-

Manufacturers

- ABB Advant OCS and Advant-800xA

- ABB Bailey

- ABB Drives

- ABB H&B Contronic

- ABB H&B Freelance 2000

- ABB Master

- ABB MOD 300, MOD 30ML & MODCELL

- ABB Procontic

- ABB Procontrol

- ABB Synpol D

- Allen-Bradley SLC 500

- Allen-Bradley PLC-5

- Allen-Bradley ControlLogix

- Allen-Bradley CompactLogix

- Allen-Bradley MicroLogix

- Allen-Bradley PanelView

- Allen-Bradley Kinetix Servo Drive

- Allen-Bradley PowerFlex

- Allen-Bradley Smart Speed Controllers

- 3300 System

- 3500 System

- 3300 XL 8mm Proximity Transducer

- 3300 XL NSV Proximity Transducer

- 990 and 991 Transmitter

- 31000 and 32000 Proximity Probe Housing Assemblie

- 21000, 24701, and 164818 ProbeHousing Assemblies

- 330500 and 330525 Piezo-Velocity Sensor

- 7200 Proximity Transducer Systems

- 177230 Seismic Transmitter

- TK-3 Proximity System

- GE 90-70 Series PLC

- GE PACSystems RX7i

- GE PACSystems RX3i

- GE QuickPanel

- GE VersaMax

- GE Genius I/O

- GE Mark VIe

- GE Series One

- GE Multilin

- 800 Series I/O

- Modicon 984

- Modicon Premium

- Modicon Micro

- Modicon Quantum

- Telemecanique TSX Compact

- Altivar Process

- Categories

- Service

- News

- Contact us

-

Please try to be as accurate as possible with your search.

-

We can quote you on 1000s of specialist parts, even if they are not listed on our website.

-

We can't find any results for “”.

-

-

Get Parts Quote

Trade-In Programs for Old Automation Equipment: A Field Guide From the Integrator’s Side

This is my linkedin:

As a seasoned expert in the field of automation spare parts, Sandy has dedicated 15 years to Amikon, an industry-leading company, where she currently serves as Director. With profound product expertise and exceptional sales strategies, she has not only driven the company's continuous expansion in global markets but also established an extensive international client network.

Throughout Amikon's twenty-year journey, Sandy's sharp industry insights and outstanding leadership have made her a central force behind the company's global growth and sustained performance. Committed to delivering high-value solutions, she stands as a key figure bridging technology and markets while empowering industry progress.

There comes a point in every plant where the control cabinets and robot cells tell a different story than the business plan. You see PLCs two or three generations behind current platforms, drives you can no longer get overnight, safety relays that make your EHS team nervous, and robots that still run but chew up maintenance hours. At the same time, you have capital pressure, supply-chain volatility, and customers who expect “Amazon-like” speed and quality.

Vendors will happily propose a full rip-and-replace. In reality, most plants need a staged roadmap. Well-designed trade-in programs for old automation equipment are one of the more underused tools in that roadmap. Done right, they free cash, reduce risk, and accelerate modernization. Done badly, they create inventory headaches, compliance risk, and unhappy operators.

I am writing from the perspective of someone who has spent years on plant floors and in vendor war rooms, sitting between manufacturers, distributors, and global integrators. I will walk through how trade-in programs work when they are set up properly, the traps I have seen, and pragmatic ways to use them as part of your automation lifecycle strategy.

What a Trade-In Program Means in Industrial Automation

In consumer markets, a trade-in program is straightforward: you hand over a used phone or laptop and receive credit toward a new one. The same basic concept applies to industrial automation equipment, but with higher stakes. You are not just trading gadgets; you are trading critical infrastructure that runs production and, in many cases, safety functions.

In the automation world, a trade-in program is a structured mechanism to exchange aging assets such as PLCs, HMIs, variable-frequency drives, robots, and even complete cells or skid systems for financial credit, improved pricing, or bundled services toward a newer solution. The program operator, whether OEM, distributor, or lifecycle partner, then evaluates, refurbishes, resells, or responsibly recycles those assets.

The goal is not to turn your plant into a used equipment business. Industry guidance from equipment dealers stresses that trade-ins should primarily support the sale and deployment of new machines, not become an unplanned side venture in remarketing. That logic holds even more strongly for automation hardware, where compatibility, safety, and supportability matter as much as the payout.

