-

Manufacturers

- ABB Advant OCS and Advant-800xA

- ABB Bailey

- ABB Drives

- ABB H&B Contronic

- ABB H&B Freelance 2000

- ABB Master

- ABB MOD 300, MOD 30ML & MODCELL

- ABB Procontic

- ABB Procontrol

- ABB Synpol D

- Allen-Bradley SLC 500

- Allen-Bradley PLC-5

- Allen-Bradley ControlLogix

- Allen-Bradley CompactLogix

- Allen-Bradley MicroLogix

- Allen-Bradley PanelView

- Allen-Bradley Kinetix Servo Drive

- Allen-Bradley PowerFlex

- Allen-Bradley Smart Speed Controllers

- 3300 System

- 3500 System

- 3300 XL 8mm Proximity Transducer

- 3300 XL NSV Proximity Transducer

- 990 and 991 Transmitter

- 31000 and 32000 Proximity Probe Housing Assemblie

- 21000, 24701, and 164818 ProbeHousing Assemblies

- 330500 and 330525 Piezo-Velocity Sensor

- 7200 Proximity Transducer Systems

- 177230 Seismic Transmitter

- TK-3 Proximity System

- GE 90-70 Series PLC

- GE PACSystems RX7i

- GE PACSystems RX3i

- GE QuickPanel

- GE VersaMax

- GE Genius I/O

- GE Mark VIe

- GE Series One

- GE Multilin

- 800 Series I/O

- Modicon 984

- Modicon Premium

- Modicon Micro

- Modicon Quantum

- Telemecanique TSX Compact

- Altivar Process

- Categories

- Service

- News

- Contact us

-

Please try to be as accurate as possible with your search.

-

We can quote you on 1000s of specialist parts, even if they are not listed on our website.

-

We can't find any results for “”.

-

-

Get Parts Quote

BOM Sourcing Services for Automation Projects: A Veteran Integrator’s View

When an automation project slips, it rarely fails because the PLC could not solve a logic formula. It fails because a handful of parts in the bill of materials never show up, arrive with the wrong spec, or are quietly changed without anyone updating the drawings, the controller program, or the panel layout. After decades of building and commissioning control systems, I have learned that BOM sourcing is where you win or lose an automation project.

This article walks through what a BOM sourcing service actually does for industrial automation and controls, how it connects to cost and lead time, and how to decide whether you should build this capability in-house or lean on a specialized partner. The focus is pragmatic: keeping your lines running, your panels buildable, and your budgets intact.

What BOM Sourcing Really Means in Automation

In manufacturing and automation, a bill of materials is the product’s recipe. It is the structured list of parts, materials, and subassemblies you need to build, commission, and maintain a system. Research from Cofactr and Fishbowl frames it as the backbone of the product: the engineering bill of materials shows the product as designed, the manufacturing bill of materials shows how it is built, and the service or MRO BOM shows how it is maintained over its life.

In automation projects, that single concept has to span a lot of realities. The same BOM needs to cover PLCs, safety relays, network switches, remote I/O slices, sensors in the field, drives and starters in the MCC, terminals and ferrules, DIN rail and enclosures, labeling, and sometimes the software licenses that bind it together. ManufacturingTomorrow and Fishbowl both emphasize that BOMs work best when they are hierarchical: top-level assemblies, such as a main control panel or a remote junction box, decompose into subassemblies and individual parts, which makes cost, traceability, and maintenance easier.

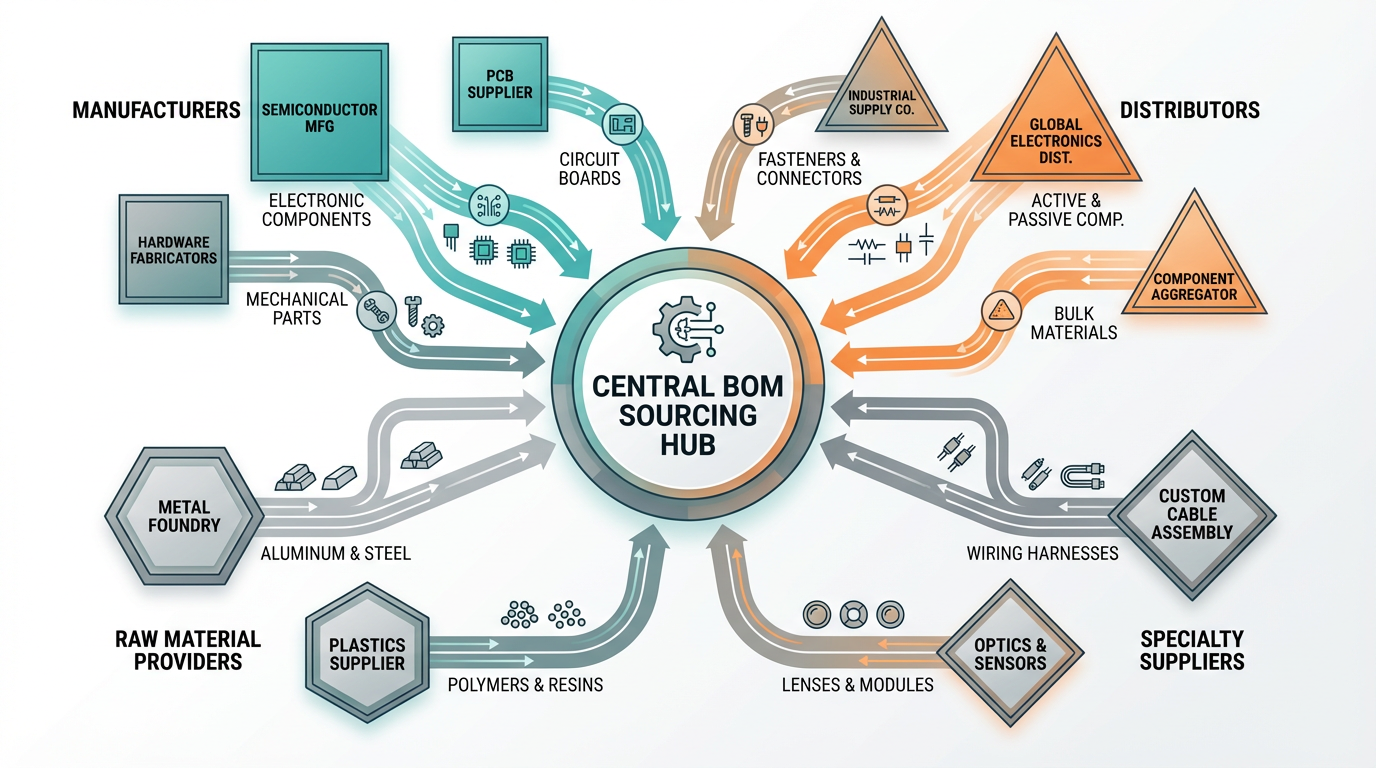

BOM sourcing is the discipline of turning that multi-view, multi-level list into practical supply: which exact manufacturer part numbers to buy, in what quantities, from whom, on what terms, and with what alternates and risk controls. It is not only buying; it is the combination of data management, supply chain strategy, and commercial negotiation that makes the BOM actually buildable.

