-

Manufacturers

- ABB Advant OCS and Advant-800xA

- ABB Bailey

- ABB Drives

- ABB H&B Contronic

- ABB H&B Freelance 2000

- ABB Master

- ABB MOD 300, MOD 30ML & MODCELL

- ABB Procontic

- ABB Procontrol

- ABB Synpol D

- Allen-Bradley SLC 500

- Allen-Bradley PLC-5

- Allen-Bradley ControlLogix

- Allen-Bradley CompactLogix

- Allen-Bradley MicroLogix

- Allen-Bradley PanelView

- Allen-Bradley Kinetix Servo Drive

- Allen-Bradley PowerFlex

- Allen-Bradley Smart Speed Controllers

- 3300 System

- 3500 System

- 3300 XL 8mm Proximity Transducer

- 3300 XL NSV Proximity Transducer

- 990 and 991 Transmitter

- 31000 and 32000 Proximity Probe Housing Assemblie

- 21000, 24701, and 164818 ProbeHousing Assemblies

- 330500 and 330525 Piezo-Velocity Sensor

- 7200 Proximity Transducer Systems

- 177230 Seismic Transmitter

- TK-3 Proximity System

- GE 90-70 Series PLC

- GE PACSystems RX7i

- GE PACSystems RX3i

- GE QuickPanel

- GE VersaMax

- GE Genius I/O

- GE Mark VIe

- GE Series One

- GE Multilin

- 800 Series I/O

- Modicon 984

- Modicon Premium

- Modicon Micro

- Modicon Quantum

- Telemecanique TSX Compact

- Altivar Process

- Categories

- Service

- News

- Contact us

-

Please try to be as accurate as possible with your search.

-

We can quote you on 1000s of specialist parts, even if they are not listed on our website.

-

We can't find any results for “”.

-

-

Get Parts Quote

Extended Support Contracts for PLC Systems: A Veteran Integrator’s Guide

If you run an industrial plant, you already know this truth: your PLCs will outlive at least one plant manager, most of the corporate IT stack, and probably the ERP system too. I have seen the same controller sit in a cabinet for twenty years while everything around it changed. That longevity is good for depreciation schedules, but it creates a dangerous gap between what the hardware can still do and what the vendor will still support.

Extended support contracts exist to bridge that gap. Done well, they protect uptime, keep aging systems safe and secure, and buy you time to modernize on your terms rather than on the OEM’s end‑of‑life schedule. Done poorly, they are an expensive comfort blanket that delays the upgrades you really need.

This article walks through extended support for PLC systems from the perspective of someone who has commissioned, maintained, and replaced them across heavy industries for decades. I will lean on real-world guidance from PLC maintenance providers, integrators, and major automation vendors such as ABB, Emerson, Rockwell Automation, Siemens, and others referenced in the research, and I will keep the focus on what actually works inside a plant.

What “Extended Support” Really Means for PLC Systems

When people say “extended support” for PLCs, they often mix three different concepts. In practice, an effective support strategy usually combines all three.

First, there is extended OEM or partner support. Vendors such as Rockwell Automation, Emerson, ABB, and Siemens offer layered support agreements that go beyond the initial warranty. Rockwell’s integrated service agreements bundle remote technical support, repair, field service, and analytics under a single contract, with tiered coverage from basic to premier. Emerson combines its Guardian Support service, which provides system health data and performance insights, with tiered SureService packages so users can pick the intensity of maintenance and reliability support they need. ABB’s SupportLine organizes support into subscription levels like Gold, Silver, and Bronze, backed by a global knowledge base and 24‑hour escalation paths into product engineering. Siemens offers support and assessment services that range from emergency manufacturer assistance to broader evaluations of a plant’s digitalization level.

Second, there are system integrator and field-service contracts. Firms like South Shore Controls and R.L. Consulting position their service contracts as a framework for long‑term reliability and continuous improvement. Typical elements include scheduled evaluations of control systems, structured preventive maintenance, remote controls support, on‑site troubleshooting, and continuous improvement services such as software optimization and integration of new technologies. In practice, these contracts often feel more personal than a pure OEM plan, because the same technicians see your site repeatedly and know its quirks.

Third, there are extension‑of‑life service contracts for end‑of‑life hardware. Providers described by EOL System specialize in keeping critical hardware running after the manufacturer has declared it end‑of‑life and stopped official support. These extension‑of‑life contracts cover replacement parts, repair, and technical expertise for devices such as servers, switches, core routers, and PLC systems. The goal is to maintain operational continuity and defer complex migrations, not to freeze your technology forever.

All three models share a basic promise: when something in your PLC ecosystem fails or falls behind, you have guaranteed access to people, parts, and knowledge instead of scrambling on the open market.

