-

Manufacturers

- ABB Advant OCS and Advant-800xA

- ABB Bailey

- ABB Drives

- ABB H&B Contronic

- ABB H&B Freelance 2000

- ABB Master

- ABB MOD 300, MOD 30ML & MODCELL

- ABB Procontic

- ABB Procontrol

- ABB Synpol D

- Allen-Bradley SLC 500

- Allen-Bradley PLC-5

- Allen-Bradley ControlLogix

- Allen-Bradley CompactLogix

- Allen-Bradley MicroLogix

- Allen-Bradley PanelView

- Allen-Bradley Kinetix Servo Drive

- Allen-Bradley PowerFlex

- Allen-Bradley Smart Speed Controllers

- 3300 System

- 3500 System

- 3300 XL 8mm Proximity Transducer

- 3300 XL NSV Proximity Transducer

- 990 and 991 Transmitter

- 31000 and 32000 Proximity Probe Housing Assemblie

- 21000, 24701, and 164818 ProbeHousing Assemblies

- 330500 and 330525 Piezo-Velocity Sensor

- 7200 Proximity Transducer Systems

- 177230 Seismic Transmitter

- TK-3 Proximity System

- GE 90-70 Series PLC

- GE PACSystems RX7i

- GE PACSystems RX3i

- GE QuickPanel

- GE VersaMax

- GE Genius I/O

- GE Mark VIe

- GE Series One

- GE Multilin

- 800 Series I/O

- Modicon 984

- Modicon Premium

- Modicon Micro

- Modicon Quantum

- Telemecanique TSX Compact

- Altivar Process

- Categories

- Service

- News

- Contact us

-

Please try to be as accurate as possible with your search.

-

We can quote you on 1000s of specialist parts, even if they are not listed on our website.

-

We can't find any results for “”.

-

-

Get Parts Quote

Allen Bradley 1756-L73 ControlLogix Price Guide: Current Market Rates and Cost Analysis

This is my linkedin:

As a seasoned expert in the field of automation spare parts, Sandy has dedicated 15 years to Amikon, an industry-leading company, where she currently serves as Director. With profound product expertise and exceptional sales strategies, she has not only driven the company's continuous expansion in global markets but also established an extensive international client network.

Throughout Amikon's twenty-year journey, Sandy's sharp industry insights and outstanding leadership have made her a central force behind the company's global growth and sustained performance. Committed to delivering high-value solutions, she stands as a key figure bridging technology and markets while empowering industry progress.

When you are speccing a ControlLogix rack, the 1756-L73 is often the brain of the whole system. It is a Logix 5570-class programmable automation controller designed for large factory and process applications, with enough I/O capacity and motion capability to run serious plant equipment. The flip side is that this kind of controller is never the cheapest line item on a project bill of materials, and its price can look wildly inconsistent across distributors, surplus houses, and online marketplaces.

Speaking from a systems integrator’s point of view, the question to answer is not just “What does a 1756-L73 cost?” but “What am I actually buying at that price, and what risks or savings come with it?” Using public distributor descriptions, marketplace snapshots, and surplus-supplier disclaimers, this guide breaks down how the current market for 1756-L73-class controllers behaves and how to evaluate quotes pragmatically.

