-

Manufacturers

- ABB Advant OCS and Advant-800xA

- ABB Bailey

- ABB Drives

- ABB H&B Contronic

- ABB H&B Freelance 2000

- ABB Master

- ABB MOD 300, MOD 30ML & MODCELL

- ABB Procontic

- ABB Procontrol

- ABB Synpol D

- Allen-Bradley SLC 500

- Allen-Bradley PLC-5

- Allen-Bradley ControlLogix

- Allen-Bradley CompactLogix

- Allen-Bradley MicroLogix

- Allen-Bradley PanelView

- Allen-Bradley Kinetix Servo Drive

- Allen-Bradley PowerFlex

- Allen-Bradley Smart Speed Controllers

- 3300 System

- 3500 System

- 3300 XL 8mm Proximity Transducer

- 3300 XL NSV Proximity Transducer

- 990 and 991 Transmitter

- 31000 and 32000 Proximity Probe Housing Assemblie

- 21000, 24701, and 164818 ProbeHousing Assemblies

- 330500 and 330525 Piezo-Velocity Sensor

- 7200 Proximity Transducer Systems

- 177230 Seismic Transmitter

- TK-3 Proximity System

- GE 90-70 Series PLC

- GE PACSystems RX7i

- GE PACSystems RX3i

- GE QuickPanel

- GE VersaMax

- GE Genius I/O

- GE Mark VIe

- GE Series One

- GE Multilin

- 800 Series I/O

- Modicon 984

- Modicon Premium

- Modicon Micro

- Modicon Quantum

- Telemecanique TSX Compact

- Altivar Process

- Categories

- Service

- News

- Contact us

-

Please try to be as accurate as possible with your search.

-

We can quote you on 1000s of specialist parts, even if they are not listed on our website.

-

We can't find any results for “”.

-

-

Get Parts Quote

Stock Clearance Allen-Bradley Parts: Discounted AB Component Sales Done Right

Why Clearance Allen-Bradley Parts Are On Everyone’s Radar

If you run an industrial plant in 2024, your control system is not a luxury line item. It is the nervous system that starts and stops motors, opens and closes valves, and keeps temperature, pressure, and speed where they need to be. As described in guidance for industrial control buyers from eINDUSTRIFY, automated controls replace manual intervention to make operations faster, more accurate, safer, and more cost-effective.

Allen-Bradley, the flagship hardware brand of Rockwell Automation, sits at the heart of a huge share of those systems. Rockwell Automation is an American industrial automation provider that employs more than 23,000 people and serves customers in over 100 countries, according to Device Surplus. That scale translates into an enormous installed base of Allen-Bradley PLCs, drives, safety devices, HMIs, and sensors that have to be kept running, day and night.

The problem is that the Rockwell roadmap moves forward, while your plant keeps running on whatever was installed ten, fifteen, or even twenty years ago. Controllers age out, HMIs get discontinued, and drive families roll over to newer models, but your conveyors, mixers, and fillers still depend on those part numbers. At the same time, capital budgets are tight, and total cost of ownership matters more than ever, as highlighted in industrial automation cost analyses by C3 Controls and National Instruments.

That combination is what drives interest in stock clearance and discounted Allen-Bradley parts. New, surplus, and professionally refurbished Allen-Bradley modules can bridge the gap between uptime and budget, particularly when the alternative is an emergency migration project you did not plan for. As a systems integrator who has watched lines sit idle while buyers chased elusive part numbers, I treat clearance AB components as a strategic tool, not a last-resort gamble.

The key is to understand exactly what you are buying, from whom, and where it fits into your lifecycle plan.

What “Stock Clearance” Really Means For Allen-Bradley Components

The term “stock clearance” gets used loosely in the industrial world, especially online. In reality, the secondary market for Allen-Bradley spans several distinct conditions and business models. Industrial Automation Co., which specializes in sourcing Allen-Bradley PLCs, HMIs, safety components, AC drives, and sensors (alongside Siemens and Schneider Electric), is explicit about how it grades condition for AB hardware and what that means for buyers.

They describe three main categories for Allen-Bradley replacement parts and support each category with a two-year warranty, even for surplus and refurbished units. That alone tells you that “clearance” does not automatically mean “high risk.” It can, in fact, mean discounted but reliable, if the process behind it is disciplined.

