-

Manufacturers

- ABB Advant OCS and Advant-800xA

- ABB Bailey

- ABB Drives

- ABB H&B Contronic

- ABB H&B Freelance 2000

- ABB Master

- ABB MOD 300, MOD 30ML & MODCELL

- ABB Procontic

- ABB Procontrol

- ABB Synpol D

- Allen-Bradley SLC 500

- Allen-Bradley PLC-5

- Allen-Bradley ControlLogix

- Allen-Bradley CompactLogix

- Allen-Bradley MicroLogix

- Allen-Bradley PanelView

- Allen-Bradley Kinetix Servo Drive

- Allen-Bradley PowerFlex

- Allen-Bradley Smart Speed Controllers

- 21500 TDXnet Transient

- 3300 System

- 3500 System

- 990 and 991 Transmitter

- 31000 and 32000 Proximity Probe Housing Assemblie

- 21000, 24701, and 164818 ProbeHousing Assemblies

- 177230 Seismic Transmitter

- TK-3 Proximity System

- 330500 and 330525 Piezo-Velocity Sensor

- 7200 Proximity Transducer Systems

- GE 90-70 Series PLC

- GE PACSystems RX7i

- GE PACSystems RX3i

- GE QuickPanel

- GE VersaMax

- GE Genius I/O

- GE Mark VIe

- GE Series One

- GE Multilin

- 800 Series I/O

- Modicon 984

- Modicon Premium

- Modicon Micro

- Modicon Quantum

- Telemecanique TSX Compact

- Altivar Process

- Categories

- Service

- News

- Contact us

-

Please try to be as accurate as possible with your search.

-

We can quote you on 1000s of specialist parts, even if they are not listed on our website.

-

We can't find any results for “”.

Same-Day Delivery for Industrial Sensors: Building an Express Sensor Shipping Service

In industrial automation, sensors used to be treated as small commodities you could order whenever it was convenient. That mindset does not survive long in a plant that runs lean, depends on predictive maintenance, and measures downtime in thousands of dollars per hour. When your vibration or temperature sensor is the only thing standing between a stable production schedule and an unplanned shutdown, the way you ship that hardware is as critical as the hardware itself.

Speaking as someone who has watched lines sit idle waiting on a single probe or accelerometer, I now treat same-day and expedited sensor shipping as part of the control architecture, not a back-office detail. This article lays out how to approach “express sensor shipping” with the same discipline you apply to safety, controls, and maintenance strategy.

Why Same-Day Sensor Delivery Suddenly Matters

Modern manufacturing has stacked the deck in favor of time pressure. Lean and just‑in‑time inventory practices keep stock levels low. Predictive maintenance programs push more and more critical decision‑making into software that relies on sensors. And customers, both B2B and consumer, now expect products to move in hours, not weeks.

Same‑day and expedited delivery started as niche services, but logistics providers now describe them as essential infrastructure for time‑sensitive operations. Same‑day courier research in manufacturing shows that getting components on site within hours instead of days can be the difference between a quick recovery and extended downtime. In one documented example, a smartphone manufacturer avoided an estimated $1.2 million in losses by moving a critical replacement component roughly 200 miles in about four hours using a same‑day courier. Another case in heavy industry saw a paper mill receive a two‑ton replacement gear in under 18 hours, cutting several days of expected downtime and preventing more than $5 million in lost production.

Those stories involved parts in general, not just sensors, but the logic applies directly. The more your plant depends on real‑time condition data, the more a failed or missing sensor becomes a single point of failure. Lean inventories amplify the impact. Instead of keeping shelves of spare transducers, many plants now depend on rapid local replenishment. Same‑day and next‑day logistics are what make that strategy workable.

Customer expectations are moving in the same direction. Research from e‑commerce logistics providers shows that a majority of consumers consider delivery speed in purchasing decisions, and a significant share is willing to pay extra for same‑day delivery. Those expectations bleed into industrial markets. If your customers are used to getting consumer products same day, they will not be patient when a critical sensor for their plant takes a week to arrive.

