-

Manufacturers

- ABB Advant OCS and Advant-800xA

- ABB Bailey

- ABB Drives

- ABB H&B Contronic

- ABB H&B Freelance 2000

- ABB Master

- ABB MOD 300, MOD 30ML & MODCELL

- ABB Procontic

- ABB Procontrol

- ABB Synpol D

- Allen-Bradley SLC 500

- Allen-Bradley PLC-5

- Allen-Bradley ControlLogix

- Allen-Bradley CompactLogix

- Allen-Bradley MicroLogix

- Allen-Bradley PanelView

- Allen-Bradley Kinetix Servo Drive

- Allen-Bradley PowerFlex

- Allen-Bradley Smart Speed Controllers

- 3300 System

- 3500 System

- 3300 XL 8mm Proximity Transducer

- 3300 XL NSV Proximity Transducer

- 990 and 991 Transmitter

- 31000 and 32000 Proximity Probe Housing Assemblie

- 21000, 24701, and 164818 ProbeHousing Assemblies

- 330500 and 330525 Piezo-Velocity Sensor

- 7200 Proximity Transducer Systems

- 177230 Seismic Transmitter

- TK-3 Proximity System

- GE 90-70 Series PLC

- GE PACSystems RX7i

- GE PACSystems RX3i

- GE QuickPanel

- GE VersaMax

- GE Genius I/O

- GE Mark VIe

- GE Series One

- GE Multilin

- 800 Series I/O

- Modicon 984

- Modicon Premium

- Modicon Micro

- Modicon Quantum

- Telemecanique TSX Compact

- Altivar Process

- Categories

- Service

- News

- Contact us

-

Please try to be as accurate as possible with your search.

-

We can quote you on 1000s of specialist parts, even if they are not listed on our website.

-

We can't find any results for “”.

-

-

Get Parts Quote

Rare Industrial Control Modules: Expert Locator for Scarce Parts

Keeping legacy lines running depends on modules that were never meant to be timeless. The PLC backplane card that makes a batching system behave, the intrinsic safety I/O that keeps a hazardous area compliant, the motion module that synchronizes a conveyor and a wrapper—these become scarce just when uptime matters most. As a systems integrator and project partner, I approach rare control modules with a sober mix of sourcing rigor, engineering verification, and lifecycle planning. This guide consolidates field-tested practices alongside reputable guidance from publishers such as ACTIA, Industrial Automation Co., Octopart, EE Times, and others, to help you find, validate, and deploy scarce control hardware without gambling with downtime.

What “Rare” Really Means in Industrial Control

Rare does not simply mean “hard to buy this week.” In control systems, rarity usually stems from obsolescence, niche brands, or specialized modules designed for a specific process, protocol, or certification. Obsolete control modules are discontinued parts—often PLC processors, I/O cards, communications adapters, HMIs, drives, servo amplifiers, and specialty safety modules—that remain essential in long-lived plants. Industrial Automation Co. defines these legacy dependencies plainly: they are still required to sustain vetted, reliable systems, even as lifecycles for many PLC families run about 10 to 15 years before the official support window closes. Industrial Electrical Warehouse notes facilities often prefer sourcing replacements over full retrofits when core equipment still performs well.

Niche or legacy components also arise from smaller or discontinued brands, proprietary expansion modules, or custom interfaces where form, fit, and firmware alignment must be exact. In such cases, generic substitutes are unacceptable because a miss on pinouts, backplane current, or protocol versions can trigger compatibility faults, nuisance trips, or even safety risks.

It helps to be precise with terminology. End of Life indicates the manufacturer has ceased production. Design for Manufacturing and a “living” Bill of Materials, as ACTIA emphasizes, mean you anticipate lifecycle and multi-source options from the concept phase, not after a line is down.

Why Scarce Modules Become Scarce

Supply disruption and demand spikes hit every level of the value chain. Octopart and All Things Supply Chain point out that obsolescence, exclusive distribution, and structural demand from high-volume sectors can drain availability. EE Times describes how the semiconductor manufacturing cycle, typically about 16 weeks, constrains short-term flexibility; shortages can outpace even sound forecasts. Partstack notes that rapid technology churn and earlier supply shocks also tightened supply for microcontrollers and other parts.