Where the 1756-L73 Fits in the ControlLogix Family

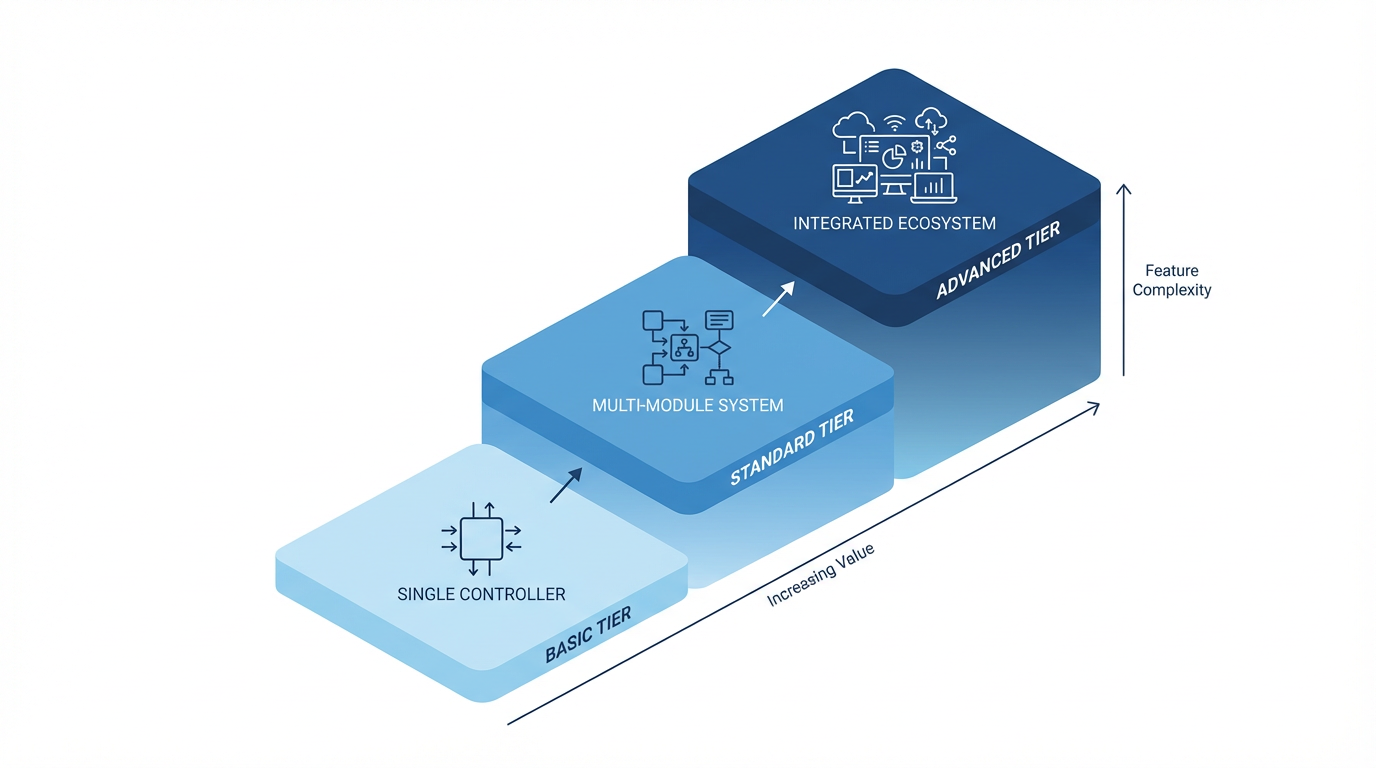

Rockwell Automation positions the 1756-L73 as a ControlLogix 5570 programmable automation controller. Rockwell describes programmable controllers generally as rugged industrial computers that monitor inputs, execute control logic, and drive outputs in manufacturing, energy, and similar environments. The 1756-L73 is one of the higher-end controllers in that family, intended for large, multi-discipline control.

A product description from an industrial automation supplier characterizes the 1756-L73 as a ControlLogix processor module in the Logix 5570 product category, used as a main processor for large factory and process automation. It supports both simplex and high-availability redundant controller configurations, which is one of the reasons it sits at a premium compared with compact or low-end PLCs.

Another distributor summary notes that this controller is used for high-performance, multi-discipline control, spanning discrete logic, process, motion, and drive integration in manufacturing plants and process industries. It installs in a ControlLogix chassis, communicates over the backplane, and relies on communication modules for plant-wide networking, such as EtherNet/IP.

In other words, you are not just paying for “a CPU module.” You are paying for the central controller that ties together a significant chunk of your plant’s I/O, networks, and motion system.

Technical Snapshot That Drives Cost

To understand why the 1756-L73 commands the prices it does, it helps to look closely at its capabilities, using distributor and refurbisher descriptions that are publicly available.

One detailed product writeup describes the 1756-L73 as a programmable automation controller with 8 MB of user memory and about 0.98 MB dedicated to I/O. It can handle up to 128,000 total digital I/O points and around 4,000 analog I/O points. It supports both local I/O in the same chassis and distributed I/O over extended communication networks.

Network flexibility is another cost driver. The same description lists support for EtherNet/IP, DeviceNet, ControlNet, SynchLink, and legacy networks such as Data Highway Plus and Remote I/O, with the option to reach third-party protocols through gateways and protocol converters. It is also compatible with partner ControlLogix modules in the Rockwell ecosystem.

For motion, the 1756-L73 supports integrated motion via SERCOS interface, analog motion modules, and motion over EtherNet/IP. That means one controller can coordinate multi-axis motion along with discrete and process control, which is substantial value in machine lines and coordinated drive applications.

Software-wise, the controller is programmed in the standard Rockwell Logix languages: ladder logic, structured text, function block diagram, and sequential function chart. It can handle up to 32 controller tasks with as many as 100 programs per task. Event tasks can accept all supported event triggers, which is important for responsive, event-driven control.

From an electrical and mechanical standpoint, a distributor specification notes that the module draws roughly 800 mA at about 5.1 V DC and a few milliamps at a lower voltage rail, dissipating around 2.5 W of power and 8.5 BTU per hour of heat. It is a one-slot, chassis-based module that fits any slot in a 1756 series chassis and weighs roughly 0.55 lb. The controller includes USB 2.0 at full-speed 12 Mbps for programming or maintenance.

Environmental ratings show it operating from about 32°F up to about 140°F, with storage down to around −40°F and up to about 185°F, and in humidity from roughly 5 to 95 percent non-condensing. Vibration tolerance is given as about 2 g from 10 to 500 Hz, with operating shock around 30 g and non-operating shock around 50 g. With an SD card installed, shock tolerance is listed up to about 45 g. Integrated energy storage eliminates the need for a traditional battery to retain volatile memory, which reduces maintenance but adds some technology cost.

You can see how this feature set stacks up into a premium controller: high I/O density, extensive network support, integrated motion, redundant capability, strict environmental ratings, and sophisticated task handling. All of that feeds directly into the price, especially through official channels.

