-

Manufacturers

- ABB Advant OCS and Advant-800xA

- ABB Bailey

- ABB Drives

- ABB H&B Contronic

- ABB H&B Freelance 2000

- ABB Master

- ABB MOD 300, MOD 30ML & MODCELL

- ABB Procontic

- ABB Procontrol

- ABB Synpol D

- Allen-Bradley SLC 500

- Allen-Bradley PLC-5

- Allen-Bradley ControlLogix

- Allen-Bradley CompactLogix

- Allen-Bradley MicroLogix

- Allen-Bradley PanelView

- Allen-Bradley Kinetix Servo Drive

- Allen-Bradley PowerFlex

- Allen-Bradley Smart Speed Controllers

- 3300 System

- 3500 System

- 3300 XL 8mm Proximity Transducer

- 3300 XL NSV Proximity Transducer

- 990 and 991 Transmitter

- 31000 and 32000 Proximity Probe Housing Assemblie

- 21000, 24701, and 164818 ProbeHousing Assemblies

- 330500 and 330525 Piezo-Velocity Sensor

- 7200 Proximity Transducer Systems

- 177230 Seismic Transmitter

- TK-3 Proximity System

- GE 90-70 Series PLC

- GE PACSystems RX7i

- GE PACSystems RX3i

- GE QuickPanel

- GE VersaMax

- GE Genius I/O

- GE Mark VIe

- GE Series One

- GE Multilin

- 800 Series I/O

- Modicon 984

- Modicon Premium

- Modicon Micro

- Modicon Quantum

- Telemecanique TSX Compact

- Altivar Process

- Categories

- Service

- News

- Contact us

-

Please try to be as accurate as possible with your search.

-

We can quote you on 1000s of specialist parts, even if they are not listed on our website.

-

We can't find any results for “”.

-

-

Get Parts Quote

Expedited Shipping Services For Industrial Parts: How To Protect Uptime Without Torching Your Budget

This is my linkedin:

As a seasoned expert in the field of automation spare parts, Sandy has dedicated 15 years to Amikon, an industry-leading company, where she currently serves as Director. With profound product expertise and exceptional sales strategies, she has not only driven the company's continuous expansion in global markets but also established an extensive international client network.

Throughout Amikon's twenty-year journey, Sandy's sharp industry insights and outstanding leadership have made her a central force behind the company's global growth and sustained performance. Committed to delivering high-value solutions, she stands as a key figure bridging technology and markets while empowering industry progress.

In industrial automation and control, nothing feels longer than the minutes between a critical failure and the arrival of the replacement part. I have sat in maintenance war rooms watching a production line sit idle while everyone stares at a tracking screen. In those moments, expedited shipping is not a “nice to have.” It is the only thing standing between you and a very expensive email to your leadership team.

This article is written from that perspective: the veteran systems integrator who has been on the hook for startup dates, line-change windows, and SLAs, and who has seen expedited shipping used both brilliantly and badly. The goal is simple: show how to use expedited shipping for industrial parts as a deliberate, engineered capability rather than a last‑minute panic button.

The New Reality Of “Fast” For Industrial Parts

Consumer expectations have pulled the entire logistics market forward. Two‑day delivery used to be a differentiator; now it is table stakes. Research cited by Ware2Go found that most ecommerce customers expect orders within two days, and nearly half expect same‑day options at checkout. Cowtown Express reports that around 45 percent of online shoppers have abandoned carts solely because of the delivery options available, and that roughly 43 percent of ecommerce revenue comes from repeat customers whose loyalty is heavily influenced by delivery performance.

Those statistics come from retail and ecommerce, but the behavioral pattern shows up in industrial supply chains as well. Your operations leader does not care that a servo drive or PLC rack is not a pair of shoes; they want the same clarity, speed, and reliability. At the same time, logistics costs are climbing. Last‑mile delivery alone is projected to grow from about $161 billion in 2024 to roughly $340 billion by 2032 according to DispatchTrack, with costs rising almost 10 percent per year. NetSuite notes that shipping is a large cost center, with major parcel carriers raising base rates and accessorials and shipping consuming a significant share of expenses.

In this environment, expedited shipping for industrial parts is no longer an occasional exception. It is a strategic tool you must design into your logistics, procurement, and maintenance planning.

