-

Manufacturers

- ABB Advant OCS and Advant-800xA

- ABB Bailey

- ABB Drives

- ABB H&B Contronic

- ABB H&B Freelance 2000

- ABB Master

- ABB MOD 300, MOD 30ML & MODCELL

- ABB Procontic

- ABB Procontrol

- ABB Synpol D

- Allen-Bradley SLC 500

- Allen-Bradley PLC-5

- Allen-Bradley ControlLogix

- Allen-Bradley CompactLogix

- Allen-Bradley MicroLogix

- Allen-Bradley PanelView

- Allen-Bradley Kinetix Servo Drive

- Allen-Bradley PowerFlex

- Allen-Bradley Smart Speed Controllers

- 3300 System

- 3500 System

- 3300 XL 8mm Proximity Transducer

- 3300 XL NSV Proximity Transducer

- 990 and 991 Transmitter

- 31000 and 32000 Proximity Probe Housing Assemblie

- 21000, 24701, and 164818 ProbeHousing Assemblies

- 330500 and 330525 Piezo-Velocity Sensor

- 7200 Proximity Transducer Systems

- 177230 Seismic Transmitter

- TK-3 Proximity System

- GE 90-70 Series PLC

- GE PACSystems RX7i

- GE PACSystems RX3i

- GE QuickPanel

- GE VersaMax

- GE Genius I/O

- GE Mark VIe

- GE Series One

- GE Multilin

- 800 Series I/O

- Modicon 984

- Modicon Premium

- Modicon Micro

- Modicon Quantum

- Telemecanique TSX Compact

- Altivar Process

- Categories

- Service

- News

- Contact us

-

Please try to be as accurate as possible with your search.

-

We can quote you on 1000s of specialist parts, even if they are not listed on our website.

-

We can't find any results for “”.

-

-

Get Parts Quote

Project Quotation Services for Industrial Controls Procurement: A Veteran Integrator’s Guide

This is my linkedin:

As a seasoned expert in the field of automation spare parts, Sandy has dedicated 15 years to Amikon, an industry-leading company, where she currently serves as Director. With profound product expertise and exceptional sales strategies, she has not only driven the company's continuous expansion in global markets but also established an extensive international client network.

Throughout Amikon's twenty-year journey, Sandy's sharp industry insights and outstanding leadership have made her a central force behind the company's global growth and sustained performance. Committed to delivering high-value solutions, she stands as a key figure bridging technology and markets while empowering industry progress.

When a controls project goes sideways, it almost never starts with a bad PLC or a flaky VFD. It starts much earlier, with a bad quote.

As a systems integrator who has spent years turning RFQs into functioning panels and running plants, I have seen the same pattern repeat. An optimistic spreadsheet quote glosses over engineering effort, underestimates commissioning time, ignores risk, and quietly assumes that panel shops, electricians, and vendors will all perform at their theoretical best. Six months later, the project team is drowning in change orders, overtime, and uncomfortable meetings.

Project quotation services exist to break that pattern. Done right, a quotation is not just a price; it is a structured, data-backed project estimate wrapped in a commercial offer. In industrial controls procurement, that difference is the line between profitable, predictable work and a year of firefighting.

This article lays out how a professional project quotation service should work for industrial automation and control hardware, why it matters, and how to use it as a practical tool rather than a formality.

Why Quotation Quality Matters in Controls Projects

Controls projects sit at the intersection of engineering complexity, production risk, and capital spending. A single project quote for a plant expansion or line upgrade often pulls together programmable controllers, safety systems, networks, drives, field devices, panels, and software, plus installation and commissioning.

Research on project controls from organizations like Hexagon emphasizes that cost and schedule control depend on accurate measuring, forecasting, and proactive correction across the entire project. In practical terms, that means your initial quote must be built on sound estimating practices, not wishful thinking.

Studies on quoting and estimation across manufacturing and project management highlight the same core points.

They show that accurate estimates are the foundation of planning and decision-making, enabling realistic budgets, resource allocation, and risk management. They also show that poor estimation leads to budget overruns, missed deadlines, and scope creep, which ultimately damage trust and profitability.

For manufacturers specifically, quoting is more than a price guess. Sources focused on manufacturing quoting describe a quote as a strategic document that sets price, scope, timeline, and conditions for a job. Quote speed and accuracy become competitive differentiators. Many manufacturers aim to return detailed quotes within about 24–48 hours, yet customers increasingly expect responses within a single day, while manual processes often stretch to three days or more.

In controls procurement, this plays out as a real tension. Sourcing wants fast numbers to compare vendors. Engineering wants time to think. Finance wants certainty. A solid project quotation service reconciles these pressures by standardizing how requirements are captured, how work is estimated, how risk is handled, and how numbers are presented.

What a Project Quotation Service Really Is

In the quote-to-order sales cycle, the quotation step is the bridge between “we need a solution” and “we are placing an order.” A mature project quotation service turns this bridge into a repeatable process rather than a one-off scramble.

Several sources on quotation and sales processes define quoting as a set of repeatable activities: receiving requirements, deciding whether and how to respond, building the estimate, routing it for internal review and approval, presenting it to the customer, negotiating, and finally converting accepted quotes into orders and contracts. In some environments, quoting is tightly integrated with production, especially when there are many product variations or add-on services.