Two points differentiate automation trade-ins from simple disposal. First, they are tied to a defined modernization action: a new robot cell, a standardized PLC platform, or an upgraded drive family. Second, they depend on high-quality technical assessment and processing, not just cosmetic grading. An old controller with pristine paint but obsolete firmware is worth less to your risk profile than a scuffed unit that can be upgraded, supported, and warrantied.

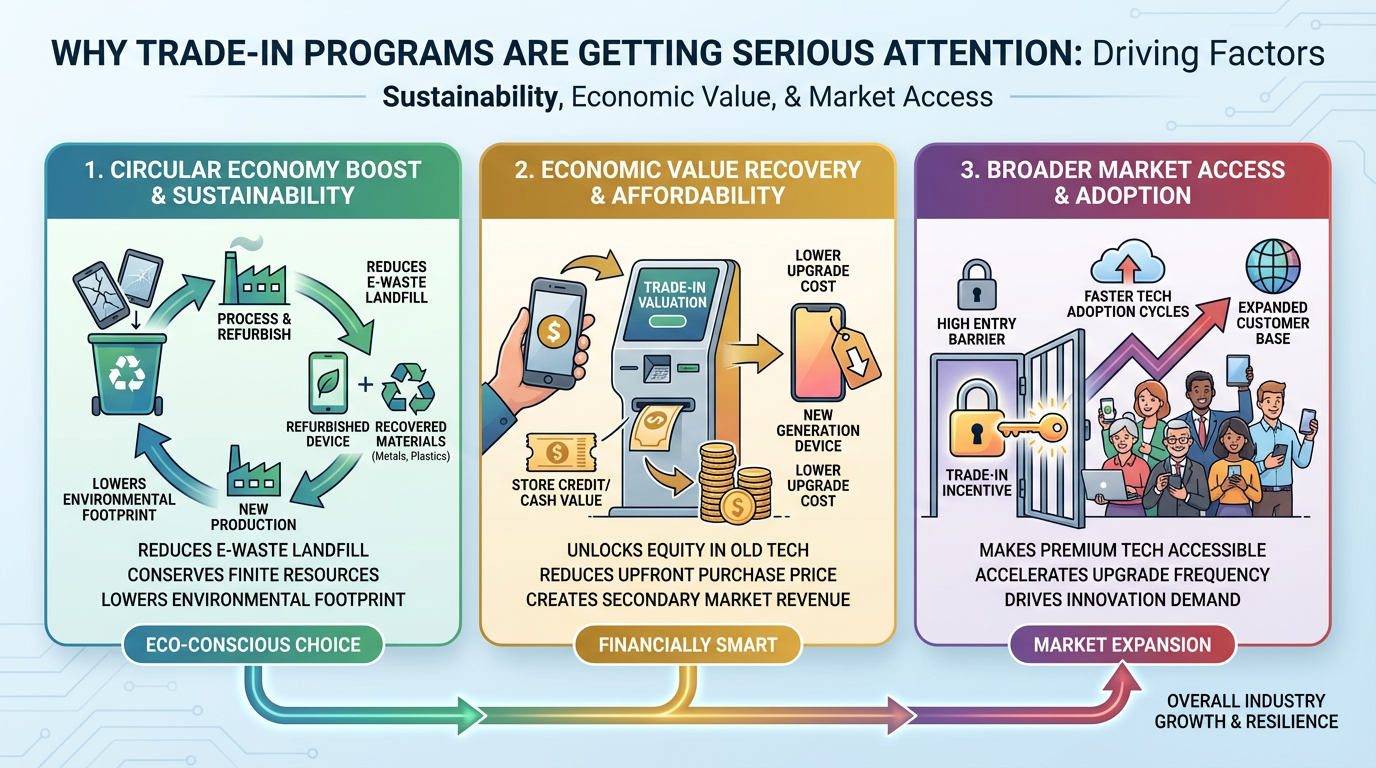

Why Trade-In Programs Are Getting Serious Attention

Several industry trends are converging to make trade-in programs much more strategic than they were even five years ago.

Supply chains have become a constant source of uncertainty. Work from Appian on supply chain automation and advisory groups to the U.S. Department of Commerce both highlight how fragmented, paper-heavy processes create bottlenecks and how automation has become a key lever for speed and resilience. During the pandemic and subsequent disruptions, analyses cited by ATS Industrial Automation estimate that up to $4 trillion in supply-chain value was destroyed across industries. Many manufacturers responded by reshoring or regionalizing production, investing in agile platforms like the high-speed Symphoni assembly technology, and accelerating automation. That wave of new equipment left a long tail of legacy hardware in its wake.

