-

Manufacturers

- ABB Advant OCS and Advant-800xA

- ABB Bailey

- ABB Drives

- ABB H&B Contronic

- ABB H&B Freelance 2000

- ABB Master

- ABB MOD 300, MOD 30ML & MODCELL

- ABB Procontic

- ABB Procontrol

- ABB Synpol D

- Allen-Bradley SLC 500

- Allen-Bradley PLC-5

- Allen-Bradley ControlLogix

- Allen-Bradley CompactLogix

- Allen-Bradley MicroLogix

- Allen-Bradley PanelView

- Allen-Bradley Kinetix Servo Drive

- Allen-Bradley PowerFlex

- Allen-Bradley Smart Speed Controllers

- 3300 System

- 3500 System

- 3300 XL 8mm Proximity Transducer

- 3300 XL NSV Proximity Transducer

- 990 and 991 Transmitter

- 31000 and 32000 Proximity Probe Housing Assemblie

- 21000, 24701, and 164818 ProbeHousing Assemblies

- 330500 and 330525 Piezo-Velocity Sensor

- 7200 Proximity Transducer Systems

- 177230 Seismic Transmitter

- TK-3 Proximity System

- GE 90-70 Series PLC

- GE PACSystems RX7i

- GE PACSystems RX3i

- GE QuickPanel

- GE VersaMax

- GE Genius I/O

- GE Mark VIe

- GE Series One

- GE Multilin

- 800 Series I/O

- Modicon 984

- Modicon Premium

- Modicon Micro

- Modicon Quantum

- Telemecanique TSX Compact

- Altivar Process

- Categories

- Service

- News

- Contact us

-

Please try to be as accurate as possible with your search.

-

We can quote you on 1000s of specialist parts, even if they are not listed on our website.

-

We can't find any results for “”.

-

-

Get Parts Quote

Excess ABB Drive Stock Done Right: A Veteran Integrator’s Guide to Overstock ABB VFD Suppliers

Why Surplus ABB Drives Are Suddenly Everywhere

Walk into enough plants, and you start to see the same picture: a shelf of boxed ABB drives, still in their foam, quietly aging in a hot electrical room. They were ordered in a panic during supply chain chaos, or for a project scope that never quite materialized. Now procurement wants them off the books, maintenance wants the space back, and finance wants the cash.

Supply chain and accounting advisors such as Deandorton, AbcSupplyChain, Nventic, and Lowry Solutions have been clear about what is going on. Excess inventory is not a niche problem; it is what happens when earlier supply constraints, optimistic forecasting, and aggressive purchasing collide with reality. Surplus stock ties up cash, consumes warehouse capacity, and drifts toward obsolescence over time. Retail and industrial analyses from Lightspeed, Flatworld, Fuse Inventory, and Smart Warehousing all echo the same story: companies everywhere are wrestling with overstock and dead stock, and trying to climb down a value‑recovery ladder that includes returns, swaps, discounts, liquidation, scrap, and donation.

Drives are no exception. Variable frequency drives are high‑value, high‑tech items that were in short supply not long ago. Many organizations overordered to protect production. Projects were canceled, re‑scoped, merged, or shifted to different drive families. That is how you end up with a growing ecosystem of overstock ABB VFD providers: specialists who aggregate excess, new or near‑new drives from real projects and make them available at a discount.

The question is not whether overstock ABB drives exist. They clearly do. The real question, from a systems integrator’s point of view, is how to use that surplus wisely without compromising reliability or creating a new excess‑inventory problem on your own site.

What “Overstock ABB VFD” Really Means

Surplus and overstock drives are not mysterious. A surplus‑focused VFD guide explains that these drives typically come from genuine but canceled or re‑scoped projects: design changes, plant consolidation, or migration to a newer drive family. In many cases the hardware is new or almost new, but you have to assume nothing about its condition until you verify it.

It also helps to distinguish three basic conditions you will encounter in the field.

| Condition type | Typical origin | Key questions before buying |

|---|---|---|

| New (standard channel) | Supplied through current OEM or authorized distribution, directly aligned with the latest catalog offering. | You usually get the latest firmware and full manufacturer support; the question is whether price and lead time fit your project. |

| Overstock / surplus | Unused drives originally purchased for other projects that changed scope or were canceled, then aggregated by a surplus provider. | You need to verify storage history, test records, configuration, and whether the options and firmware actually match your application. |

| Refurbished | Failed or returned units that have been repaired and re‑tested by a refurbisher. | You must clearly understand what was repaired, what was tested, and what level of documentation and warranty is attached. |

A surplus VFD article stresses that new, overstock, and refurbished drives differ less in their silicon than in their documentation, test pedigree, and traceability. New units arrive with complete paperwork and a clear manufacturing trail. Overstock drives usually have most of that, but may have sat on a shelf for years. Refurbished units need careful scrutiny of the repair and test process.