Common Condition Codes In The Allen-Bradley Surplus Market

Here is how a serious surplus specialist characterizes the clearance landscape for Allen-Bradley parts.

| Condition type | How it is typically described | Typical use cases | Key advantages | Key watch-outs |

|---|---|---|---|---|

| New / Surplus Sealed | Original manufacturer packaging still sealed; outer box may show shelf wear or discoloration | Plants wanting a drop-in spare that is effectively new, often for higher criticality controllers or safety devices | Lowest risk among discounted options; priced below conventional list; backed by two-year warranty | Check date codes and firmware expectations; long shelf life can still matter for batteries and some electronic parts |

| New / Surplus Open Box | Original packaging opened; accessories and documentation not guaranteed | Less critical nodes, test benches, and non-safety I/O or communications modules | Deeper discounts; still unused hardware; same two-year warranty in the Industrial Automation Co. model | Confirm that you truly do not need every accessory; factor in the cost of missing cables, keys, or memory cards |

| Refurbished | Professionally restored by engineers following a defined refurbishment and test process | Legacy controllers, drives, and HMIs no longer available new from the OEM | Often the only practical route for obsolete SKUs; two-year warranties possible when standards are high | Quality varies widely in the market; you must verify test procedures, documentation, and support in detail |

Industrial Automation Co. notes that high-standard refurbished Allen-Bradley parts go through inspection for damage and wear, cleaning and component testing, load testing under simulated conditions, firmware resets and parameter checks where needed, and final quality control, again backed by a two-year warranty. That is a very different proposition from a random used module pulled out of a cabinet and thrown straight onto an online marketplace.

Device Surplus, a U.S.-based distributor that focuses heavily on surplus Allen-Bradley parts, similarly positions itself around lifecycle support rather than just new hardware sales. Their catalog spans PLC hardware, HMIs and displays, inverter and DC drives, process control, safety automation, servo drives, soft starts, software, and general automation parts, most of it surplus. They also actively buy surplus Allen-Bradley gear from customers, reinforcing the idea that surplus is about structured reuse and lifecycle management, not just scrap.

Santa Clara Systems also sells Allen-Bradley automation parts across PLCs, sensors, safety components, servo motors and drives, contactors, and switchgear, but explicitly states that it is not an authorized distributor or manufacturer representative of Rockwell Automation. That distinction matters, because in the clearance world “authorized” and “unauthorized” have implications for OEM support, but not necessarily for the intrinsic quality of the individual module if it has been handled correctly.

Where Discounted AB Parts Actually Come From

If you are going to trust a discounted Allen-Bradley module with your production line, you need to know the supply chain behind it. The research notes highlight several major channels that feed the clearance market.

Surplus specialists such as Industrial Automation Co., Device Surplus, and Santa Clara Systems play a central role. Industrial Automation Co. focuses on keeping CNC and production equipment running by sourcing new, surplus, and discontinued Allen-Bradley parts, and emphasizes its ability to locate hard-to-find surplus and discontinued items. They also document shipping behavior clearly: any Allen-Bradley replacement part under 20 lb qualifies for two-day shipping in the continental United States, and same-day courier options can be arranged for emergencies, with quotes often turned around in ten minutes or less during business hours.

Device Surplus presents itself as a U.S.-owned distributor with one of the widest selections of Allen-Bradley automation parts in the country, specializing in surplus gear. Crucially, they not only sell but also buy surplus Allen-Bradley automation equipment, turning excess inventory or decommissioned systems into a secondary supply of parts. That circular flow is what keeps older Allen-Bradley families supportable long after the OEM has moved on.

Santa Clara Systems highlights the breadth of Allen-Bradley lines, from PhotoSwitch sensors and PanelView operator interfaces to PowerFlex drives, GuardMaster safety devices, and controller families such as Pico, MicroLogix, SLC-500, PLC-5, CompactLogix, ControlLogix, and FlexLogix. They also publish representative specifications for safety devices and switches, which gives an idea of the technical level clearance parts must still satisfy. For example, they describe motor protection circuit breakers with trip ratings at 125 percent of the dial setting over a 1.0–1.6 A range, suitable for 600 VAC control voltages and fault currents up to about 5 kA; cable-pull safety systems like Lifeline 4 with cable lengths up to roughly 250–410 ft; and non-contact safety switches with assured sensing distances around 0.4–0.8 in.