What “Express Sensor Shipping” Really Means

It is important to be precise about terms, because the logistics world draws a clear line between standard, expedited, and same‑day services.

Industry sources such as DAT Freight & Analytics define expedited shipping as a premium service typically delivering in about one to three business days, depending on distance and carrier. That is much faster than standard options that often run five to seven days or even longer. Expedited freight often uses dedicated vehicles, minimal stops, and streamlined processing to move time‑sensitive shipments quickly and reliably.

Same‑day delivery is the extreme end of that spectrum. Same‑day shipping in e‑commerce usually means the order leaves the warehouse the day it is placed; same‑day delivery means the shipment arrives that same calendar day. Dedicated same‑day freight providers note that they routinely move everything from envelopes and small boxes to palletized goods and heavy machinery within that window, scaling equipment from cars and vans up to box trucks and tractor‑trailers.

For industrial sensors, express shipping can span several models:

- Manufacturer‑level expediting for non‑stock products. For example, Pyromation offers express orders for temperature sensors manufactured to order, with guaranteed shipment tiers of same day, twenty‑four hours, or seventy‑two hours. Those orders must be placed by telephone with the sales department during normal business hours, and the guaranteed ship date is confirmed on the call. That is a factory‑direct version of express service.

- Distribution‑level same‑day processing. CHOOVIO, an Industrial IoT supplier, notes that it processes all orders on the same day and ships from its facility in Irvine, California, with free standard shipping above a certain order value. While this is “standard” shipping, the same‑day processing shrinks lead time considerably for sensors in stock.

- Freight‑level expedited and same‑day services. Same‑day freight specialists and expedited logistics providers design their networks around time‑critical cargo. They combine dedicated vehicles, priority handling, route optimization, and in many cases twenty‑four–seven operations to move urgent freight, including electronics and industrial components, at high speed.

The real design question is not whether you can get a sensor fast. The question is which mix of same‑day, next‑day, and expedited services fits each part of your sensor strategy.

Standard vs Expedited vs Same‑Day for Sensors

A useful way to frame logistics choices is to compare modes by transit time, typical use cases, and tradeoffs. Industry research on expedited freight, same‑day services, and standard shipping allows us to summarize the landscape this way:

| Shipping mode | Typical transit time | Best use for sensors | Key advantages | Key tradeoffs |

|---|---|---|---|---|

| Standard parcel or LTL | Roughly five to seven business days, sometimes longer | Non‑critical spares, surplus stock, training hardware | Lowest freight rates, efficient for planned replenishment | Long lead times, poor fit for downtime‑sensitive assets |

| Expedited ground or air | Roughly one to three business days | Critical spares where a day or two of risk is acceptable | Faster than standard, higher reliability and visibility, still cost‑controlled | Premium over standard, may not prevent all downtime |

| Same‑day delivery | Hours within the same calendar day, often using dedicated vehicles | Sensors whose absence will stop production, impact safety, or block regulatory compliance | Maximum uptime protection, very high responsiveness, strong customer satisfaction | Highest freight cost, requires tight coordination and clear rules of use |

Research from logistics providers suggests that expedited options can reduce transit times by thirty to fifty percent compared with standard shipping, while costing thirty to seventy percent more. From a sensor strategy standpoint, that premium is not a problem as long as you apply it selectively, based on asset criticality and downtime cost.