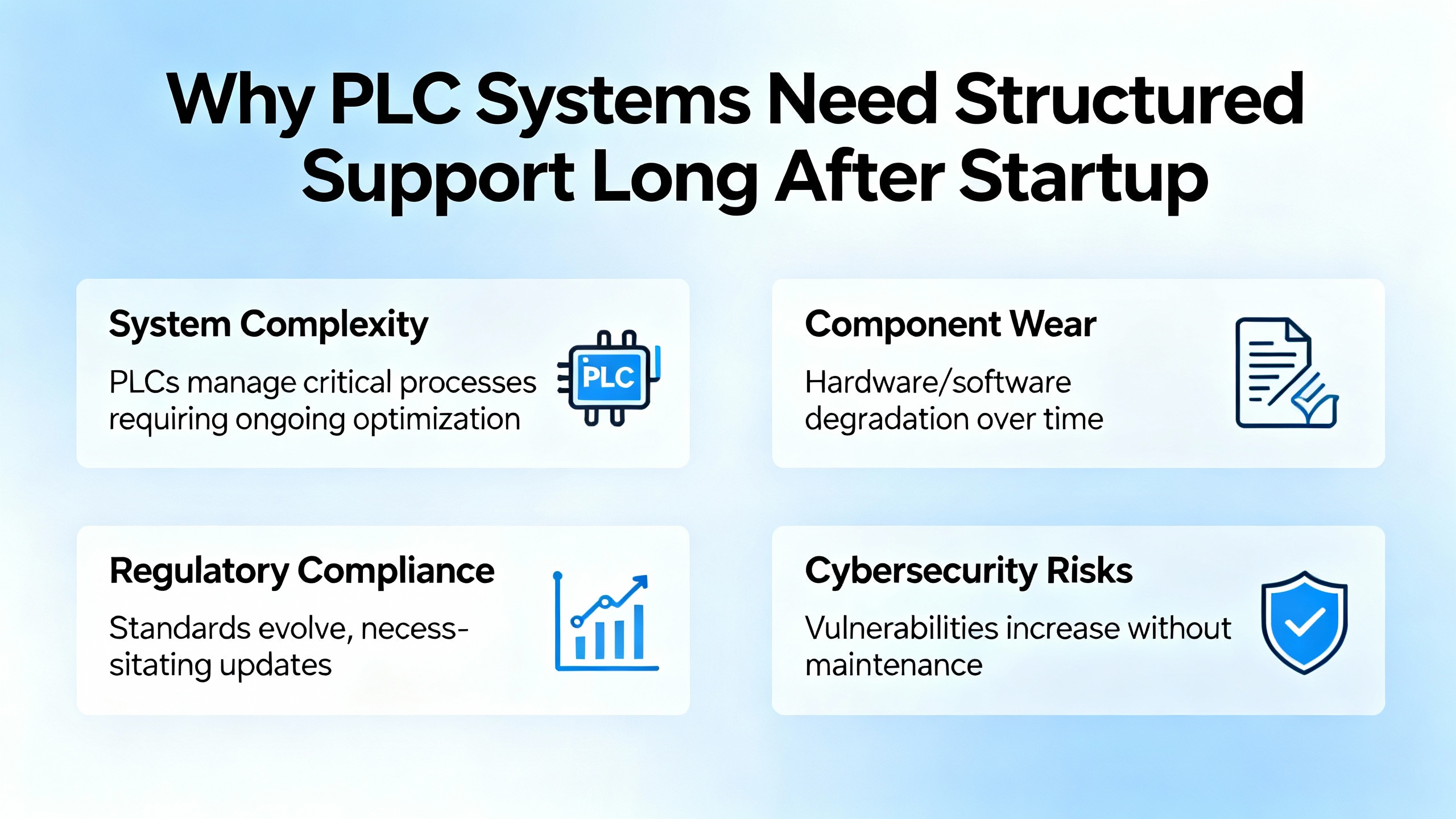

Why PLC Systems Need Structured Support Long After Startup

On paper, a PLC is a rugged industrial computer designed for harsh environments. Maintenance guides from multiple providers emphasize that these devices tolerate vibration, dust, electrical noise, and heat better than general‑purpose IT hardware. That is true, but it can be misleading. Rugged does not mean maintenance‑free.

A typical PLC architecture combines input modules reading sensors and switches, a CPU executing the logic, output modules driving actuators, memory storing programs and data, and a power supply. Around that core you usually find communication modules to talk to SCADA systems, HMIs, drives, and sometimes other PLCs. Maintenance guides from eWorkOrders, PDFSupply, PLC Department, and others consistently highlight the same underlying reality: every one of these layers can fail or drift.

Preventive tasks such as regular backups of PLC programs, inspection and tightening of terminals, cleaning vents and filters, managing temperature and humidity, and checking status LEDs are essential. Maintenance experts recommend risk‑based scheduling: high‑vibration or dirty environments need more frequent inspections and cleaning, while software backups and planned component replacements can follow an interval based on historical failure patterns.

But maintenance addresses only part of the picture. Three additional forces make extended support contracts particularly important for PLC systems.