What “Expedited Shipping” Really Means

Expedited shipping is a premium service where speed is deliberately prioritized over cost. Several sources describe it in consistent terms:

Cowtown Express defines expedited shipping as any option that is faster than a carrier’s standard service. For domestic freight, expedited transit is often overnight or within roughly two days, while standard ground moves usually fall in the three‑to‑seven business day range. The key is not a universal guarantee but a relative one: expedited is faster than the baseline.

Ware2Go describes expedited shipping as typically one to three business days. The speed comes from fewer handoffs, shorter distances, dedicated routes, and streamlined processing in fulfillment centers. Global Bioenergy notes that properly designed expedited services frequently deliver in about 24 to 48 hours for high‑priority shipments, especially when dedicated trucking or air is involved.

Terminology complicates things. “Express” is often used interchangeably with “expedited,” but Cowtown Express points out that express is usually the premium tier when both exist, and that “next‑day” or “two‑day” might be branded as express or expedited depending on the carrier. The only safe rule is this: unless the service level agreement explicitly states a day and time, “expedited” by itself means “faster than standard,” not “guaranteed by 10:30 AM tomorrow.”

A useful way to think about it is summarized in the table below.

| Service type | Typical domestic transit window | Handling pattern | Reliability focus |

|---|---|---|---|

| Standard ground | Around 3–7 business days | Multiple terminals, many touches | Cost per pound |

| Expedited | Around 1–3 business days | Fewer terminals, limited rehandling | Faster than standard, less damage |

| Express/Next‑day | Same‑day to next‑day or 2‑day | Highly prioritized, often dedicated capacity | Speed with specific commitment |

For industrial parts, what matters is the combination of speed, handling, and clarity. You need services that are not only fast but designed to minimize touches, misroutes, and damage on high‑value components.

Where Expedited Shipping Belongs In An Industrial Parts Strategy

Expedited shipping earns its keep in industrial environments when it protects operations, safety, or critical project milestones. Across multiple sources, several recurring use cases emerge.

Time‑critical replacement parts are the most obvious. Cowtown Express highlights manufacturers and industrial operations that turn to expedited freight when facing tight production deadlines or urgent replenishment windows. RXO describes using expedited truckload and small vehicles when assembly lines break down and every hour of downtime translates directly into revenue loss. In automation and control, that might be a failed drive, a fried controller, or a damaged robotic axis that stops a bottleneck process.

Emergency replenishment and recovery also drive expedited demand. Expedited freight is used to recover delayed standard shipments, rush emergency retail or MRO stock between distribution centers, and deliver disaster relief supplies, spare parts, or tools when normal cycles will not suffice. Global Bioenergy emphasizes that expedited shipping is reserved for shipments where delays are unacceptable, such as time‑sensitive equipment or aid.

Greenfield projects and critical cutovers are another important category. When you are commissioning a new production line, data center, or process skid, a missing flow meter, I/O module, or safety relay can slip your entire startup window. In my experience, most project teams will pay the premium to overnight those missing parts because the alternative is burning project contingency and labor waiting around.

Heavy and oversized industrial equipment adds another layer. Creopack describes heavy‑equipment shipping for sectors such as construction, medical, aerospace, and data centers, where shipments can weigh tens of thousands of pounds and require flatbeds, step‑deck trailers, or even specialized sea freight like Roll‑On/Roll‑Off vessels. For this class of freight, “expedited” typically means reserved capacity, advanced permit planning, and direct routing rather than pure speed, but the goal is the same: compress total lead time and reduce risk.

Finally, there is the final‑mile problem. USPack (through its industrial logistics content) calls the last leg the “critical mile,” especially when delivering HVAC units, gear assemblies, or other high‑value components into active construction or manufacturing environments. Here, expedited final‑mile services rely on just‑in‑time delivery windows, on‑demand runs, and tight appointment slots to keep cranes, crews, and production cells working rather than waiting.

The Operational Upside Of Expedited Services

When used correctly, expedited shipping is more than expensive freight. It can be a lever for operational performance.

Protecting Uptime And Project Schedules

Current SCM describes expediting in procurement as a proactive discipline built to secure on‑time delivery of materials, avoid production stoppages, and prevent project delays. Expedited transport is the physical counterpart. Together they support lean inventories and tight project schedules by stepping in when normal lead times start to slip.

PLS Logistics explains that expedited shipping has evolved from a purely reactive measure into an intentional tool used to hit tight retailer and consumer deadlines. In industrial automation, that might mean ensuring that replacement drives and PLC racks arrive in time for a planned weekend shutdown, or that critical subassemblies reach an integrator before a factory‑acceptance test date.