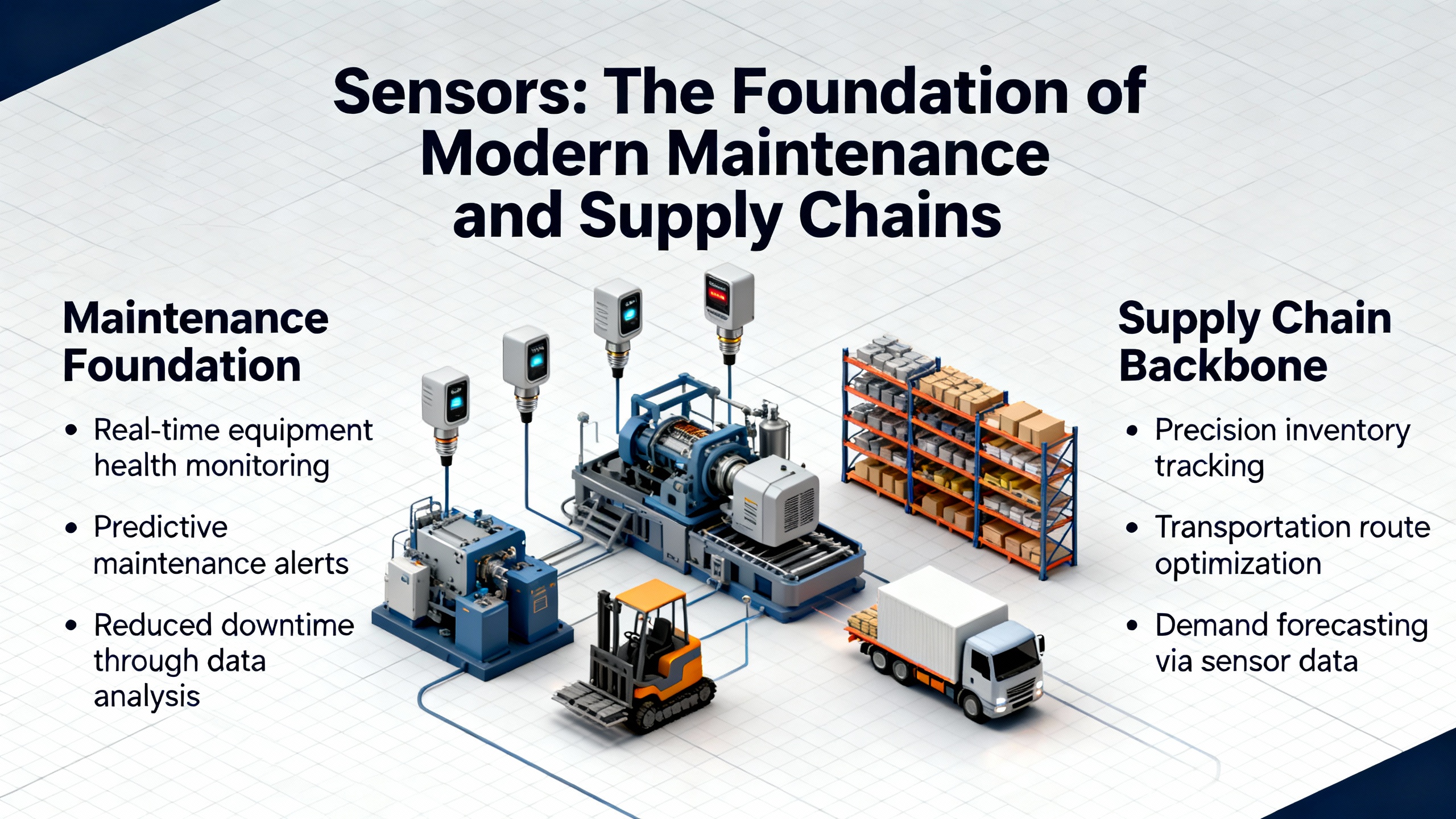

Sensors as the Foundation of Modern Maintenance and Supply Chains

To justify an express shipping program, you have to start with what sensors actually do for you.

Guidance from industrial analytics firms such as F7i emphasizes that there is no single “best” industrial sensor. The right sensor is the one that delivers the right data, on the right asset, at the right time, to drive the right maintenance action. A robust strategy rests on several pillars: clear objectives such as cutting unplanned downtime or reducing energy waste, asset criticality analysis to focus on high‑risk equipment, tight integration of sensor data into CMMS and IIoT platforms so alerts become work orders, and future‑proofing through interoperable devices and protocols.