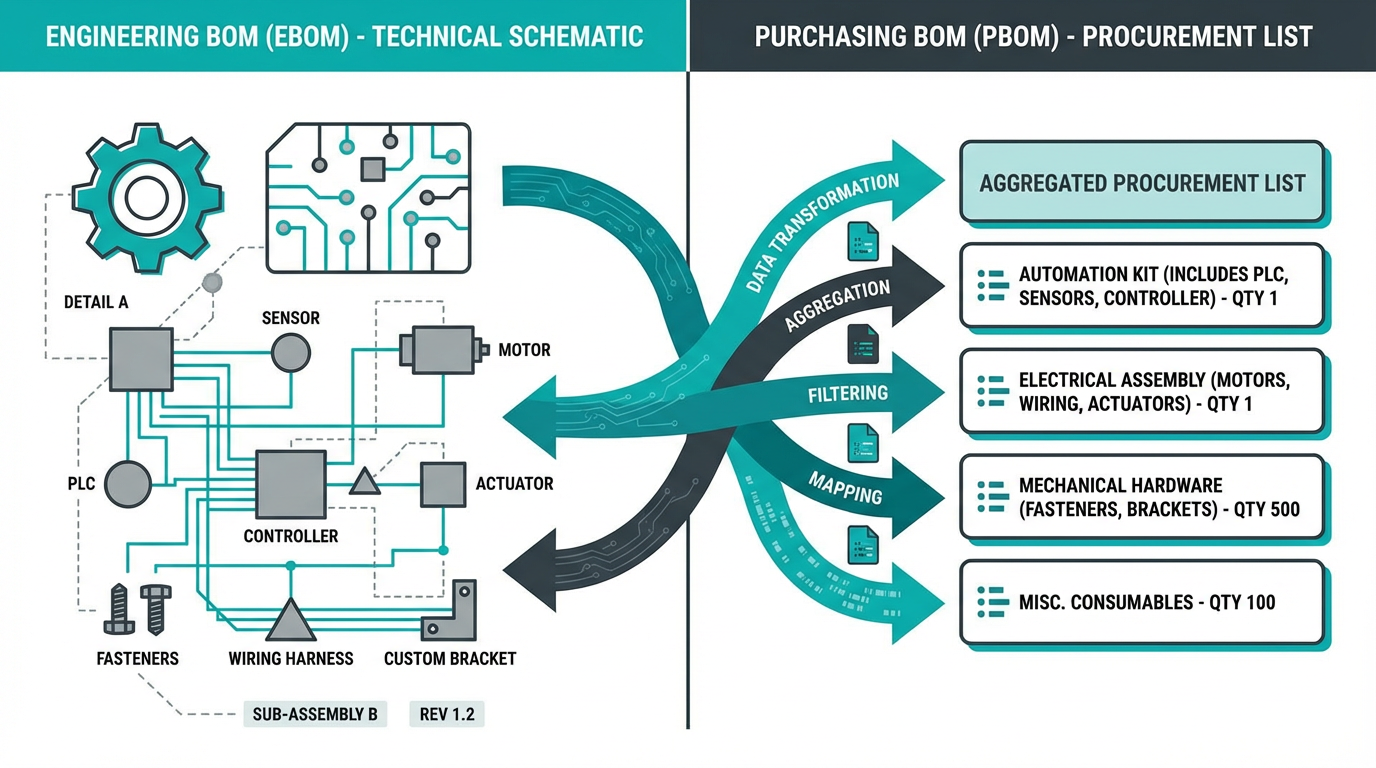

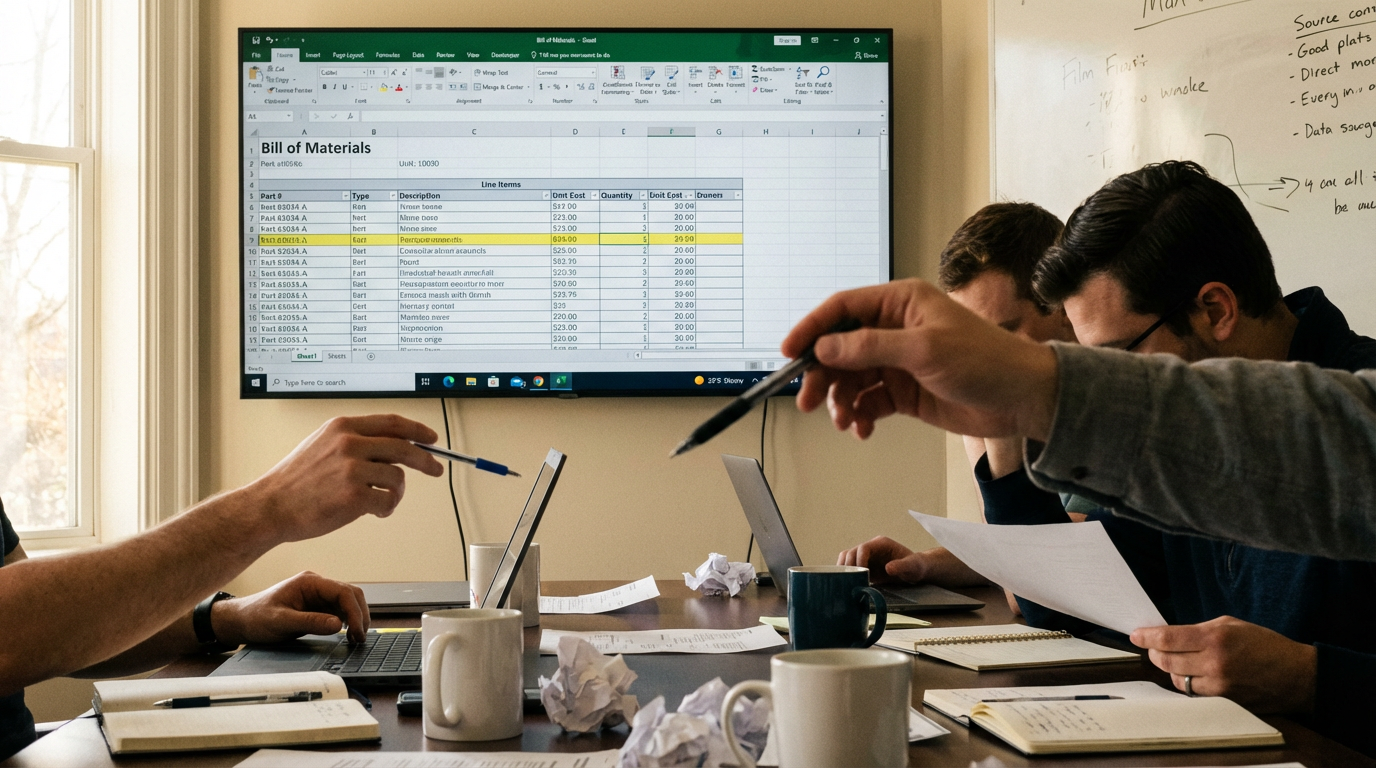

A detail from the Siemens community illustrates the gap between engineering and purchasing views. Designers want a “purchasing BOM” that rolls up every instance of a shared item, such as a 1/4–20 bolt, into a single line with an aggregated quantity, while still updating dynamically when the CAD model changes. That is exactly the type of bridge a good BOM sourcing service builds: translating a complex engineering structure into a simple, dynamic, procurement-ready view without losing fidelity.

Why BOM Sourcing Matters More Than Ever

The last few years have made one thing clear: static BOMs and spreadsheet-based sourcing cannot keep up with today’s supply volatility. Luminovo’s work on real-time BOM costing shows that traditional methods, such as one-off spreadsheet costing and periodic price refreshes, are too slow for markets where lead times and prices move faster than your change approval cycle. The result is surprise price hikes, sudden shortages, and reactive redesigns.

AGS Devices points out that BOM cost generally represents up to around seventy percent of total manufacturing expense. Their analysis also notes that fifty to seventy percent of a product’s manufacturing cost is effectively locked in at the BOM stage. Once you have designed the product and frozen the BOM, your cost flexibility shrinks dramatically. Poor sourcing decisions at this stage, such as clinging to end-of-life parts or ignoring tariff exposure, can drive BOM costs fifteen to twenty‑five percent higher than they needed to be.