When you align expediting discipline with expedited transport, you can carry less safety stock without accepting the same level of risk. You are not gambling everything on stretch targets; you are backing up lean planning with a reliable emergency lane.

Reducing Damage And Risk

Expedited shipments usually travel a much simpler path. Cowtown Express notes that standard freight tends to bounce through terminals and trucks with many people touching the cargo, while expedited freight often stays on a single truck with limited transfers. PLS Logistics adds that expedited services offer fewer handling “touches,” tighter handling practices, and better security because loads spend less time sitting in terminals or warehouses.

USPack’s industrial content highlights chain‑of‑custody and visibility as a core part of critical‑mile logistics. Barcode scanning, milestone tracking, secure handoff logs, and electronic proof of delivery with timestamps and geolocation give you a clear record of who handled a shipment and when. For high‑value automation hardware—safety PLCs, special‑order HMI panels, or custom enclosures—this level of traceability substantially reduces the risk of loss, misrouting, and disputes.

Global Bioenergy emphasizes the dedicated nature of many expedited moves. Using dedicated trucks, air freight, or local couriers means fewer opportunities for theft and damage. Combined with appropriate crating and packaging, especially for heavy equipment as described by Creopack, expedited services can materially improve the physical integrity of critical shipments.

Enabling Leaner Inventories Without Losing Sleep

Just‑in‑time strategies reduce inventory carrying costs, but they also shrink your margin for error. PLS Logistics frames expedited shipping as a way to support lean and JIT operations, allowing manufacturers and retailers to hold less stock while still meeting demand spikes and avoiding spoilage.

Current SCM makes a similar point from the procurement side: effective expediting supports leaner inventories by identifying issues early and intervening before they cause major delays. When you know that you have access to reliable expedited transport modes and vetted providers, it becomes more realistic to trim buffers on selected items without putting uptime at unacceptable risk.

The key is selectivity. You do not rely on expedited services for everything. You reserve them for the subset of parts where the cost of downtime, safety, or lost revenue is far higher than the premium paid for speed.

Strengthening Customer Experience And Loyalty

For OEMs and industrial distributors, expedited shipping is part of the customer promise. Cowtown Express cites research showing that roughly 45 percent of shoppers abandon carts due to delivery options, and that repeat customers can drive around 43 percent of ecommerce revenue. NetSuite notes that poorly designed shipping strategies—as in slow or expensive delivery—are a major driver of cart abandonment and customer churn.

Ware2Go shows the upside with an example: by building a distributed warehouse network and optimizing inventory, one brand achieved about 98 percent coverage for two‑day delivery and around 42 percent for one‑day, which contributed to sales growth exceeding 300 percent. While that case comes from consumer goods, the logic carries over to B2B: if you are the industrial supplier that can reliably get critical automation components to a plant in one or two days, your relationship becomes much stickier.

DispatchTrack’s research reinforces this. Close to half of consumers expect delivery within two days, 98 percent say that delivery is a major driver of brand loyalty, and a majority would switch vendors for lower shipping costs. In industrial markets, those dynamics show up as preferred vendor status, long‑term frame agreements, and repeat project work.

The Trade‑Offs: Cost, Complexity, And Sustainability

If expedited shipping is so beneficial, why not use it for everything? The answer, of course, is cost and complexity.

Direct Freight Cost And Pricing Nuances

Global Bioenergy lays out the basic cost drivers: distance, weight and size, speed, and surcharges for remote locations or difficult conditions. The faster and heavier the shipment, the more you pay. Air freight and dedicated vehicles carry especially high per‑pound costs but deliver unmatched speed.

Cowtown Express provides illustrative price points for parcel‑scale services. Two to three day services such as FedEx Express Saver, UPS 3‑Day Select, or USPS Priority Mail can run from under twenty dollars to around forty dollars for typical small shipments, while overnight options like UPS Next Day or FedEx Express Same Day can be many times more. Those are not industrial LTL or truckload rates, but they show the step‑change in cost when you move from “fast” to “fastest.”

RXO adds a useful nuance: for true expedited truckload, the level of urgency does not usually change the rate. Carriers already assume “as soon as possible,” and pricing is driven more by where capacity is available than by whether you ask for same‑day pickup versus “today if you can.” They also note that shippers can often receive an expedited rate quote within about 15 minutes, and that in major metro areas a vehicle may be able to arrive for pickup within roughly 90 minutes during business hours, subject to capacity.