When the name on the label is ABB or any other tier‑one drive manufacturer, the underlying technology is usually robust. The risk lies in how the product has been stored, handled, and matched to your application, not in the logo.

Why Drives Are Worth Chasing, Even As Overstock

Before deciding whether surplus ABB drives are worth the effort, it is worth reminding ourselves why we use drives at all.

Multiple engineering sources, including AutomationDirect, Control Engineering, and surplus‑drive specialists, describe a VFD as an electronic system that takes fixed‑frequency AC, rectifies it to DC, and inverts it back to a controlled three‑phase AC output with adjustable voltage and frequency. That lets you control the speed and torque of an AC induction motor while providing soft start and stop, acceleration and deceleration ramps, and built‑in overload protection.

For variable‑torque loads such as fans, pumps, and blowers, the economics are compelling. Surplus VFD analysis and Control Engineering coverage both point out that power for centrifugal loads scales roughly with the cube of speed. A modest speed reduction can produce substantial energy savings. One surplus VFD study, referencing work by Plant Engineering and major drive vendors, highlights typical energy savings in the range of about 20 to 50 percent for these applications, with payback periods commonly between roughly 6 and 24 months depending on motor size and duty cycle.

AutomationDirect explains that halving fan speed can cut required horsepower by a factor of eight, which is why VFDs have become standard in HVAC and pumping. Instead of throttling with valves and dampers, you remove those losses and let the drive handle the control.

Even in constant‑torque applications such as conveyors, mixers, and some hoists, where the cube‑law energy benefits are smaller, drives deliver very real value. They reduce inrush current compared with across‑the‑line starting, which often draws more than eight times the motor’s full‑load amps, causing voltage dips and stressing both motors and upstream equipment. Drives ramp motors smoothly, limit torque, reduce mechanical shock, and provide precise speed matching and electronic reversing.

Modern VFDs can also improve facility power factor and provide advanced diagnostic data. Control Engineering notes that they can be treated as long‑term efficiency and emissions‑reduction investments rather than just motor starters.

Those fundamentals do not change just because the drive came from an overstock shelf instead of a brand‑new purchase order. If you do your homework, surplus ABB drives can deliver the same motor control, the same energy savings, and the same process improvements at a lower capital cost.