The administrative burden is not trivial. Forrester research cited by Altium found that engineers spend up to one hundred fifty‑nine hours per year on administrative tasks, mostly around procurement and BOM management. Eighty percent of designs require part replacements, adding roughly forty hours of sourcing effort and contributing to an average of 2.8 PCB respins at about forty six thousand dollars per respin in electronics contexts. While those numbers come from PCB design, the pattern will look familiar to anyone who has reworked panel layouts because a critical relay or network switch disappeared from the market halfway through a project.

NetSuite reports that as recently as 2023, around seventy percent of manufacturers still entered BOM data manually. In an automation project, that typically means separate spreadsheets for engineering, panel shops, purchasing, and maintenance. Every time someone copies and pastes a part number, you create another opportunity for mismatch, especially when the field tech on night shift orders a replacement off an outdated print.

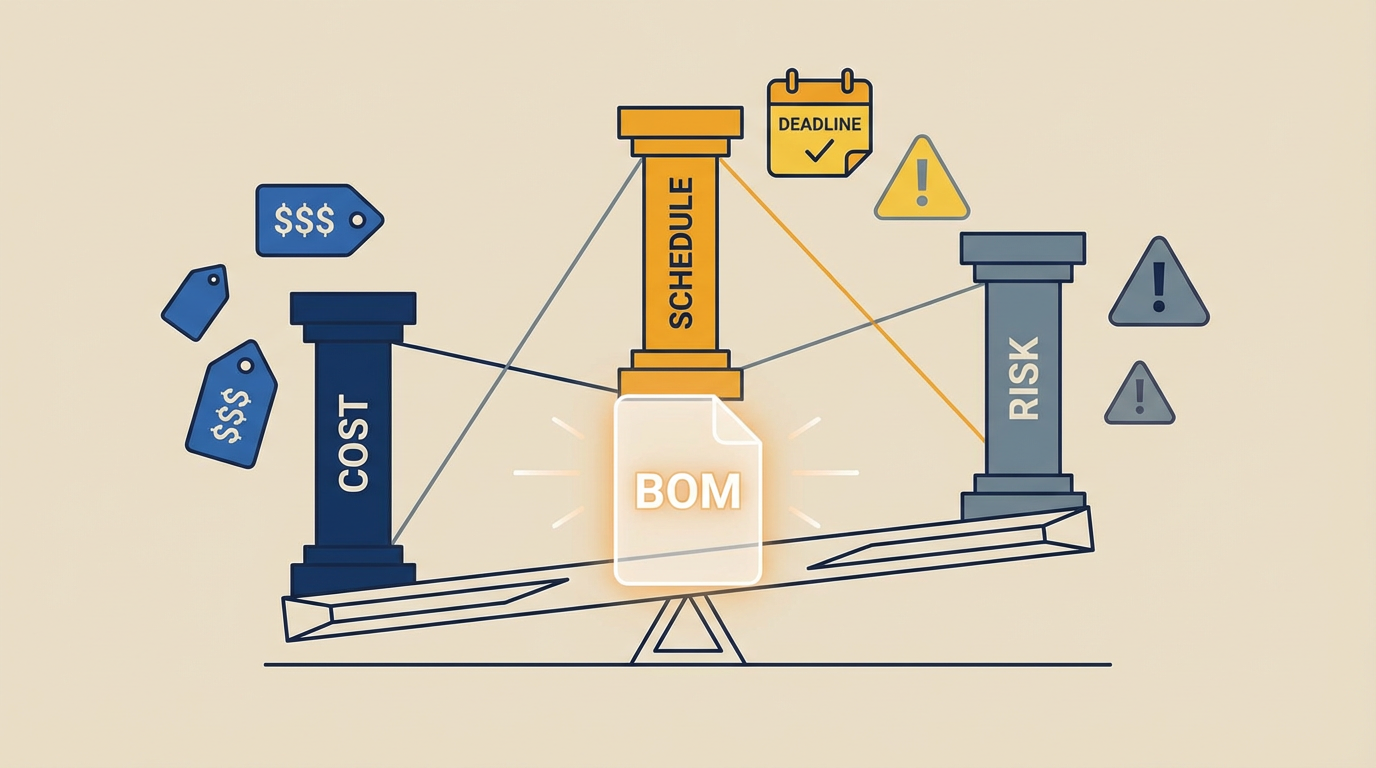

In that environment, BOM sourcing is not just a tactical buying activity. It is a strategic lever for cost, schedule, and risk.