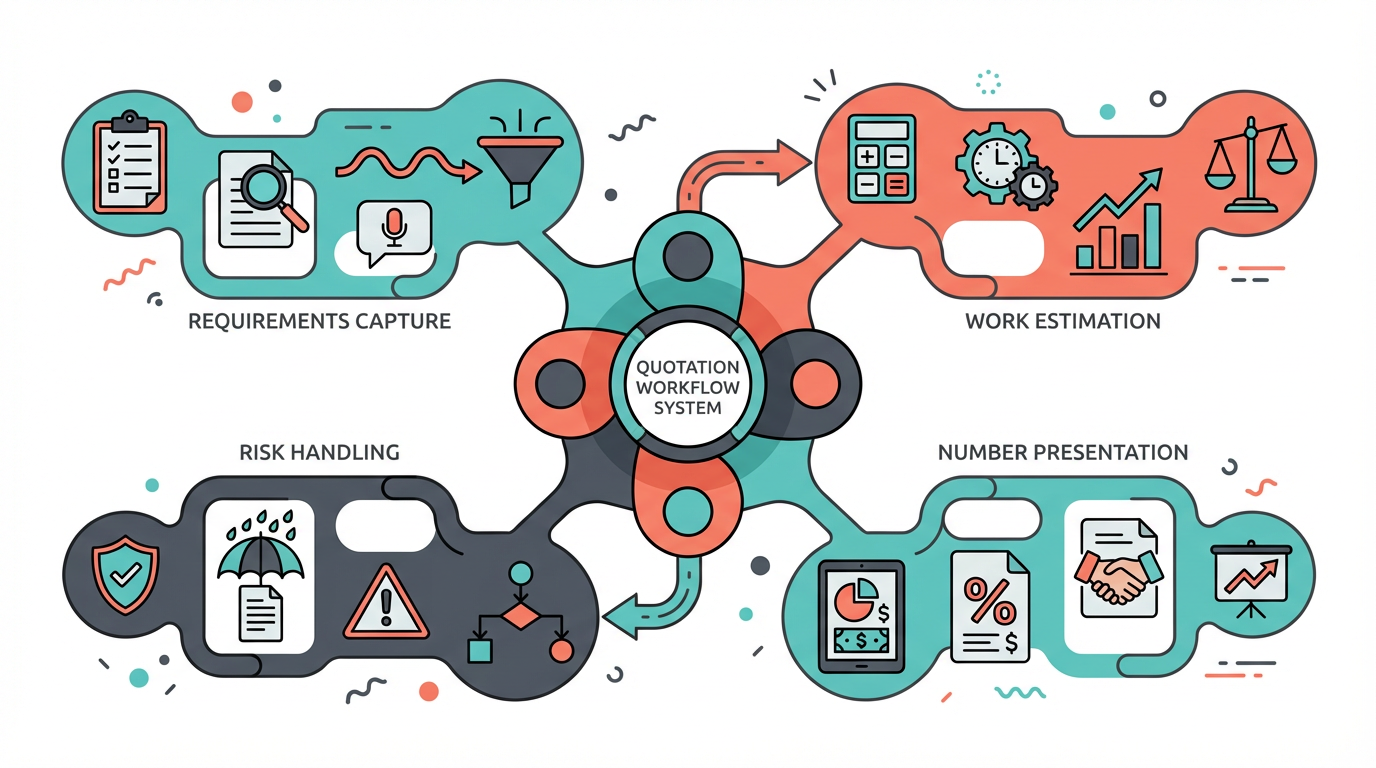

In industrial controls, a project quotation service typically covers these areas.

It clarifies technical scope. This means turning a vague RFQ into engineering deliverables: I/O counts, control philosophy, safety requirements, network architecture, panel standards, environmental constraints, and integration points with existing systems.

It estimates resources, time, and costs across the full lifecycle. That includes design, drafting, programming, panel build, FAT, SAT, commissioning, and often training and documentation. Research from project estimation experts such as Galorath and PMI makes it clear that estimation is an initial prediction of scope, effort, cost, and schedule, distinct from forecasting (ongoing updates) and budgeting (financial limits). A real quotation respects that distinction.