The sensor technologies involved are diverse. Vibration sensors are the gold standard for rotating assets such as motors, pumps, compressors, fans, and gearboxes. They allow time and frequency‑domain analysis to detect bearing faults, imbalance, misalignment, looseness, and gear tooth wear. Temperature sensors, from thermocouples and RTDs to non‑contact infrared devices, monitor mechanical, electrical, and process equipment. Ultrasonic sensors detect high‑frequency acoustic signatures from friction, fluid leaks, and electrical discharge, making them powerful for compressed air leak detection, precision lubrication, steam trap inspection, and identification of arcing and corona.

Real‑world case studies underline the stakes. One food plant instrumented twenty conveyor drive motors with triaxial vibration sensors. Analytics software picked up a subtle high‑frequency signature indicating an outer race bearing fault, allowing a planned weekend replacement instead of catastrophic failure and product loss. In another case, an infrared monitoring system on high‑voltage switchgear detected a temperature rise of about 54 °F above ambient on one phase, leading to the discovery of a loose lug and avoidance of a possible arc‑flash incident and facility‑wide outage. Ultrasonic surveys in an automotive plant found more than one hundred fifty compressed air leaks in a single month; fixing them cut energy use, with a single faulty fitting wasting more than $8,000 per year and total savings on the order of fifteen to thirty percent of the facility’s energy bill.

None of those gains are free. They depend on having the right sensor, in the right form factor, in service at the right time. When a triaxial accelerometer, wireless node, or high‑temperature probe fails, the risk is not just that one point of data goes dark. The risk is that your maintenance program loses its lead time and reverts to firefighting. If it then takes a week to get a replacement, your “predictive” maintenance strategy starts to look reactive again.

How Shipping Speed Connects to Sensor Strategy

The logistics world is also undergoing a sensor‑driven transformation. Innovapte, writing on sensor‑based monitoring for supply chains, describes how embedding sensors into goods, containers, vehicles, and storage environments turns traditional blind spots into real‑time visibility. Location, temperature, humidity, motion, and light data flow into AI‑enabled platforms that detect route deviations, tampering, or condition problems and trigger interventions such as rerouting or environmental adjustments. A McKinsey study cited in that work reports that companies using high‑quality real‑time sensor data can improve decision‑making quality by up to sixty percent.

That same mindset should apply to the sensors you use for operations. Your sensor assets live in a supply chain long before they touch a motor or a process line. They are designed, built, stored, shipped, installed, and eventually replaced. If you treat logistics as an afterthought, you create new blind spots and delays. If you integrate shipping into your maintenance and automation strategy, you now have an end‑to‑end sensor lifecycle.

Express shipping for sensors becomes a way to:

Ensure that pilot projects on critical assets are not delayed by long lead times. F7i recommends piloting on high‑criticality assets instead of trying to monitor everything. That only works if the pilot kit arrives quickly, particularly when you are moving between suppliers or technologies.

Protect predictive maintenance coverage when a sensor fails unexpectedly. Same‑day or next‑day delivery prevents the gap between failure and replacement from stretching into weeks.

Support lean inventory practices. Same‑day courier research shows that rapid local replenishment allows manufacturers to hold less stock while keeping lines running through quick component resupply. Sensors are prime candidates for this approach.

Link logistics data to maintenance decision‑making. When sensor shipments themselves carry tracking and condition data, you can tie inbound visibility directly into planning. You can know exactly when a replacement will arrive, which technicians will be available, and which downtime window to use.

In practice, this means that sensor strategy and freight strategy should be designed together, not in isolation.

