-

Manufacturers

- ABB Advant OCS and Advant-800xA

- ABB Bailey

- ABB Drives

- ABB H&B Contronic

- ABB H&B Freelance 2000

- ABB Master

- ABB MOD 300, MOD 30ML & MODCELL

- ABB Procontic

- ABB Procontrol

- ABB Synpol D

- Allen-Bradley SLC 500

- Allen-Bradley PLC-5

- Allen-Bradley ControlLogix

- Allen-Bradley CompactLogix

- Allen-Bradley MicroLogix

- Allen-Bradley PanelView

- Allen-Bradley Kinetix Servo Drive

- Allen-Bradley PowerFlex

- Allen-Bradley Smart Speed Controllers

- 21500 TDXnet Transient

- 3300 System

- 3500 System

- 990 and 991 Transmitter

- 31000 and 32000 Proximity Probe Housing Assemblie

- 21000, 24701, and 164818 ProbeHousing Assemblies

- 177230 Seismic Transmitter

- TK-3 Proximity System

- 330500 and 330525 Piezo-Velocity Sensor

- 7200 Proximity Transducer Systems

- GE 90-70 Series PLC

- GE PACSystems RX7i

- GE PACSystems RX3i

- GE QuickPanel

- GE VersaMax

- GE Genius I/O

- GE Mark VIe

- GE Series One

- GE Multilin

- 800 Series I/O

- Modicon 984

- Modicon Premium

- Modicon Micro

- Modicon Quantum

- Telemecanique TSX Compact

- Altivar Process

- Categories

- Service

- News

- Contact us

-

Please try to be as accurate as possible with your search.

-

We can quote you on 1000s of specialist parts, even if they are not listed on our website.

-

We can't find any results for “”.

Obsolete Emerson DeltaV Components: Discontinued System Parts Without Discontinued Production

The Quiet Risk Inside Your DeltaV Cabinets

Walk into almost any mature plant and open a DeltaV cabinet and you see the same story playing out. Controllers that went in 15 to 20 years ago, I/O cards that have been limping along through multiple turnarounds, a server still tied to an operating system that IT retired a decade ago. On the surface, production looks fine. Underneath, obsolescence risk is accumulating.

Moore’s Law and the broader pace of electronics change mean automation hardware inevitably falls out of mainstream production. An article from Applied Manufacturing points out that this constant march of computing capability is a major driver of obsolescence across industries. OEMs understandably focus their engineering resources on the newest, fastest, most efficient platforms. Support and manufacturing for older systems begin to taper off, and eventually you are left with a shrinking pool of spare parts and expertise.

For Emerson DeltaV, this is not an abstract concept. You have very real questions to answer. Which modules in your cabinet are simply “old” versus truly obsolete? How do you keep a plant running when the only replacement you can find is a used controller from a surplus dealer? When do you stop buying spares and commit to a modernization project?

As a systems integrator who has been asked many times to “keep this DeltaV system running another five years,” I have learned that the worst position is reacting after the fact. The plants that win treat obsolete DeltaV components as a lifecycle risk to be managed, not a surprise to be endured. The goal is simple: keep the process safe and reliable today while positioning yourself for an orderly migration tomorrow.

This article lays out how to think clearly about discontinued DeltaV hardware, what the term “obsolete” really means in a DeltaV context, and pragmatic strategies to source parts, manage spares, and plan migrations without gambling your production on the last good module in the warehouse.

What “Obsolete” Really Means in a DeltaV World

A common mistake I see is treating any older DeltaV module as obsolete the moment Emerson releases a new series. In reality, there are several distinct lifecycle states, and confusing them leads either to unnecessary panic or to dangerous complacency.

A discussion on Emerson’s user community made an important distinction. Many DeltaV parts are superseded by newer hardware, especially I/O cards that have Series 2 replacements. Those older cards are not automatically obsolete. They remain compatible with current DeltaV software and can continue to run in modern systems. From a plant’s perspective, they are not your first choice for new designs, but they are still viable in service.

The same discussion suggested reserving the word “obsolete” for hardware that can no longer be used with the current DeltaV version at all. Under this stricter definition, the only items specifically called out were certain very old DeltaV controllers that are incompatible with current DeltaV releases. The controllers identified were the M2, M3, M5, and M5+ models. Once your control system or project has standardised on current DeltaV software versions, those controller types are effectively out of play.

To manage DeltaV lifecycle risk sensibly, it helps to use consistent terminology.

Practical Definitions for DeltaV Components

In practice, four categories are useful when you review your installed base.

Supported in production means the hardware is still manufactured or fully supported by Emerson for new projects and existing systems. Firmware updates and formal documentation are current, and standard spare parts programs cover these modules.

Superseded but compatible refers to hardware that has been replaced in the catalog by a newer series yet remains supported in the current DeltaV software. Classic I/O modules that have newer equivalents fall into this category. They may not be recommended for new projects, but they are valid for existing installations and still available as spare parts through OEM or reputable third parties.

Obsolete and incompatible covers equipment that the current DeltaV software no longer supports. The older controllers mentioned earlier are a prime example. They might still be running in legacy systems, but if you want to move to newer DeltaV versions, you cannot carry these forward. Obsolescence in this sense is a strict functional boundary: the hardware will simply not operate in a modernized system.