Inside the plant, scarcity is compounded by long system lifetimes, tightly integrated code and wiring, and certifications that make seemingly minor changes nontrivial. Hermary highlights that integrators and OEMs choose channels based on product positioning; specialized modules often flow through direct routes with engineering support, which can lengthen lead times. When a discontinuation arrives without a prepared alternate, the clock starts on an expensive scramble.

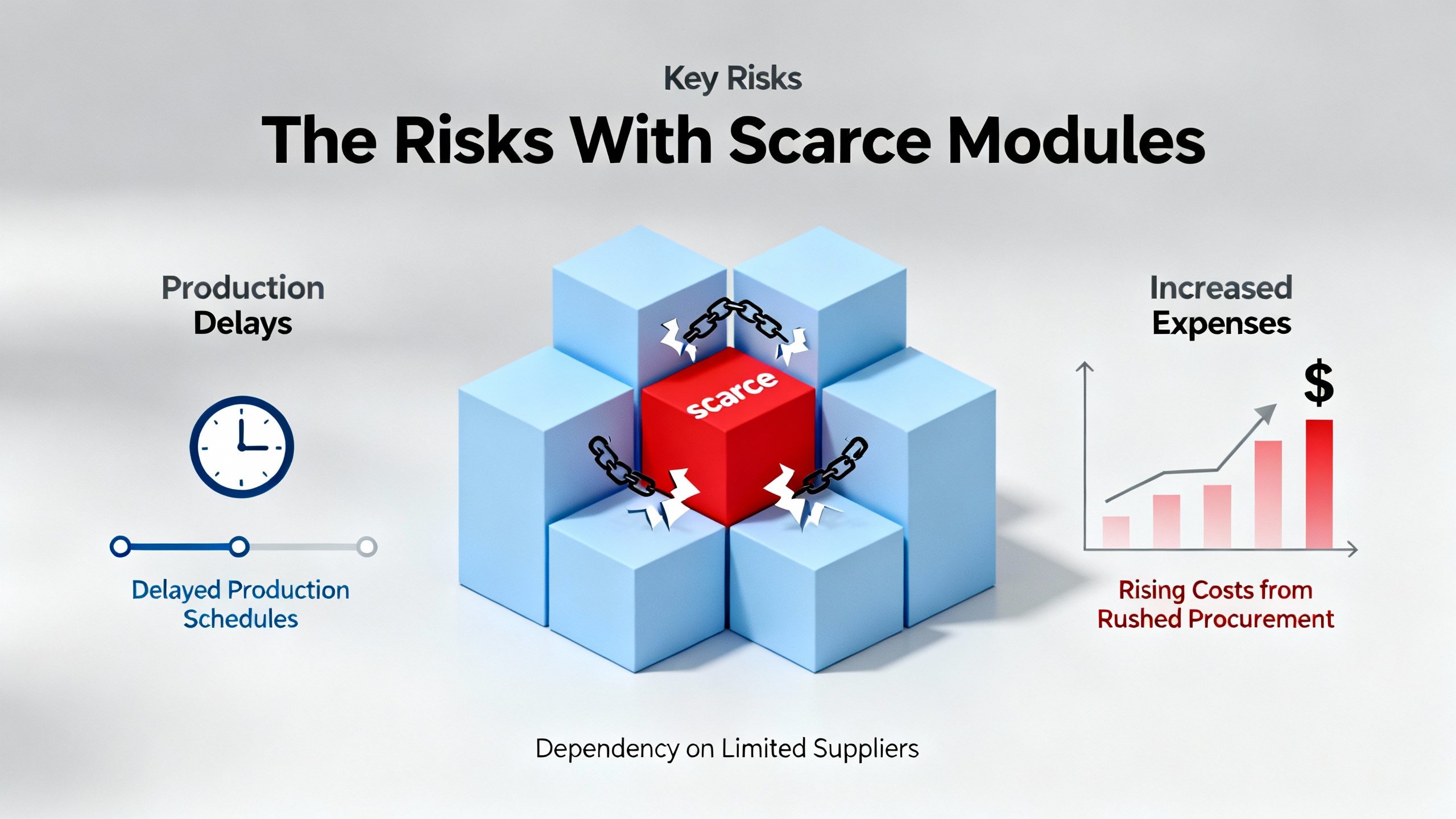

The Risks With Scarce Modules

The risk is not only that you cannot find a part; it is that you find the wrong one. Digital Journal recounts downtime costs that can exceed $50,000 per hour, and describes real cases where mismatched or counterfeit parts caused shutdowns and voided warranties. Industrial Automation Co. warns that price-first sourcing invites counterfeit or substandard items. Counterfeits are not always obvious: “remarked” cards may boot, then fail under load or within a few months.

Compatibility pitfalls are equally unforgiving. DirectIndustry’s guidance underscores the importance of matching I/O ranges, protocols like PROFINET, EtherCAT, or Modbus, and ensuring environmental and safety certifications are appropriate. Mixing firmware revisions across redundant controllers, or exceeding backplane current with a seemingly “equivalent” module, triggers intermittent faults that are hard to diagnose. In my experience, a bargain module without traceability or test reports is rarely a bargain after the second unplanned stop.