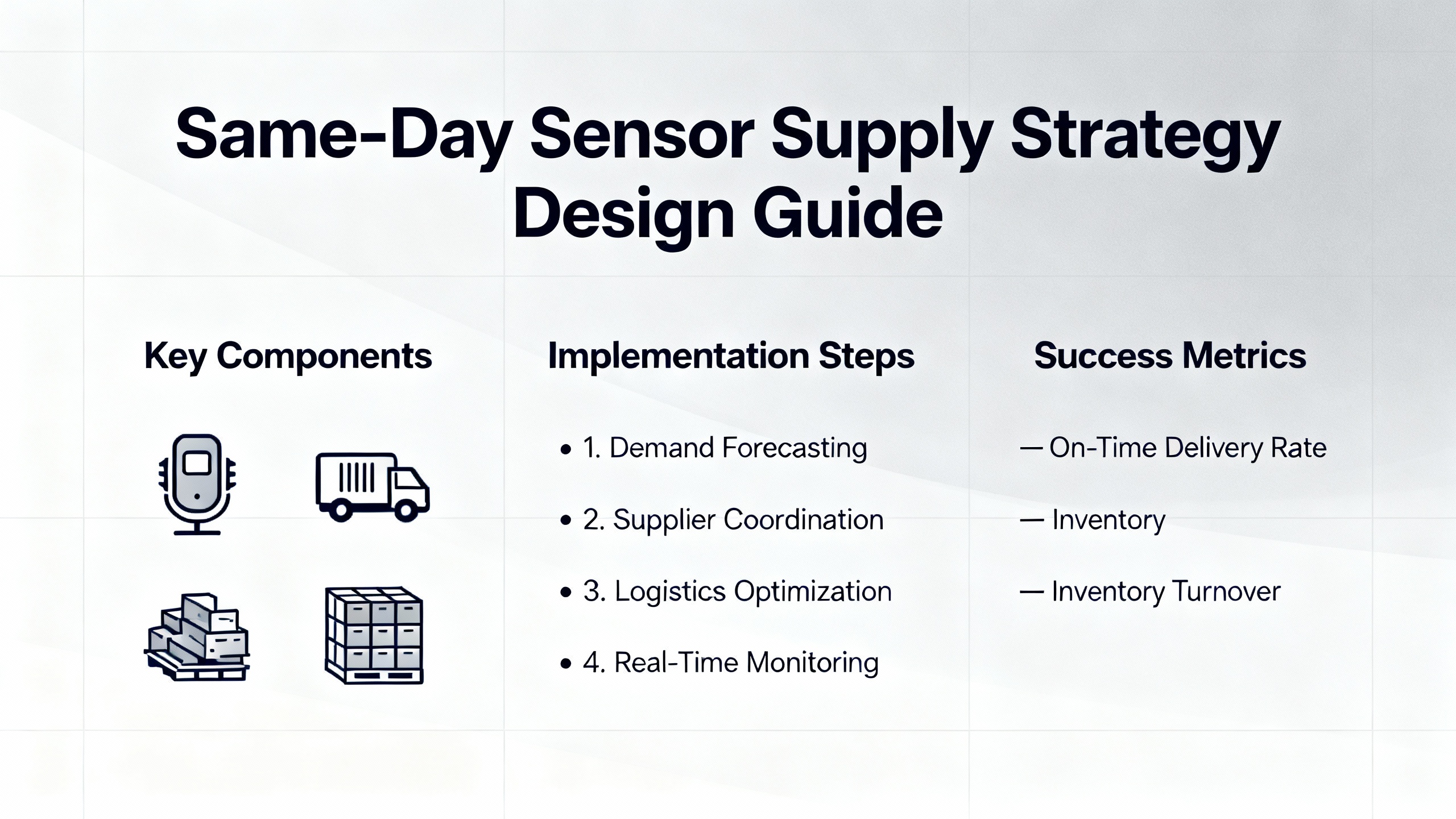

Designing a Same‑Day Sensor Supply Strategy

The starting point is always criticality. High‑value and high‑risk assets justify express support; low‑impact ones do not. Asset criticality analysis and failure mode and effects analysis give you a ranked list of machines where a missing sensor would have significant consequences for safety, quality, or uptime.

For the assets at the top of that list, define which sensor SKUs are truly time‑sensitive. That often includes triaxial vibration sensors on main drives, temperature probes on critical thermal processes, ultrasonic devices used in compressed air leak programs that pay back in a few months, and current or power sensors on key pumps or fans where failures can threaten permits or regulatory compliance.

Once you have the list, you have several levers:

You can stock those sensors in your own storerooms in small quantities.

You can negotiate express manufacturing and shipping options with your sensor suppliers.

You can build relationships with same‑day and expedited logistics providers who understand industrial components.