Inbound Logistics warns against overbuying. One of their examples describes a shipper tempted to spend eight thousand dollars on expedite to protect about five thousand dollars in sales—an obvious mismatch. The message is clear: you must consistently compare the cost of delay against the cost of speed.

Operational Complexity And Risk Of Overuse

Every expedited move you run has a planning and coordination overhead. Creopack points out that heavy‑equipment shipments, especially cross‑border or oversize loads, require permits, customs documentation, and compliance with safety and environmental regulations. ShipERP’s content underlines the complexity of export compliance; in the United States, shipments above a certain value must be filed through the Automated Export System with accurate export information and supporting documents like certificates of origin and packing lists. When you add expedited timelines to that mix, there is less room for error.

Current SCM stresses that expediting is inherently resource intensive. Their guidance highlights challenges such as limited visibility into supplier production, fragmented communication, and “prioritization overload” where everything is treated as urgent. Overuse of expedited shipping is often a symptom of underlying problems: poor forecast accuracy, inadequate safety stock on truly critical items, weak supplier performance, or siloed communication between engineering, procurement, and logistics.

If your team feels like every week involves a new “expedite emergency,” logistics is not your only problem.

Environmental Impact

Global Bioenergy points out that widespread use of expedited shipping can increase environmental impact because it leans more on air freight and less on consolidated loads. Logistics Viewpoints notes that packaging waste alone makes up a large share of municipal solid waste, and that shipping “air” in half‑empty cartons drives unnecessary fuel and material use. NetSuite reports that many consumers are willing to pay more for greener shipping, which has started to push companies toward electric vehicles, alternative fuels, and better route optimization.

For industrial operations with corporate sustainability goals, that means expedited shipping must be managed as a targeted tool, not a default mode. You can offset some of the impact through better packaging, consolidation, and routing, but there is no free lunch. Speed costs carbon.