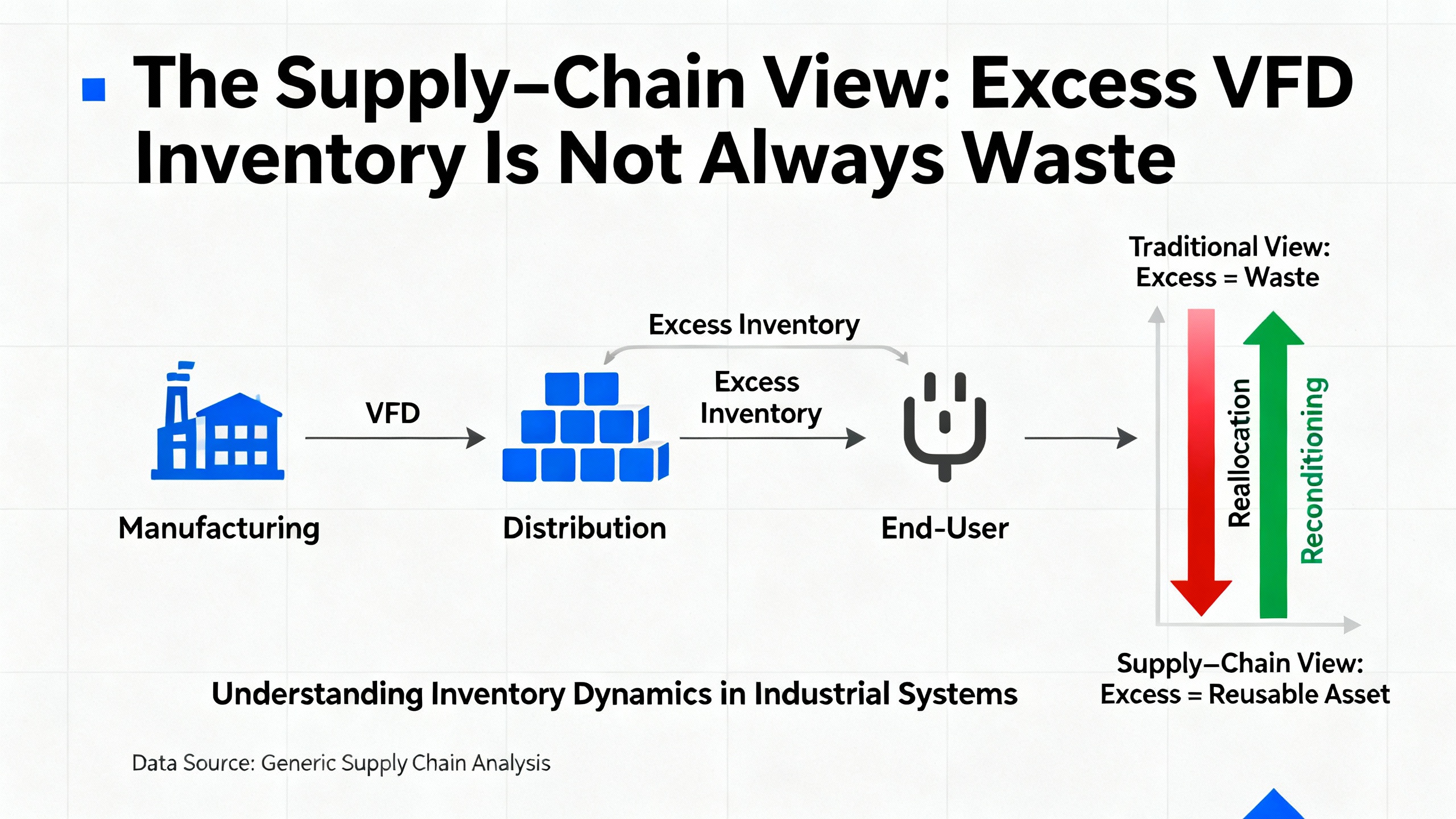

The Supply‑Chain View: Excess VFD Inventory Is Not Always Waste

From a supply‑chain perspective, a stack of ABB drives on the shelf is just one more form of excess and obsolete inventory, often abbreviated E&O. Analysts from Lowry Solutions, Nventic, Flatworld, Deandorton, Fuse Inventory, and AbcSupplyChain all define excess inventory in similar ways: stock beyond what is required for normal demand and operations, held longer than intended, with increasing carrying costs and risk of obsolescence.

The causes are familiar. Lightspeed and Smart Warehousing point to inaccurate forecasts, supply chain disruptions, seasonal misreads, bulk‑buy incentives, and shifts in technology or customer preference. Nventic emphasizes lifecycle blind spots: optimistic demand at new product introduction and poorly managed end‑of‑life transitions. Deandorton reminds us that even in lean operations, excess stock appears when supply constraints ease and purchasing habits do not adapt quickly enough.

When the product is a drive, especially at ABB’s scale, the stakes are higher because each unit ties up substantial working capital and shelf space. Yet excess inventory is not purely negative. Lowry Solutions notes that surplus can buffer against supply disruptions and demand spikes, preventing stockouts when the supply chain is volatile. Smart Warehousing goes further and frames excess inventory as an opportunity if you have the right processes and partners.

Inventory experts suggest a few disciplines that apply directly to ABB drives. AbcSupplyChain and Nventic both underline the importance of segmentation, especially ABC analysis based on value. Drives are usually A‑class items: a small number of SKUs that represent a large portion of inventory value. That means they warrant meticulous management. You do not manage a $5 sensor and a 150 hp VFD the same way.

Nventic also stresses the need for differentiated service levels instead of a naive target of one hundred percent service across the board. For a critical pump or fan on a safety or environmental duty, keeping a spare ABB drive on the shelf might be justified. For a noncritical utility conveyor, it may be more efficient to rely on a trusted overstock supplier for rapid replacement rather than stock multiple spares yourself.