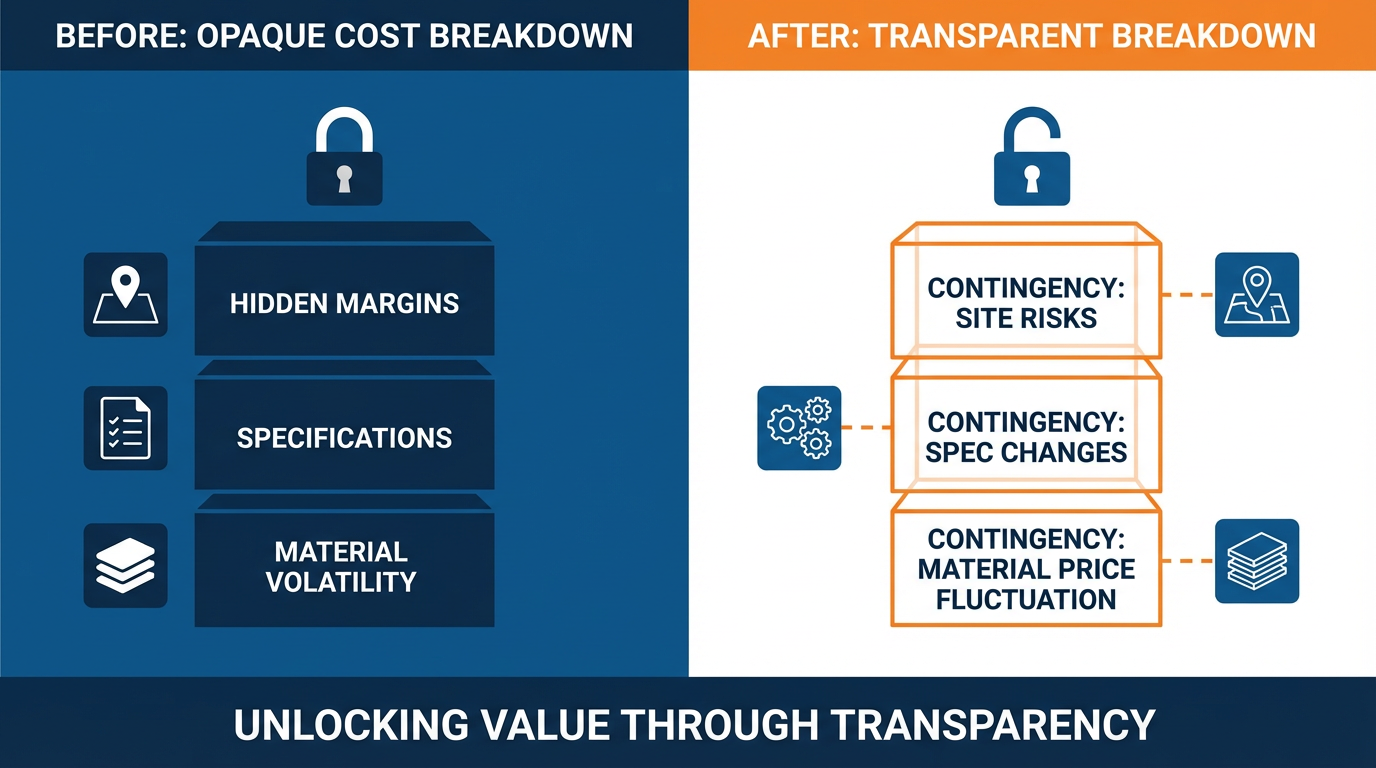

It identifies risk and contingency. Best-practice guides from construction and industrial estimation communities stress that early estimates must acknowledge uncertainty. They recommend structured methods to assess risk and assign contingency, rather than hiding buffers inside individual task estimates.

It documents assumptions, boundaries, and options. Quoting guidance from manufacturing and consulting firms emphasizes that a good quote explicitly states inclusions, exclusions, delivery assumptions, and conditions, rather than leaving them as verbal understandings. For controls, that means being explicit about what is in the integrator’s scope versus what stays with the plant, OEMs, or electrical contractors.

It aligns stakeholders around facts. Project controls research notes that when everyone works from the same data, communication can focus on facts rather than interpretation. A robust quote provides that shared baseline for engineering, purchasing, finance, and operations.

In short, a project quotation service is an estimation, risk, and communication engine, packaged as a commercial offer.

The Project Controls Backbone Behind a Good Quote

Underneath a strong controls quote are the same disciplines that drive good project controls in any capital project: planning and standardization, documentation and communication, forecasting, and proactive management.

Organizations such as Hexagon describe project controls as tools and processes for measuring, forecasting, and improving project performance, particularly around cost and schedule. Their best practices translate directly into how a quotation service should operate.

Planning and standardization come first. A project cannot succeed without a detailed plan, implementation schedule, and tracking tools. Standardized templates and estimating checklists help create consistency across quotes, making it easier to analyze performance and replicate successful work.

Documentation and communication are continuous. From initiation through closeout, project controls guidance emphasizes maintaining up-to-date records so that all stakeholders work from the same information. In quoting, that means capturing decisions, open questions, and clarifications so that what was promised can be traced back later.