The first is obsolescence. Articles on legacy PLCs from industrial suppliers point out that many controllers still in use today rely on outdated software and hardware that are no longer supported by the OEM. Indicators of a legacy PLC include missing security patches, dependence on old programming tools and operating systems, difficulty obtaining spare parts, and slow or limited communications that cannot support modern data needs. At some point, maintenance alone cannot overcome the lack of vendor support and parts.

The second is cybersecurity and software compatibility. As described in both PLC upgrade and software support contract discussions, unsupported software cannot receive security patches and may become incompatible with newer computers and operating systems. That is true for PLC programming tools and engineering workstations just as much as for CAD or EDA tools. Elektor’s analysis of software support contracts in electronic design tools underscores how allowing maintenance to lapse can leave you stranded on obsolete versions that fail as operating systems change, and resuming support later can be much more expensive than keeping it active.

The third is knowledge loss. Plants change ownership, engineers retire, and tribal knowledge walks out the door. Documentation gets stale. R.L. Consulting and other long‑term PLC maintenance partners emphasize how important accurate as‑built documentation and disciplined backup routines are for resilience. When you combine aging hardware, unsupported software, and a thin in‑house team, the risk of prolonged downtime skyrockets whenever something goes wrong.

Extended support contracts exist to manage those three forces in a predictable way rather than reacting to them in a crisis.

Typical Components of a PLC Support Contract

Although terminology varies, most serious PLC support agreements cover a similar set of building blocks.

There is always a remote technical support element. ABB’s SupportLine assigns each case to a specialist and routes escalations into global development resources around the clock. Rockwell’s integrated service agreements and Agilix Solutions’ description of Rockwell Integrated Service Agreements emphasize a single phone number to get access to remote support, repairs, and field services. These arrangements matter when your internal controls engineer is staring at a cryptic fault code at 2:00 AM and needs someone who has seen it before.

Preventive maintenance and scheduled evaluations are another foundation. South Shore Controls describes scheduled evaluations and preventive maintenance as core options: pre‑planned inspections, adjustments, optimization, and performance assessments to catch issues early and extend equipment life. In practice, these visits combine control panel inspections, wiring checks, program verification against process requirements, and review of error logs and diagnostics. They complement the daily or weekly tasks your in‑house technicians perform.

Field services and on‑site support sit behind the remote tier. When the issue involves physical repair, major upgrades, or commissioning, you need someone on the factory floor. Service integrators like South Shore Controls list on‑site controls support, repairs, installations, commissioning, upgrades, and systems integration among the services that can be bundled into a contract.

Software and firmware support is increasingly important. PLC maintenance guides advise monitoring for product notices, recalls, patches, and firmware upgrades, and applying them in a controlled way. Software support contracts in other domains, such as the EDA tools discussed by Elektor, typically include entitlement to new software releases; many automation vendors follow a similar pattern, where an active support agreement entitles you to updates and new features during the term.

Continuous improvement and optimization services round out the picture. South Shore Controls describes continuous improvement services as part of its service contracts, focused on enhancing system efficiency and integrating new technologies. R.L. Consulting goes further, positioning maintenance as an opportunity to optimize PLC programs, streamline logic, upgrade hardware selectively, and improve diagnostics and safety over time.

Finally, most frameworks today are tiered. ABB uses Gold, Silver, and Bronze subscriptions. Rocla’s AGV service packages illustrate a common pattern: an essentials package with preventive maintenance and basic support, an advanced package adding 24/7 help desk access with a one‑hour response time and defined repair response windows, and a full package that includes software maintenance, broader support hours, and bundled repairs and spare parts for predictable monthly costs. Emerson’s SureService program uses four tiers to allow different levels of coverage aligned with maintenance strategy. Rockwell’s integrated agreements, as described via Agilix Solutions, come in Essential, Enhanced, and Premier flavors, with higher tiers adding more proactive services, asset management tools, and priority handling.

The labels differ, but the underlying idea is the same: you pick a service level proportional to how critical the assets are and how much risk you are willing to carry yourself.

Extended Support for Legacy and End‑of‑Life PLCs

Legacy PLCs deserve special attention because they are where extended support contracts can make the difference between an orderly modernization and a very expensive surprise.

Several articles converge on a common definition: a legacy PLC is one that is still running but based on outdated hardware and software that are no longer updated or supported by the manufacturer. Traits include lack of security updates, incompatibility with modern networks and programming tools, scarce spare parts, and dependence on rare engineering skills. As these systems age, unplanned downtime risk grows, and integration with newer systems becomes harder.

Extension‑of‑life service contracts, as described by EOL System, offer a structured way to keep such hardware running safely for longer. These contracts provide ongoing support, replacement parts (new or refurbished), and technical expertise after the OEM has ended official support and stopped issuing regular updates. They are especially appealing in environments where the PLC is tied to critical infrastructure or specialized equipment that would be very costly to replace quickly.