A concise way to visualize the technical baseline that influences cost is to summarize a few of these attributes:

| Aspect | 1756-L73 Characteristics (from distributor descriptions) |

|---|---|

| Controller class | ControlLogix 5570 programmable automation controller for large factory and process systems |

| Memory | About 8 MB user memory; approximately 0.98 MB I/O memory |

| I/O capacity | Up to roughly 128,000 digital I/O and 4,000 analog I/O |

| Networks | EtherNet/IP, DeviceNet, ControlNet, SynchLink, DH+, RIO, plus gateways for other protocols |

| Motion | Integrated motion via SERCOS, analog motion modules, and motion over EtherNet/IP |

| Tasks/programs | Up to 32 controller tasks, up to 100 programs per task; event tasks with multiple triggers |

| Environmental range | Operation roughly 32°F to 140°F; storage roughly −40°F to 185°F; high shock and vibration |

| Form factor | One-slot, chassis-based module for 1756 chassis, around 0.55 lb |

The market recognizes that you can drop cheaper logic in small machines, but when you need the capabilities in this table, you are automatically in a higher price band.

Market Landscape: Where 1756-L73 Prices Come From

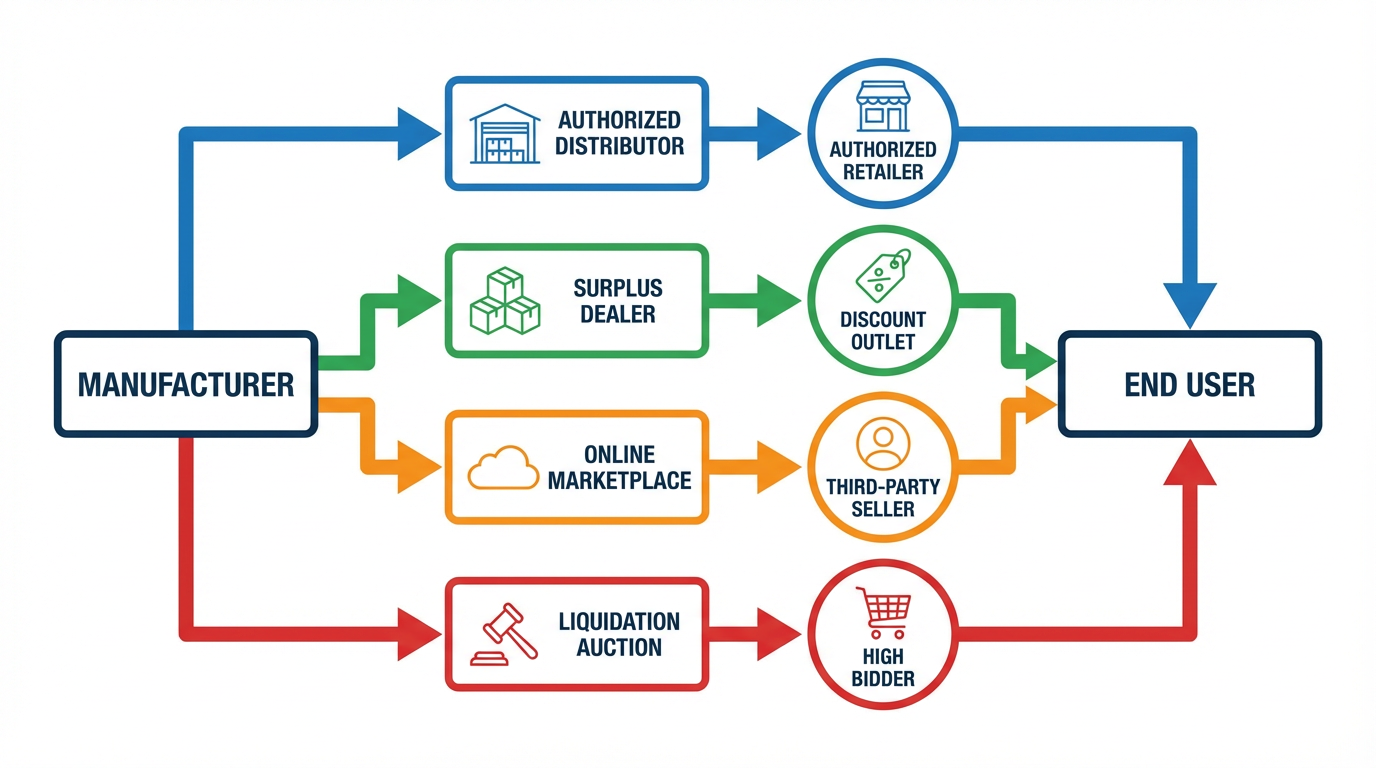

In project work, I tend to see four broad sourcing channels for 1756-L73-class controllers. Each has a distinct price behavior and risk profile, and the research notes line up well with that field experience.

One channel is manufacturer and authorized distribution. Rockwell Automation describes its programmable controllers and standard ControlLogix controllers on its own product pages, and official channels are where you receive factory-new stock, aligned firmware, and direct access to the manufacturer’s software and support ecosystem. The notes we have do not show Rockwell list prices, but from a cost-structure standpoint, you are paying for guaranteed authenticity, current revisions, and direct warranty support.

A second channel consists of independent surplus and refurbishment suppliers. Companies like Radwell, PDF Supply, and PLC Department explicitly state that they are not authorized distributors, resellers, or representatives of Rockwell Automation or Allen-Bradley. They emphasize that all trademarks and product names remain the property of their owners and are used for identification only. This is the classic surplus market: devices may be new surplus, refurbished, or previously used, typically with a separate in-house warranty provided by the reseller rather than by the original manufacturer.