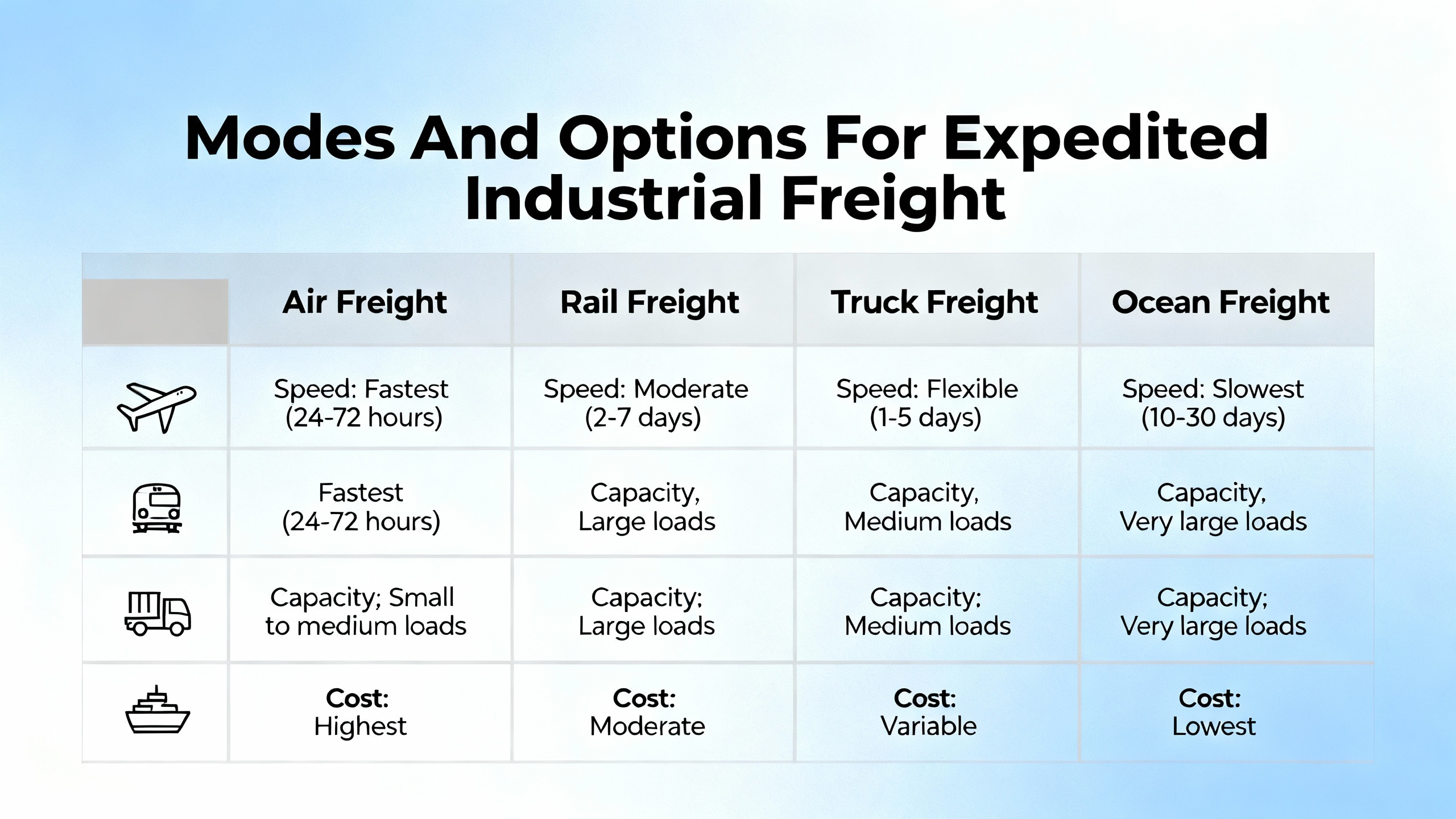

Modes And Options For Expedited Industrial Freight

For industrial parts, expedited shipping is not a single product. It is a menu of modes that you assemble to match risk, distance, and weight.

RXO describes common equipment for expedited truckload and small freight. Sprinter or cargo vans and box trucks, typically in the ten to twenty‑six foot range, handle smaller but urgent loads and often move directly from origin to destination without mixing other shippers’ freight. For heavier loads, expedited full truckload uses team drivers so the truck can keep moving while each driver takes mandated rest breaks. That alone can cut a day or more off long‑haul transit.

GoFC Logistics outlines three broad expedited modes: ground, air freight, and air charter. Ground expedited is often the sweet spot for domestic shipments, especially when you can reach the destination within a one to two day drive. Air freight is the go‑to for international expedited moves, with options to ship on dedicated cargo aircraft or as freight on commercial passenger flights. Air charter sits at the top of the pyramid; you effectively rent the entire aircraft and pay accordingly, reserving this for the highest‑value or most time‑critical shipments.

Global Bioenergy expands the list to include same‑day courier services for local or regional deliveries and global express networks like the big integrators for smaller parcels. For industrial automation, that might translate into using a local same‑day service to move a replacement HMI or servo from a nearby distributor, even while a larger pallet of noncritical material moves by standard LTL.

For heavy or oversized parts, Creopack recommends flatbed trailers for many machines up to roughly 48,000 pounds, step‑deck and double‑drop trailers for taller or heavier equipment that need special permits, and options like flat‑rack containers or Roll‑On/Roll‑Off vessels for overseas movements. In those cases, “expedited” often means securing the right specialized carrier and permits quickly, then running the cleanest possible route rather than shaving a few hours off drive time.

The main point is that you should design a toolkit, not chase single quotes. Your logistics playbook should make it clear when to use a sprinter van, when to use a team‑driven truck, when to escalate to air freight, and when a specialized heavy‑haul solution is warranted.

Getting The Last Mile Right For Industrial Parts

In automation projects, the last mile is often the most fragile. You might have a large drive arriving at a jobsite with no dock, a control panel going into a congested plant with strict safety rules, or a skid of fragile instruments that have to be placed inside a clean room.

USPack’s industrial content emphasizes that final‑mile providers built for industrial work bring specific capabilities: handling of heavy and oversized parts, liftgate services for non‑dock locations, white‑glove delivery for sensitive equipment, and drivers trained to move safely through busy job sites and plants. They highlight the ability to offer just‑in‑time deliveries, scheduled replenishment, and on‑demand emergency runs, along with tight delivery windows measured in minutes, not half‑day slots. Top providers in this space report on‑time performance around the ninety‑eight percent mark, which is what you need when cranes, electricians, and commissioning engineers are standing by.

Visibility also matters. USPack describes using barcode scanning, milestone tracking, electronic proof of delivery, and compliance support for site‑specific safety requirements. ShipERP and DispatchTrack detail how real‑time tracking and analytics can surface carrier performance issues, predict delays, and trigger proactive communication. That combination of physical capability and digital transparency is what allows you to coordinate “truck hits the dock at 7:15 AM, line is back up by lunch” scenarios with confidence.