Key benefits of extension‑of‑life contracts include reduced pressure to perform rushed migrations, the ability to continue running existing applications without major re‑engineering, continued access to compatible parts, and avoidance of immediate capital outlays for new systems. EOL System notes that these contracts can cover a wide range of hardware, including network and data center equipment and PLC systems, and can improve security relative to running truly unsupported devices with no structured maintenance.

The trade‑offs are real, though. Even with extension‑of‑life support, you are still on a platform that is not evolving. Security posture will always lag behind modern systems, and you will eventually run out of vendor patches and compatible components. Extension‑of‑life support should therefore be paired with a migration roadmap, not used as an excuse to ignore modernization indefinitely.

Migration strategies themselves have matured. Guidance from Control Engineering highlights plug‑and‑play PLC migration solutions that preserve I/O wiring and panel footprints, using pre‑engineered adapters and cables to minimize downtime and wiring errors compared to traditional rip‑and‑replace approaches. Panelmatic’s discussion of PLC upgrade options distinguishes between migration, where you retain wiring and field devices while replacing the CPU and software platform, and full replacement, where the entire PLC system, cabinets, and HMIs are redesigned. Extended support and extension‑of‑life contracts often provide the breathing room you need to evaluate and execute these migrations safely.

The Business Case: Reliability, Cost, and Risk

In boardrooms, extended support contracts sometimes get reduced to a simple budget question: “Is this annual fee worth it?” On the plant floor, the calculus is more nuanced.

Reliability and uptime are the most obvious drivers. PLC maintenance guides and integrator case studies consistently show that proactive care and timely access to expertise reduce unexpected failures and shorten the mean time to repair when something does go wrong. One case reported by a mid‑sized food manufacturing plant that migrated to a modern Allen‑Bradley PLC platform described a 45 percent reduction in unplanned downtime and annual savings of over $100,000 in maintenance and lost production costs. That particular outcome came from a modernization project rather than support alone, but support agreements and installed‑base tools are often part of the same strategy: you cannot improve what you do not measure and monitor.

Cost behavior is the next element. Integrated service agreements described by Rockwell Automation and Agilix Solutions emphasize budget predictability. Instead of raising a separate purchase order for every repair or emergency visit, you shift much of that variability into a contract, sometimes including repairs and spare parts in a fixed monthly fee, as Rocla’s full service package does for AGV systems. Extension‑of‑life contract providers point out that keeping existing hardware running with supported component replacements can avoid large capital expenditures and the soft costs of retraining staff on new platforms.

There is also the cost of letting support lapse. Elektor’s analysis of EDA software maintenance points out that restarting maintenance after a gap can be significantly more expensive than keeping it active, because of upgrade policies and amnesty rules. While the commercial specifics differ in industrial automation, the pattern is familiar: if you defer support for years and then suddenly need to catch up, you may find that your options are limited and pricey.

Finally, there is the risk dimension: safety, compliance, and cyber exposure. R.L. Consulting ties effective PLC maintenance programs to standards such as IEC 61131‑3 for code quality, NFPA 79 for machinery safety, UL 508A for control panels, and ISA/IEC 62443 for cybersecurity. Panelmatic emphasizes that outdated PLCs may not meet modern safety and compliance expectations, lacking advanced diagnostics, fail‑safe behavior, and record‑keeping. Support agreements with vendors and integrators who understand these standards make it more likely that your system changes and upgrades will maintain compliance rather than eroding it over time.