Radwell’s kind of listing for the 1756-L73 highlights that they can supply new sealed, new surplus, refurbished, or repaired units, with multi-year in-house warranties on surplus and refurbished hardware and on repair services. They also market same-day shipping for in-stock units and global logistics support, and they offer to repair a customer’s existing 1756-L73 as an alternative to replacement. The important point is that while these providers can undercut authorized channels and solve lead-time problems, their warranty is their own, not the OEM’s.

PDF Supply and PLC Department go even further in their disclaimers regarding firmware and software. PDF Supply states that some hardware they sell may include firmware installed by the original manufacturer, but they make no representation regarding a buyer’s legal right to download, obtain, or use that firmware. They do not sell or license any software required to operate the hardware, and they do not warrant that the firmware version is suitable or up to date. Customers are responsible for complying with firmware licenses and acquiring any required software and licenses directly from the original manufacturer or authorized sources.

PLC Department describes itself as supplying surplus and refurbished industrial automation hardware sourced exclusively from independent third-party channels. They note that products may be used, surplus, have older date codes or earlier series or versions, and may differ in appearance, features, or configuration from units sold through authorized channels. They explicitly state that firmware presence or version is not guaranteed, they do not obtain or install firmware, and manufacturer quality control and warranties do not apply unless they specifically say otherwise. In short, the hardware might work perfectly, but you own the risk of firmware compatibility and licensing.

A third channel is online industrial marketplaces and aggregators. One marketplace entry for a closely related controller, the 1756-L73K, describes it as an 8 MB memory controller for ControlLogix chassis, backward-compatible with I/O modules, and highlights that the broader industrial controller market is projected to grow at about a 7.2 percent compound annual rate through 2028. That same snapshot shows the 1756-L73K offered by independent suppliers across a wide price band, roughly from $10.00 to $400.00, with noted volume-based pricing and minimum order quantities that sometimes use unusual descriptors that must be clarified with the seller.

Within that marketplace, supplier-quality benchmarks are described in terms of review scores of at least 4.8, documented buyer return rates below about 30 percent, transparent transaction histories, and after-sales terms such as around-the-clock technical support and minimum one-year warranties. Several specific suppliers are mentioned with high review scores and claims of “sealed new” or “100 percent original” units, but limited price transparency beyond the general range.

Finally, there are general-purpose e-commerce platforms and auctions, including listings for new factory-sealed 1756-L73 units. These listings emphasize condition such as “factory sealed,” seller location, and shipping restrictions, but the snapshots we have focus mainly on international shipping and customs notes rather than specific price numbers. They remind buyers that international shipments may be subject to customs processing and delays, that sellers must declare customs value, and that import duties, taxes, and brokerage fees fall on the buyer. Buyers are advised to consult their customs office for details.

Across these four channels, the pattern is clear.

OEM and authorized distribution aim for maximum control and support; surplus and refurbished suppliers offer cost and availability advantages at the expense of OEM warranty and occasionally firmware certainty; marketplaces and auctions add another layer of price competition and risk, especially across borders.

What Current Data Suggests About Price Levels

The research notes we have do not include official manufacturer list prices for the 1756-L73, so any responsible price guide has to be careful. That said, several pieces of evidence show how the market behaves and how wide the spread can be.

The most explicit numerical data appears in the marketplace snapshot for the 1756-L73K variant. That source describes sealed, 8 MB controllers in the same ControlLogix class with a price range of about $10.00 to $400.00 per unit, depending on supplier and configuration. It also notes that volume-based pricing can reduce the per-unit cost by roughly 15 to 40 percent for minimum order quantities on the order of one to five units.

From an integrator’s perspective, that tells you two things. First, the observed range is extremely broad, which usually means you are seeing a mix of genuine surplus, aggressively priced used units, potentially mislabeled items, and perhaps simply stale or placeholder pricing. Second, the magnitude of the volume discount in that sample, on the order of a few tens of percent even at small quantities, suggests that any one-off quote you receive in that ecosystem is a starting point, not a final number.

The surplus and refurb channels tend not to publish fixed list prices either, but their business model is clear. Surplus units, especially older date codes or series, and refurbished controllers obtained from independent channels will usually be priced below factory-new, sometimes significantly so, while still carrying an in-house warranty. Repair services for an existing 1756-L73 might undercut both new OEM and surplus replacement depending on the failure mode.

At the same time, the legal and technical disclaimers around firmware and software show why some stock appears “cheap.” Sellers such as PDF Supply and PLC Department candidly state that they do not guarantee firmware presence or version, they do not supply software, and the customer is fully responsible for obtaining licenses from the manufacturer. A lower purchase price might hide later engineering time for firmware downgrades or upgrades, software license acquisition, or even a re-specification if the hardware turns out to be incompatible with existing project files.

Customs and cross-border shipping introduce their own cost band. The e-commerce platform guidance makes it clear that international buyers should expect possible customs inspection delays, duty and tax charges, and brokerage fees at delivery. None of those appear in a headline price, but they are real cash costs. For a high-value controller, import duties and taxes can easily erase a perceived price advantage from a low foreign listing.

Taken together, the picture that emerges is not a single “market price” for a 1756-L73, but a spectrum shaped by condition, channel, legal posture, and logistics. The only quantitative reference we have is the $10.00 to $400.00 spread on a closely related variant and the 15 to 40 percent volume discount behavior. That is enough to prove that wide spreads exist, but not enough to claim a precise going rate. Any serious buyer should treat that range as evidence of variability, then do the hard work of normalizing quotes by condition, warranty, and risk.

