com/blog/inventory-management-techniques

- https://www.genie.io/blog-articles/strategies-for-effective-management-of-excess-inventory

- https://itemit.com/managing-obsolete-inventory/

- https://katanamrp.com/inventory-management-methods/

Keep your system in play!

Related articles Browse All

-

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu...

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu... -

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ...

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ... -

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

Need an automation or control part quickly?

- Q&A

- Policies How to order Part status information Shipping Method Return Policy Warranty Policy Payment Terms

- Asset Recovery

- We Buy Your Equipment. Industry Cases Amikong News Technical Resources

- ADDRESS

-

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

Copyright Notice © 2004-2026 amikong.com All rights reserved

Disclaimer: We are not an authorized distributor or distributor of the product manufacturer of this website, The product may have older date codes or be an older series than that available direct from the factory or authorized dealers. Because our company is not an authorized distributor of this product, the Original Manufacturer’s warranty does not apply.While many DCS PLC products will have firmware already installed, Our company makes no representation as to whether a DSC PLC product will or will not have firmware and, if it does have firmware, whether the firmware is the revision level that you need for your application. Our company also makes no representations as to your ability or right to download or otherwise obtain firmware for the product from our company, its distributors, or any other source. Our company also makes no representations as to your right to install any such firmware on the product. Our company will not obtain or supply firmware on your behalf. It is your obligation to comply with the terms of any End-User License Agreement or similar document related to obtaining or installing firmware.

Cookies

Individual privacy preferences

We use cookies and similar technologies on our website and process your personal data (e.g. IP address), for example, to personalize content and ads, to integrate media from third-party providers or to analyze traffic on our website. Data processing may also happen as a result of cookies being set. We share this data with third parties that we name in the privacy settings.

The data processing may take place with your consent or on the basis of a legitimate interest, which you can object to in the privacy settings. You have the right not to consent and to change or revoke your consent at a later time. This revocation takes effect immediately but does not affect data already processed. For more information on the use of your data, please visit our privacy policy.

Below you will find an overview of all services used by this website. You can view detailed information about each service and agree to them individually or exercise your right to object.

You are under 14 years old? Then you cannot consent to optional services. Ask your parents or legal guardians to agree to these services with you.

-

Google Tag Manager

-

Functional cookies

Leave Your Comment