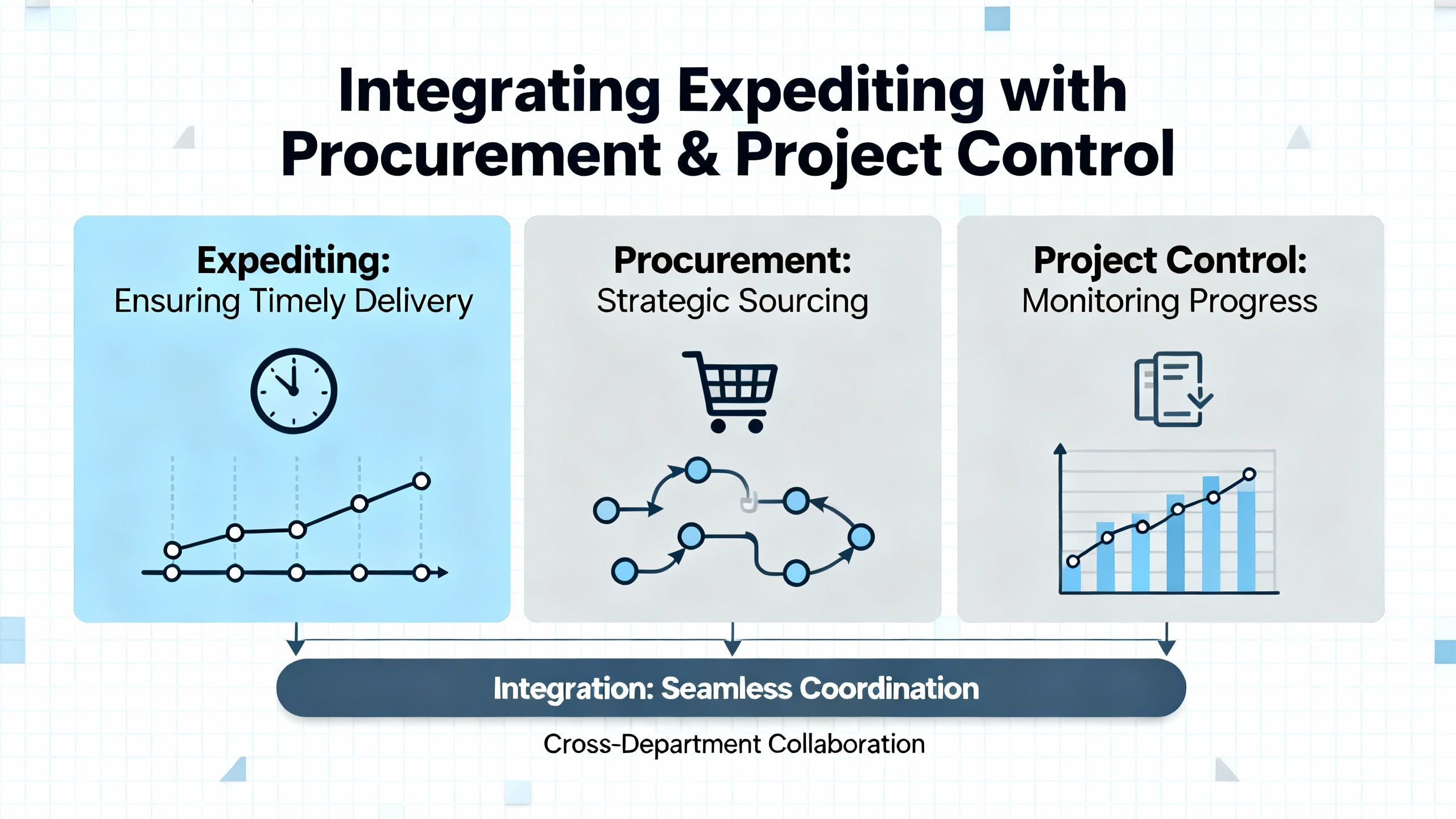

Integrating Expediting With Procurement And Project Control

In many organizations, “expediting” is split between procurement and logistics. Current SCM defines expediting in procurement as a structured process with three stages: preparation, proactive monitoring, and timely intervention. In preparation, you identify critical items, gather order details, and establish communication channels. During proactive monitoring, you track production milestones, supplier lead times, and potential risks. In the intervention stage, you resolve issues, escalate if necessary, and document what happened.