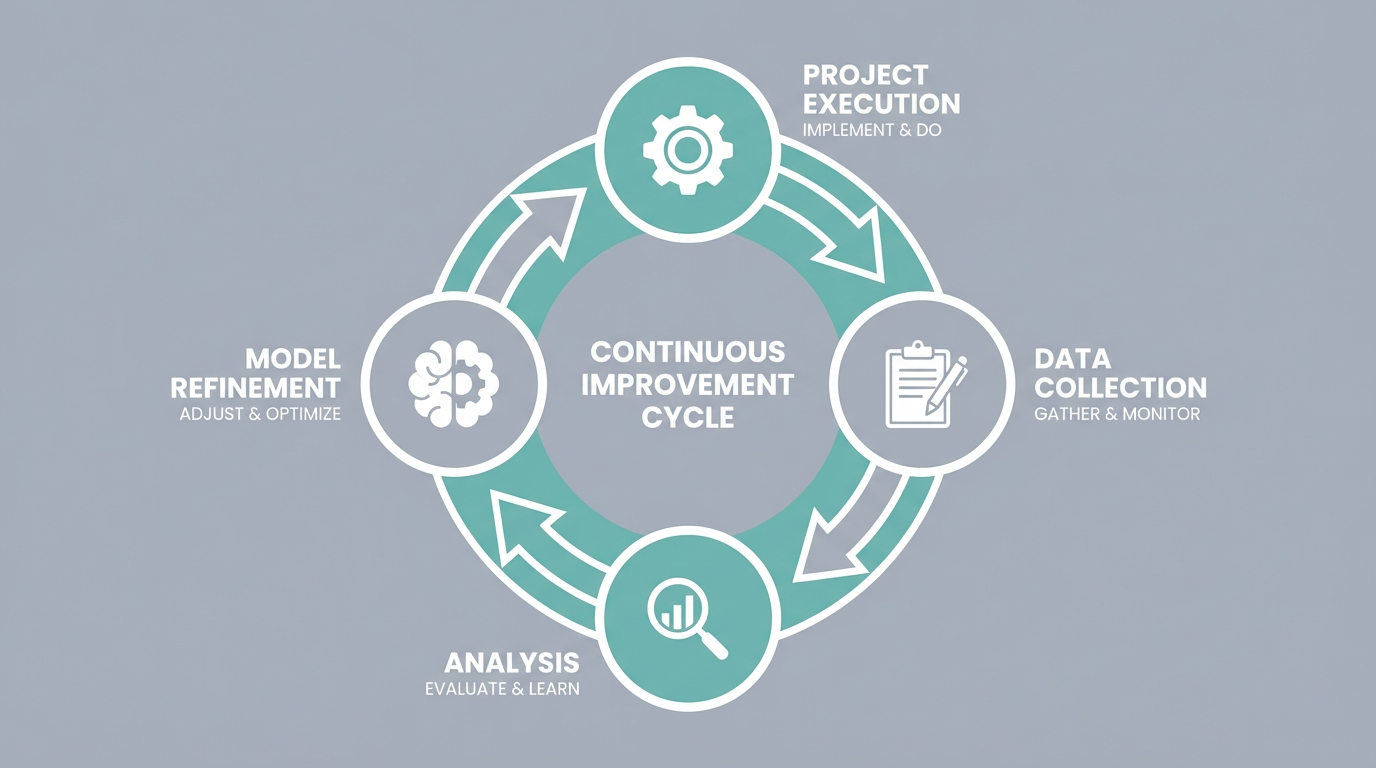

Forecasting must be a living process. The “living forecast” idea, described in project controls literature, is that cost and schedule forecasts should be updated regularly based on what is actually happening. For a quotation service, this means the estimating models and rate tables behind your quotes are kept current with real-world performance, not frozen in a spreadsheet created five years ago.