At the same time, the secondary market for electronic devices and components has expanded dramatically. Research on device trade-in and lifecycle partners such as Ingram Micro Lifecycle and SmekDigital shows that demand for refurbished equipment has surged, driven by cost pressure, supply constraints, sustainability expectations, and the rise of remote work. A separate analysis from Apkudo places the secondary market for handheld devices alone north of $64 billion, with tens of millions of units moving through warehouses each year. The same economic forces apply, with different numbers, to drives, controls, and industrial PCs.

Finally, corporate sustainability and ESG reporting have moved from marketing slides to board-level commitments. Trade-in programs that demonstrably support reuse, refurbishment, and responsible recycling help meet those goals. Partners that can track devices at serial-number level, share environmental metrics, and document compliant recycling provide tangible evidence that equipment is not just being shipped to an unknown scrapyard.

Put together, these trends make it much easier to answer the question executives will inevitably ask: “Why are we doing this program at all?” The answer is that trade-ins are now a lever for capital efficiency, supply chain resilience, and ESG performance, not just a sweetener on a quote.

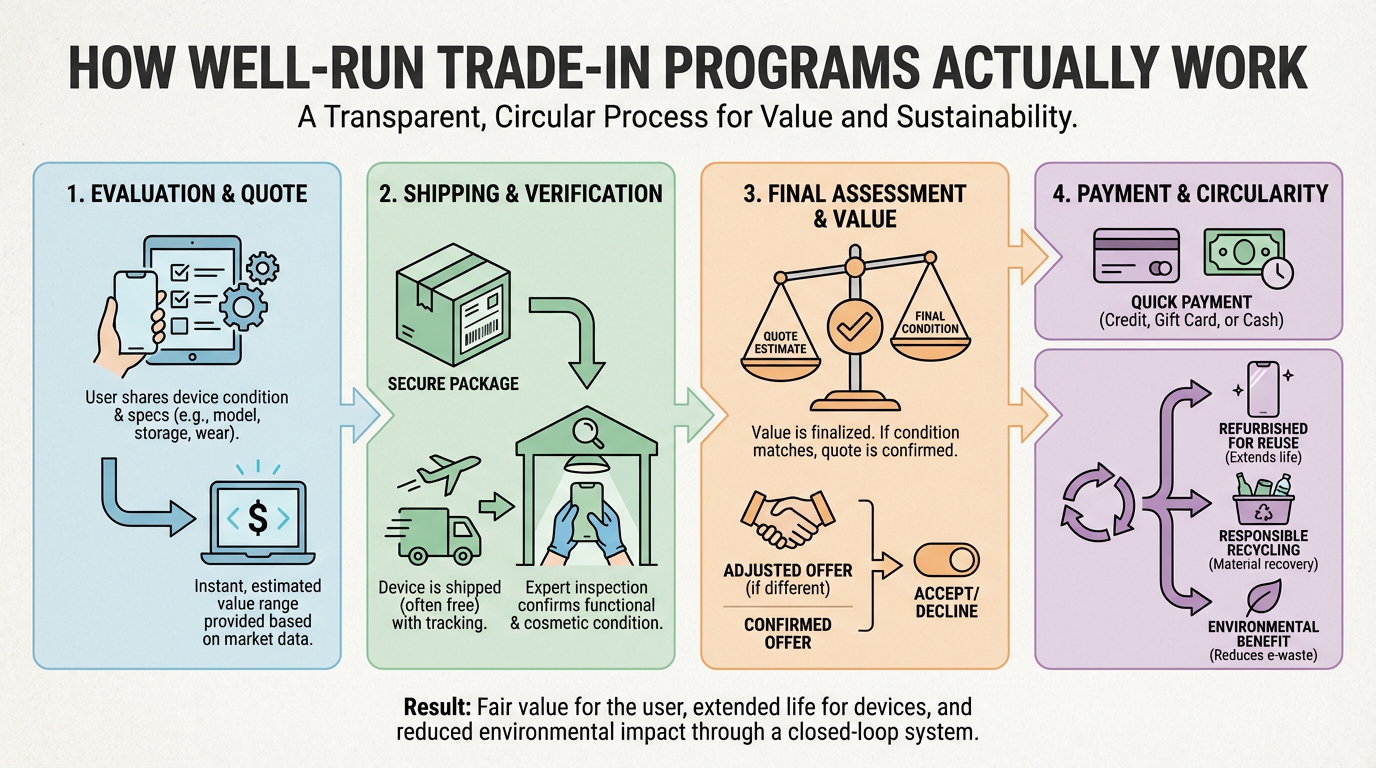

How Well-Run Trade-In Programs Actually Work

On the surface, a trade-in program looks simple: quote, collect, credit. In practice, the programs that perform reliably borrow heavily from how advanced device trade-in and reverse logistics operations are run.