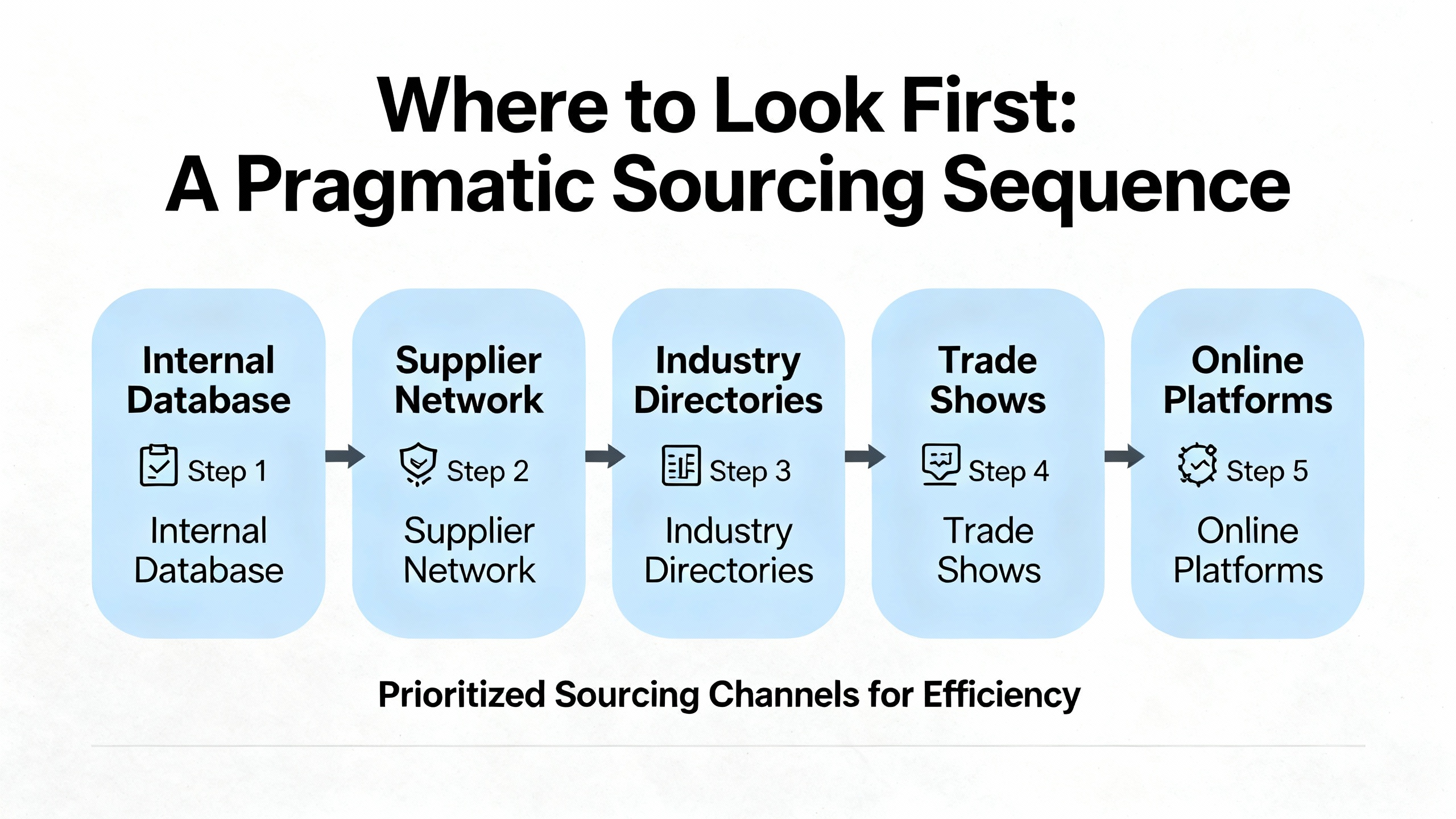

Where to Look First: A Pragmatic Sourcing Sequence

Start with the channels most likely to deliver authentic, compatible hardware with documentation. Octopart cites higher satisfaction when sourcing via authorized distributors and vetted brokers because reliability and quality screening reduce surprises. EE Times urges buyers to maintain relationships with both suppliers and distributors to improve visibility and allocation during constraints. When authorized stock is exhausted, Digital Journal points to specialist obsolete-part suppliers and OEM legacy programs as the next best sources, followed by independent distributors and, lastly, surplus marketplaces.

Use a stepwise approach. Query authorized distributors and any OEM legacy or refurbishment program. Engage a specialist in obsolete automation who can validate part numbers and firmware alignment and who stands behind testing and warranty. If needed, move to independent distributors with strong quality systems and full traceability. Reserve open marketplaces for last resort, being strict about seller vetting, test evidence, and return terms.

Channel Comparison at a Glance

| Channel Type | Typical Use Case | Strengths | Cautions | Example Publishers Referenced |

|---|---|---|---|---|

| Authorized distributor | Current or recently EOL modules | Authenticity, datasheets, support, allocation priority | Limited on deep-legacy stock | Octopart, EE Times |

| OEM legacy/refurb programs | End-of-life and last-time buys | Exact fit, known firmware, official refurb paths | Higher price, limited volume | EE Times |