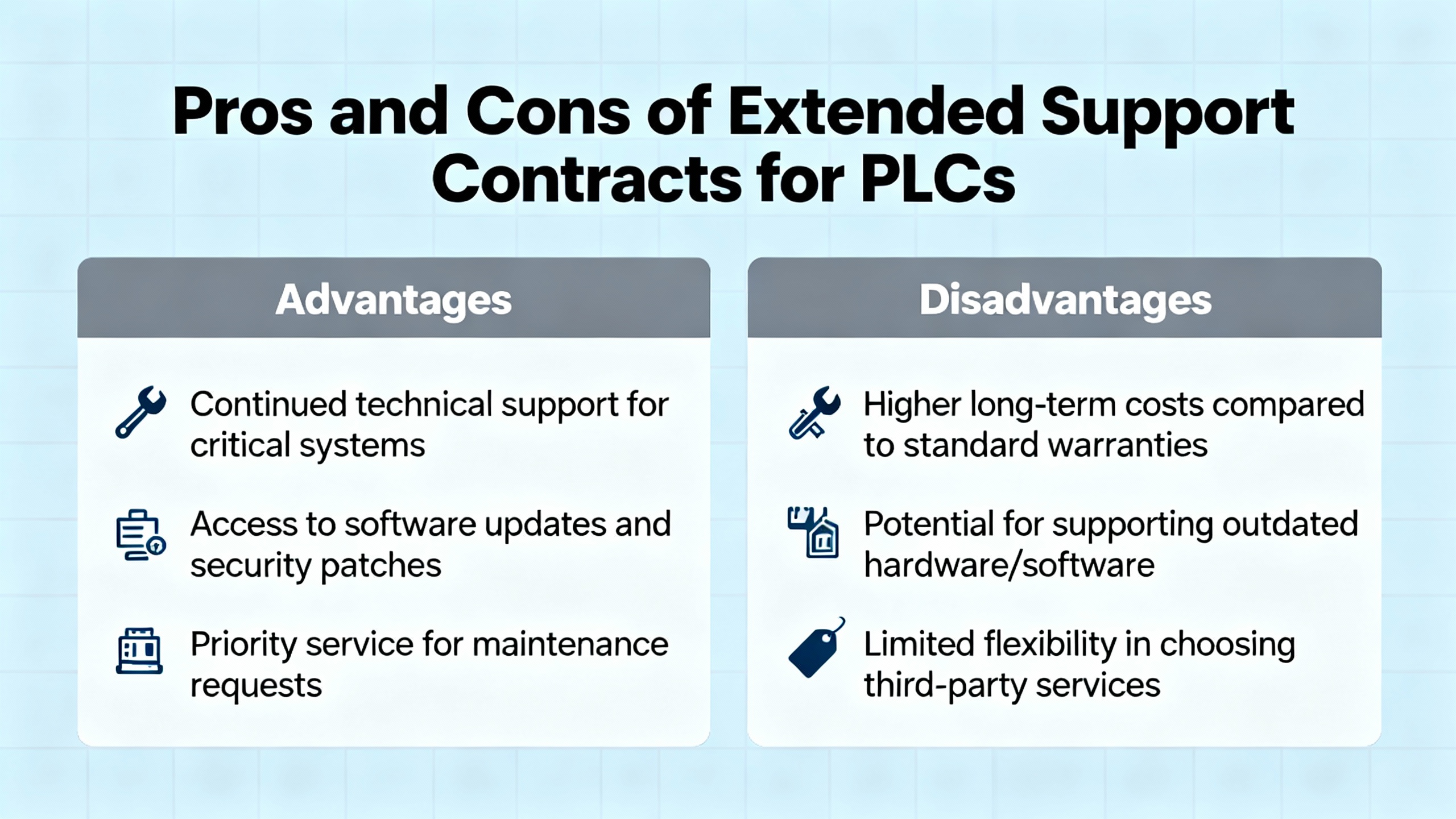

Pros and Cons of Extended Support Contracts for PLCs

From a plant‑level perspective, extended support contracts bring clear advantages.

You gain faster access to specialized expertise when something fails. ABB’s SupportLine structure, with tracked cases and 24‑hour escalation into global engineering, exists precisely because some problems require insight that only the product team has. Integrators with deep domain knowledge, such as R.L. Consulting or South Shore Controls, provide the same depth in custom PLC systems where the OEM only supplied the components, not the overall design.

You get a more disciplined maintenance program. Contracts that include scheduled evaluations, preventive maintenance, and continuous improvement embed maintenance into the way you run the plant rather than leaving it as a “when we have time” activity. Maintenance guides from eWorkOrders, PDFSupply, and PLC Department all stress the importance of systematic tasks such as regular backups, environmental control, and hardware inspections; a good contract turns those recommendations into a calendar with accountability.

You improve lifecycle planning and modernization decisions. Asset‑health analytics, installed‑base tools, and digitalization assessments offered by vendors such as Emerson, Rockwell Automation, and Siemens provide hard data on where your risks lie. Combined with extension‑of‑life options, that data helps you decide whether to keep a given PLC under enhanced support, migrate it, or replace it entirely.

There are downsides and pitfalls, however, and they deserve equal attention.

The most common pitfall I see is treating the contract as an autopilot. A purchase order and a phone number do not replace in‑house ownership of the control system. If no one inside the plant is tracking recurring alarms, reviewing support reports, or ensuring that recommended changes are implemented, the value of the contract erodes quickly.

Another risk is poor scoping and weak service‑level definitions. Service level discussions around support contracts in other domains, such as managed service providers and contract renewals, emphasize the importance of clear objectives and risk‑based prioritization. The same applies to PLC support. If the contract does not distinguish between critical production lines and auxiliary systems, or if response times and coverage windows are vague, you may discover the gaps during your worst outage.

Auto‑renewal without real review is a quieter hazard. Research on contract renewals stresses that renewals should be treated as checkpoints, not administrative rubber stamps. Before renewing a PLC support agreement, you should revisit whether the scope, SLAs, and vendor performance still match your risk profile and modernization roadmap.

Finally, extended support can, if misused, become a crutch that delays necessary modernization. Extension‑of‑life contracts are powerful tools to avoid rushed migrations, but they should sit alongside, not instead of, a plan to move away from obsolete and insecure platforms.