Beyond dedicated surplus specialists, there are buyers and marketplaces whose core business is turning idle inventory into live spares. American West Surplus positions itself as a buyer of Allen-Bradley PLC families such as SLC 500, CompactLogix, ControlLogix, MicroLogix, and Micro800, along with PanelView HMIs, circuit breakers, motor protection devices, PowerFlex AC drives, relays, and limit switches. They explicitly welcome everything from excess inventory liquidation to small lots of just a few pieces.

On the marketplace side, EquipNet hosts a used Allen-Bradley equipment page where the captured data shows 94 items tagged to the Allen-Bradley manufacturer at one point, with 68 controllers and 132 MRO or repair parts. That ratio is not surprising from a systems integrator’s perspective; in the field, you replace far more individual modules and repair parts than entire control systems.

Finally, open marketplaces like eBay are another source of Allen-Bradley parts, but the captured research snapshot contained almost no concrete listing data. For serious industrial buyers, that is a reminder that these platforms require extra diligence, because product grading, testing, and warranty terms are usually less standardized than what you see from dedicated industrial surplus specialists.

The Economics: Downtime, TCO, And When Clearance Parts Make Sense

From the plant floor, the math on stock clearance Allen-Bradley parts is rarely about the discount by itself. It is about the relationship between downtime, risk, and total cost of ownership.

Industrial Automation Co. shares a telling example in its guidance on buying automation parts online. A food packaging line lost nearly seventy-two hours of production because a variable frequency drive order failed, leaving the line down while procurement scrambled for an alternative. The cost ran into tens of thousands of dollars in lost output, dwarfing any savings that might have been achieved by picking a cheaper but unreliable supplier.

C3 Controls, in its analysis of industrial automation cost considerations, reinforces the point that hardware sticker price is only a fraction of the story. They frame automation investments in terms of total cost of ownership and total value of ownership, noting that automation assets have long, uneven life cycles: roughly fifteen years for controllers, twenty years for I/O and panels, and up to forty years for wiring. For robots, they cite hardware costs in the range of $50,000 to $150,000 per unit, with the real payoff coming from labor savings, higher throughput, and quality gains over many years.

National Instruments makes a similar argument when comparing custom industrial control boards with commercial off-the-shelf solutions such as CompactRIO. They list not only development labor, test and validation, and manufacturing overhead, but also the ongoing burden of sustaining engineering, redesigns when parts go end-of-life, and OS or driver maintenance.

Discounted Allen-Bradley parts sit squarely in this TCO context. A surplus CompactLogix processor at a strong discount might look like a pure cost saver, but the real question is whether it reduces or increases your long-term cost of keeping the line running. If the part has been properly tested, carries a meaningful warranty, and plugs seamlessly into an existing Allen-Bradley architecture that still has years of useful life, it can significantly improve your total value of ownership by avoiding premature platform migrations.

On the other hand, if you buy an unknown-condition module from a marketplace with no documentation, no warranty, and no support, any short-term savings are likely to evaporate the first time that module fails in service and your line sits idle.

A Practical Buying Framework For Clearance Allen-Bradley Parts

In practice, teams that get the most value from stock clearance Allen-Bradley components follow a disciplined, repeatable process. Industrial Automation Co., ROC Automation, and eINDUSTRIFY all point toward the same core themes: precise part identification, honest supplier evaluation, and explicit planning for integration.

It starts with the use case. You should be clear about which process you are trying to support, how critical it is to plant throughput, and how the controller or drive fits into the broader architecture. As eINDUSTRIFY notes, industrial controls connect sensors, controllers, and feedback loops to keep parameters like temperature, pressure, and speed within limits across manufacturing, oil and gas, and chemical operations. A clearance safety relay on a non-critical test stand is a different risk than a clearance motion module on a bottling line running three shifts every day.