Intake and Assessment: From Checklists to Automated Grading

In equipment dealerships, best practice is to use a structured evaluation with defined tests rather than a quick visual once-over. Articles aimed at construction and outdoor power equipment dealers emphasize checklists, compression tests, and drivetrain checks to price trade-ins accurately and minimize financial risk. For automation equipment, the equivalent is a disciplined, repeatable assessment of control hardware and cells.

At a minimum, that assessment should include powering the unit, verifying communications, checking firmware levels, and confirming I/O and safety functions. For robots, you add cycle counts, backlash checks, and safety circuit validation. For safety controllers and field devices, you verify that they still meet current functional safety expectations.

Device trade-in providers have shown how far this can be pushed with automation. A Pandas case study describes a web app that guides smartphone owners through a short series of tests and delivers a precise trade-in quote in under five minutes. Apkudo shows how automated grading and diagnostics on used devices remove human subjectivity caused by lighting, fatigue, or inconsistent criteria, allowing high-volume, consistent evaluation across thousands of product variants.

The same philosophy transfers directly to industrial automation. The more you can instrument and partially automate your grading process, the more predictable your results become. Camera-based inspection of panel condition, automated test sequences for drives and I/O modules, and even robotic test fixtures for small devices all reduce disputes and rework. They also create clean data that can be used in pricing and reliability analysis.

Pricing and Risk Management

In consumer trade-ins, articles from Pandas and SmekDigital emphasize that pricing is the economic core of the business. Offers have to be fair and data-driven, not arbitrary, and they must consider historical quotes and current market demand across thousands of models.

Automation equipment is no different. Good pricing practice blends three types of information. First, you look at objective condition: passing tests, maintenance history, and visible wear. Heavy equipment guidance from Caterpillar dealers stresses that documented maintenance and fluid analysis materially reduce risk and justify higher trade-in values; controllers and robots respond the same way. Second, you assess marketability: how many of these units are in the field, how often they fail, and whether they are still supported. Work from Qviro shows how international specialists can often quote more competitive pricing on complex automation projects by aligning components and design more accurately; that same depth of knowledge applies when valuing used robots or drives. Third, you estimate processing cost and risk: what it will cost to refurbish, test, repackage, and warranty the unit.

Device-focused lifecycle companies like Ingram Micro Lifecycle point out that trade-in partners with strong cash flow can pre-fund device buybacks and still pay end customers the amount they were originally quoted, even when automated testing reveals small faults. They achieve this by having in-house repair and refurbishment capabilities, OEM accreditations that give them access to original parts, and well-optimized repair processes. That combination reduces their cost per unit and lets them avoid re-quoting the customer downward for minor issues. Translating that approach to automation means working with partners who can cost-effectively replace fans, caps, or contactors, reload firmware, and run burn-in tests, rather than writing off units for small defects.

The pricing model should also account for customer lifetime value. Research on consumer trade-ins notes that fair, consistent offers increase repeat trade-ins and referrals, which matters if you are a vendor or integrator using trade-ins to lock in standard platforms across a customer’s plants. Taking a slightly lower margin on the first wave of equipment can be sensible if it accelerates a multi-year standardization program.

Refurbishment, Remarketing, and Recycling

What happens after the credit hits your capital budget is where many programs either create or destroy value.

In the device world, firms like Apkudo treat secondary device processing as a full reverse supply chain that includes receiving, inspection, grading, diagnostics, refurbishing, storage, and repair. Automation and warehouse digitization connect these operations, boosting predictability and throughput. The same architecture can be applied to automation hardware: standardized intake, consistent test and refurbishment flows, and clear routing to resale, harvest-for-parts, or recycling.