Legacy but confined describes equipment that might be obsolete for new DeltaV environments but is intentionally kept alive in an isolated legacy system. Plants sometimes maintain a small DeltaV island or separated controller environment at older software levels purely to support a specific unit until a full modernization can be executed. This is a conscious tactical choice, not a recommended long‑term strategy.

To keep these categories straight, it can help to put them side by side.

| Status | DeltaV meaning | Typical risk level | Common action |

|---|---|---|---|

| Supported in production | Current catalog hardware, fully supported by DeltaV software and services | Lowest | Standard spares via Emerson lifecycle services and warranty programs |

| Superseded but compatible | Older series replaced by new hardware but still supported by current DeltaV versions | Moderate, rising over time | Maintain spares, plan phased replacement, avoid for new designs |

| Obsolete and incompatible | Cannot be used with current DeltaV software (for example, M2/M3/M5/M5+ controllers) | High | Replace or isolate, treat as urgent migration candidate |

| Legacy but confined | Kept alive on older software in a tightly scoped, isolated system | High, but contained | Define exit date; plan and budget for full migration |

When you treat “obsolete” as “no longer functional in the present platform,” your risk picture becomes much clearer. Age alone is not the metric that matters; compatibility and supportability are.

Typical Pain Points with Discontinued DeltaV Hardware

Not all obsolete DeltaV components create the same operational pain. Controllers, I/O, servers, networks, and power all fail in different ways and at different speeds. Several technical articles and field guides give a realistic picture of what tends to go wrong.

Controllers and I/O Cards Near the End of Life

A detailed guide on DeltaV hardware from Amikong describes how failing I/O cards typically do not die cleanly. Instead, they generate diagnostic “chatter” in the Event Chronicle. You see repeated “I/O Input Failure” followed by “Error Cleared” messages that may not yet trigger bad‑quality alarms, but they are a strong signal that the card is on its way out.

As degradation continues, symptoms escalate. Modules can show a “BAD” status in DeltaV diagnostics. Channel LEDs or the main module LED may blink abnormally, and in some cases the card slot might be reported as “Empty” even though a card is physically present. These behavior patterns often come with FAILED_ALM or COMM_ALM hardware alarms.

Experienced engineers know that replacing the card is only part of the story. The same Amikong guidance stresses the importance of root cause analysis. If you see similar issues across all cards in a rack, the real culprit may be power supply or backplane problems. If you see repeated failures on the same discrete channel, the issue might be in the field wiring, such as induced voltage or a grounding problem. Cases of board delamination or metallic “whiskers” on components often indicate environmental issues like contaminated air or poor HVAC.

DeltaV controllers are even more critical. They are effectively the brain of the plant, executing all control logic and advanced applications. Modern DeltaV controllers incorporate embedded learning and diagnostics to detect process issues such as sticky valves. When controllers age, failure risk goes beyond a simple module replacement; it threatens both process stability and the integrity of your data.

Many plants sensibly deploy redundant controllers, with active and standby units designed for bumpless transfer. However, the very success of this strategy can mask failures. When the primary controller dies and the standby takes over cleanly, no one feels the impact, and the plant can run for months unknowingly “on the last leg.” At that point, a second failure means a full unit shutdown. With industry sources citing unscheduled downtime costs around $260,000 per hour on average, and up to $5,000,000 per hour in high‑risk industries, running on a single healthy controller is not a trivial risk.

Servers, Workstations, and Software Compatibility

Obsolescence is not limited to the hardware on the DIN rail. Servers and operator workstations face their own lifecycle curve. In many plants I visit, the engineering workstation is tied to an operating system that IT retired years ago. Patching is risky, driver support is limited, and end users keep old laptops around purely because they still run the right serial drivers and DeltaV configuration software.

Both the Applied Manufacturing article on obsolete components and an Emerson troubleshooting article highlight how software updates and new operating systems can break communication with older control hardware. At some point, it becomes increasingly difficult to keep a modern, secure client environment talking reliably to a legacy controller or server. That is one reason Emerson offers lifecycle services and has catalog entries under names such as DeltaV Obsolete Server Replacement. The catalog confirms that Emerson recognizes server obsolescence as a distinct problem, even though the captured public text for that specific entry mainly exposes e‑commerce controls rather than technical details.

When you weigh options, you must consider not only whether the server still boots, but whether it can run a supported operating system, receive security patches, and host the DeltaV versions your plant needs without sacrificing cybersecurity and compliance. Emerson’s Guardian platform illustrates how seriously the vendor takes this problem. Guardian has been in use for almost two decades as a central portal for asset lifecycle data, security advisories, and software updates, and it even tests monthly Microsoft security updates against known DeltaV configurations before presenting curated patch sets.

Networks, Power, and Supporting Infrastructure

A separate troubleshooting guide from IDS, focused on DeltaV DCS issues, drives home that many failures blamed on “mystery controller problems” are actually infrastructure issues. Communication errors, delayed data, or intermittent link failures often trace back to noisy or poorly designed networks. Common culprits include electromagnetic interference, dirty or loose terminations, and congested network segments.