| Specialist obsolete-part supplier | Scarce legacy cards and drives | Cross-referencing, testing, real warranties | Vet quality systems carefully | Industrial Automation Co., Industrial Electrical Warehouse |

| Independent distributor/broker | When authorized stock is gone | Global reach, traceability with robust QMS | Counterfeit risk without audits | Manufacturing Tomorrow, EE Times |

| Surplus/marketplaces | Opportunistic buys and spares | Wide listings, quick finds | Variable condition, documentation gaps | eBay, CBI Surplus |

Verifying Fit and Authenticity Before You Buy

Sourcing is only half the job. The other half is proving the hardware will operate as intended. ACTIA stresses end‑to‑end traceability, controlled warehousing, and supplier qualification. Digital Journal outlines a practical compatibility and authenticity regimen: decode the part number and revision, verify pinouts and voltage within tight tolerance, confirm backplane current capacity, ensure protocol and firmware alignment, and demand certificates of conformity alongside photographed serials.

Functional testing matters. Industrial Automation Co. highlights multi‑point testing and warranties up to 24 months; Rainhill Logic Controls recommends verifying part numbers and firmware, and assessing condition, testing, and return terms. I lean on bench tests that replicate the target rack or drive environment, verify LED diagnostics, scan and write configurations, and record firmware versions for redundant systems. For analog I/O, calibrating channels to within specification and documenting the results reduces surprises on site.