From there, you move to part identity. Industrial Automation Co. emphasizes verifying the full part number including every suffix, voltage, power rating, and even firmware version. You also need to determine whether the clearance unit is a one-to-one replacement or an upgrade, check the physical form factor and mounting footprint, and confirm supported network protocols such as EtherNet/IP, DeviceNet, or Modbus. This is especially crucial for Allen-Bradley drives and network modules, where firmware mismatches or protocol gaps can create subtle, hard-to-diagnose issues.

Supplier evaluation is next. The Industrial Automation Co. guide recommends looking far beyond price to supplier credibility indicators: clear contact information and responsive communication, detailed technical listings with compatibility notes, published warranty and return policies, and access to real technical support before and after the sale. ROC Automation’s overview of affordable automation parts echoes this, highlighting the need for transparent pricing with no hidden fees, responsive technical guidance, and clear warranty and returns.

Inventory transparency and shipping speed are also critical. Industrial Automation Co. distinguishes between items physically in its warehouse, which can often ship the same day, and sourced items that carry explicit lead times such as “ships in one to two weeks.” ROC Automation notes that one to two day domestic shipping has become a game changer, allowing maintenance teams to reduce on-site inventory and lean more on fast replenishment. But this only works if the supplier’s stock indicators are accurate.

Finally, you need a plan for what happens after the box arrives. The Industrial Automation Co. guidance calls out the importance of planning for restoring parameters, firmware, or logic when replacing Allen-Bradley drives or controllers. Even with a perfect hardware match, you may need to align firmware with existing PLCs or HMIs, verify communications settings on EtherNet/IP or other networks, confirm mechanical fit, and execute a test plan before returning the line to production.

Teams that treat these steps as a standard operating procedure, rather than ad hoc heroics, tend to make clearance parts work for them rather than against them.

Technical Integration Checks You Cannot Skip

Good surplus hardware can still cause bad days if it is dropped into a system without rigorous integration checks. The research on industrial controls and Allen-Bradley product specs highlights several areas that deserve particular attention.

First is architecture fit. eINDUSTRIFY describes three main control architectures: programmable logic controllers for robust, discrete factory automation; distributed control systems for large, continuous plants; and SCADA for remote monitoring of distributed assets such as water treatment or energy networks. Allen-Bradley hardware spans all three roles, but a clearance part with the right logo and voltage rating does not automatically fit your architecture and lifecycle plan. You should verify that a surplus AC drive, safety relay, or controller will be fully at home in your PLC, DCS, or SCADA environment.

Second is safety behavior. Santa Clara Systems’ descriptions of Allen-Bradley safety hardware underscore how tightly behavior is specified. Cable-pull safety systems designed for cable lengths of roughly 250–410 ft, with lid-mounted emergency stop buttons and combinations of normally closed and normally open safety contacts, are engineered into the safety-related parts of your system. Non-contact safety switches with sensing distances of about 0.4–0.8 in and PNP safety outputs rated up to 0.2 A may be protecting operators from hazardous motion. Motor protection circuit breakers trip at defined percentages of dial settings under known current ranges. If you are substituting clearance parts into safety functions, you must confirm that every relevant parameter, contact configuration, and mechanical interface matches your functional safety design and risk assessment.

Third is environmental suitability. Santa Clara Systems notes, for example, that some terminal block housings are rated for operating temperatures from roughly 32 to 140 °F. Lifeline cable-pull systems specify particular conduit entry sizes such as M20 or 1/2 in NPT. Control knobs may be about 2.6 in square and support specific locking behaviors for lockout/tagout. These details matter in real cabinets and real panels exposed to dust, washdown conditions, or high ambient heat. Clearance parts should be vetted against the same environmental and mechanical criteria you would apply to new hardware.

Fourth is protocol and software compatibility. Industrial Automation Co. stresses verifying firmware compatibility between drives, PLCs, and HMIs, and ensuring that communication protocols align with the plant network. Modern control systems often combine Allen-Bradley controllers with third-party sensors, HMIs, and SCADA software over EtherNet/IP or other fieldbuses. A clearance module that cannot speak the right protocol, or that requires a firmware downgrade or upgrade that your existing tools do not support, can turn into an integration project of its own.

Protecting Quality: Refurbishment Standards, Warranty, And Risk

In clearance Allen-Bradley projects, refurbishment standards and warranty terms are your safety net. They are the clearest, most objective evidence of how seriously a supplier takes reliability.