Those same stages apply to expedited shipping services.

During preparation, operations, engineering, and procurement should agree on which parts are truly critical. Criteria usually include lead time, single‑source risk, impact on safety, and the cost of downtime if the part is unavailable. You also define what “expedited” means for each category in terms of mode, carrier options, and budget.

In proactive monitoring, you watch open orders and shipments. Supplier portals, transportation management systems, and integration tools such as those discussed by ShipERP and Translogistics allow you to see when an order is slipping before it becomes a crisis. You can then decide whether to move the shipment to an expedited service, split an order, or adjust schedules.

Timely intervention is where the expedited shipment actually happens. Here, the best practices from Current SCM and Inbound Logistics are simple but powerful: treat people professionally, keep communication transparent, and document decisions. Use expediting software or workflow tools where possible to avoid losing information in email chains. Track not just whether the expedited shipment arrived on time, but also why it was needed in the first place.

Over time, you should monitor key performance indicators such as on‑time delivery rate for critical parts, the number of orders requiring expediting, average expediting lead time, and the direct cost of expediting. When those metrics trend in the wrong direction, the answer is rarely “buy more expedited freight.” It is almost always upstream.

Building A Practical Expedited Shipping Strategy For Industrial Operations

Turning expedited shipping into a controlled, reliable tool involves several deliberate moves.

First, quantify the cost of downtime for your major assets. Inbound Logistics recommends asking “Why expedite, and why now?” and comparing the premium freight cost with the financial impact of delay. If a line stoppage costs tens of thousands of dollars per hour, paying for a dedicated sprinter van to move a drive overnight is rational. If the impact is a modest delay in noncritical production, it may not be.

Second, define what “expedited” means in your own contracts and procedures. Cowtown Express points out that labels such as expedited, express, or guaranteed are not standardized. Work with carriers and third‑party logistics providers to establish specific commitments: transit windows, handling rules, and visibility expectations. PLS Logistics notes that expedited carriers operate with tighter windows and higher communication demands; you should ensure their service levels match your risk profile.

Third, map your critical parts. For a typical automation operation, this might include PLCs, remote I/O, drives, servo motors, key sensors, specialized communication modules, and critical spares for bottleneck equipment. For each category, decide whether you will hold on‑site stock, rely on regional distribution with expedited options, or both. Inbound Logistics suggests pre‑identifying where expedited shipping is justified so you are not debating in the middle of a crisis.

Fourth, invest in technology that makes expedited logistics smarter, not just faster. Transportation management systems, route optimization tools, and real‑time tracking platforms such as those described by OptimoRoute, DispatchTrack, ShipERP, and Translogistics can automatically select modes, consolidate loads, and monitor performance. Logistics Viewpoints shows how cartonization and packaging optimization can reduce shipping “air,” improve trailer cube utilization, and cut shipping costs by double‑digit percentages, which helps pay for the occasional expedited move when you really need it.

Fifth, refine packaging and handling standards for expedited shipments. Material handling guidance emphasizes choosing protective yet simple packaging tailored to product needs, using reusable crates, and properly labeling and organizing products to reduce picking errors. Creopack underlines the importance of custom‑built crates, reinforced corners, and padding for heavy or sensitive equipment. For expedited moves, this kind of packaging prevents a rush job from turning into a damage claim.

Finally, start with a pilot. Choose one plant, one product line, or one customer where the cost of downtime is high and the current expediting process is messy. Document your current state: how often you expedite, what it costs, how often shipments arrive late or damaged. Then implement structured expediting rules, preferred providers, and technology support. Within a few months you will know what works and what you want to scale.

FAQ: Practical Questions About Expedited Shipping For Industrial Parts

Is “expedited” the same as “guaranteed delivery”?

Not necessarily. Cowtown Express makes it clear that expedited shipping generally means faster than standard, but it does not always guarantee a specific delivery day or time unless that is explicitly stated. Inbound Logistics warns that many standard less‑than‑truckload providers use labels such as “expedited” or “guaranteed” while still operating hub‑and‑spoke networks that involve multiple terminals and handoffs. When your operations depend on a specific arrival time, insist on clear service commitments rather than relying on marketing language.

When is air freight or air charter really worth it?