Just‑in‑time and lean strategies typically push you toward the second and third options, because they reduce carrying cost while maintaining responsiveness. Research on expedited shipping suggests that, when total cost is considered, faster freight can reduce inventory holding costs and disruption impacts enough to justify the higher rate, especially for selected SKUs.

Operational best practices from same‑day courier providers are instructive. They recommend integrating your inventory systems with courier platforms for automated dispatch when stock hits certain thresholds, defining internal rules for when to use same‑day services, and building a network of suppliers aligned on packaging and labeling standards. Periodic review of delivery metrics and costs, combined with staff training on packaging methods and courier tools, helps reduce damage, errors, and unnecessary rush orders.

Sensors also introduce special constraints. Many industrial sensors are small, fragile electronics. Packaging guidance from manufacturing couriers stresses anti‑static protection and compartmentalized boxes for small electronics, double‑boxing and bracing for heavy items, custom foam and suspension systems for precise or fragile parts, and palletization and strapping for larger assemblies. Hazardous materials, such as some specialty chemicals and batteries, must meet strict regulatory requirements.

If you intend to rely on same‑day services for sensors, you should ensure that your packaging, labeling, and documentation practices are tuned to that environment. The last thing you want is an urgent accelerometer or infrared camera held back because its hazmat label or export classification is unclear.

Choosing Logistics Partners for Sensor Shipments

Not every carrier is well suited to critical industrial components. Best‑practice guidance from expedited freight specialists points toward several evaluation criteria that apply directly to sensors.

Speed is essential but not sufficient. You need proven reliability and network coverage that reflects your plant and supplier locations. Services like Baton Transport highlight relay trucking models that keep trucks moving almost nonstop across large networks by switching drivers rather than parking vehicles for long rest periods. That model is attractive when you need high‑speed long‑distance truck delivery without sacrificing safety.

Industry expertise matters. Same‑day courier operators who work regularly with manufacturing already understand factory site rules, booking‑in procedures, out‑of‑hours collections, and shift‑change deliveries. Logistics providers that serve automotive, aerospace, food and beverage, pharmaceuticals, electronics, and telecommunications on a regular basis are already tuned to time‑critical, high‑value, and compliance‑sensitive shipments.

For sensors, you should prioritize partners that can demonstrate experience with high‑value electronics and, where relevant, temperature‑controlled or environmentally sensitive cargo. Pharmaceutical logistics experience is particularly relevant for certain temperature and humidity‑sensitive sensors, because FDA guidance treats transportation as part of manufacturing and holds manufacturers responsible for carrier practices.

Visibility and traceability are non‑negotiable. Expedited services commonly provide real‑time tracking and electronic proof of delivery. Advanced providers integrate GPS tracking, route optimization, and automated exception management into transportation management systems. That makes it possible to monitor shipments continuously and respond quickly to disruptions, which is crucial when the missing sensor is holding up production.

Lastly, support and communication style should fit the way your plant works. Many manufacturing‑focused couriers assign a single point of contact for each job and emphasize responsive support, ideally via a dedicated account manager. That minimizes chasing and guesswork when a critical part is in motion.

Operational Considerations: Compliance, Packaging, and Data Integration

Beyond choosing a carrier, there are practical constraints to address.

Export control and destination restrictions can affect where your sensors and spare parts can legally go. Electronics distributors such as Arrow Electronics, for example, highlight that some products are subject to export regulations and are classified under Export Control Classification Numbers. They explicitly do not ship to certain countries and regions due to trade control laws. If you ship sensors across borders, especially those containing encryption, specialized materials, or advanced capabilities, you must understand whether similar restrictions apply.

Hazardous materials require special handling. Logistics guidance notes that items classified as hazardous materials must be shipped via ground with a hazmat‑approved vendor, and orders that mix hazmat and non‑hazmat items may need to be split into separate shipping streams. Some sensors, particularly those with built‑in batteries or certain chemical elements, may fall into this category.