Industrial Automation Co. sets a high bar with its IAC Certified Refurbished program, where refurbished automation parts go through full inspection, cleaning and component testing, load testing under simulated operating conditions, firmware resets and parameter checks where needed, and final quality control. They back not only refurbished units, but also new surplus sealed and new surplus open-box parts with the same two-year warranty as their new stock. That level of consistency gives you a quantifiable risk profile when you build a spares strategy.

Device Surplus, by specializing in surplus Allen-Bradley parts and actively buying customers’ surplus equipment, helps create a feedback loop where parts move from primary duty, to spares, to structured reuse. This kind of reuse supports more sustainable practices in industrial automation supply chains and keeps legacy systems maintainable longer, as they note.

Santa Clara Systems, while explicitly not an authorized Rockwell distributor and not exporting outside the United States, offers detailed technical descriptions of Allen-Bradley parts and emphasizes that it is not constrained by OEM pricing or territorial restrictions. For buyers, that can unlock access to legacy or geographically constrained parts, but it also makes warranty and test documentation even more important, because there is no OEM backing behind the sale.

From a cost perspective, C3 Controls warns against looking at hardware cost in isolation. Total cost of ownership models in process automation must include people, data, equipment, and robotic costs, along with the long-term costs of platform switching and retraining. With that in mind, a clearance Allen-Bradley component with a robust refurbishment process and a meaningful warranty can reduce TCO by extending the life of an existing installed base. A cheap, poorly refurbished module with no warranty can do the opposite by increasing failure rates and forcing premature migrations.

Clearance AB Parts As An Obsolescence Strategy

Used correctly, stock clearance Allen-Bradley parts are not just emergency stopgaps. They can be a controlled way to manage obsolescence and extend the useful life of installed assets while you plan the next generation.

The EquipNet marketplace snapshot, with more than ninety Allen-Bradley listings and a larger number of MRO or repair parts than controllers, reflects the reality that industrial facilities replace far more components and spares than entire systems. By combining structured surplus sourcing with a deliberate migration roadmap, you can keep older Allen-Bradley families such as PLC-5 or SLC-500 running safely until you are ready to move to CompactLogix or ControlLogix on your own terms.

C3 Controls suggests using total value of ownership, defined as total benefits attained minus total cost of ownership, as the decision metric for such strategies. Clearance parts improve TVO when they deliver meaningful uptime and defer expensive migrations without increasing risk disproportionately. They reduce TVO when they create uncertainty about future support, safety, or compliance.

Meanwhile, B2B e-commerce trends highlighted by eINDUSTRIFY and ROC Automation reinforce the advantages of buying industrial controls and replacement parts online: faster comparisons of features, transparent pricing and specifications, easy reordering or bulk purchasing, and direct access to support and configuration tools. For stock clearance Allen-Bradley parts, these same capabilities translate into better visibility into condition, warranty, and shipping commitments, which are crucial for obsolescence planning.

The purchasing guidance from Industrial Control Direct, another customer-centric distributor, points out that consolidating more of your equipment spend with a smaller, service-focused supplier can yield time and cost savings, including claims of thirty to forty percent savings on industrial control parts when sourcing is optimized. They emphasize that value-added services such as custom marking, DIN rail cutting, and cross-referencing equivalents can help overcome resistance to change and make it easier to adopt alternative parts. Those same services are extremely useful when you are substituting clearance Allen-Bradley components, because they reduce the engineering effort needed to qualify and integrate each unit.