From Engineering BOM to Purchasing BOM in Controls Projects

On the engineering side, it is natural to think in terms of function: I need eight analog inputs here, four safety gates there, three drives on that line. That turns into an engineering BOM with manufacturer part numbers, reference designators, and functional groupings that make sense to the controls designer.

ManufacturingTomorrow and Cofactr both emphasize that you also need a manufacturing BOM that describes how the system is actually built and shipped. For automation, that typically means panel-level and skid-level structures that align to how your panel shop quotes and how your fabricator assembles the hardware. Fishbowl and SDI add a third view that matters for industrial facilities: the service or equipment BOM that captures every consumable and replacement part needed to keep the line running over its lifetime.

The purchasing BOM is yet another view. The Siemens community request for a dynamic purchasing BOM captures the key idea: buyers need a flat, aggregated list of all purchased items across the assembly, with total quantities and current revisions, so that they can order accurately without manually recounting every screw and terminal.

A competent BOM sourcing service sits at that intersection. It understands how to translate an engineering BOM into a manufacturing BOM and then into a purchasing BOM without losing intent. Cofactr’s guidance on multi-view BOMs makes this explicit: all of these views should live in a single system of record, not in a pile of spreadsheets. When that is done well, design changes propagate cleanly into purchasing and back into inventory and service, instead of being rediscovered on the plant floor.

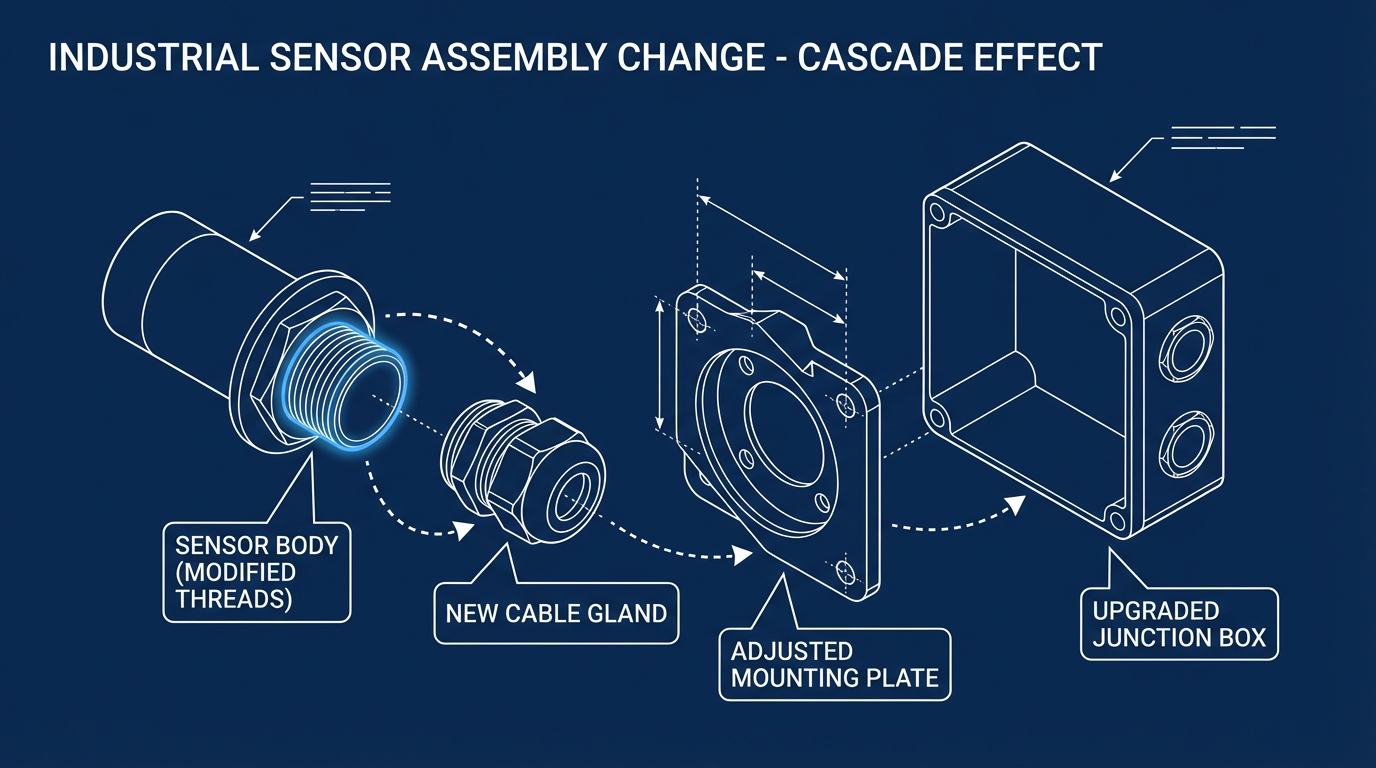

In a controls project, that translation also has to respect practical details. If you change a sensor to one with a different thread or cable gland size, the BOM must reflect not only the new sensor but also the fittings, gland plates, and sometimes the field junction boxes that change with it.

When BOM sourcing is handled by a team that understands automation hardware, those ripple effects are caught early, not when the electrician is standing on a lift with a part that does not fit.

What a Professional BOM Sourcing Service Actually Does

From the outside, BOM sourcing can sound like “they buy parts for us.” In practice, a mature service does several distinct things that map directly to pain points in automation projects.

A first job is data cleaning and standardization. Parabola’s article on BOMs highlights how messy BOM data can be: different suppliers use different formats, units of measure, and naming conventions. Altium and UnleashedSoftware both stress the need for consistent part numbers, standardized fields, and version control. Before a sourcing service can optimize anything, it has to turn the engineering BOM into clean, structured data with unambiguous manufacturer part numbers, quantities, and attributes.