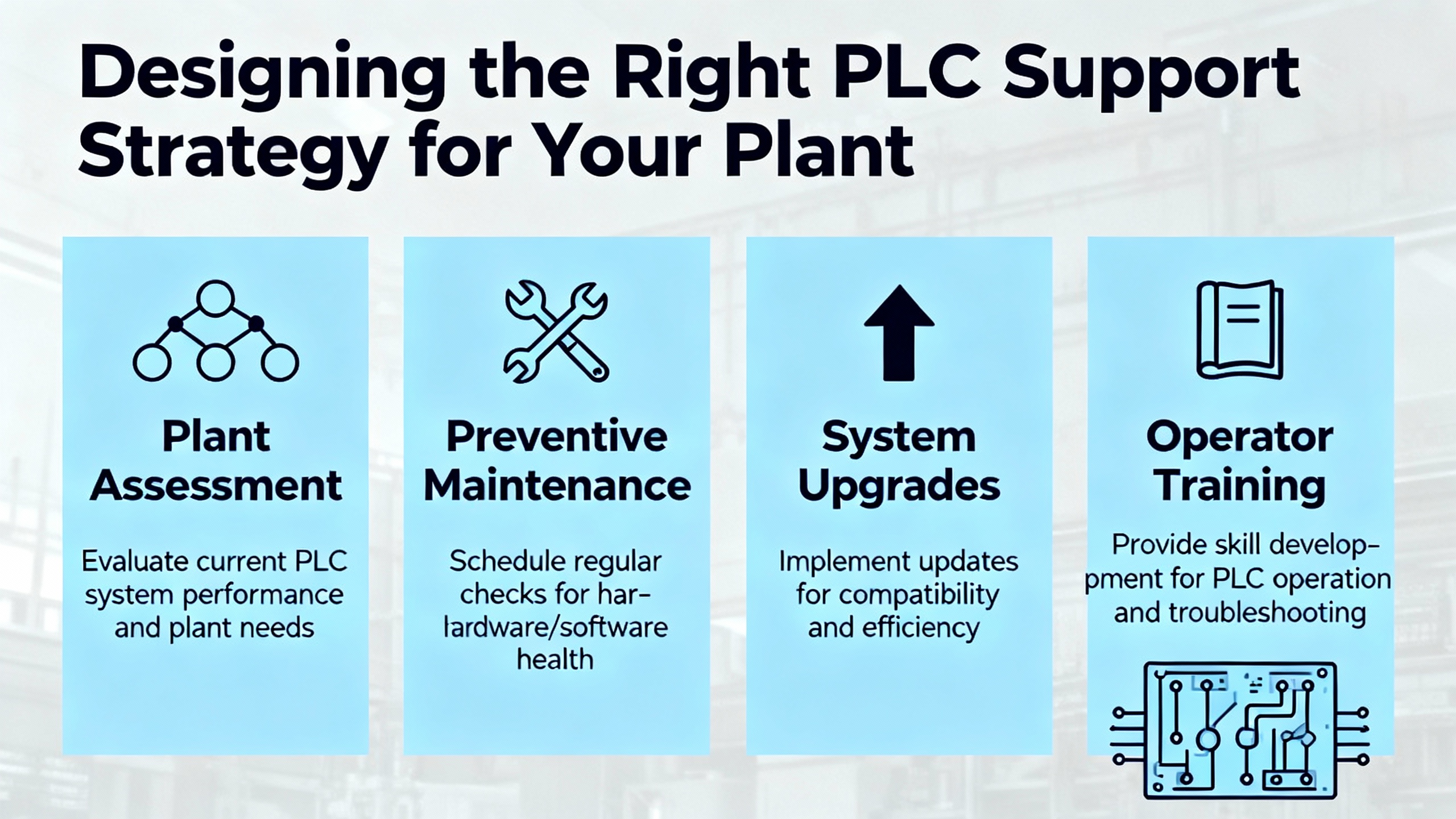

Designing the Right PLC Support Strategy for Your Plant

An effective support strategy starts long before you sign any contract. It starts with understanding your installed base and your risk tolerance.

Begin with an honest inventory and risk assessment. PLC maintenance guides recommend keeping an up‑to‑date audit of every PLC in use, including location, make, program type, last backup date, and criticality of the equipment it controls. Combine that with environmental data, known problem spots, and vendor lifecycle information indicating which models are approaching or past end‑of‑life. Some vendors, such as Siemens, explicitly offer digitalization and support assessments to help quantify where you stand; Emerson’s Guardian Support focuses on system health and performance data. Whether you use external services or do it internally, the outcome should be a clear map of which systems are critical, which are legacy, and where your biggest single‑points‑of‑failure live.

Next, decide where extended support meaningfully reduces risk. High‑throughput continuous processes, safety‑critical systems, and remote or hard‑to‑staff sites typically benefit the most. PLCs controlling minor utilities in a well‑staffed plant may be adequately covered by internal resources and a basic parts stock. Legacy systems with scarce spare parts are strong candidates for extension‑of‑life contracts while you prepare a migration.