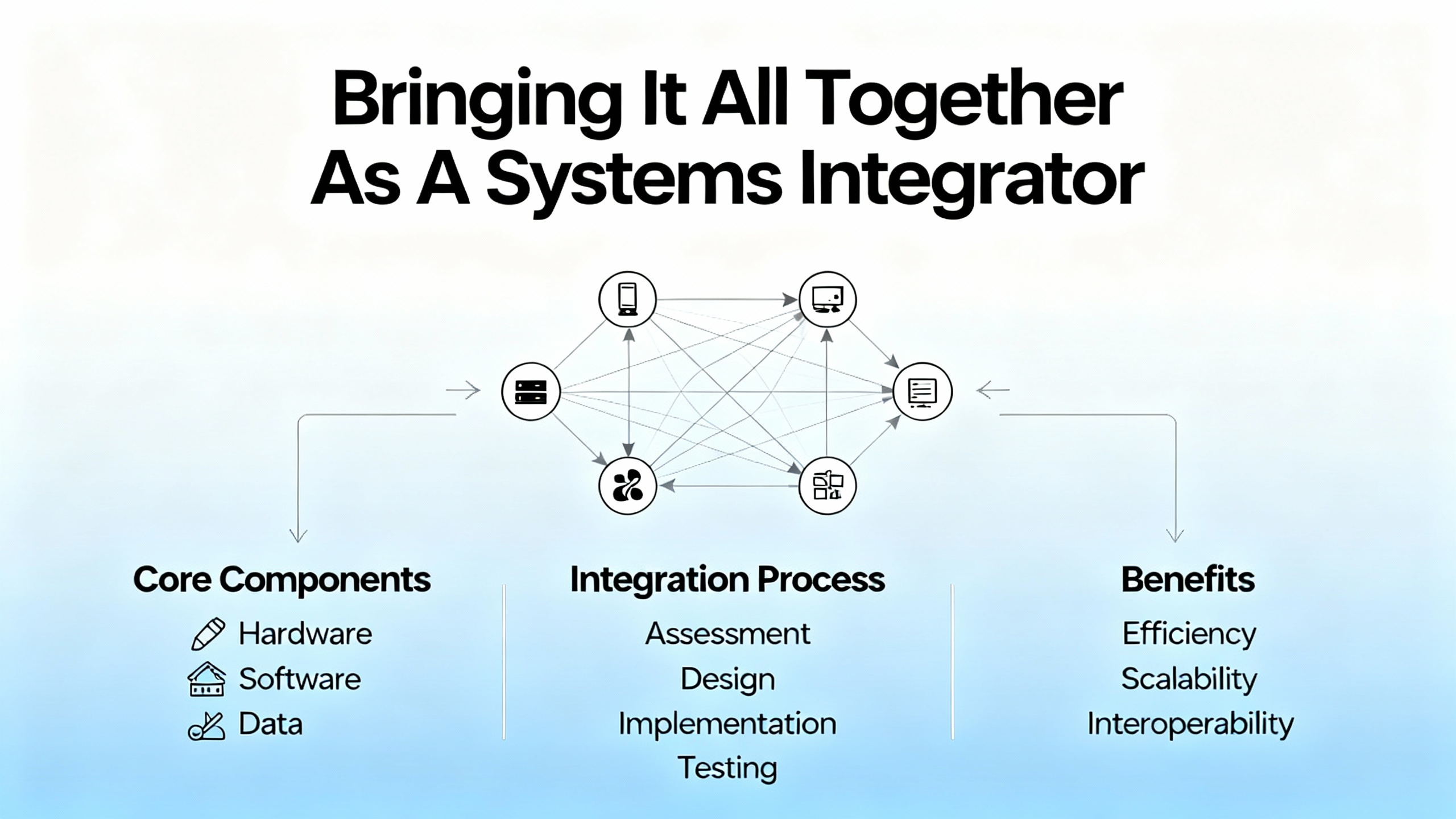

Bringing It All Together As A Systems Integrator

From a veteran integrator’s perspective, stock clearance Allen-Bradley parts are neither a silver bullet nor a necessary evil. They are a tool that can either de-risk your operations or quietly undermine them, depending on how you use them.

When I sit down with a plant team to talk about discounted Allen-Bradley components, we rarely start with a price list. We start with the installed base, the control architecture, the safety strategy, and the uptime requirements. Then we identify which parts are genuine risk points, which ones can safely be covered by well-tested surplus or refurbished units, and which ones are better left to new hardware from authorized channels.

The research behind Industrial Automation Co., Device Surplus, Santa Clara Systems, ROC Automation, eINDUSTRIFY, C3 Controls, National Instruments, and Industrial Control Direct all tell the same story from different angles. Affordable automation parts with fast shipping are vital because downtime is expensive. Total cost and total value of ownership matter more than individual line items. Surplus and refurbished parts can be high-quality, long-term solutions if they are sourced and tested properly. And weak suppliers who hide behind low prices but provide no real support are a recipe for headaches and missed production.