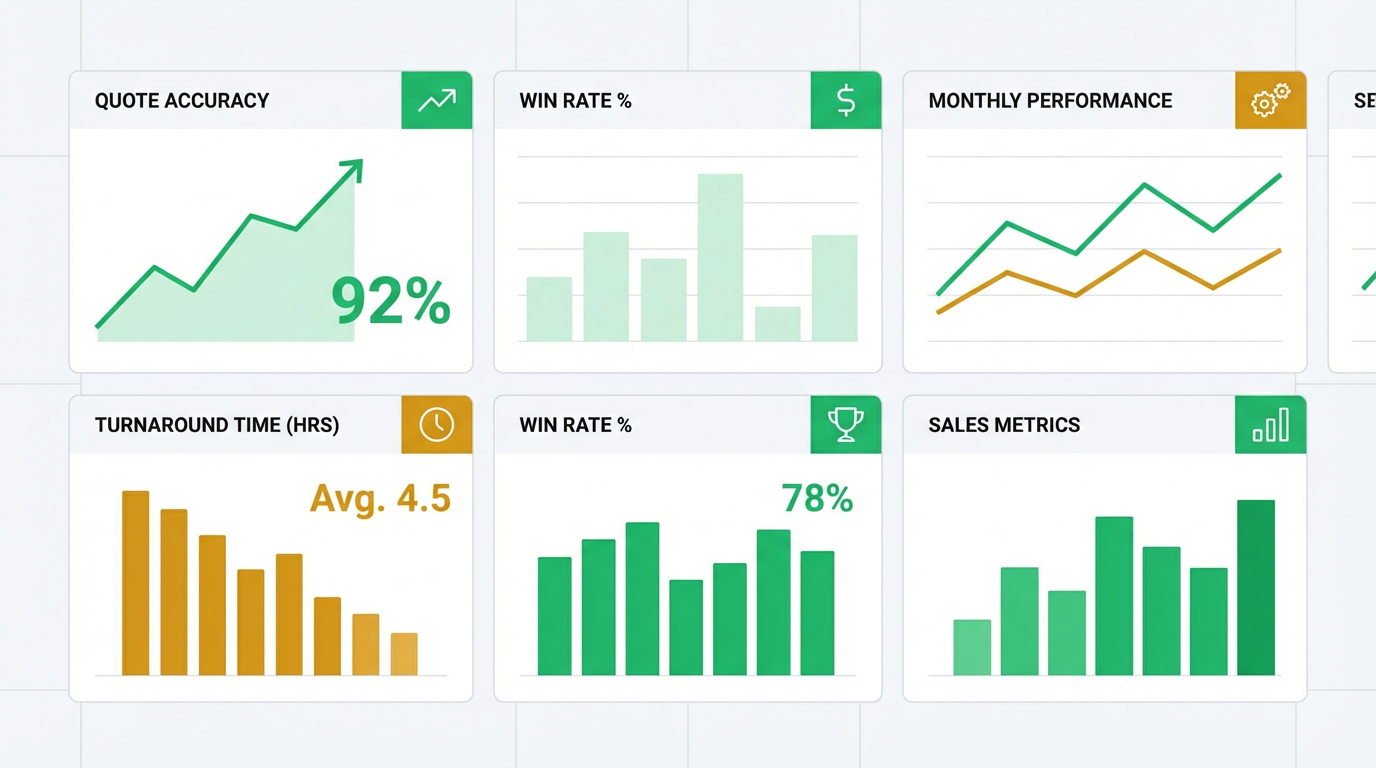

KPIs should add insight, not noise. Advanced key performance indicators such as predictability indices and earned schedule are used in project controls to understand how well teams are forecasting and delivering. For a quotation service, analogous metrics might track quote accuracy versus actual cost, quote turnaround time, and win rates by quote type. These are not vanity metrics; they show where estimating and process improvements are needed.

Integration and automation tie it together. Enterprise project controls platforms and project management automation tools from vendors like Hexagon and BigTime Software show the value of integrating schedules, budgets, expenditures, timesheets, and other data into a single source of truth, then automating repetitive tasks. Quoting is no exception; the more your quotation service taps real-time data and automated workflows, the more reliable and scalable it becomes.

Inside a High-Quality Industrial Controls Quotation

When you strip away brand logos and boilerplate, a high-quality controls quotation has a few characteristics in common. It is built on clear requirements, decomposed work, realistic costing, explicit risk treatment, and disciplined governance.

Requirements and Scope Definition

Automation firms such as AMS Automated Machine Systems emphasize that the quote process should start by clearly defining project requirements before jumping to solutions. That sounds obvious, but in practice many RFQs arrive half-baked.

A good quotation service treats RFQ intake as a collaborative discovery stage. The integrator works with the project lead or sourcing team to understand not just the equipment list but the business problem: throughput targets, quality constraints, safety and compliance requirements, staffing constraints, and integration with existing MES or ERP systems.

Manufacturing quoting specialists remind us that a professional quote is a strategic document, not a quick cost guess. For controls, that means the quote should tell a coherent story: what will be delivered, how it will be delivered, and under what constraints.

Decomposed Engineering and Hardware Scope

Control engineering guidance on estimating warns against lump-sum “hours per deliverable” estimates. Instead, it recommends decomposing the project into major deliverables and then into activities, with the smallest activities typically somewhere between about one workday and two workweeks in duration. This level of decomposition makes it easier to see complexity and avoid missing critical tasks.

Project management bodies such as PMI underline the importance of a work breakdown structure and critical path analysis. The WBS ensures that all required work is identified. Critical path analysis reveals which activities actually drive schedule and cost. A quotation service that builds from a WBS and understands the critical path can produce estimates that are both comprehensive and transparent.

In controls, this decomposition might include activities like detailed I/O definition, network design, safety analysis, panel layout, schematic drafting, PLC programming, HMI development, FAT procedure development and execution, on-site commissioning, and operator training. Each has its own effort drivers that an experienced estimator recognizes.

Costing That Reflects Reality

Manufacturing and industrial consulting sources are consistent on one point: knowing your actual costs is non-negotiable.

Quoting guides for metal fabrication and industrial machinery call out the need to re-cost raw materials and freight each time, account for waste, factor in testing and documentation, and include all overheads, from utilities to administrative labor. They also point out the risk of vague specifications, currency fluctuations, and mis-specified configurations, which can create expensive dead inventory or erode margins.

Broader manufacturing quoting advice stresses the importance of using real-time cost data from inventory, purchasing, and labor systems, and of explicitly allocating indirect costs with methods such as activity-based costing. Without this, companies either underquote and lose margin, or overquote and lose business.

Consultants focused on winning profitable quotes warn that work mixes can become distorted when some segments inadvertently subsidize others. They advocate more sophisticated costing techniques that treat batch-level costs and complexity-driven costs differently, so that high-complexity, low-volume jobs carry the right share of engineering and quality overhead.

For a controls quotation, this means the following in practice.

Hardware must be priced with current vendor data and realistic scrap and rework factors. Panels, field devices, safety hardware, and networking components all have volatility, and a quote that blindly reuses last year’s pricing is asking for trouble.

Engineering time should be based on task-level estimates validated against historical projects. Estimation experts recommend a combination of expert judgment, three-point estimates, and historical data. The quotation service should maintain a database of past projects with actual hours per activity and use it as a reality check.

Overheads and risk should be explicit. Construction and estimation literature emphasizes formal risk assessment, scenario analysis, and structured contingency. Rather than hiding safety margins inside individual line items, a quote should define contingency allowances tied to specific uncertainties, such as unknown site conditions, ambiguous upstream specifications, or volatile material markets.