Channel Comparison: Cost Versus Risk

Even without precise list prices, it is possible to summarize how the main channels trade off price and risk for 1756-L73-class controllers. The following table synthesizes the behaviors described by Rockwell Automation and multiple independent suppliers.

| Channel type | Typical condition and support | Price behavior and notes | Key risks and caveats |

|---|---|---|---|

| Manufacturer / authorized | Factory-new hardware, current series and firmware, OEM warranty, official software ecosystem | Highest baseline price; discounts negotiated via contracts and volume; no public numbers in the research notes | Best overall assurance; long lead times possible; up-front spend balanced by lower lifecycle uncertainty |

| Independent surplus / refurb | New surplus, refurbished, or used; in-house warranty; older date codes possible | Priced below OEM in most cases; details of actual prices not published in the notes; repair can be cheaper than replacement | Not authorized; OEM warranty and QC do not carry over; firmware version not guaranteed; software not included |

| Online industrial marketplaces | Mix of “sealed new” and “100% original” units via third-party sellers | For related 1756-L73K, observed range of about $10.00 to $400.00; volume discounts of roughly 15–40% for small MOQs | Wide variability in authenticity and support; unusual MOQ descriptors; need to vet seller rating and returns |

| General e-commerce / auctions | Individual sellers; “factory sealed” often claimed; mixed return policies | Prices not captured in the notes; cross-border shipping may add duties, taxes, and brokerage fees beyond the sticker price | Import delays, customs charges, and limited recourse on mis-labeled hardware or incorrect firmware |

The important lesson is that any price comparison has to normalize for these channel differences. A controller from an authorized distributor with OEM warranty and clean firmware alignment is a different product, in practical terms, from a surplus controller with unknown firmware that may require licenses you do not yet own.

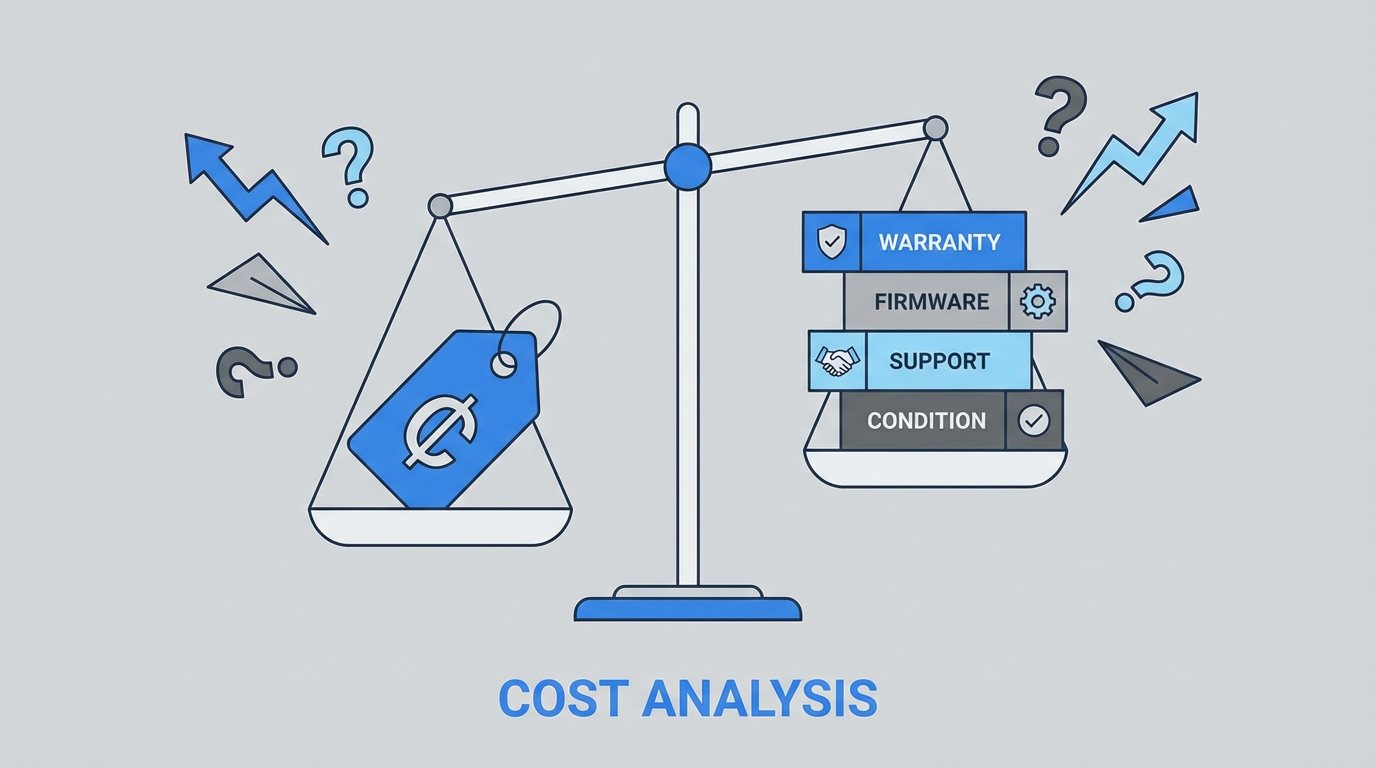

Hidden Costs and Risk Premiums

When plant managers or purchasing teams focus purely on unit price, they often miss the less obvious cost drivers. The research notes around firmware, software, and customs highlight several of these.