Next comes risk and lifecycle analysis. Altium’s practical guide to BOM management emphasizes lifecycle states such as active, not recommended for new designs, and obsolete, along with compliance data like RoHS and REACH. Perceptive‑IC adds lifecycle notifications and product change notices as key inputs. A sourcing service will flag parts that are at risk, either because they are near end of life, have weak availability, or show erratic lead times, and will propose alternates before those risks bite you during commissioning.

Costing and scenario analysis are another core function. AGS Devices goes into detail on BOM cost as the sum of unit cost times quantity, plus indirects like shipping, tariffs, and procurement overhead. LevaData and Luminovo both describe methods for rolling up BOM cost, incorporating labor and overhead, and testing scenarios: alternative suppliers, different price breaks, and different sourcing geographies. For an automation project, that might be as simple as modeling the difference between sourcing all components regionally versus mixing in long-lead imported drives and specialty components.

A good sourcing service also leans on economies of scale and supplier networks.

Avnan’s discussion of EMS-led sourcing shows how consolidating component demand across multiple customers allows better pricing and more stable supply. Dragon Sourcing and AGS Devices both describe how strategic sourcing companies use broad supplier networks and category expertise to find competitive options and negotiate stronger terms. For automation integrators and end users, that can translate into better pricing on commodity items such as terminals, cables, and enclosures, and more resilient supply for critical items such as PLCs and network hardware.

Finally, modern BOM sourcing involves tooling. NetSuite’s view of BOM automation, along with platforms like Luminovo, LevaData, Altium Develop, Cofactr, and MRPeasy, all point toward the same direction: centralized, digital BOMs connected to live supplier data and integrated with ERP and MRP. Instead of emailing spreadsheets back and forth, the sourcing service operates in a live environment where changes are tracked, approvals are controlled, and inventory and cost data stay synchronized.

A simplified way to think about the scope is shown below.

| Activity | What the BOM sourcing service does for automation projects | Why it matters on the plant floor |

|---|---|---|

| Data cleaning | Normalizes part numbers, units, and descriptions across PLCs, MCC gear, instruments, and wiring | Reduces rework and prevents ordering the wrong revision or variant |

| Risk and lifecycle checks | Monitors obsolescence, lead times, and compliance on key components | Avoids redesigns mid‑project and supports long‑term maintainability |

| Costing and scenarios | Builds costed BOMs, models tariffs, freight, and alternates | Keeps project budgets realistic and protects margins |

| Supplier and contract management | Aggregates demand, negotiates terms, and qualifies alternates | Improves pricing and supply continuity |

| Tooling and integration | Maintains a single, digital BOM integrated with ERP and inventory | Keeps everyone working from the same, current data |

Cost, Lead Time, and Risk: The Three Axes of BOM Sourcing

Every automation project balances three constraints: what it costs, how fast you can deliver it, and how much risk you are carrying. Research across several sources makes it clear that BOM sourcing sits right at the intersection.

Cost: More Than the Sum of Unit Prices

AGS Devices defines BOM cost as the total expense of all materials, components, and related procurement costs required to build one unit of a product. They note that BOM costs commonly represent up to about seventy percent of total manufacturing expenses, and that poor sourcing decisions can raise BOM costs by roughly fifteen to twenty‑five percent. Tstronic’s analysis adds that in many products, about twenty percent of parts account for around eighty percent of BOM expense. That lines up with what I have seen in automation: you spend most of your money on a small set of high‑value items such as drives, PLC racks, network hardware, and certain sensors.

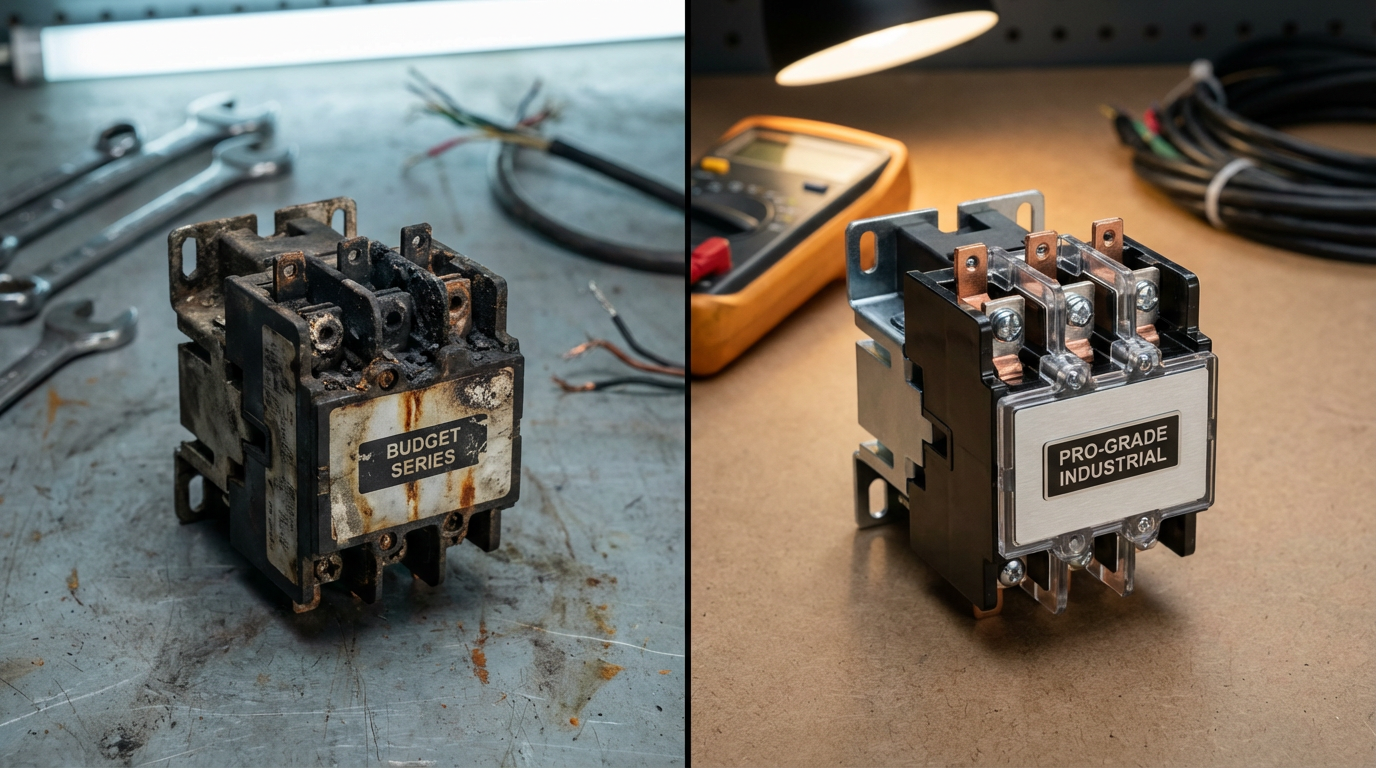

Perceptive‑IC and Altium both highlight the importance of total cost of ownership. A cheaper part with poor reliability can drive far higher warranty and downtime costs over time. In an automation environment, that might be the difference between a budget contactor that fails every few months and a higher‑grade part that runs for years.