If you take one actionable idea from this discussion, let it be this: treat discounted Allen-Bradley parts with the same discipline you apply to new hardware. Verify every part number and specification. Demand clear refurbishment and test standards. Insist on meaningful warranties. Align each clearance purchase with your architecture and your long-term migration plan.

Do that consistently, and stock clearance Allen-Bradley parts stop being a gamble. They become one more lever you can pull, as a reliable project partner, to keep your lines running, your risks controlled, and your budget where it needs to be.

References

- https://www.plctalk.net/forums/threads/where-to-find-an-allen-bradley-online-store.117303/

- https://anaheimautomation.com/?srsltid=AfmBOoooiicC9-Us-7504oPPq3UQ5kfn6EFJ-T5k9DCNWHYCWGhwaLs9

- https://www.devicesurplus.com/allen-bradley-automation

- https://www.digikey.com/

- https://www.industrialcontroldirect.com/index.php?main_page=articles&aID=7&srsltid=AfmBOopL4pZYnR7gV-2oFyPVcKA-xskVecB9eE_ysnYh3nIKovIcWtX-

- https://www.mouser.com/?srsltid=AfmBOork297mrTSNn_wVzee63_Mt81YMwTFRlNYlHYLwlHJKNKBxvS2X

- https://www.plchardware.com/default.aspx?man=rockwell+automation&srsltid=AfmBOooN0HFHHl4zcUz6u1uosU91w2mGogHRwFpUFFUDty4_gm_DE7W0

- https://us.rs-online.com/?srsltid=AfmBOoo-lIYyKdzSZIBXIVtNrgP-PpsMxqDAnaTnBoN71b90mhxIfehw

- https://www.c3controls.com/white-paper/cost-considerations-for-industrial-automation?srsltid=AfmBOopH5j6moRKH4tsoSYw3IxrQN8YqqHGy70Rb6sCaC94HKv6M6_ZQ

- https://www.ebay.com/shop/allen-bradley-parts?_nkw=allen+bradley+parts

Keep your system in play!

Related articles Browse All

-

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu...

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu... -

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ...

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ... -

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

Need an automation or control part quickly?

- Q&A

- Policies How to order Part status information Shipping Method Return Policy Warranty Policy Payment Terms

- Asset Recovery

- We Buy Your Equipment. Industry Cases Amikong News Technical Resources

- ADDRESS

-

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

Copyright Notice © 2004-2026 amikong.com All rights reserved

Disclaimer: We are not an authorized distributor or distributor of the product manufacturer of this website, The product may have older date codes or be an older series than that available direct from the factory or authorized dealers. Because our company is not an authorized distributor of this product, the Original Manufacturer’s warranty does not apply.While many DCS PLC products will have firmware already installed, Our company makes no representation as to whether a DSC PLC product will or will not have firmware and, if it does have firmware, whether the firmware is the revision level that you need for your application. Our company also makes no representations as to your ability or right to download or otherwise obtain firmware for the product from our company, its distributors, or any other source. Our company also makes no representations as to your right to install any such firmware on the product. Our company will not obtain or supply firmware on your behalf. It is your obligation to comply with the terms of any End-User License Agreement or similar document related to obtaining or installing firmware.

Cookies

Individual privacy preferences

We use cookies and similar technologies on our website and process your personal data (e.g. IP address), for example, to personalize content and ads, to integrate media from third-party providers or to analyze traffic on our website. Data processing may also happen as a result of cookies being set. We share this data with third parties that we name in the privacy settings.

The data processing may take place with your consent or on the basis of a legitimate interest, which you can object to in the privacy settings. You have the right not to consent and to change or revoke your consent at a later time. This revocation takes effect immediately but does not affect data already processed. For more information on the use of your data, please visit our privacy policy.

Below you will find an overview of all services used by this website. You can view detailed information about each service and agree to them individually or exercise your right to object.

You are under 14 years old? Then you cannot consent to optional services. Ask your parents or legal guardians to agree to these services with you.

-

Google Tag Manager

-

Functional cookies

Leave Your Comment