Firmware and software licenses are one category. PDF Supply explicitly warns that while some hardware it sells includes manufacturer-installed firmware, the company does not represent that buyers have the right to download, obtain, or use that firmware and does not provide or license required operating software. PLC Department similarly disclaims any guarantee of firmware presence or version and points customers back to manufacturers or authorized sources for software and licenses. If a surplus controller arrives with a firmware revision that does not match the existing project or the rest of the rack, you may have to spend engineering hours, secure firmware from Rockwell Automation, and ensure your software licenses cover any version changes. In some organizations, that effort is more expensive than paying more up front for fully aligned hardware.

Warranty and support are another hidden dimension. Radwell, for example, emphasizes its own multi-year warranties on surplus and refurbished units and on repairs, but notes that it is an independent supplier and not an authorized Rockwell distributor. OEM warranties and support obligations are structured differently for authorized versus independent sales. When a controller fails in the field during a critical production run, you want clarity on who owns the replacement and support liability. A cheaper surplus purchase might justify a higher “risk premium” in your internal budgeting.

Customs and cross-border shipping can also be non-trivial. The e-commerce platform notes that international shipments may be subject to customs processing tied to declared value, that import duties and taxes are the buyer’s responsibility, and that brokerage fees may be payable at delivery. It also warns of possible delays due to customs inspections. If you buy a controller abroad because the unit price is lower, then wait through customs delays and pay unexpected duties and brokerage, the total landed cost can exceed a more straightforward domestic purchase.

Finally, there is the cost of compatibility and commissioning. Radwell and others recommend verifying part number suffix, series, and firmware revision of a 1756-L73 against existing ControlLogix hardware and Studio 5000 or RSLogix 5000 project requirements. If a controller arrives with the wrong series or firmware, you may need to align firmware across the rack, adjust project files, and retest safety and motion functions. Time on the plant floor with production stopped is real money.

That downtime risk belongs in your cost model, even if it does not appear on a quote.

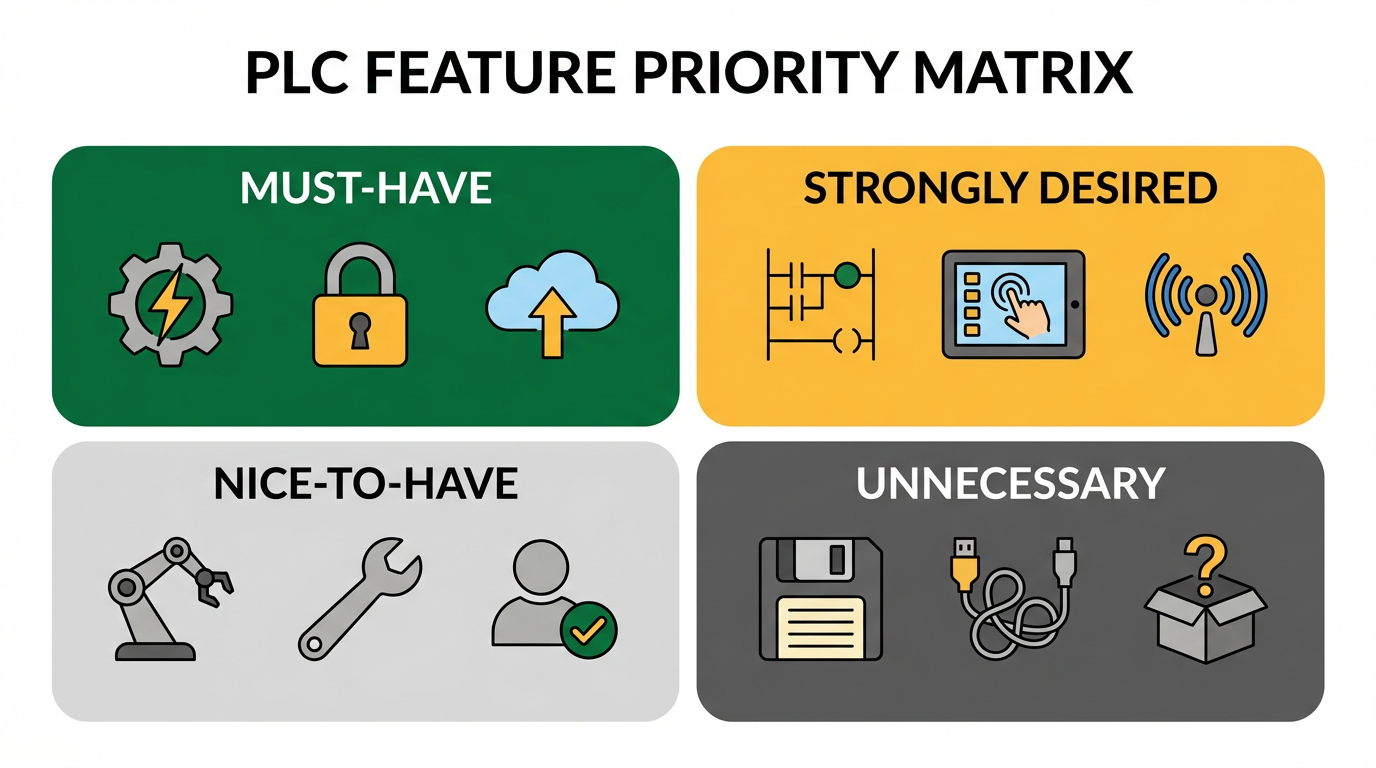

Buying Strategy From a Systems Integrator’s View

One of the more grounded pieces of advice in the research comes from an automation engineer commenting on PLC selection. He says that lists of PLC features are of limited value and that the better approach is to make a structured list of things that are absolutely required, things that are strongly desired, and things that would be nice but are not critical. He notes that most modern PLC families will meet the must-have and strongly desired items as long as you are honest about what truly belongs in those categories.