On the disposition side, Deandorton describes a value‑recovery ladder for excess inventory. Returning stock to suppliers is typically best when possible. Beyond that, firms can rework or reuse items, trade or swap with industry peers, sell at a discount, consign through distributors, liquidate, scrap, or donate. The growth of overstock ABB drive providers is essentially this ladder in action: they aggregate drives that others have chosen not to keep.

The lesson for plant managers and integrators is straightforward. Overstock ABB VFDs exist because someone else needed to unwind their E&O problem. You can benefit from that, but you must avoid simply shifting the excess from their warehouse to your own.

Technical Non‑Negotiables When You Buy Overstock ABB VFDs

In practice, the risks around surplus ABB drives are less about whether they used to belong to a different project and more about whether you apply the same engineering discipline you would to any new drive. Several engineering and surplus‑VFD references converge on a set of technical non‑negotiables.

Get the Application Right: Variable‑Torque vs Constant‑Torque

A surplus VFD guide stresses the importance of matching drive rating not just to voltage and horsepower but also to duty type. Variable‑torque loads such as fans, pumps, and blowers behave very differently from constant‑torque loads such as conveyors, mixers, and hoists.

Control Engineering and AutomationDirect both note that drives for variable‑torque loads are usually optimized for lower overload capacity but high efficiency in the speed band where energy savings matter most. Constant‑torque drives must tolerate higher overloads and may face more demanding acceleration and deceleration conditions.

When reusing an ABB drive that came from a different project, confirming whether it was originally specified for variable‑torque or constant‑torque duty is essential. A drive originally sized for a lightly loaded fan may not survive a heavily loaded conveyor that needs high breakaway torque, even if the nameplate horsepower appears similar.

Match Voltage, Current, and Overload Capability

AutomationDirect’s guidance is blunt: do not size a drive by horsepower alone. Size it to handle the motor’s maximum current under worst‑case peak torque conditions. Surplus VFD analysis reinforces this point and warns against confusing derating with overload capability.

A derating reference from vfds.com explains that you sometimes must intentionally reduce a drive’s usable current rating based on ambient temperature, installation altitude, and input phase configuration.

Typical ambient limits for many drives are around 14°F to 32°F on the low end and about 104°F on the high end. Above roughly 104°F, manufacturers often require a linear derate, for example on the order of one percent per degree Celsius, up to an absolute ceiling near 122°F where operation is not recommended without mitigation. At higher altitudes, cooling air is thinner. A common rule is no derate up to about 3,280 ft, then around one percent derate per additional 328 ft. By the time you reach approximately 8,200 ft, the effective derate can be close to 15 percent.

Phase conversion introduces another derating scenario. When you run a three‑phase drive from a single‑phase supply, all the current flows through two rectifier legs instead of three. The vfds.com guidance suggests that a safe rule of thumb in those cases is to treat the drive’s continuous capability as about half of the published current, effectively requiring a drive with a current rating roughly twice the motor’s full‑load amps.

The same source differentiates derating from overload. Overload is a short‑term capability, such as allowing a drive to deliver 110 percent of rated current for one minute to handle transient peaks. Derating, by contrast, reduces the continuous current limit. If you oversize a drive solely based on overload capability and ignore continuous current versus motor nameplate, you can effectively disable thermal protection for the motor.

For surplus ABB drives, this means you should always check the motor’s full‑load amps, environmental conditions, and input type, then consult the specific ABB manual for temperature and altitude derate curves. Do not assume that a physically large frame is automatically safe.

Environment, Enclosures, and Cooling

Several maintenance‑focused articles, including those from Heat Transfer Sales, Innovative‑IDM, PCTX, Plant Engineering, and LinkedIn authors, all highlight the same three enemies of drive reliability: heat, contamination, and moisture.

Heat is consistently described as the number‑one killer of drives. Drives dissipate significant heat through semiconductors and braking components. Cooling fans run almost continuously and are among the first components to fail. Innovative‑IDM recommends replacing fans proactively rather than waiting for failure, because overheating a drive once can shorten its life dramatically.

Dust and airborne contaminants accumulate on heat sinks and fans, reducing cooling efficiency and causing hot spots. Heat Transfer Sales recommends cleaning drives with dry, oil‑free compressed air, particularly for common NEMA 1 enclosures with vent slots. PCTX adds that sealed NEMA 12 enclosures need less frequent cleaning but still benefit from regular inspections.