The same guidance emphasizes the importance of shielded and properly grounded cabling, structured network design, traffic segmentation, and prioritization of critical control data. Power quality is equally important. Instability, noise, or outright failures in the power supply threaten the entire DCS. IDS recommends redundant power feeds, uninterruptible power supplies, surge protection, and continuous monitoring of power health, along with routine testing of backup systems and batteries.

These elements interact with obsolescence in two ways. First, aging power modules and network hardware may themselves be discontinued, making replacement harder. Second, marginal infrastructure accelerates failure of your already scarce legacy components by subjecting them to stress beyond their design assumptions.

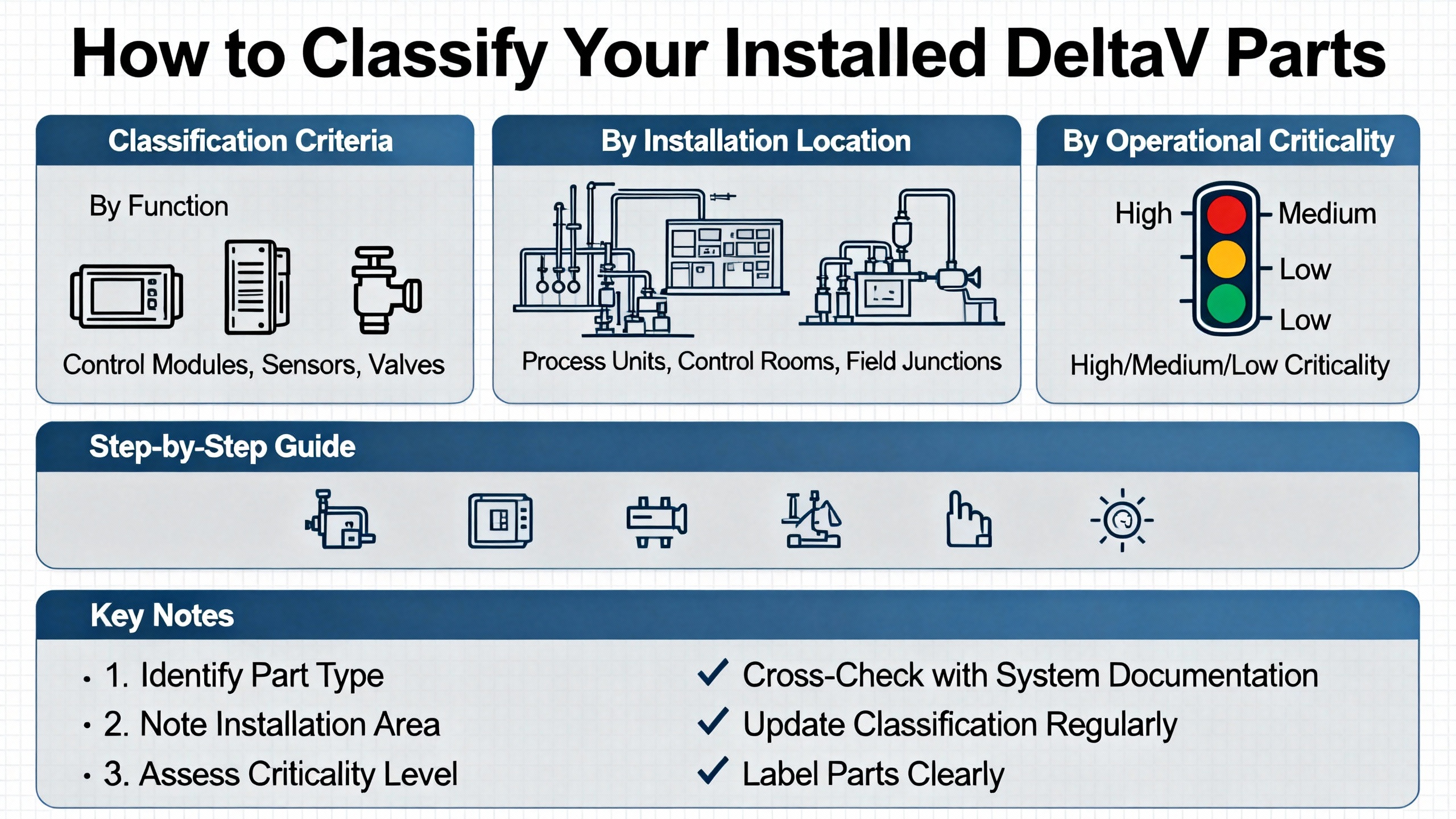

How to Classify Your Installed DeltaV Parts

Before you can manage obsolete DeltaV components, you need an accurate picture of what you have. That sounds obvious, but many plants skip this step and go straight to “we need spares.” A structured classification workflow pays off quickly.

Start with a clean inventory. Guidance from Secure Components and Industrial Electrical Warehouse stresses the value of physically reconciling what sits on shelves and in cabinets with your asset records. Identify slow‑moving or dormant items and verify that part numbers, revisions, and conditions are correctly recorded.

Next, classify each DeltaV item using the lifecycle categories described earlier. For controllers and I/O, cross‑reference your installed part numbers with Emerson lifecycle information where available. The EmersonExchange discussion about obsolete controllers shows why this matters. If you discover M2, M3, M5, or M5+ controllers in service, you know they are fundamentally incompatible with current DeltaV releases and must be prioritized for migration or isolation.