That logic applies directly to 1756-L73 pricing and sourcing. Before you compare quotes or hunt for a bargain, you should decide what is non-negotiable and what you are willing to trade off for cost or lead time.

For some organizations, OEM warranty and direct manufacturer support are non-negotiable. In those cases, you are effectively restricted to authorized channels and should tune your expectations accordingly. Cost optimization then becomes a matter of contract negotiation, volume aggregation across projects, and timing your purchases.

For others, especially when keeping legacy lines running, the required criteria may be part-number accuracy, series compatibility, and proven test results, while the source of the hardware is more flexible. In those scenarios, surplus and refurb suppliers and marketplaces become viable options. You still need to manage firmware and licensing, but you can accept an independent warranty if it is documented and robust.

At the same time, you should consciously place things like cosmetic condition, packaging style, or even minor date-code differences into the nice-to-have category rather than the must-have list. That mindset keeps you from overpaying for factors that have little impact on production performance.

Practical Steps to Analyze a 1756-L73 Quote

When I evaluate 1756-L73 quotes in projects, I treat price as the last metric, not the first. Several practical checks, many of which are explicitly or implicitly recommended in the research notes, help put a number into context.

The starting point is clarifying exactly which part you are being quoted. That means confirming the part number, any suffixes, the series, and the hardware revision. Radwell and others recommend matching these against your existing ControlLogix chassis and your controller project requirements. A misaligned revision can materially change the cost to deploy, even if the module itself is inexpensive.

Next, confirm the condition and origin. Is the unit factory-new with OEM warranty, new surplus with independent warranty, refurbished, repaired, or used? Surplus and refurb suppliers are clear that manufacturer warranties usually do not apply and that their own warranties govern. That transparency is helpful, but you should assign a different risk factor and internal “cost of ownership” to each condition type.

You should then ask very specific questions about firmware and software. Given how blunt PDF Supply and PLC Department are about not guaranteeing firmware presence or version and not supplying software, I always expect to manage firmware myself. The question for the supplier is what is currently loaded, whether they can test it to that revision, and whether they will document it. On your side, you must verify that your Rockwell Automation software licenses and firmware access rights cover the needed versions.

Warranty, returns, and after-sales support belong on your checklist as well. The marketplace snapshot suggests using supplier review scores, return rates, and warranty length as quality benchmarks. It mentions review scores on the order of 4.8 or higher, return rates below about 30 percent, documented transaction history, around-the-clock technical support, and at least a one-year warranty. You might set your own thresholds, but the idea is to treat supplier history and terms as part of the price evaluation, not as fine print.

Finally, you need to fold in logistics. For domestic suppliers, that is primarily lead time and overnight shipping availability, which some outlets emphasize. For cross-border purchases, you must factor in duties, taxes, brokerage fees, and customs delays described in the e-commerce shipping guidance. It is not uncommon for those to swing the effective cost by a noticeable margin.

By the time you finish this checklist, two quotes that looked very different in raw dollars often turn out to be much closer when risk, warranty, and engineering effort are included.

Occasionally, a seemingly cheap option becomes the most expensive once you count the hidden work.

Volume Pricing and Project-Level Cost Planning

The marketplace data for the 1756-L73K variant includes an important insight for project planners: even modest quantities can yield substantial per-unit discounts. That source notes that minimum order quantities of roughly one to five units can reduce per-unit prices by about 15 to 40 percent. While that is one sample, it is consistent with how many suppliers, including surplus houses, think about small-volume industrial orders.

In practice, that means if you know you will need several 1756-L73-class controllers over a series of projects, it can be smarter to negotiate or place a consolidated order rather than buying individual units ad hoc. The savings may not just be in headline price; suppliers might offer longer warranties, priority handling, or better testing documentation when they see a larger order.

The same marketplace entry also flags unusual minimum-order descriptors, such as using terms that clearly do not belong in an industrial context. The guidance is simple: clarify exactly what a supplier means by its order quantity and pricing structure before committing. Ambiguous terms around quantity or unit of measure are a red flag, and in a controller class as critical as the 1756-L73, you cannot afford surprises.

FAQ: Common Questions About 1756-L73 Pricing

Why do some 1756-L73-class offers seem unrealistically cheap?

The only concrete price range in the research is for a closely related 1756-L73K controller, where some marketplace offers span from about $10.00 up to $400.00. Offers near the bottom of that range are far below what you would expect for a high-end ControlLogix controller through official channels. In my view, such listings are best treated as indicators of market noise rather than reliable opportunities. The price can reflect mislabeling, placeholder data, incomplete units, or high-risk stock with unknown firmware or history. Always weigh the claimed condition, seller ratings, warranty, and your total cost of ownership before treating very low prices as real options.

Is it safe to buy surplus or refurbished 1756-L73 controllers?