Moisture is just as destructive. Plant Engineering and Heat Transfer Sales both describe how condensation and leaks corrode circuit boards and trigger erratic behavior, overcurrent faults, and eventual failure. Their guidance is to install drives in clean, dry spaces when possible and, where moisture is inherent to the environment, consider higher‑protection enclosures such as NEMA 12 and carefully manage ventilation and sealing.

When you buy surplus ABB drives, you inherit an unknown environmental history. This is exactly why a surplus VFD guide insists on visual inspection for contamination and heat damage, checking enclosure integrity, fans, and filters before installation. Any signs of corrosion or severe contamination are a red flag and may justify rejecting that unit or involving the manufacturer’s technical support for a repair‑versus‑replace decision.

Noise, Cables, and Motors

An in‑depth analysis at Electrical Engineering Portal explains why drives, including ABB units, can be noisy neighbors in an electrical system. Pulse‑width‑modulated inverters using IGBT devices generate very fast voltage rise times and high‑frequency switching, which create common‑mode currents, reflected waves, and electromagnetic interference.

The type and length of motor cable matter. Manufacturers typically specify maximum cable runs from drive to motor. One example in that analysis shows that cable lengths beyond roughly 100 ft can produce reflected voltage waves that approach twice the inverter’s output voltage at the motor terminals. It recommends keeping VFD‑to‑motor cable under about 200 ft where practical and notes that very fast rise times can drive even lower limits.

Proper cable construction makes a significant difference. Tests cited in that same source show that type MC metal‑clad cable with a continuous corrugated aluminum sheath and three symmetric ground conductors drastically reduces crosstalk and common‑mode current compared with unshielded tray cable, and even outperforms steel armor. The recommendation is to use well‑shielded, metal‑clad three‑phase cable with appropriately sized phase and ground conductors and a robust outer jacket.

Additional mitigation includes feeding the drive from a dedicated isolation transformer, using input and output filters and common‑mode chokes, and bonding shields at both ends instead of only one. The article also stresses the importance of effective facility grounding, short drive‑to‑motor cables, and physical separation between drive power cables and sensitive instrumentation wiring. Low‑power drives can inject high‑frequency noise into analog and HART signals if these basics are ignored.

Finally, both Electrical Engineering Portal and surplus VFD guidance point out that not all motors are created equal. Inverter‑duty motors with suitable insulation systems, bearing protection, and cooling arrangements are recommended for demanding or low‑speed operation. When applying surplus ABB drives to existing motors, you must confirm that the motor is suitable for VFD service, or you risk premature failures even if the drive itself is sound.

Integration and Parameters

Even a perfectly matched ABB drive can misbehave if it is still running yesterday’s parameters from somebody else’s job. AutomationDirect, Wolf Automation, LinkedIn authors, and Plant Engineering all stress careful parameter configuration.

Key items include accurate motor nameplate data (voltage, current, base frequency, speed), appropriate control mode (simple volts‑per‑hertz for basic applications, sensorless or closed‑loop vector control for tighter speed regulation), acceleration and deceleration ramps, torque limits, and protective thresholds. Input and output assignments for digital and analog signals must match your control scheme. Drives must be integrated into the plant’s control architecture using the right I/O and network protocols, whether that is simple hardwired control or communication via Modbus, EtherNet/IP, Profibus, or similar, as highlighted in the surplus VFD selection criteria.

Surplus VFD best‑practice articles recommend, where possible, resetting the drive to factory defaults, loading the latest approved firmware, and then applying a clean, documented parameter set tailored to your motor and process. Copy tools or PC‑based configuration utilities can dramatically reduce commissioning time when you have multiple similar ABB drives to configure.

Pros and Cons of Sourcing Excess ABB Drives

From an engineering and commercial standpoint, overstock ABB drives are neither miracle bargains nor ticking time bombs. They are tools, with trade‑offs that need to be understood.

| Aspect | Overstock ABB VFDs | New ABB VFDs via standard channels |

|---|---|---|

| Upfront cost | Typically discounted because the original owner is unlikely to recover full cost on excess stock, as Deandorton and other inventory experts note. | Usually priced at current market levels, reflecting full OEM support and latest features. |

| Availability | Often available from stock, helpful when standard lead times are long or budgets are tight. | Dependent on current lead times and allocation; may involve waiting for production slots. |

| Documentation and traceability | Can be very good, but varies by supplier; surplus VFD guides emphasize the need to verify storage history, test data, and configuration. | Generally complete and up to date, with clear manufacturing records and manuals. |

| Technology currency | May be from a slightly older product wave or firmware revision, which is acceptable for many applications but must be checked for compatibility with your standards. | Represents the current catalog offering and firmware baseline. |

| Risk profile | Heavily dependent on the surplus provider’s testing discipline, storage practices, and honesty about condition. | Risk primarily tied to installation, environment, and application, not prior history. |

If you are an integrator or plant engineer, the decision comes down to application criticality, budget, and your confidence in the overstock supplier’s process. For many utility or noncritical drives, surplus ABB units are a smart way to stretch budgets. For high‑impact or safety‑critical systems, that decision requires more careful risk analysis.