A Field Checklist for Control Modules

| Verification Area | What to Confirm |

|---|---|

| Identity and lifecycle | Exact part number, revision, and lifecycle status; confirm whether EOL or successor exists |

| Electrical and protocol | Nominal voltage and current draw, backplane current headroom, protocol support and version alignment |

| Mechanical fit | Rack size, DIN‑rail or chassis form factor, connector types, hot‑swap capabilities where relevant |

| Firmware and software | Firmware version compatibility with peers and tools; licensing status for PLCs/HMIs/drives |

| Environmental and safety | Operating temperature rating, EMC compliance, UL/CE marks, functional safety levels as needed |

| Traceability and QA | Serial numbers, photos, certificates of conformity, test reports, and repair/refurb documentation |

| Warranty and returns | Length and coverage details, DOA terms, RMA process, and shipping windows |

| Storage and handling | ESD protection, humidity control, and packaging integrity for transit and shelf life |

Obsolescence Management That Prevents Fire Drills

Treat the Bill of Materials as a living risk tool. ACTIA recommends monitoring lifecycles, anticipating End of Life, planning last‑time buys, and pre‑qualifying alternates or redesigns before pressure rises. Dual or multi‑sourcing reduces exposure when a single facility or region goes offline. Forecast forward for high‑risk modules and carry buffers sized to your risk tolerance; Octopart and McKinsey note that efficient inventory control can reduce costs and improve service levels materially. All Things Supply Chain advises diversifying suppliers globally and placing earlier, volume‑appropriate orders to secure slots.

Keep a registry of aging modules and train maintenance to flag early failure signals. Industrial Automation Co. recommends classifying components by replacement risk and creating watchlists and alerts for fleeting legacy inventory. Industrial Electrical Warehouse suggests cross‑reference guides and targeted search strategies, including variant part numbers, to avoid long hunts caused by small formatting differences.

Refurbished Versus New Equivalents

When an exact module is discontinued, you often face a choice between a certified refurbished unit and a new equivalent that requires adaptation. Digital Journal describes how certified refurbishments can preserve form factor and firmware alignment, often with 18 to 24‑month warranties, while new equivalents may require firmware, wiring, or mounting changes. Industrial Automation Co. emphasizes insisting on functional testing and a real warranty.

| Option | Advantages | Trade‑offs | When to Choose |

|---|---|---|---|

| Certified refurbished original | Form‑fit‑function match, known firmware behavior, proven in legacy racks, real warranty support | Supply is finite; price may be premium; verify refurbishment report | When downtime risk and validation costs outweigh the price premium |

| New equivalent or successor | Longer manufacturer support horizon, modern features, potential efficiency gains | May require rewiring, programming changes, or mechanical adapters; training and validation effort | When a planned mini‑retrofit fits windows and budget, or when legacy stock is exhausted |

Storage, Handling, and Care That Protects Your Investment

If you buy scarce modules but store them poorly, you are simply deferring failure. ACTIA advises secure warehousing with controlled temperature and humidity for sensitive electronics. Rainhill Logic Controls reminds sellers and buyers to use ESD‑safe packaging and to include accessories, terminals, and manuals when available. In my storeroom, we label power and region ratings clearly, log firmware versions, and keep test reports with each spare. For long‑shelf items, reseal in moisture‑barrier packaging and keep silica indicators visible. The first day a rare module arrives is the best day to image, configure, and test it on a spare chassis, then return it to protective storage with a dated tag.

Procurement Tactics That Actually Work

Avoid single‑point reliance wherever possible. ACTIA recommends dual or multi‑sourcing and aligning procurement with design early through Design for Manufacturing principles. Hermary suggests a hybrid channel mix: use distributors for standardized items with transparent stock, and go direct to manufacturers for mission‑critical evaluations, customizations, and training when justified by risk and investment. Advanced Tech notes that treating procurement as core to MRO reliability improves uptime, and that technology—ERP integrations, demand sensing, storeroom controls—reduces surprises.