Complicating matters, DeltaV part numbering can be confusing. A post from DCS Center illustrates this using an MX controller that carries multiple identifiers. The box might show a modern VE‑series part number such as VE3007 alongside older Fisher Rosemount numbers like KJ2005X1‑BA1 and 12P4375X022. The physical device itself may be labeled only with the older codes. When you are sourcing replacements or building an inventory list, this mismatch between packaging and nameplate can lead to wrong orders or misclassified spares.

Specialists like DCS Center have taken it upon themselves to compile cross‑reference tables for these old and new DeltaV part numbers. Whether you leverage that type of independent database, work through Emerson, or use your own internal mapping, the key is to normalize your identifiers so that your maintenance system, procurement, and shelf labels all agree on what a given module actually is.

Once you have a normalized, classified inventory, you can assign risk levels and actions. Superseded but compatible I/O cards might be safe to run but warrant a spare on the shelf. Obsolete controllers that block your ability to upgrade should be tagged as high priority and tied explicitly to modernization plans. Legacy but confined hardware should carry a clearly defined retirement date so it does not become a forgotten island that quietly accumulates risk and technical debt.

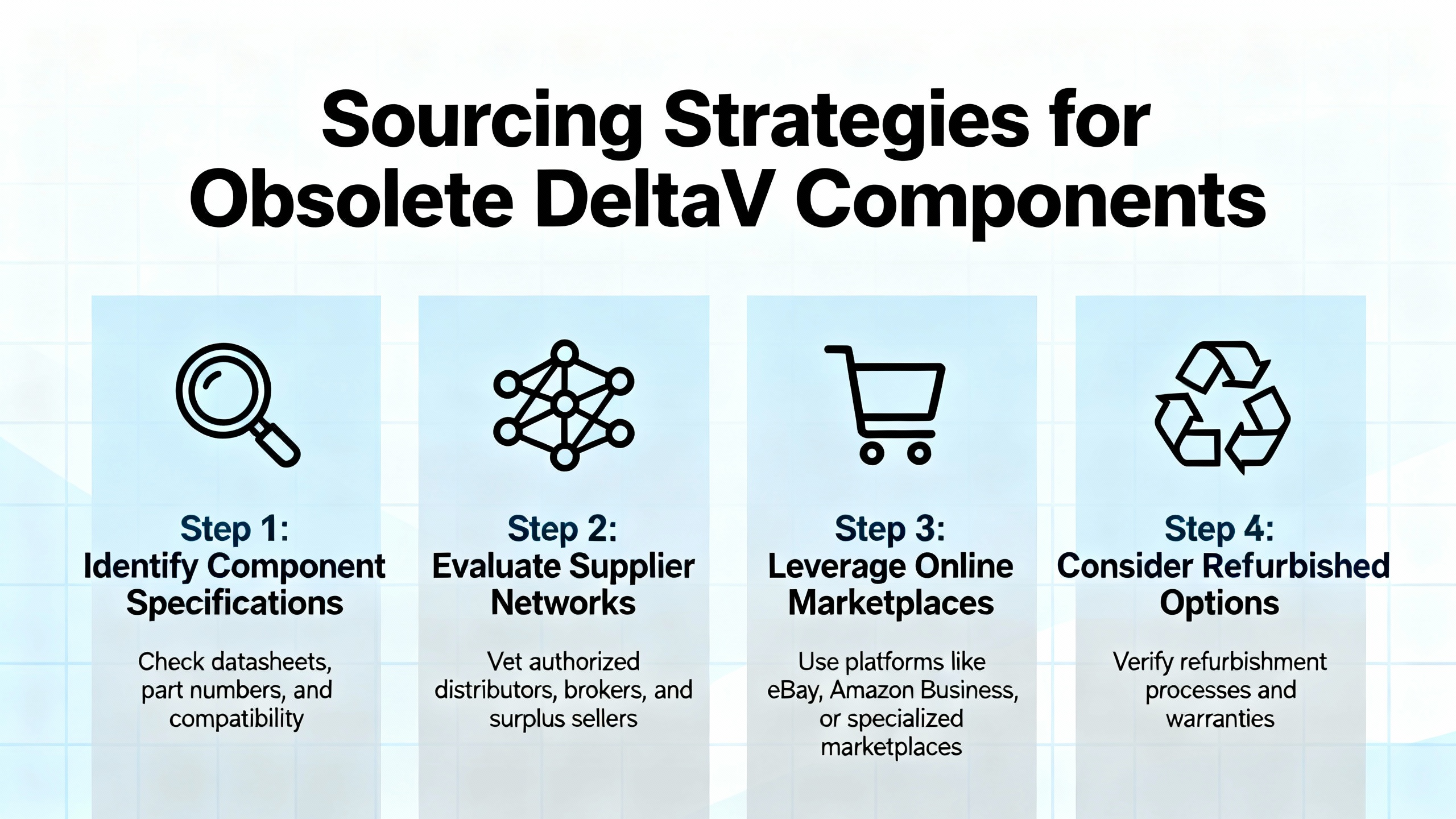

Sourcing Strategies for Obsolete DeltaV Components

When a critical DeltaV module fails and you discover it is discontinued or backordered, you have several sourcing paths. Each comes with different trade‑offs in cost, risk, and speed.