A BOM sourcing service should weigh not only unit price but also reliability, failure modes, and the cost of replacement or downtime.

LevaData recommends a structured costing method that starts with accurate component data, rolls up direct materials, then adds labor, overhead, shipping, and currency impacts before adding a profit margin. When you apply that thinking to an automation BOM, panels and systems that looked comparable on raw hardware cost can look very different once you consider tariffs on imported devices, freight, and field labor to work around marginal parts.

Lead Time: Keeping the Line Running

Avnan’s experience with EMS‑led sourcing shows that early involvement of manufacturing and sourcing experts during design can cut product lead times by twenty to thirty percent. They achieve that by aligning component choices with what is actually available and by building in logistics efficiencies from the start.

Luminovo explains how static BOM costing methods fail to capture the reality of today’s volatile electronics market, where prices and lead times move quickly. Real‑time BOM tools use live data feeds from multiple distributors and manufacturers to show current stock, lead times, and risk indicators so you can design around choke points instead of discovering them when your line is half built.

In industrial automation, long‑lead items might be drives, PLC processors, safety systems, or specialty instrumentation. A BOM sourcing service that uses real‑time availability insights can steer your design toward multi‑sourced, readily available options and can secure long‑lead items early or hold safety stock when justified. Avnan’s description of global supplier networks, inventory buffering, and flexible manufacturing footprints for EMS maps well to automation: you want alternate sources, buffered supply for critical parts, and the ability to adjust build locations or schedules to work around bottlenecks.

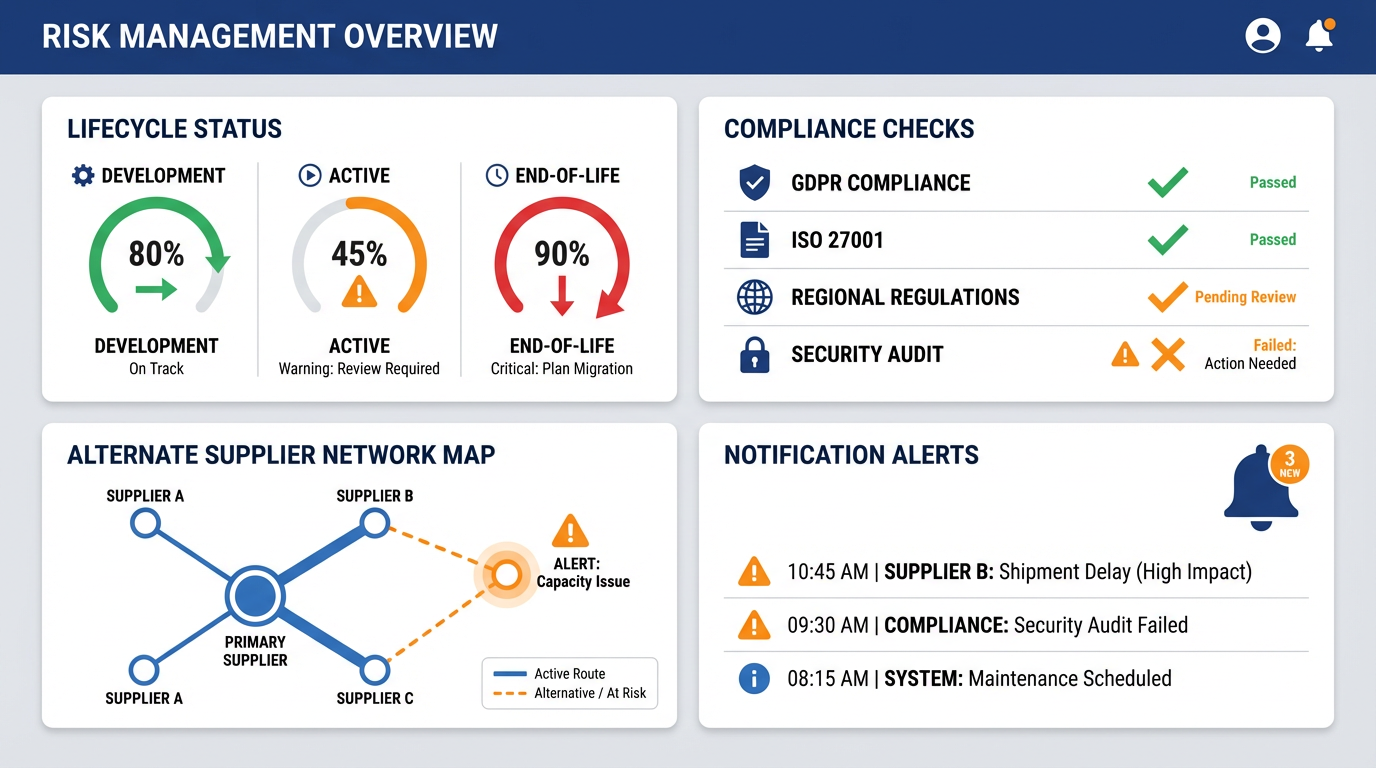

Risk: Obsolescence, Compliance, and Quality

Altium and Cofactr both frame BOM management as a continuous process of risk monitoring. That includes lifecycle states, obsolescence, compliance with environmental regulations, and even emerging sustainability requirements. For electronics-heavy automation systems, it is particularly important to track manufacturer part numbers, approved vendor lists, and environmental compliance at the line‑item level.

Luminovo and LevaData call out multiple sourcing risks: price volatility, component shortages, supplier unreliability, geopolitical and disaster disruptions, obsolescence, counterfeits, logistics issues, regulatory changes, and intellectual property risks. In an automation project, these risks are not abstract. A single obsolete safety relay or network switch that no longer meets current standards can force you into a design change, recertification, or, in the worst case, a partial rebuild.