Relationships pay dividends. Octopart reports that firms with strong supplier relationships secured business continuity arrangements, and that working with authorized distributors and vetted brokers increases satisfaction. EE Times emphasizes exception management and being a dependable customer to improve allocation during shortages. Manufacturing Tomorrow discusses how independent distributors with audited quality systems can secure constrained parts with full traceability; vet them thoroughly and maintain audit rights.

Total cost beats unit cost. 889 Global Solutions and Warehousenews underscore total cost of ownership, which includes logistics, storage, rework, downtime, and returns. That calculus favors reliable supply, documented testing, and support, even when the unit price is higher. It is a simple equation in a plant: one avoided emergency more than pays for rigorous sourcing.

Real‑World Examples You Will Encounter

The individual part numbers change, but the patterns remain. Rainhill Logic Controls lists a range of Allen‑Bradley ControlLogix modules such as 1756‑series analog inputs and Ethernet modules, Kinetix axis modules, and various PowerFlex components across a wide price range. Industrial Automation Co. notes retrofit and replacement activity around drives and amplifiers including Allen‑Bradley PowerFlex 525, Siemens SINAMICS G120, FANUC Alpha amplifiers, ABB ACS550, Schneider ATV320, and LS Electric S100. When you pursue these, confirm chassis compatibility, rail and power requirements, and, for motion and drives, the exact firmware and option boards in play. Ask suppliers for test reports that show command and feedback signals, not just “power‑on” status.

Buying Tips and Red Flags

Lean on verified channels and insist on evidence. Octopart suggests authorized distributors and vetted brokers to reduce counterfeit risk. Digital Journal recommends photographed serials, certificates of conformity, and functional testing that includes firmware checks. Industrial Electrical Warehouse advises tapping decommissioned systems and surplus while verifying provenance and condition. On open marketplaces such as eBay, scrutinize condition notes, confirm included accessories and licensing, and understand return terms and warranty coverage. Be cautious with ultra‑low pricing without documentation; in my experience, that is the most reliable red flag.

Sustainability and the Circular Economy

CBI Surplus and Rainhill Logic Controls both emphasize the circular economy benefits of repurposing automation equipment. Every working module kept in service extends an asset’s life and reduces waste. Facilities can also monetize idle spares and decommissioned assets to fund upgrades. When you can responsibly repair or refurbish rather than scrap, you create a sustainability win without compromising reliability.

Takeaway

Scarce control modules are a reality of long‑lived automation. The way to win is methodical: anticipate obsolescence in the design and BOM, build multi‑source resilience, cultivate dependable channel partners, and verify authenticity and compatibility with the same discipline you apply in safety reviews. When you must act fast, move through authorized and OEM legacy paths first, then reputable specialists and audited independents, and use marketplaces only with rigorous vetting. Document everything—part identities, firmware, tests, and storage conditions—so that when the rare module is called into service, it performs like it has always been there.

FAQ

What is the best first step when a legacy I/O module fails and stock seems unavailable? Start by confirming the exact part number, revision, and firmware in your asset records, then contact authorized distributors and the OEM’s legacy or refurbishment program. If they cannot supply, engage a specialist obsolete‑parts supplier that offers documented testing and a real warranty before exploring independent distributors or marketplaces.

How can I reduce the risk of counterfeit or misrepresented modules? Favor authorized distributors and vetted brokers, require end‑to‑end traceability with photographed serials, and insist on functional test reports and certificates of conformity. Be wary of unusually low prices without documentation and avoid suppliers that cannot describe their quality system. Guidance from publishers such as Octopart, EE Times, and Digital Journal aligns on these practices.

When is a certified refurbished part better than a modern equivalent? Choose certified refurbished when form‑fit‑function compatibility is crucial, firmware alignment matters, or validation time is limited. A modern equivalent may require rewiring, mounting adapters, software changes, or retraining. Digital Journal and Industrial Automation Co. note that reputable refurbishment can include robust testing and warranties that support production confidence.