It is helpful to think about these in terms of OEM lifecycle services, specialist third‑party suppliers, open surplus markets, and repair or refurbishment.

| Sourcing route | Typical advantages | Key watchpoints |

|---|---|---|

| Emerson lifecycle services | Known compatibility, firmware alignment, formal warranty, lifecycle data | Higher unit price, potential lead times for older items |

| Specialist DeltaV suppliers | Large multi‑brand inventories, cross‑references, extended warranties | Verify quality processes and test coverage |

| General surplus and marketplaces | Lowest upfront price, last‑chance source for rare items | High counterfeit or condition risk, limited recourse on failures |

| Repair and refurbishment | Keeps rare modules in circulation, may be faster than sourcing new parts | Limited remaining life, must vet repair quality and test rigor |

Working with Emerson Lifecycle Services

Emerson’s own spare parts management offerings, highlighted in DeltaV lifecycle services materials and the “5Ps of Control System Reliability and Performance” series, take a data‑driven approach. Rather than guessing at spares, Emerson uses reliability intelligence such as mean time between failures, field failure data, and logistics information to recommend the right level of on‑site spares.

The Spare Parts Calculator App combines these inputs with product lifecycle status and country‑specific transit times to generate an “in‑stock probability” for different stocking levels. That gives you a rational way to balance the cost of inventory against the risk and expense of downtime.

Extended hardware warranty programs for DeltaV hardware add another dimension. Emerson’s extended warranty service covers critical spare parts across DeltaV DCS, safety instrumented systems, and standalone controllers, committing to replace failed assemblies with new or factory‑repaired units at no additional cost, typically with a one‑year warranty on replacements and rapid shipment after material return. When used properly, these programs let you reduce on‑site inventory while maintaining confidence that you can recover quickly from failures.

Quick‑response shipping offerings such as 24/7 emergency and expedited programs further support this model, especially when combined with local Emerson offices that act as your first contact for non‑stocked parts and can reach into a global inventory network.

For genuinely obsolete items, Emerson sometimes offers targeted replacement kits or products positioned explicitly for legacy upgrades, as suggested by catalog entries labeled as obsolete server replacements and similar. Even when the publicly visible catalog text is sparse, working through Emerson’s lifecycle team often uncovers options beyond the standard online listings.

Specialist Third‑Party Suppliers

The OEM is not your only option. Several reputable firms focus specifically on legacy and obsolete automation hardware, including DeltaV.

Amikong, for example, positions itself as a specialist in discontinued and surplus DCS hardware and reports maintaining more than 30,000 spare parts, including new and obsolete DeltaV modules. They emphasize thorough testing, environmental screening for issues such as corrosion or capacitor damage, and a one‑year warranty on refurbished or surplus parts, backed by 24/7 technical support and global logistics.

Classic Automation operates a multi‑vendor marketplace with tested automation parts from many manufacturers. Their catalog includes Emerson DeltaV parts as part of a broader collection that spans control, measurement, motion, and power equipment. They highlight a two‑year warranty on supplied parts, with all hardware tested by their internal technical staff before shipment.

Industrial Electrical Warehouse discusses more generally how specialized obsolete‑parts suppliers add value by maintaining large multi‑brand inventories, using manufacturer cross‑reference guides, and verifying authenticity to avoid counterfeits. In a DeltaV context, that means a good supplier can look at your old KJ‑series or Fisher Rosemount code and translate it into a compatible modern part, or find a surplus module that matches form, fit, and function.

These specialist channels tend to sit between OEM and open surplus in terms of price. You pay more than an anonymous online auction, but you receive testing, warranty, and technical support that are hard to find elsewhere.

Surplus Marketplaces and Auctions

Sometimes your only option for a truly rare DeltaV module is the open surplus market. Articles from Applied Manufacturing and Secure Components acknowledge that online marketplaces and auction sources can be useful for clearing out or acquiring obsolete stock, but they also stress the risks.

Used modules may have unknown service histories, hidden environmental damage, or be outright counterfeit. Warranty is limited or nonexistent. At best, you get a short return window, and even that may be complicated by international shipping and customs.

If you must use these channels, several practices help. Buy multiple spares when you choose an out‑of‑warranty or untested item, because there is no fallback if the part fails even when it is “new in box.” Align part numbers carefully using cross‑reference information to avoid buying modules that look similar but are incompatible with your specific DeltaV version or backplane. Physically inspect hardware before installation, watching for classic signs of electronic distress such as bulging capacitors, corrosion, or board discoloration.

Repair and Refurbishment

When parts become almost impossible to source, repair and refurbishment can be a practical option. Industrial Electrical Warehouse and Secure Components both emphasize the role of third‑party repair services for items such as circuit boards, contactors, and relays. In the DeltaV space, specialized repair partners can rework controller and I/O modules, reflow solder, replace components, and then test the modules under simulated load.

The Amikong guidance illustrates how visual inspection and diagnostic logs feed into this process. If you see repeat patterns of failures, an experienced repair house can sometimes recommend upstream fixes as well, such as addressing environmental contamination or field wiring issues that are driving the damage.