Schedule, Resource Capacity, and Risk

If a quote ignores resource capacity, it is just a wish list. Manufacturing project management guidance stresses planning resources’ capacity in advance as a first step before committing to new projects. The idea is to compare projected demand with the availability of key roles and equipment and then decide whether the proposed schedule is feasible.

Resource estimation articles highlight the need to consider availability explicitly, including competing projects and other constraints. They also recommend aligning resource estimates with the project timeline, recognizing that intensity changes by phase.

In modern manufacturing environments, AI-powered tools such as Epicflow offer capacity planning and portfolio views to visualize overloads and bottlenecks. Even if you are not using such a tool, the principle is the same: a quotation service should be able to answer the question “With our current workload, can we actually deliver this when we say we can?”

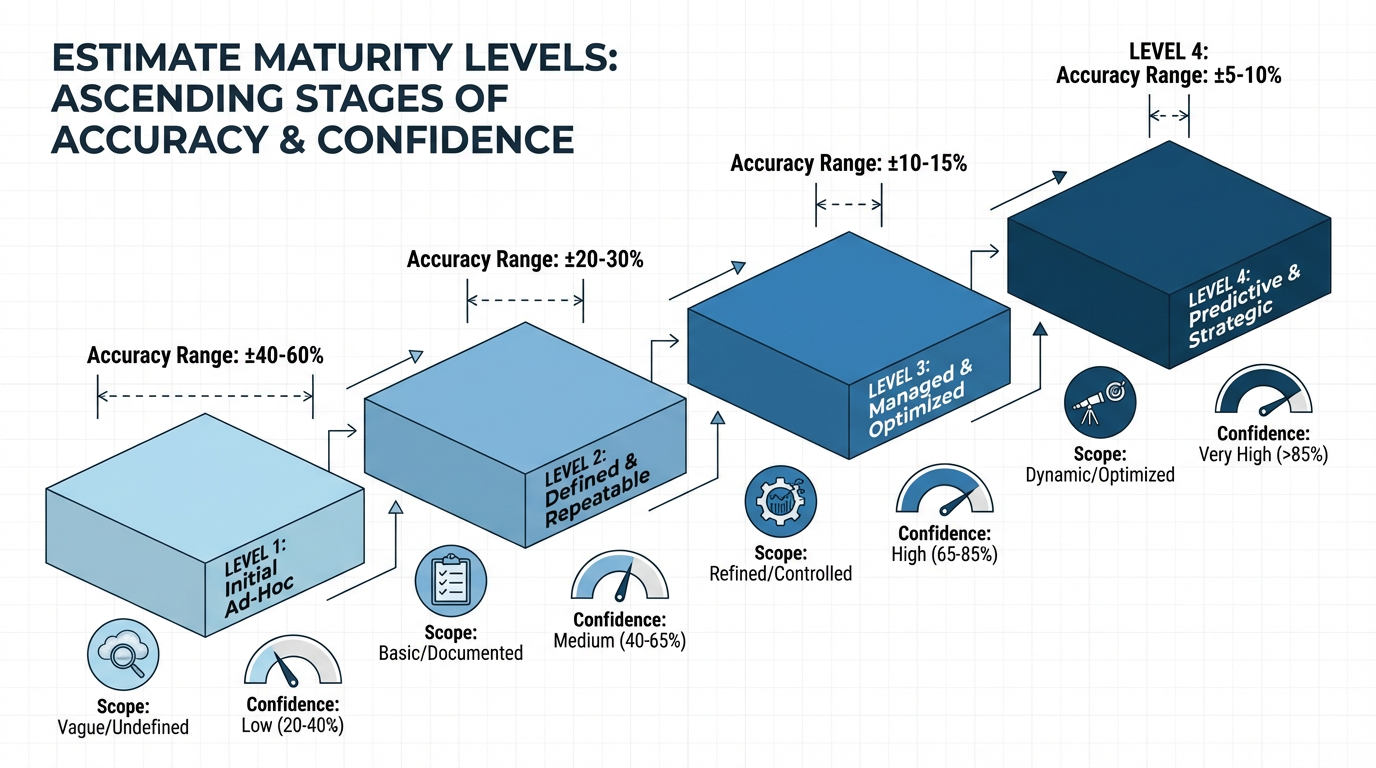

Risk and uncertainty must be treated systematically. Early-estimate best-practice guides from organizations like the Construction Industry Institute stress that estimate accuracy depends on scope definition and that risk assessment and contingency are especially important in early stages. Project management research on PERT-style three-point estimating provides a rational way to combine optimistic, pessimistic, and most-likely views into a single time estimate.

A mature quotation service for controls will therefore classify estimates by maturity, explain expected accuracy ranges, and state what level of scope definition the quote is based on.

That is very different from offering a single date and cost as if there were no uncertainty.

Governance, Documentation, and Communication

Project controls research is clear that documentation and communication across all phases are crucial. For quotation services, this translates into disciplined governance.

Standard, formal procedures should govern how quotes are created, reviewed, and approved internally. Several sources warn against the “estimator in a vacuum” problem and recommend cross-functional involvement from operations, engineering, sales, purchasing, and accounting, scaled to the opportunity’s risk.

Quote automation research highlights the need for version control, clear validity periods, and centralized tracking. Sales and operations teams need to know which quote is the authoritative version, what changed, and why.