Environmental protection during transit is another priority. Sensor‑based logistics platforms emphasize how temperature and humidity sensors, motion sensors, and light sensors can monitor cargo conditions in real time. For high‑precision sensors, that kind of monitoring can be part of your quality control, especially for long or complex routes. At a minimum, packaging and route planning should account for shock, vibration, temperature excursions, and potential electromagnetic interference.

Finally, data integration is where logistics and operations converge. Innovapte advises organizations implementing sensor‑based monitoring to start with high‑impact shipments or routes and integrate sensor data with existing ERP and digital supply chain systems. That same principle applies when you ship the sensors themselves. If your logistics providers can feed real‑time status into your CMMS or work‑management tools, you can coordinate maintenance windows with actual arrival times instead of estimates.

Pros and Cons of Express Sensor Shipping

Express shipping for sensors is not a universal solution; it is a controlled tool.

On the upside, faster shipping directly supports uptime and safety. It allows you to maintain lean inventory without abandoning resilience. It accelerates pilot projects by reducing lead times for kit deployment. It protects predictive maintenance coverage by minimizing the gap between sensor failure and replacement. It can also differentiate your service if you are a systems integrator or OEM providing sensors and monitoring as part of a package; being able to promise and deliver rapid replacements builds trust.

Express freight also supports financial performance when used smartly. Research in expedited logistics shows that by shortening delivery windows, companies can lower inventory levels, reduce storage and holding costs, and cut the risk of stockouts. In sectors where downtime is expensive, the total cost of ownership often favors expedited shipping for selected items.

On the downside, express and same‑day services are more expensive on a per‑shipment basis. That premium must be justified by clear downtime avoidance or customer value. There is also operational complexity. You need clear internal rules defining when same‑day is allowed, who approves it, and how it is budgeted. Without discipline, users may default to “rush everything” behavior that erodes the financial case.

Regulatory and compliance constraints can further limit options. Export‑controlled sensors or those containing hazardous materials cannot always take the fastest route, even if you are willing to pay. Scheduling constraints matter as well. Some services, such as Pyromation’s express manufacturing options, require telephone orders during business hours. Miss that window and the guaranteed ship date shifts.

The right conclusion is not that express sensor shipping is inherently good or bad. The right conclusion is that it is powerful when tightly aligned with asset criticality, maintenance strategy, and total cost calculations.

A Practical Implementation Roadmap

From a systems integrator’s perspective, rolling out an express sensor shipping capability follows the same pattern as any other reliability improvement.

First, clarify what you are trying to achieve in measurable terms. F7i suggests objectives such as cutting unplanned downtime by a given percentage or reducing energy waste from leaks by a specific amount. For logistics, you might target a reduction in average sensor replacement lead time from several days to less than one day for a defined critical asset list, or a reduction in emergency line‑stop events caused by missing condition monitoring hardware.

Second, perform an asset criticality analysis and derive your “express list” of sensor SKUs. For each, document the failure modes it helps detect, the cost of downtime or quality issues it prevents, and the impact of losing coverage. This is the list you will treat differently in your inventory and logistics planning.

Third, review your current sensor supply chain. Identify which parts are made to order, which are stocked locally, which come from overseas, and which distributors or manufacturers already offer same‑day processing or express manufacturing options. Engage those suppliers in discussions about guaranteed lead times, packaging standards, and data sharing.

Fourth, select and onboard logistics partners with clear roles. You might use one provider for local same‑day pickups, another for regional expedited moves, and rely on manufacturer‑level express services for certain product lines. Ensure that each understands your cargo, site constraints, and communication expectations.

Fifth, integrate systems. Work with IT and operations to link your inventory, CMMS, and purchasing systems with carrier platforms where possible. Implement rules that automatically flag when an order should be considered for express shipping based on asset importance, downtime risk, and delivery windows.

Sixth, pilot and refine. Start with a subset of assets and plants rather than trying to redesign everything at once. Monitor metrics such as average time from sensor failure to restored monitoring, number of emergency line stops due to missing sensors, freight cost per critical sensor, and any incidents of damage or compliance delays in transit. Use those data to tune your express list and your rules.