Repair does not reset the lifecycle clock, but it can stretch scarce hardware a few more years while you prepare for migration. Just be honest about the limitations, document repaired modules clearly, and avoid building your entire future around components that are already at the end of their useful life.

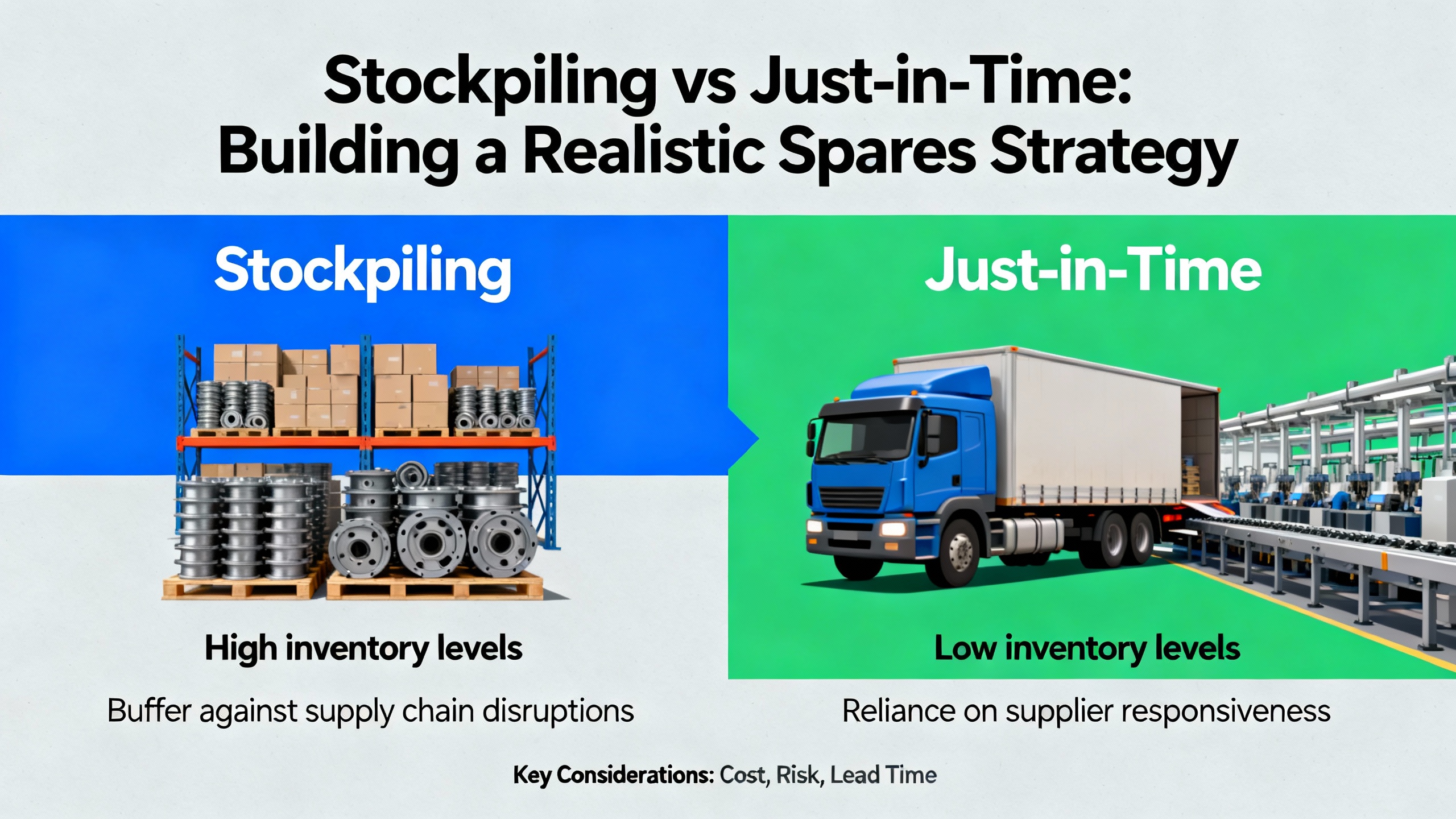

Stockpiling vs Just‑in‑Time: Building a Realistic Spares Strategy

Many maintenance teams respond to obsolescence risk by stockpiling DeltaV parts “just in case.” The Applied Manufacturing article on obsolete components points out how deceptively complex that strategy can be. Stockpiling consumes capital, takes up space, and potentially leaves you with large quantities of obsolete, out‑of‑warranty parts sitting on the shelf years later.

From a DeltaV perspective, modern spare parts management works best when it integrates three threads: reliability data, downtime economics, and lifecycle status.

Emerson’s 5Ps article on spare parts and extended warranty makes a compelling case for using mean time between failures and mean time to repair as design parameters. Components with lower reliability or long lead times justify higher stocking levels. The cost of carrying those spares must be weighed against the cost of downtime that would occur if you had to wait for expedited shipments or scramble on the surplus market.

Carrying costs for inventory go beyond the purchase price. You incur warehousing, environmental control, security, obsolescence risk, and the effort required to maintain accurate records. Secure Components notes that technologies such as barcode tracking and real‑time inventory systems help keep counts accurate, avoid both stockouts and overstocking, and generate analytics to support decisions.