SDI, writing about equipment BOMs for maintenance, connects the BOM directly to uptime, repair costs, and inventory. If your BOM sourcing does not consider long‑term availability and service, you might deliver a project that is buildable once but painful to maintain for the next decade.

A competent BOM sourcing service treats risk management as part of its core mandate: approving alternates in advance, building robust approved manufacturer lists, watching lifecycle notifications, and ensuring compliance attributes are captured from the start.

In-House vs Outsourced BOM Sourcing for Automation

The decision to use a BOM sourcing service is really a decision about where you want to invest your internal capability. Research and industry practice show there are clear tradeoffs.

Keeping BOM sourcing fully in-house gives you tight control and intimate knowledge of your own standards, preferred vendors, and plant constraints. For large end users with strong centralized engineering and procurement, that can work well. ManufacturingTomorrow and MRPeasy both show how integrated ERP with good BOM management can give smaller manufacturers a big lift; MRPeasy reports customers seeing more than fifty percent improvement in business performance and over forty percent better on‑time deliveries when they adopt integrated BOM and production planning tools. Those results depend on having people and processes to feed and interpret the tools.

The downside of staying entirely in-house is the burden. Altium’s Forrester data on engineer time spent on BOM administration, NetSuite’s finding that most manufacturers still manage BOMs manually, and Tstronic’s emphasis on data cleansing and ongoing governance all underline how heavy this work can be. For smaller integrators and maintenance teams, building that level of expertise internally can be unrealistic.

Outsourcing to a BOM sourcing service shifts a chunk of that workload and brings in breadth of expertise. Avnan, Dragon Sourcing, AGS Devices, Perceptive‑IC, and others all describe the advantages of aggregating demand, tapping global supplier networks, and applying specialized analytics and tools. Dragon Sourcing points out that strategic sourcing companies can streamline procurement processes, reduce administrative load, and improve terms through scale.

The cost of outsourcing is that you have to manage an extra interface and be clear about who owns which decisions. In automation, I generally recommend keeping control of a few key elements in-house: control over approved control-system platforms, safety‑critical component selection, and any vendor relationships tied to service or licensing. A BOM sourcing partner can then handle the heavy lifting on commodity parts, analytics, and global market coverage.

What to Look For in a BOM Sourcing Partner

Not all BOM sourcing services are equal, and automation has its own demands. The research gives some useful signposts for what “good” looks like.

Altium, Cofactr, and NetSuite all argue strongly for a single source of truth for BOMs with robust revision and change control. A partner should be comfortable working in that environment, not trying to manage your BOM through ad hoc spreadsheets. They should be able to handle multi-view BOMs: engineering, manufacturing, and service, as outlined by Cofactr and Fishbowl, rather than flattening everything into a single list.

Access to live supply chain data is another must. Luminovo and LevaData describe platforms that pull in real‑time price, stock, and lead time data, and Altium Develop integrates with providers such as Octopart and IHS Markit to show lifecycle and availability. Ask prospective partners how they obtain and maintain supply chain data, how frequently it updates, and how they handle conflicting signals between different sources.

Risk and lifecycle discipline matter as much as cost. Altium stresses lifecycle and compliance analysis, while Perceptive‑IC highlights structured methods for value analysis and value engineering, combined with reliability testing to validate substitutions. If a partner’s approach to cost reduction is simply to chase the lowest unit price, without talking about total cost of ownership, lifecycle, and reliability, that is a red flag.

Experience in industrial and MRO contexts is another differentiator. SDI’s work on equipment BOMs shows how different maintenance‑oriented BOMs can be from one‑time manufacturing BOMs. For automation projects that will run for ten or twenty years, you need a partner that understands spare parts strategies, criticality analysis, and the practical realities of maintaining control systems in a live plant.

Finally, look for partners who work comfortably with your systems. MRPeasy, NetSuite, UnleashedSoftware, and Parabola all describe integrations between BOM tools, ERP, inventory, and CAD or EDA. A sourcing service that can plug into your existing stack, rather than forcing you into a proprietary silo, will make it easier to keep BOMs accurate and synchronized.

A simple way to test alignment is to ask them to walk through one of your recent projects line by line.

How they talk about lifecycle, alternates, risk, and total cost will tell you a lot about whether they are a tactical buyer or a true BOM sourcing partner.

How to Engage a BOM Sourcing Service on Your Next Automation Project

Over the years, the best outcomes I have seen from BOM sourcing partnerships share a consistent pattern.

The engagement works best when sourcing comes in early. Avnan’s data point about twenty to thirty percent lead time reduction with early EMS involvement in electronics applies directly to automation. When sourcing experts are at the table while you are still selecting PLC families, network architectures, and major field devices, they can steer you away from hard-to-source platforms and toward multi-sourced, stable options.

You need to start by sharing a complete picture. That means not only the engineering BOM, but also target volumes, project phases, critical path items, site and standards constraints, and any preferred or banned suppliers. Luminovo and LevaData both stress the importance of complete, up-to-date component data as the foundation for accurate costing and risk assessment; the same applies here.

Together, you define strategy: which parts are non-negotiable due to corporate standards or regulatory approvals, which can be substituted as long as function and safety are maintained, and which are purely commodity items. Perceptive‑IC’s description of value analysis and value engineering is useful here: examine each significant BOM line in terms of the function it provides and the cost you are paying, and decide where you are willing to consider alternatives.

Then you let the sourcing partner run scenarios. Using tools and methods like those described by LevaData and AGS Devices, they can model different supplier mixes, tariffs, and logistics options, and present you with cost and risk tradeoffs. In my experience, this is where the first surprises surface: items everyone assumed were trivial that actually carry long lead times or tariffs, or conversely, big-ticket items where standardization across plants could unlock significant savings.

Once you agree on a baseline, you put governance in place. Altium, Cofactr, and UnleashedSoftware all emphasize formal change control, with engineering change requests and orders, effectivity dates, approvals, and clear communication of changes. You should decide who can initiate a BOM change, who approves it, how it is recorded, and how it propagates into purchasing, inventory, and field documentation.

Finally, you monitor and adjust. NetSuite and Tstronic both stress continuous improvement and regular reviews. Price, availability, and performance will change over the life of the project and the installed system. A disciplined sourcing partner will review top cost drivers, high‑risk parts, and actual field failures regularly, and work with you to adjust the BOM over time without disrupting operations.

Common Pitfalls I See – And How BOM Sourcing Helps Avoid Them

Looking back over many automation projects, a few recurring problems stand out.