How a Veteran Integrator Qualifies an Overstock ABB VFD Partner

When I look at an overstock ABB drive supplier, I do not start with price. I start with process. Surplus VFD guidance and field experience suggest a few habits that separate reliable partners from opportunistic resellers.

A good surplus partner can clearly explain where their drives come from. They know whether a unit came from a canceled project, a plant consolidation, or a drive family upgrade. They can tell you how long it sat in storage and under what conditions. They document serial numbers and can cross‑reference units to their original applications where possible.

Testing is the next filter. Serious surplus VFD operations follow a structured workflow: visual inspection for contamination, heat damage, or physical abuse; checking enclosure integrity, fans, and filters; power‑up testing with proper line protection; monitoring input current and DC bus health; verifying option cards and interfaces; and where possible, running the drive under representative load for a soak period to catch intermittent or thermal faults. The surplus VFD guide highlights exactly this kind of staged testing, culminating in short endurance runs with controlled ramps and braking tests.

Configuration matters as well. Drives reused from other projects may carry parameter sets that are completely wrong for your motor and process. A competent surplus ABB supplier either ships drives reset to defaults with original manuals or works with you to pre‑load parameter sets that match your specification. Ideally, they provide parameter backups and configuration summaries so you can revalidate settings during commissioning.

On the selection side, surplus VFD advice reminds us to look beyond price. The right control method, overload capability, enclosure rating, and communication options matter more than a few dollars saved. If you need advanced vector control or direct torque control, or you must support a specific network protocol, the overstock unit must be verified against those needs. If your environment is dusty, hot, or corrosive, enclosure suitability is not negotiable.

Finally, I look for alignment with manufacturer best practices. Responsible surplus partners explicitly encourage you to follow the original drive manuals for derating rules, wiring, EMC mitigation, and maintenance. They do not tell you that you can ignore altitude limits or cable length guidance to save money on copper. When a supplier’s story aligns with what vfds.com, Electrical Engineering Portal, Plant Engineering, and the drive manufacturer all recommend, that is a good sign.

Inventory Strategy: Using Overstock Drives Without Creating Your Own E&O Problem

It is tempting, once you find a trustworthy overstock ABB supplier, to overbuy. The price looks good, the lead times are short, and you want to protect yourself. That is exactly how your own E&O problem starts.

Inventory experts at AbcSupplyChain and Nventic recommend segmenting and setting explicit service‑level targets instead. Treat drives as A‑class items with high value and high impact, then decide where you truly need spares and where you can lean on your supply base.

For example, critical fans, pumps, or compressors that protect safety, environmental compliance, or core production throughput may justify on‑site ABB spare drives. Nventic points out that inventory’s role is not to eliminate all shortages but to keep them within an acceptable range by product segment. These critical items warrant high service levels and possibly multiple layers of redundancy.

On the other hand, noncritical drives on secondary conveyors or auxiliary systems may not justify expensive spares. For those, it may be more efficient to have a commercial arrangement with an overstock ABB supplier who can ship a replacement quickly when needed. Flatworld, Fuse Inventory, and Smart Warehousing all emphasize using external channels, including third‑party logistics providers, to handle peaks and overflow rather than permanently expanding your own footprint.

Deandorton and Lightspeed remind us that aging inventory declines in value. That reality applies to drives as much as to consumer goods. If you find yourself sitting on shelves of obsolete ABB drives with no realistic use, the value‑recovery ladder they describe becomes relevant. Options include returning units to suppliers if programs exist, swapping inventory with partners, selling through surplus channels, consigning to distributors, liquidating at deep discounts, scrapping for material content, or donating to educational or charitable organizations.