Global Bioenergy and GoFC Logistics both position air freight as the right choice for long‑distance and international moves when speed truly matters, especially for time‑sensitive or high‑value goods. Air charter, where you reserve an entire aircraft, is the fastest and most expensive option and is usually reserved for extraordinary cases. In my experience, air solutions are justified when the combination of downtime, contractual penalties, and reputational damage dwarfs the charter cost. If you cannot clearly articulate that upside, a well‑planned expedited ground solution with team drivers is often the better fit.

How do we keep expedited costs from spiraling out of control?

Inbound Logistics, PLS Logistics, and Translogistics all emphasize planning and data. Start by reserving expedited transport for truly critical items, not every late purchase order. Use mode optimization software and shipment data to consolidate loads where possible and to select the most efficient mode for each move. Be specific with requirements instead of defaulting to “ASAP,” which often drives unnecessary cost. Keep accurate data on shipment dimensions, weights, and locations so you can match freight to the right equipment size instead of overspecifying vehicles. Finally, track how often you resort to expediting and why; trends in that data usually point directly to issues in forecasting, supplier performance, or internal processes.

Industrial automation projects live or die on details. A missing adapter card or a delayed VFD can quietly burn more money than the entire control panel they belong to. Expedited shipping, when treated as a designed capability rather than a last‑minute reaction, is one of the few tools you have that can actually buy time back.

As a systems integrator and project partner, my recommendation is straightforward. Engineer your expediting process with the same discipline you use for safety circuits or network architecture. Define your critical parts, build relationships with the right logistics partners, and use technology and data to control when and how you pull the expedited lever. Done well, you will keep uptime high, protect your budgets, and earn a reputation as the team that finishes projects on schedule instead of the one that spends weekends waiting on a truck.

References

- https://www.globalbioenergy.org/expedited-shipping-guide/

- https://blog.shiperp.com/shipping-smarter-for-industrial-machines-components

- https://cowtownexpress.com/blog/expedited-shipping-101-a-full-guide

- https://www.dat.com/resources/expedited-shipping-benefits-best-practices

- https://www.dispatchtrack.com/blog/logistics-optimization

- https://www.gofclogistics.com/the-ins-and-outs-of-expedited-freight-shipping/

- https://gouspack.com/delivering-the-heavy-stuff-logistics-strategies-for-oversized-and-high-value-industrial-parts/

- https://www.la247forwarder.com/how-we-coordinate-the-shipping-of-industrial-goods/

- https://blogs.material-handling.com/how-to-optimize-your-shipping-process/index.html

- https://optimoroute.com/logistics-management/

Keep your system in play!

Related Products

Related articles Browse All

-

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu...

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu... -

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ...

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ... -

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

Need an automation or control part quickly?

- Q&A

- Policies How to order Part status information Shipping Method Return Policy Warranty Policy Payment Terms

- Asset Recovery

- We Buy Your Equipment. Industry Cases Amikong News Technical Resources

- ADDRESS

-

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

Copyright Notice © 2004-2026 amikong.com All rights reserved

Disclaimer: We are not an authorized distributor or distributor of the product manufacturer of this website, The product may have older date codes or be an older series than that available direct from the factory or authorized dealers. Because our company is not an authorized distributor of this product, the Original Manufacturer’s warranty does not apply.While many DCS PLC products will have firmware already installed, Our company makes no representation as to whether a DSC PLC product will or will not have firmware and, if it does have firmware, whether the firmware is the revision level that you need for your application. Our company also makes no representations as to your ability or right to download or otherwise obtain firmware for the product from our company, its distributors, or any other source. Our company also makes no representations as to your right to install any such firmware on the product. Our company will not obtain or supply firmware on your behalf. It is your obligation to comply with the terms of any End-User License Agreement or similar document related to obtaining or installing firmware.

Cookies

Individual privacy preferences

We use cookies and similar technologies on our website and process your personal data (e.g. IP address), for example, to personalize content and ads, to integrate media from third-party providers or to analyze traffic on our website. Data processing may also happen as a result of cookies being set. We share this data with third parties that we name in the privacy settings.

The data processing may take place with your consent or on the basis of a legitimate interest, which you can object to in the privacy settings. You have the right not to consent and to change or revoke your consent at a later time. This revocation takes effect immediately but does not affect data already processed. For more information on the use of your data, please visit our privacy policy.

Below you will find an overview of all services used by this website. You can view detailed information about each service and agree to them individually or exercise your right to object.

You are under 14 years old? Then you cannot consent to optional services. Ask your parents or legal guardians to agree to these services with you.

-

Google Tag Manager

-

Functional cookies

Leave Your Comment