One common failure is treating the BOM as a static, one-time document. Parabola and UnleashedSoftware both point out that BOMs are most effective when treated as living documents with version control and regular audits. When teams copy the “final” BOM into a spreadsheet and then let it drift independently from CAD, PLC programs, and site modifications, you end up with parts ordered to old revisions, panels built with non‑standard content, and maintenance teams chasing the wrong items.

Another pitfall is EBOM–MBOM misalignment. Tstronic and ManufacturingTomorrow both warn that misalignment between the engineering BOM and the manufacturing BOM creates hidden costs, redundant part numbers, and longer lead times. In automation, that shows up when panel shops build panels differently from the engineering model, or when site modifications are not reflected back into the official BOM. A sourcing service that insists on linking EBOM and MBOM in a single system of record, as Cofactr recommends, dramatically reduces these mismatches.

Single‑sourcing critical components is a third recurring issue. Perceptive‑IC emphasizes the value of an approved manufacturer list with multiple qualified suppliers per component. AGS Devices notes how end‑of‑life or allocation parts can cost three to five times more and force expensive redesigns. When I see a PLC platform, network switch, or drive series with no qualified alternates and only one viable channel, I know we are carrying risk. A good BOM sourcing service will flag these cases and help you build in alternates where possible.

A final trap is ignoring the MRO view. SDI’s work on equipment BOMs shows that a well‑managed BOM improves uptime, repair cost, inventory, and supply chain decisions. Too many projects treat the commissioning BOM and the long‑term maintenance BOM as separate worlds. When BOM sourcing explicitly considers MRO, critical spares are captured and sourced up front, and obsolete equipment is reflected back into spare parts strategy, instead of lingering as dead stock in the storeroom.

In all of these areas, a disciplined BOM sourcing service provides structure, data, and focus that most project teams struggle to maintain on their own.

Short FAQ on BOM Sourcing for Automation

How early should I bring a BOM sourcing partner into an automation project? The earlier, the better. Avnan’s experience in electronics shows that early manufacturing and sourcing involvement can cut lead times by twenty to thirty percent. In automation, bringing sourcing in when you are picking control platforms, network architectures, and major field devices allows you to avoid problematic parts instead of patching around them later.

Is BOM sourcing only worth it for high-volume products, or does it help one-off automation projects as well? Parabola notes that BOMs are especially valuable for companies manufacturing at scale, but the same principles apply to complex, capital automation projects, even at low volume. The mix of high‑value components, long lead times, and long operating life means that cost, risk, and maintainability benefits from professional BOM sourcing can be significant, even if you only build a few systems.

What if my engineering team already manages BOMs in CAD and spreadsheets? UnleashedSoftware, NetSuite, and Altium all point out that manual and spreadsheet‑based BOM management tends to create errors, outdated data, and heavy administrative load. A sourcing service does not replace engineering ownership; it complements it by cleaning data, adding lifecycle and risk insight, integrating with live supplier data, and enforcing change control so that everyone works from the same, current BOM.

Closing Thoughts

After enough nights spent sorting out missing parts in a hot panel room, you stop seeing BOM sourcing as paperwork and start seeing it as risk control. The research is clear and matches what I have seen on the ground: most of your cost and a good share of your schedule and uptime are decided at the BOM stage. Treating BOM sourcing as a structured, professional discipline—whether in-house, with a specialized partner, or a mix of both—is one of the most reliable ways to make sure your automation projects come in on budget, turn on when you hit the start button, and stay maintainable for the long haul.

References

- https://dspace.mit.edu/bitstream/handle/1721.1/28562/57454866-MIT.pdf?sequence=2

- https://www.agsdevices.com/bom-cost/

- https://resources.altium.com/p/bom-management-practical-guide

- https://avnan.com/building-a-better-bom-ems-strategies/

- https://www.cofactr.com/articles/the-definitive-guide-to-bill-of-materials-boms

- https://www.designtodevice.com/blog/bom-optimization-strategies

- https://www.dragonsourcing.com/bom-cost-reduction-strategies-how-to-save-money-and-boost-your-bottom-line/

- https://www.fishbowlinventory.com/blog/bill-of-materials-management

- https://www.levadata.com/post/how-to-accurately-calculate-bom-costs-a-guide-for-procurement-professionals

- https://www.linkedin.com/pulse/bom-cost-reduction-global-supply-chain-strategies-maximize-tuteja-jqzxf

Keep your system in play!

Related Products

Related articles Browse All

-

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu...

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu... -

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ...

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ... -

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

Need an automation or control part quickly?

- Q&A

- Policies How to order Part status information Shipping Method Return Policy Warranty Policy Payment Terms

- Asset Recovery

- We Buy Your Equipment. Industry Cases Amikong News Technical Resources

- ADDRESS

-

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

Copyright Notice © 2004-2026 amikong.com All rights reserved

Disclaimer: We are not an authorized distributor or distributor of the product manufacturer of this website, The product may have older date codes or be an older series than that available direct from the factory or authorized dealers. Because our company is not an authorized distributor of this product, the Original Manufacturer’s warranty does not apply.While many DCS PLC products will have firmware already installed, Our company makes no representation as to whether a DSC PLC product will or will not have firmware and, if it does have firmware, whether the firmware is the revision level that you need for your application. Our company also makes no representations as to your ability or right to download or otherwise obtain firmware for the product from our company, its distributors, or any other source. Our company also makes no representations as to your right to install any such firmware on the product. Our company will not obtain or supply firmware on your behalf. It is your obligation to comply with the terms of any End-User License Agreement or similar document related to obtaining or installing firmware.

Cookies

Individual privacy preferences

We use cookies and similar technologies on our website and process your personal data (e.g. IP address), for example, to personalize content and ads, to integrate media from third-party providers or to analyze traffic on our website. Data processing may also happen as a result of cookies being set. We share this data with third parties that we name in the privacy settings.

The data processing may take place with your consent or on the basis of a legitimate interest, which you can object to in the privacy settings. You have the right not to consent and to change or revoke your consent at a later time. This revocation takes effect immediately but does not affect data already processed. For more information on the use of your data, please visit our privacy policy.

Below you will find an overview of all services used by this website. You can view detailed information about each service and agree to them individually or exercise your right to object.

You are under 14 years old? Then you cannot consent to optional services. Ask your parents or legal guardians to agree to these services with you.

-

Google Tag Manager

-

Functional cookies

Leave Your Comment