The key is to treat surplus ABB drives as part of a deliberate inventory strategy, not as a pile of “just in case” hardware. Measure inventory turnover, track slow‑moving and obsolete units, and incorporate E&O metrics into your supply chain reviews, as Nventic and AbcSupplyChain recommend. Otherwise, you simply move excess from someone else’s books to your own.

Life‑Cycle Care: Maintenance and Monitoring for Overstock ABB Drives

Once a surplus ABB drive is bolted into your panel and running a motor, it behaves like any other drive: it will reward basic care and punish neglect.

Multiple maintenance articles from Plant Engineering, PCTX, Heat Transfer Sales, Innovative‑IDM, and others converge on three pillars of VFD maintenance: keep the drive clean, keep it dry, and keep its electrical connections tight. Dust restricts airflow through heat sinks and fans, leading to overheating and faults. Moisture and condensation corrode circuit boards and connectors. Vibration loosens terminal screws and bus bar bolts, causing arcing, erratic behavior, and eventual failure.

Recommended practices include regular visual inspections inside and outside the VFD for dust buildup, discoloration, corrosion, loose conductors, and signs of overheating. Cleaning is typically done with vacuuming and dry, oil‑free compressed air, particularly for NEMA 1 enclosures with vent slots. Moisture problems warrant investigation of the room environment and, if necessary, upgrading to more protective enclosures such as NEMA 12.

Electrical checks should verify tight, corrosion‑free connections, using a torque wrench set to manufacturer specifications to avoid both under‑ and over‑tightening. Thermal imaging can be an effective way to spot hot terminals or failing components before they cause downtime.

PCTX recommends a preventive maintenance schedule broken into daily, monthly, and annual tasks. Daily checks focus on abnormal noise, temperature, and basic indicators on the drive display. Monthly work includes filter cleaning and more detailed inspections. Annual maintenance can involve deep cleaning, thorough connection torque checks, and planning replacement of aging components. They specifically mention replacing main DC bus capacitors roughly every seven years and cooling fans every three to five years, or sooner if there are signs of degradation.

Plant Engineering adds that using the drive’s built‑in diagnostics, alarms, and fault codes should be your first step in troubleshooting issues such as overheating, irregular voltage, or overcurrent trips. LinkedIn and Control Engineering authors emphasize keeping firmware and configuration documentation up to date for easier debugging and support.

ABB’s own Asset Performance Management ecosystem, described in ABB’s industrial software materials, illustrates where the industry is heading. Their APM platform is designed to support predictive maintenance using machine learning, templates, and configurable dashboards, allowing self‑service analytics and structured reliability programs. While APM is broader than drives alone, integrating ABB drives into such platforms can shift maintenance from reactive to predictive, whether the drive was new or surplus when installed.

The bottom line is that an overstock ABB drive, once commissioned correctly, responds to the same maintenance practices as any other VFD. If anything, its unknown history makes it even more important to follow these disciplines.

When You Should Stick With New Drives

Despite all the advantages of surplus ABB drives, there are cases where sticking with new product from the primary channel is simply the more prudent choice.

If you are designing a system with very tight performance requirements, such as high‑precision web handling, paper lines, or converting systems, you may need specific control capabilities, firmware features, or option modules that only the latest ABB drives provide. AutomationDirect points out that certain applications require closed‑loop vector control or higher overload capability that not all drive families offer.

Power quality requirements can also drive you toward new hardware. Control Engineering and the surplus VFD guide note that harmonics from drives can affect transformers and other equipment, and in some projects you must meet standards such as IEEE 519. Active front ends, low‑harmonic drives, and specific filter combinations are often easier to implement using current catalog product with full manufacturer support.

Regulatory and safety requirements are another dimension. When you must satisfy updated standards, integrate into modern safety architectures, or demonstrate compliance to regulators, using current drives with full documentation and certification may be worth the premium.

Finally, if the application sits at the heart of your production or safety envelope and the cost of failure is extremely high, you may decide that the extra assurance of new hardware, direct OEM support, and long‑term product roadmap alignment outweighs the savings on surplus units. Nventic’s point about setting differentiated service levels applies here as well; some applications are simply in the highest‑criticality tier.

Short FAQ

Are overstock ABB VFDs safe to use in critical applications?

Technically, an overstock ABB drive can be as capable as a new one if it is properly tested, matched, installed, and maintained. However, surplus VFD guidance and supply chain best practices suggest that you should weigh application criticality, supplier process maturity, and the impact of failure. For truly critical duties where downtime or failure has severe consequences, many organizations prefer new drives with full manufacturer support and documented history, using surplus units for less critical roles or as short‑term stopgaps.