Warranty windows add another dimension. Applied Manufacturing warns that holding components for more than a couple of years often pushes them beyond the manufacturer’s warranty period. That is particularly relevant when you buy spares to hedge against obsolescence. Years later, when you finally break open the box, you may discover that any formal recourse for defects has long expired. On the other hand, as the same article notes, the unopened PLC module you bought 15 years ago might still be the only thing that keeps the line running today.

A reasoned approach starts by identifying truly critical DeltaV components where downtime costs are highest and lead times or lifecycle risks are most severe. Controllers, power supplies, backbone network gear, and unique specialty I/O cards generally belong in this tier. For these, pairing a limited on‑site stock with extended warranty and quick‑ship programs gives you resilience without tying up excessive capital.

Lower‑impact hardware can rely more heavily on external inventories, especially when specialist suppliers or Emerson local offices maintain strong stock levels. Throughout, the goal is not to eliminate risk entirely—that is impossible—but to shape it in a way that is transparent, affordable, and aligned with your business priorities.

Migration and Modernization When Parts Are Truly Obsolete

There comes a point where sourcing more obsolete parts becomes a poor use of money. When key DeltaV components are incompatible with current software or their failure would strand you on an unsupported island, it is time to migrate.

A Laurentide article on modernizing industrial control systems points out that many mills and plants are still running control systems and software that are 15 to 30 years old. The result is a tangle of multiple DCS and PLC platforms, growing cybersecurity exposure, difficulty finding experienced support, and escalating maintenance effort. At the same time, newer engineers expect to work with modern tools, and digital initiatives such as advanced analytics and machine learning are far easier to implement on a contemporary system.

In the DeltaV ecosystem, modernization choices often come down to full replacement versus phased migration. Full “rip and replace” means tackling controllers, I/O, workstations, networks, and sometimes wiring in a single major project. The advantage is a clean, consistent architecture with maximum life extension and modern capability. The downside is higher upfront cost, longer planning, and concentrated outage windows.

Phased migration takes a more incremental approach. Aging controllers and power supplies that represent single‑point failures may be upgraded first, often during planned turnarounds. Older I/O cards can be replaced rack by rack. Wiring can be left in place while you adopt technologies such as Emerson’s Electronic Marshalling, which Laurentide highlights as a way to provide per‑channel I/O flexibility and simplify field terminations. Over several cycles, you arrive at a modernized DeltaV system without a single disruptive event.

Cloud‑enabled architectures also enter the picture. Case study titles from Emerson referencing DeltaV SaaS SCADA and consolidated legacy systems illustrate an emerging pattern in which on‑premises hardware is complemented by cloud‑delivered supervisory layers. Even without relying on those specifics, the general principle is clear: migrating away from fragmented, aging control platforms toward a unified, lifecycle‑managed environment reduces complexity and strengthens both resilience and sustainability.

Regardless of path, modernization is not just a hardware project. It requires updated operator graphics, new alarm philosophies, process simulation for training and offline testing, and a thoughtful cutover plan. The more you front‑load this engineering, the smoother the transition away from obsolete hardware will be.

How an Integrator Typically Tackles Obsolete DeltaV Hardware

When a plant asks for help with obsolete DeltaV modules, I normally follow a predictable pattern that brings together the concepts above.

The work begins with a site assessment. That includes walking the cabinets, reviewing diagnostic logs, and reconciling hardware in the field against engineering documentation and inventory records. The goal is to identify obsolete and superseded parts, critical single‑point failures, and any controllers such as older M‑series models that limit your ability to move to current software.

Next comes risk ranking. For each major node—controllers, power supplies, I/O racks, servers, network switches—we look at process criticality, observed health, lifecycle status, and the availability of spares. Guidance from Amikong and IDS is useful here to interpret what the diagnostics are really telling us. Where possible, we cross‑check downtime cost estimates against finance or production data rather than relying on generic industry averages.

From there, we develop a spare parts and sourcing strategy tied to the risk picture. For some items, the right answer is to lean on Emerson lifecycle services, extended warranty, and quick‑ship channels, particularly when compatibility and latest revisions matter. In other areas, specialist third‑party suppliers such as Amikong or Classic Automation provide a more economical way to maintain coverage on legacy modules, especially when they offer robust warranties and testing. Open surplus markets are treated as a last resort for rare modules, and even then we usually buy more than one and subject them to careful inspection.

Only once we understand the immediate risk and have a spare strategy in place do we turn to the migration roadmap. That roadmap prioritizes upgrades that remove hard blockers, such as obsolete controllers or server operating systems, while aligning with plant shutdown schedules and capital constraints. Where appropriate, we factor in technologies like Electronic Marshalling for wiring simplification and examine opportunities to consolidate legacy systems into a more unified DeltaV architecture.

Throughout, communication is as important as technology. Operations leadership needs a clear view of which obsolete components represent acceptable risk for the next few years, and which ones put them one failure away from a multi‑million‑dollar event. When those conversations are grounded in real data—from Guardian lifecycle information, from Emerson reliability metrics, from supplier inventories, and from your own diagnostics—they become far more productive.

Frequently Asked Questions on Obsolete Emerson DeltaV Components

Is my older DeltaV hardware obsolete as soon as a new series is released?