How should I plan inventory for scarce or EOL modules? Classify components by replacement risk, monitor lifecycle notices, pre‑approve alternates, and maintain buffer spares for high‑risk modules. ACTIA recommends treating the BOM as a living risk tool with multi‑sourcing and last‑time buys, while Octopart and McKinsey call out the performance benefits of robust inventory management.

What documentation should accompany any scarce control module I buy? Capture the part and revision, firmware version, electrical ratings, test results specific to the module’s function, certificates of conformity, and warranty and return terms. Maintain storage and handling notes that confirm ESD protection and controlled conditions. This file should travel with the spare from storeroom to panel.

Where can I look for rare modules if authorized channels are dry? Consult OEM legacy programs and specialist obsolete‑part suppliers first. Independent distributors with audited quality systems can be effective with the right due diligence. Surplus sources and marketplaces are viable as long as you verify authenticity, functionality, and return provisions. Publishers such as Industrial Electrical Warehouse, Industrial Automation Co., and CBI Surplus outline these pathways and safeguards.

References

- https://cbisurplus.com/

- https://www.industrialcontroldirect.com/index.php?main_page=articles&aID=7&srsltid=AfmBOooF1xRjkRMcVSv9cUY-RX65Vk8P2y9Bq0jXnO3GXzlQRhXXW8XD

- https://rainhilllogiccontrols.com/

- https://simcona.com/electronic-component-procurement-guide

- https://tcisupply.com/?srsltid=AfmBOooG6FUU03jiFepuDg9_1THDhe7o3Xmj4j5CRnyEUKcVD7aezaIE

- https://www.889globalsolutions.com/blog/industrial-component-sourcing-overcoming-common-obstacles

- https://ems.actia.com/https-ems-actia-com-en-news-components-sourcing/

- https://www.allthingssupplychain.com/a-guide-to-sourcing-hard-to-find-components/

- https://www.directindustry.com/industrial-manufacturer/industrial-control-module-147310.html

- https://www.eetimes.com/finding-securing-hard-to-find-parts/

Keep your system in play!

Related articles Browse All

-

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu...

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu... -

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ...

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ... -

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

Need an automation or control part quickly?

- Q&A

- Policies How to order Part status information Shipping Method Return Policy Warranty Policy Payment Terms

- Asset Recovery

- We Buy Your Equipment. Industry Cases Amikong News Technical Resources

- ADDRESS

-

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

Copyright Notice © 2004-2026 amikong.com All rights reserved

Disclaimer: We are not an authorized distributor or distributor of the product manufacturer of this website, The product may have older date codes or be an older series than that available direct from the factory or authorized dealers. Because our company is not an authorized distributor of this product, the Original Manufacturer’s warranty does not apply.While many DCS PLC products will have firmware already installed, Our company makes no representation as to whether a DSC PLC product will or will not have firmware and, if it does have firmware, whether the firmware is the revision level that you need for your application. Our company also makes no representations as to your ability or right to download or otherwise obtain firmware for the product from our company, its distributors, or any other source. Our company also makes no representations as to your right to install any such firmware on the product. Our company will not obtain or supply firmware on your behalf. It is your obligation to comply with the terms of any End-User License Agreement or similar document related to obtaining or installing firmware.

Cookies

Individual privacy preferences

We use cookies and similar technologies on our website and process your personal data (e.g. IP address), for example, to personalize content and ads, to integrate media from third-party providers or to analyze traffic on our website. Data processing may also happen as a result of cookies being set. We share this data with third parties that we name in the privacy settings.

The data processing may take place with your consent or on the basis of a legitimate interest, which you can object to in the privacy settings. You have the right not to consent and to change or revoke your consent at a later time. This revocation takes effect immediately but does not affect data already processed. For more information on the use of your data, please visit our privacy policy.

Below you will find an overview of all services used by this website. You can view detailed information about each service and agree to them individually or exercise your right to object.

You are under 14 years old? Then you cannot consent to optional services. Ask your parents or legal guardians to agree to these services with you.

-

Google Tag Manager

-

Functional cookies

Leave Your Comment