How can I tell if a surplus ABB drive is worth buying?

Start by verifying that the drive matches your motor and application in voltage, current, duty type, and control requirements. Then assess the surplus supplier’s testing workflow, documentation, and transparency about prior storage. Look for visual inspection, electrical and DC bus checks, option verification, and, ideally, load testing and parameter backups. Cross‑check selection, derating, cabling, and EMC practices against ABB manuals and independent engineering sources such as vfds.com and Electrical Engineering Portal.

How do I avoid creating my own surplus‑drive problem?

Treat ABB drives as high‑value, segmented inventory. Use ABC analysis and differentiated service levels as described by AbcSupplyChain and Nventic to decide where spares are truly justified. Monitor inventory turnover, identify slow‑moving and obsolete drives, and include E&O metrics in your planning. When stock genuinely exceeds realistic need, apply the value‑recovery tactics outlined by Deandorton and others: returns, swaps, sale to surplus providers, consignment, liquidation, or donation, rather than letting drives gather dust indefinitely.

Closing

Surplus ABB drives are not a shortcut around good engineering; they are an option inside it. When you combine solid application design, disciplined supplier qualification, and thoughtful inventory strategy, overstock ABB VFDs can reduce capital cost and lead time without sacrificing reliability. That is how a veteran integrator treats any component: not as a bargain to chase, but as a piece of the system that has to earn its place for the long run.

References

- https://electrical-engineering-portal.com/measures-to-reduce-interference-from-variable-speed-drives

- https://new.abb.com/industrial-software/asset-performance-management

- https://abcsupplychain.com/optimize-reduce-inventory/

- https://library.automationdirect.com/top-10-tips-specifying-vfds-part-one-of-a-two-part-series-issue-20-2011/

- https://www.controleng.com/variable-frequency-drive-advice-best-practices-for-engineers/

- https://deandorton.com/ten-ways-to-deal-with-excess-inventory/

- https://flatworldgs.com/7-strategies-for-managing-excess-inventory/

- https://www.fuseinventory.com/blog/8-ways-to-deal-with-excess-inventory

- https://afs.gogcg.com/blog/reducing-drive-complexity

- https://blogs.heattransfersales.com/blog/three-steps-to-properly-maintain-a-variable-frequency-drive

Keep your system in play!

Related articles Browse All

-

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu...

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu... -

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ...

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ... -

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

Need an automation or control part quickly?

- Q&A

- Policies How to order Part status information Shipping Method Return Policy Warranty Policy Payment Terms

- Asset Recovery

- We Buy Your Equipment. Industry Cases Amikong News Technical Resources

- ADDRESS

-

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

Copyright Notice © 2004-2026 amikong.com All rights reserved

Disclaimer: We are not an authorized distributor or distributor of the product manufacturer of this website, The product may have older date codes or be an older series than that available direct from the factory or authorized dealers. Because our company is not an authorized distributor of this product, the Original Manufacturer’s warranty does not apply.While many DCS PLC products will have firmware already installed, Our company makes no representation as to whether a DSC PLC product will or will not have firmware and, if it does have firmware, whether the firmware is the revision level that you need for your application. Our company also makes no representations as to your ability or right to download or otherwise obtain firmware for the product from our company, its distributors, or any other source. Our company also makes no representations as to your right to install any such firmware on the product. Our company will not obtain or supply firmware on your behalf. It is your obligation to comply with the terms of any End-User License Agreement or similar document related to obtaining or installing firmware.

Cookies

Individual privacy preferences

We use cookies and similar technologies on our website and process your personal data (e.g. IP address), for example, to personalize content and ads, to integrate media from third-party providers or to analyze traffic on our website. Data processing may also happen as a result of cookies being set. We share this data with third parties that we name in the privacy settings.

The data processing may take place with your consent or on the basis of a legitimate interest, which you can object to in the privacy settings. You have the right not to consent and to change or revoke your consent at a later time. This revocation takes effect immediately but does not affect data already processed. For more information on the use of your data, please visit our privacy policy.

Below you will find an overview of all services used by this website. You can view detailed information about each service and agree to them individually or exercise your right to object.

You are under 14 years old? Then you cannot consent to optional services. Ask your parents or legal guardians to agree to these services with you.

-

Google Tag Manager

-

Functional cookies

Leave Your Comment