Choosing partners is the next step. OEM agreements provide direct access to manufacturer knowledge and, in some cases, bundled repairs and parts. Integrator contracts add system‑level understanding across mixed vendors and custom logic. Extension‑of‑life providers complement both by ensuring hardware availability for retired platforms. In complex plants, it is common to use a blend: an OEM agreement for major DCS or PLC platforms, an integrator contract for plant‑wide support and upgrades, and targeted extension‑of‑life for specific legacy islands.

When you structure the agreement details, think in terms of service tiers and SLAs that match your process. The tiered service packages used by Rocla for AGVs illustrate the trade‑offs between basic preventive maintenance, extended support hours, defined response times, and bundled repairs and parts. For PLC systems, similar decisions apply: which assets require 24/7 phone support and guaranteed engineer response on site within a day, which can tolerate business‑hours support with a longer response, and which can be handled on a best‑effort basis.

A concise way to frame those decisions is to compare contract types side by side.

| Contract Type | Typical Use Case | Key Strengths | Key Limitations |

|---|---|---|---|

| Standard OEM support | Newer PLC platforms under active lifecycle | Direct vendor updates and bug fixes; basic support | Limited to vendor’s own products |

| Extended OEM / integrator support | Critical production lines and complex systems | Faster response, preventive visits, optimization | Ongoing cost; requires active internal engagement |

| Extension‑of‑life (EOLC) contracts | Legacy PLCs and infrastructure past vendor EOL | Access to parts and expertise, defers migrations | Does not eliminate obsolescence or security concerns |

Finally, build metrics and review into the process. Research on contract renewal best practices recommends setting explicit objectives for each agreement, such as targeted uptime improvements, cost reductions, or consolidation of vendors, and then reviewing performance against those objectives before renewal. For PLC support, that means tracking downtime, incident response times, repeated failures, and the status of recommended upgrades, and asking whether the contract and partner mix is still the right tool for the next period.

When Extended Support Is Not Enough: Knowing When to Upgrade

No support contract can turn an obsolete PLC into a modern platform. At some point, modernization becomes the safer and more economical path.

Panelmatic’s guidance on PLC upgrade decisions lists clear triggers: obsolete hardware and software, difficulty sourcing replacement components, increasing maintenance time and cost, limited diagnostics and programming flexibility, and incompatibility with newer sensors, drives, or networking protocols. Analyses of legacy PLC systems add drivers such as cybersecurity risk due to unpatched vulnerabilities and the inability to support modern control strategies or data requirements.

Upgrade options fall broadly into migration and full replacement. Migration retains existing wiring and field devices while replacing the CPU and software platform. Panelmatic notes that this approach reduces material cost and installation downtime, and allows operators to face a gentler learning curve. The trade‑offs are potential code‑conversion issues and limits imposed by old wiring and architecture. Full replacement involves redesigning panels, power, and HMIs around a new PLC platform, enabling state‑of‑the‑art performance and scalability at the price of higher upfront cost, longer downtime, and more extensive training.

Control Engineering’s discussion of plug‑and‑play PLC migration approaches shows that modern migration hardware can significantly reduce downtime by preserving field wiring and using pre‑verified adapter cables and racks. One facility converted fourteen 16‑slot racks in about five days using such a solution, compared to an estimated ten to fifteen days with traditional rip‑and‑replace methods.

Extended support contracts should support these modernization efforts, not compete with them. A well‑structured agreement will include upgrade planning, testing support, and perhaps even favorable commercial terms around migration services. Extension‑of‑life contracts can keep legacy systems stable while you stage and test replacements, but they should sit within a defined timeline for moving to supported platforms.

Practical Steps to Implement or Improve PLC Support

From experience, plants that get the most from their PLC support contracts tend to follow a similar practical path.

They treat their PLC inventory and documentation as living assets. Maintenance best practices from multiple sources stress the importance of accurate as‑built wiring diagrams, up‑to‑date logic documentation, and verified backups stored safely. Support partners can only be as effective as the information they have; if every fault call begins with reverse‑engineering your own system, the value of extended support diminishes quickly.

They integrate support workflows with their maintenance management tools. Computerized maintenance management systems are often used to schedule tasks, log failures, and track asset history. When support tickets, vendor recommendations, and contract entitlements are visible alongside maintenance work orders, it becomes much easier to prioritize changes and justify upgrades.

They involve operators and technicians, not just engineering and procurement. Service providers such as R.L. Consulting emphasize training and operator‑friendly HMIs and alarm schemes as part of long‑term support. That only works if the people using the system daily are part of the conversation, feeding back which alarms are noisy, where procedures are unclear, and where they see recurring issues.

They revisit contracts and partners as their automation strategy evolves. Siemens positions its support and assessment services as part of a broader journey toward a “sustainable digital enterprise,” and Emerson frames its agreements as lifecycle support. As plants add more advanced analytics, remote access, and integrated IT/OT architectures, the balance between internal capability, OEM support, integrator involvement, and extension‑of‑life strategies should be re‑evaluated rather than assumed to be fixed.