It can be, but only if you understand and accept the trade-offs. Companies such as Radwell, PDF Supply, and PLC Department openly state that they are not authorized Allen-Bradley or Rockwell Automation distributors and that manufacturer warranties do not apply unless they specifically say so. They also emphasize that firmware versions are not guaranteed and that they do not supply or license the software needed to operate the hardware. On the positive side, surplus and refurbished units often come with in-house warranties and can be available quickly. The burden is on you to verify compatibility, manage firmware and licensing, and decide whether the in-house warranty is strong enough for your application.

How much can I realistically expect to save through volume purchases?

The only explicit indicator in the notes is that in one marketplace dataset for the 1756-L73K, per-unit prices dropped by roughly 15 to 40 percent when minimum order quantities of around one to five units were met. That suggests that even small batches can attract meaningful discounts. Actual savings will depend on the supplier, condition, and your negotiation leverage, but it is reasonable to assume that grouping several controllers into a combined purchase will buy you some discount headroom, whether you are dealing with an authorized distributor or a surplus house.

What should I watch for with international purchases of 1756-L73 controllers?

International listings often advertise fast global shipping, but e-commerce platform guidance makes it clear that customs processing can introduce delays and extra costs. Sellers must declare the item’s customs value, and buyers are responsible for import duties, taxes, and any brokerage fees charged at delivery. These costs are highly dependent on the destination country and declared value, and they are not captured in the sticker price. Before relying on an overseas bargain, you should talk with your customs office or logistics partner to understand likely charges and timeframes, then incorporate those into your cost comparison.

Closing Thoughts

The 1756-L73 is a serious controller, and the market treats it that way. What looks like a single part number on a bill of materials actually hides a web of variables: condition, firmware, licensing, warranty, logistics, and supplier quality. As a systems integrator and project partner, I recommend treating price as the outcome of those choices rather than the starting point. If you define what you truly need, vet your suppliers, and budget for the engineering and legal realities around firmware and software, you can land on a 1756-L73 sourcing strategy that protects both your plant and your project budget.

References

- https://www.plctalk.net/forums/threads/plc-costs.26350/

- https://www.accio.com/plp/1756-l73k

- https://www.ebay.com/itm/197580294042

- https://eecoonline.com/product-family/rockwell-automation-1769-compactlogix-control-systems

- http://plccompare.com/rockwell-controllogix/

- https://www.plcdepartment.com/products/1756-l73?srsltid=AfmBOoqm4RfKgCaB9_-TsgJ-MaigBa4nSRY7LizBin6cW5lI5HilnpdI

- https://www.plchardware.com/Products/RA-1756-L73.aspx?srsltid=AfmBOoopFYGRLKeh2P0X8DU0pzzj3DsiFOvOip2EDTp74sL6mFI-mANd

- https://www.1sourcedist.com/product/category/US_121512030000/controllogix?srsltid=AfmBOopa0qKmLP3Px_Z33HXs1zRL-RKMKCEjrrEGpgYX40JCW2s6aC4F

- https://control.com/forums/threads/plc-manufacturers-product-comparison.10688/

- https://www.dosupply.com/automation/allen-bradley-plc/controllogix/1756-L73?srsltid=AfmBOooU_yvhUkrr4CD3774QgXfihI68yR9_j-Bwem0yAidjah2iXCwI

Keep your system in play!

Related Products

Related articles Browse All

-

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu...

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu... -

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ...

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ... -

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

Need an automation or control part quickly?

- Q&A

- Policies How to order Part status information Shipping Method Return Policy Warranty Policy Payment Terms

- Asset Recovery

- We Buy Your Equipment. Industry Cases Amikong News Technical Resources

- ADDRESS

-

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

Copyright Notice © 2004-2026 amikong.com All rights reserved

Disclaimer: We are not an authorized distributor or distributor of the product manufacturer of this website, The product may have older date codes or be an older series than that available direct from the factory or authorized dealers. Because our company is not an authorized distributor of this product, the Original Manufacturer’s warranty does not apply.While many DCS PLC products will have firmware already installed, Our company makes no representation as to whether a DSC PLC product will or will not have firmware and, if it does have firmware, whether the firmware is the revision level that you need for your application. Our company also makes no representations as to your ability or right to download or otherwise obtain firmware for the product from our company, its distributors, or any other source. Our company also makes no representations as to your right to install any such firmware on the product. Our company will not obtain or supply firmware on your behalf. It is your obligation to comply with the terms of any End-User License Agreement or similar document related to obtaining or installing firmware.

Cookies

Individual privacy preferences

We use cookies and similar technologies on our website and process your personal data (e.g. IP address), for example, to personalize content and ads, to integrate media from third-party providers or to analyze traffic on our website. Data processing may also happen as a result of cookies being set. We share this data with third parties that we name in the privacy settings.

The data processing may take place with your consent or on the basis of a legitimate interest, which you can object to in the privacy settings. You have the right not to consent and to change or revoke your consent at a later time. This revocation takes effect immediately but does not affect data already processed. For more information on the use of your data, please visit our privacy policy.

Below you will find an overview of all services used by this website. You can view detailed information about each service and agree to them individually or exercise your right to object.

You are under 14 years old? Then you cannot consent to optional services. Ask your parents or legal guardians to agree to these services with you.

-

Google Tag Manager

-

Functional cookies

Leave Your Comment