On the customer side, best-practice quoting advice stresses clear, value-focused descriptions, precise time frames, transparent terms and conditions, and active follow-up. A good controls quotation does not just email a PDF and hope for the best; it prepares the customer by aligning expectations, clarifying decision-makers, and being ready to explain trade-offs.

Manual Versus Automated Quoting in Controls Procurement

Much of the pain in controls quoting traces back to manual, siloed processes. Multiple sources on quoting problems describe the same issues: spreadsheets scattered across the company, slow back-and-forth via email, outdated price books, inconsistent quote formats, and poor version control.

Quoting automation and CPQ (configure–price–quote) research in manufacturing and construction provides a clear contrast between manual and automated approaches.

Here is how that difference looks when applied to industrial controls.

| Aspect | Manual spreadsheet-based quoting | Automated and CPQ-enabled project quotation |

|---|---|---|

| Speed and responsiveness | Estimates assembled by hand can take days, and complex quotes may stall in email approvals; customers often wait longer than the one-day turnaround they expect. | Rule-based configuration and automated workflows generate quotes in minutes, with internal approvals routed automatically; vendors report speed improvements up to roughly 50 percent for complex manufacturing quotes. |

| Data accuracy | Static spreadsheets rarely reflect current component prices, inventory, labor rates, or lead times; mis-typed digits and outdated lists are common. | Integrated systems pull live data from ERP, inventory, and cost databases; automation reduces manual data entry and ensures quotes reflect current rates and availability. |

| Configuration quality | Complex product and system configurations rely heavily on individual experience; configuration errors can create incompatible designs or costly rework. | CPQ tools enforce configuration rules and dependencies, preventing invalid combinations and flagging missing components before the quote is issued. |

| Consistency and branding | Each estimator has their own format and level of detail, leading to inconsistent documents and confusion over revisions. | Centralized templates standardize layout, branding, and content; version histories are tracked, and customers see consistent, professional proposals. |

| Analytics and continuous improvement | Little or no systematic tracking of quote win/loss, margin by quote type, or estimate-versus-actual performance. | Automated systems capture quote data and outcomes; analytics tools highlight patterns, support margin analysis, and drive refinement of estimating models. |

Sources from no-code and CPQ communities add another dimension: automation is now accessible without full custom development. No-code platforms allow teams to build digital workflows that generate, route, and track quotes, connecting existing tools without heavy IT involvement. Studies cited in this context report that sales teams that automate quoting can see productivity gains up to about 40 percent and that workers can reclaim significant time each week once repetitive manual tasks are automated.

For industrial controls procurement, the practical takeaway is straightforward. If you are still managing complex project quotes in isolated spreadsheets and email, you are accepting avoidable risk. A project quotation service that uses integrated data and automation will be faster, more accurate, and easier to scale.

Using a Project Quotation Partner Effectively

Bringing in a systems integrator or specialist vendor to provide comprehensive project quotation services is only half the battle. How you work with them determines how much value you actually get.

Automation firms that have formalized quoting into structured, multi-step internal processes describe a few consistent practices.

They emphasize early coordination and open communication between the customer’s project lead or sourcing department and the vendor’s quotation team. Rather than tossing an RFQ over the wall and waiting, they encourage joint sessions to clarify scope, constraints, and expectations.

They often start with a budgetary quote that outlines general scope, components, timelines, and an order-of-magnitude budget, followed later by a detailed official quote once assumptions are validated. This two-stage approach aligns with estimation best practices that distinguish early, less-defined estimates from more mature ones.

They leverage “custom standard” solutions. Each project is unique, but experienced vendors reuse patterns, component choices, and design standards from previous projects. This mirrors the advice from cost estimation experts to use analogous and parametric estimating techniques based on historical data, supplemented by detailed estimating where it matters most.

To get the most from a quotation partner on a controls project, treat the process as a joint design and estimation exercise rather than a price contest.

Share realistic constraints and priorities. If schedule matters more than capital cost, say so. If your plant has strict standards for safety architectures or vendor approvals, bring those into the discussion early.

Ask for transparency on estimating methods and risk treatment. Reputable partners will explain how they decomposed the work, where they used historical data versus expert judgment, and how they set contingency.

Close the loop after execution. Manufacturing quoting and project management sources alike stress the importance of comparing quotes to actual performance. Share post-project actuals with your partner, and expect them to refine their estimating models based on that feedback.

Pros and Cons of Outsourcing Quotation for Controls

Outsourcing project quotation services to an experienced integrator or vendor has real advantages, but it is not without trade-offs.

On the plus side, you gain access to specialized estimating expertise built across many projects and industries. Vendors who live and die by project delivery have strong incentives to evolve their cost models, document tacit knowledge, and integrate quoting with real production data. They are also more likely to have invested in CPQ tools, integrated ERP, and analytic capabilities that an individual plant or OEM might find hard to justify alone.

You also get speed. Companies that have formalized quoting processes report fast, repeatable turnaround times, even for complex automation projects, which directly supports your competitive position in the market.

And you get risk visibility. A structured quotation service that surfaces assumptions and risk explicitly makes it easier for you to make informed go or no-go decisions and to align internal stakeholders.