Short FAQ

Is an extended support contract a substitute for upgrading a legacy PLC?

No. Extended support and extension‑of‑life contracts can safely extend the life of legacy PLCs and provide structured access to parts and expertise, but they do not change the underlying platform. Guidance from upgrade specialists and legacy PLC analyses agree that once hardware and software are obsolete, modernization becomes necessary to address performance, security, and scalability requirements. Extended support is best viewed as a bridge to a planned upgrade, not a permanent solution.

How do I decide whether to buy OEM support or work primarily with an integrator?

OEM support agreements provide the most direct line into product engineering, bug fixes, and official updates for a specific vendor’s hardware and software. Integrator contracts, as illustrated by companies like South Shore Controls and R.L. Consulting, bring system‑level knowledge across multiple brands and custom logic, and they often handle upgrades, integrations, and plant‑wide troubleshooting. In practice, facilities with diverse automation platforms often choose a combination: OEM support for major platforms and an integrator contract to cover multi‑vendor systems and higher‑level performance and safety concerns.

Are extension‑of‑life contracts safe from a cybersecurity perspective?

Extension‑of‑life providers argue that structured support with access to patches, parts, and expertise is safer than running truly unsupported devices with no plan. However, any system on an obsolete platform will lag modern cybersecurity practices. Standards such as ISA/IEC 62443, referenced in PLC maintenance best practices, recommend a defense‑in‑depth approach. That means compensating controls such as network segmentation, strict access management, and careful monitoring, combined with a roadmap to migrate away from inherently insecure platforms over time.

In the end, extended support contracts for PLC systems are not magic and they are not optional luxuries. They are tools. In the right hands, with clear objectives and honest risk assessment, they keep your controls reliable, your migrations orderly, and your team focused on improving the plant rather than fighting fires. If your support arrangements have not been revisited in years, now is the time to walk your control rooms and cabinets with your integrator or vendor, line by line, and make sure the contracts you are paying for match the plant you are actually running.

References

- https://action-point.com/three-key-benefits-to-having-a-software-support-contract/

- https://research.aimultiple.com/service-level-agreement-automation/

- https://www.controleng.com/benefits-of-plug-and-play-plc-migration/

- https://www.elektormagazine.com/articles/benefits-of-maintaining-software-support-contracts

- https://www.eolsystem.com/extension-of-life-service-contracts-eolc/

- https://www.gatekeeperhq.com/blog/contract-renewals

- https://rlconsultinginc.com/best-practices-for-maintaining-custom-plc-systems/

- https://eworkorders.com/cmms-industry-articles-eworkorders/guide-to-programmable-logic-controller-maintenance/

- https://www.goagilix.com/blog/rockwell-automation-integrated-service-agreement/

- https://www.impactmybiz.com/blog/blog-4-reasons-long-term-service-contract/

Keep your system in play!

Related articles Browse All

-

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu...

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu... -

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ...

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ... -

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

Need an automation or control part quickly?

- Q&A

- Policies How to order Part status information Shipping Method Return Policy Warranty Policy Payment Terms

- Asset Recovery

- We Buy Your Equipment. Industry Cases Amikong News Technical Resources

- ADDRESS

-

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

Copyright Notice © 2004-2026 amikong.com All rights reserved

Disclaimer: We are not an authorized distributor or distributor of the product manufacturer of this website, The product may have older date codes or be an older series than that available direct from the factory or authorized dealers. Because our company is not an authorized distributor of this product, the Original Manufacturer’s warranty does not apply.While many DCS PLC products will have firmware already installed, Our company makes no representation as to whether a DSC PLC product will or will not have firmware and, if it does have firmware, whether the firmware is the revision level that you need for your application. Our company also makes no representations as to your ability or right to download or otherwise obtain firmware for the product from our company, its distributors, or any other source. Our company also makes no representations as to your right to install any such firmware on the product. Our company will not obtain or supply firmware on your behalf. It is your obligation to comply with the terms of any End-User License Agreement or similar document related to obtaining or installing firmware.

Cookies

Individual privacy preferences

We use cookies and similar technologies on our website and process your personal data (e.g. IP address), for example, to personalize content and ads, to integrate media from third-party providers or to analyze traffic on our website. Data processing may also happen as a result of cookies being set. We share this data with third parties that we name in the privacy settings.

The data processing may take place with your consent or on the basis of a legitimate interest, which you can object to in the privacy settings. You have the right not to consent and to change or revoke your consent at a later time. This revocation takes effect immediately but does not affect data already processed. For more information on the use of your data, please visit our privacy policy.

Below you will find an overview of all services used by this website. You can view detailed information about each service and agree to them individually or exercise your right to object.

You are under 14 years old? Then you cannot consent to optional services. Ask your parents or legal guardians to agree to these services with you.

-

Google Tag Manager

-

Functional cookies

Leave Your Comment