Seventh, standardize and train. Once you have a pattern that works, document the workflows, packaging requirements, and approval rules. Train maintenance planners, storeroom staff, and engineers on how and when to use each shipping mode. Reinforce that express shipping is a strategic tool, not an emergency button.

Short FAQ for Plant and Project Teams

When is same‑day shipping actually worth it for a sensor?

Same‑day shipping makes sense when the cost of downtime, safety risk, or regulatory exposure clearly exceeds the cost of premium freight. That is usually the case for sensors guarding critical production assets, high‑voltage equipment, or environmental and safety compliance. For low‑impact sensing points on non‑critical assets, expedited or even standard shipping is usually sufficient.

How many spare sensors should we keep if we adopt express shipping?

There is no single right number. In practice, plants often hold minimal on‑site stock for the most critical and hard‑to‑replace sensors, then rely on same‑day or expedited delivery for additional coverage. Combining a small buffer with reliable express shipping allows you to keep inventory lean while staying resilient. The sizing should come out of your asset criticality and risk analysis, not from a rule of thumb.

Does express shipping change how we choose sensor technology?

It should not change the fundamentals, which are still driven by measurement needs, reliability, and data integration. However, if two comparable sensors are available and one has stronger support for express manufacturing and shipping, that is a legitimate tie‑breaker. A sensor you can get in hours is, in practice, more valuable than one that takes weeks to arrive.

A modern automation strategy depends on sensors as much as it depends on PLCs and drives. Treating those sensors as generic catalog items with week‑long lead times is increasingly out of sync with how plants are run and how maintenance is managed. When you design an express sensor shipping capability that is grounded in asset criticality, integrated with your maintenance systems, and backed by proven logistics partners, you turn shipping speed into another engineering control. That is the kind of quiet, reliable infrastructure that keeps projects on track and production lines running.

References

- https://www.entouragefreightsolutions.com/the-benefits-of-expedited-shipping-for-time-sensitive-shipments

- https://www.samedaydelivery.com/

- https://bocsit.com/blog/local-same-day-courier-manufacturing-parts-components

- https://www.choovio.com/ultimate-guide-to-industrial-iot-sensor-selection/?srsltid=AfmBOopbvDI7od3axZbCIpY1A6T0-Cf1D40DTI0VSyBLtNMK0xy50Q24

- https://www.business-reporter.co.uk/digital-transformation/smarter-manufacturing-with-sensors

- https://www.dat.com/resources/expedited-shipping-benefits-best-practices

- https://f7i.ai/blog/beyond-the-datasheet-how-to-choose-the-best-industrial-sensors-for-your-predictive-maintenance-strategy-in-2025

- https://prdlax.com/why-these-5-major-industries-benefit-from-expedited-shipping-services/

- https://www.purolatorinternational.com/which-industries-benefit-from-expedited-shipping-services/

- https://www.pyromation.com/services/Expediting.aspx

Keep your system in play!

Top Media Coverage

Related articles Browse All

-

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu...

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu... -

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ...

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ... -

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

Need an automation or control part quickly?

- Q&A

- Policies How to order Part status information Shiping method Return Policy Warranty Policy payment terms

- Asset Recovery

- We Buy Your Equipment. Industry Cases

- ADDRESS

-

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

Copyright Notice © 2004-2024 amikong.com All rights reserved

Disclaimer: We are not an authorized distributor or distributor of the product manufacturer of this website, The product may have older date codes or be an older series than that available direct from the factory or authorized dealers. Because our company is not an authorized distributor of this product, the Original Manufacturer’s warranty does not apply.While many DCS PLC products will have firmware already installed, Our company makes no representation as to whether a DSC PLC product will or will not have firmware and, if it does have firmware, whether the firmware is the revision level that you need for your application. Our company also makes no representations as to your ability or right to download or otherwise obtain firmware for the product from our company, its distributors, or any other source. Our company also makes no representations as to your right to install any such firmware on the product. Our company will not obtain or supply firmware on your behalf. It is your obligation to comply with the terms of any End-User License Agreement or similar document related to obtaining or installing firmware.