Not necessarily. Emerson community discussions make it clear that many older I/O cards and modules are superseded by newer versions but remain fully compatible with current DeltaV software. In those cases, the parts are still supported and usable even though they are not preferred for new designs. Hardware becomes truly obsolete in a strict sense when the current DeltaV version can no longer run it at all, as is the case for certain older controllers such as the M2, M3, M5, and M5+ models.

Can I safely buy used or surplus DeltaV components?

Used or surplus parts can be part of a strategy, but they come with elevated risk. Articles from Applied Manufacturing, Secure Components, and Industrial Electrical Warehouse highlight counterfeit concerns, uncertain histories, and lack of formal warranty on many open‑market purchases. If you use surplus channels, it is wise to work with established specialist suppliers that test and warrant their hardware, such as Amikong or Classic Automation, and to buy more than one unit when dealing with out‑of‑warranty modules. Careful part number cross‑referencing and physical inspection are essential.

When should I stop buying spares and start planning a migration?

The tipping point usually comes when critical components are both obsolete and incompatible with current DeltaV releases, or when the ecosystem required to support them has collapsed. Examples include controllers that prevent you from upgrading DeltaV software, servers locked to insecure operating systems, and I/O families with no viable replacements. Emerson’s own lifecycle services and Laurentide’s modernization guidance both suggest you treat these as triggers for structured migration projects rather than continuing to pour money into increasingly scarce spares.

How do I avoid ending up with shelves of obsolete, unusable DeltaV parts?

Avoiding this outcome requires deliberate obsolescence management. Secure Components recommends regular inventory reviews, tracking lifecycle status, and flagging slow‑moving items. Emerson’s spare parts management and 5Ps guidance add the idea of using reliability data and downtime costs to size spares scientifically rather than guessing. If you pair that approach with clear lifecycle categories, defined retirement dates for legacy systems, and responsible e‑waste disposal through certified recyclers when parts are no longer usable, you can keep shelves lean and relevant instead of collecting expensive dead weight.

Closing Thoughts

Obsolete Emerson DeltaV components are not just a purchasing headache; they are a control‑system reliability and business‑risk problem. The plants that handle this well do not chase every discontinued part on the surplus market. They classify what they have, prioritize what truly matters, combine OEM and specialist support intelligently, and use obsolescence as a forcing function to modernize on their own terms. If you approach your DeltaV lifecycle with that mindset—and work with partners who have lived through these transitions many times—you can keep legacy systems running safely today while building a path toward a more modern, resilient architecture tomorrow.

References

- https://www.amikong.com/n/delatv-dcs-hardware-upgrade-tips

- https://blog.appliedmfg.com/blog/obsolete-components-best-practices

- https://idspower.com/deltav-dcs-troubleshooting/

- https://www.linkedin.com/posts/ats-after-sales-service_video-finding-obsolescence-risk-in-your-activity-7371198001488482305-hGzD

- https://securecomponents.com/best-practices-to-find-obsolete-components/

- https://www.classicautomation.com/parts/emerson/emerson-delta-v?srsltid=AfmBOoogbxT6AH8A2ooQV_zjlx8UO6HZq5vfQwOiidn1d9rmoLcKeBqJ

- https://www.emerson.com/documents/automation/case-study-strategically-consolidated-legacy-systems-deltav-saas-scada-for-growth-sustainability-en-10735992.pdf

- https://industrialelectricalwarehouse.com/blogs/news/keeping-legacy-systems-alive-a-guide-to-sourcing-obsolete-electrical-parts?srsltid=AfmBOoqcjd_lEA_5mu-_hgWwcbw0vAh5SzPyAax3eW2-2VR8VHpP-Zfo

- https://www.emersonautomationexperts.com/2023/services-consulting-training/5ps-control-system-reliability-performance-parts-extended-warranty/

- https://www.scalloncontrols.com/CMS/getattachment/2dea15d7-1286-4381-9789-9d37bda64802/planning-and-designing-your-deltavtm-digital-automation-systems-and-deltavtm-sis-process-safety-systems-2015.pdf

Keep your system in play!

Top Media Coverage

Related articles Browse All

-

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu...

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu... -

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ...

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ... -

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

Need an automation or control part quickly?

- Q&A

- Policies How to order Part status information Shiping method Return Policy Warranty Policy payment terms

- Asset Recovery

- We Buy Your Equipment. Industry Cases

- ADDRESS

-

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

Copyright Notice © 2004-2024 amikong.com All rights reserved

Disclaimer: We are not an authorized distributor or distributor of the product manufacturer of this website, The product may have older date codes or be an older series than that available direct from the factory or authorized dealers. Because our company is not an authorized distributor of this product, the Original Manufacturer’s warranty does not apply.While many DCS PLC products will have firmware already installed, Our company makes no representation as to whether a DSC PLC product will or will not have firmware and, if it does have firmware, whether the firmware is the revision level that you need for your application. Our company also makes no representations as to your ability or right to download or otherwise obtain firmware for the product from our company, its distributors, or any other source. Our company also makes no representations as to your right to install any such firmware on the product. Our company will not obtain or supply firmware on your behalf. It is your obligation to comply with the terms of any End-User License Agreement or similar document related to obtaining or installing firmware.