On the downside, there is a risk of dependency. If your organization lacks internal estimating discipline, you may find it hard to challenge or validate vendor quotes. There is also the potential for misaligned incentives if vendors focus on winning work rather than on long-term lifecycle cost.

There is a cost dimension as well. Professional quotation services require effort, and vendors may need to recover some of that cost, especially for large, complex proposals. Some manufacturers address this by segmenting opportunities, reserving full-scope quotation services for high-value or strategic projects and using lighter-weight methods for smaller ones.

The pragmatic answer is usually a hybrid. Build enough internal capability to understand and challenge estimates, but leverage specialist partners for complex, high-risk controls projects where their experience and tools materially improve outcomes.

Frequently Asked Questions

How is a project quotation different from a simple hardware price list?

A project quotation for industrial controls combines hardware pricing with engineering, installation, commissioning, documentation, and risk considerations. Research on manufacturing quoting and project estimation emphasizes that quotes should itemize materials, labor, machine time, overhead, markup, and terms. A simple price list tells you the cost of a PLC or VFD; a project quotation tells you what it will take to design, build, and deploy an entire control system around it, under your specific constraints.

When should I insist on a full project quotation service instead of a quick budgetary number?

Full quotation services make the most sense when scope complexity, business risk, or customization is high. Studies on early estimates highlight that the less defined the scope, the greater the potential error band. If a project involves safety systems, multiple vendors, tight regulatory requirements, or major production impact, a quick back-of-the-envelope number is dangerous. In these cases, using a structured quotation process with proper requirements capture, decomposition, costing, and risk analysis is well worth the upfront effort.

How can I tell if a controls quote is realistic?

Several clues come from the research and practices discussed here. Realistic quotes are traceable: they are built from decomposed tasks, reference historical data, and explain assumptions. They acknowledge uncertainty and may include explicit contingency. They align with your known resource capacity rather than promising impossible timelines. They show evidence of cross-functional review and agreed scope boundaries. In contrast, quotes that are single numbers with little explanation, that gloss over engineering effort, or that rely heavily on manual spreadsheets without integration to real cost data are more likely to hide unpleasant surprises.

Closing Thoughts

In industrial controls, a quote is more than a piece of paper that kicks off procurement. It is your first and best chance to set a project on a realistic, profitable path.

When you treat project quotation services as a disciplined, data-backed process grounded in sound project controls and estimation practices, you change the character of your controls projects. You move from reactive firefighting to deliberate execution.

From the integrator side of the table, that is the kind of project we want to deliver—and the kind of partner we aim to be.

References

- https://www.construction-institute.org/improving-early-estimates-best-practices-guide

- https://www.pmi.org/learning/library/five-keys-accurate-project-estimating-6927

- https://www.bigtime.net/blogs/project-management-automation/

- https://www.accelo.com/post/quick-tips-for-accurate-quoting

- https://amsmachinesinc.com/automation-quote-made-easy/

- https://www.cflowapps.com/quotation-process-automation/

- https://www.controleng.com/simple-tips-for-project-estimating/

- https://galorath.com/estimation/

- https://aliresources.hexagon.com/enterprise-project-performance/6-best-practices-for-project-controls

- https://www.machinemetrics.com/blog/improve-quoting-in-manufacturing

Keep your system in play!

Related Products

Related articles Browse All

-

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu...

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu... -

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ...

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ... -

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

Need an automation or control part quickly?

- Q&A

- Policies How to order Part status information Shipping Method Return Policy Warranty Policy Payment Terms

- Asset Recovery

- We Buy Your Equipment. Industry Cases Amikong News Technical Resources

- ADDRESS

-

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

Copyright Notice © 2004-2026 amikong.com All rights reserved

Disclaimer: We are not an authorized distributor or distributor of the product manufacturer of this website, The product may have older date codes or be an older series than that available direct from the factory or authorized dealers. Because our company is not an authorized distributor of this product, the Original Manufacturer’s warranty does not apply.While many DCS PLC products will have firmware already installed, Our company makes no representation as to whether a DSC PLC product will or will not have firmware and, if it does have firmware, whether the firmware is the revision level that you need for your application. Our company also makes no representations as to your ability or right to download or otherwise obtain firmware for the product from our company, its distributors, or any other source. Our company also makes no representations as to your right to install any such firmware on the product. Our company will not obtain or supply firmware on your behalf. It is your obligation to comply with the terms of any End-User License Agreement or similar document related to obtaining or installing firmware.

Cookies

Individual privacy preferences

We use cookies and similar technologies on our website and process your personal data (e.g. IP address), for example, to personalize content and ads, to integrate media from third-party providers or to analyze traffic on our website. Data processing may also happen as a result of cookies being set. We share this data with third parties that we name in the privacy settings.

The data processing may take place with your consent or on the basis of a legitimate interest, which you can object to in the privacy settings. You have the right not to consent and to change or revoke your consent at a later time. This revocation takes effect immediately but does not affect data already processed. For more information on the use of your data, please visit our privacy policy.

Below you will find an overview of all services used by this website. You can view detailed information about each service and agree to them individually or exercise your right to object.

You are under 14 years old? Then you cannot consent to optional services. Ask your parents or legal guardians to agree to these services with you.

-

Google Tag Manager

-

Functional cookies

Leave Your Comment