Refurbished industrial equipment is not a second-class citizen anymore. Motoman notes that retrofitting existing robotic systems, including the use of certified pre-owned robots, is now a mainstream strategy for small and midsized manufacturers. Qviro highlights that refurbished units can cut cost and lead time, and may come with OEM-style testing and warranty, provided that sourcing and installation follow the supplier’s rules. In other words, your traded-in robot might reappear in someone else’s plant with a fresh warranty and extended life.

Environmental responsibility is an increasingly important design criterion. Ingram Micro Lifecycle explicitly warns against an “out-of-sight, out-of-mind” mindset where devices are shipped to distant countries for disposal outside of proper oversight. They advocate for partners who can clearly explain where devices go, how they are processed, and what environmental metrics they can share. Volvo Construction Equipment’s “Change Starts Here” messaging ties used-equipment practices to broader sustainability goals. Automation trade-ins should meet the same standard, with transparent reporting on reuse versus recycling and adherence to relevant environmental regulations.

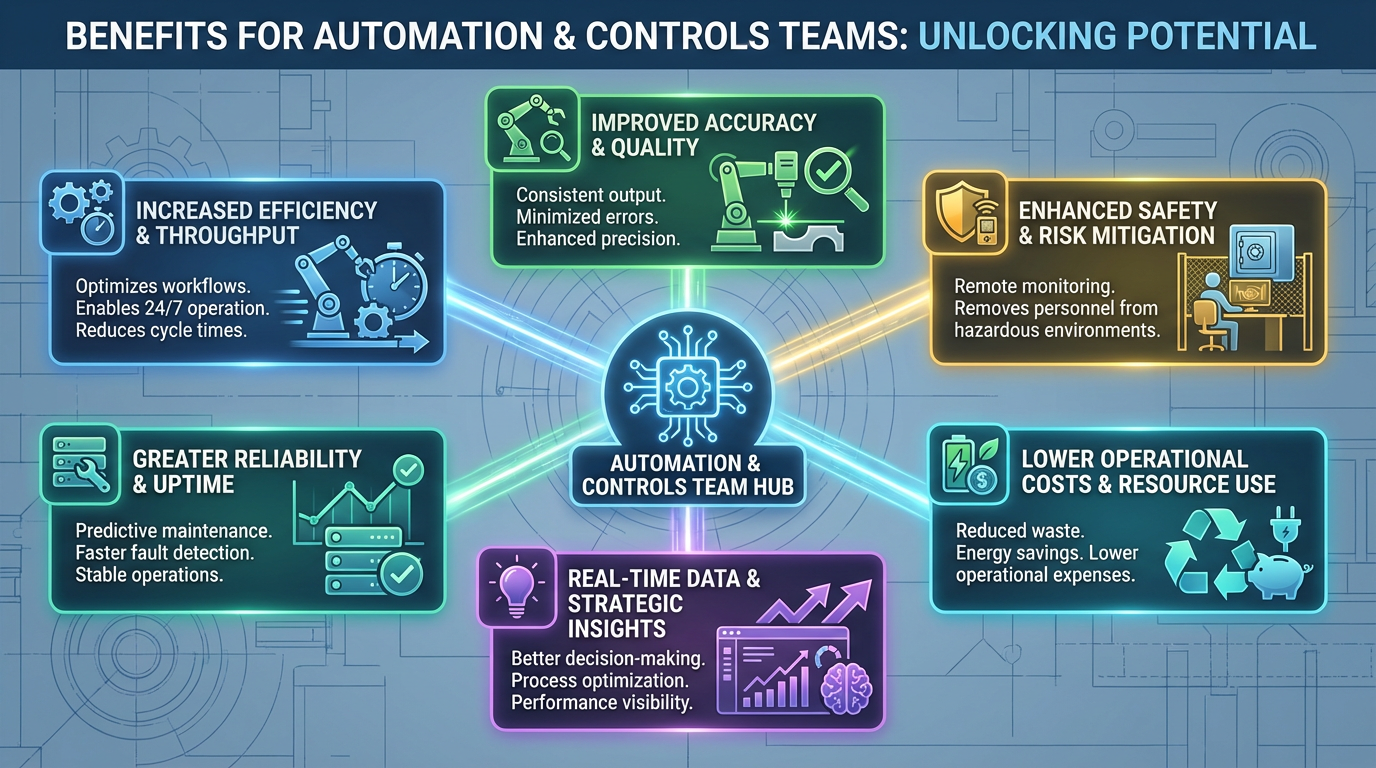

Benefits for Automation and Controls Teams

When trade-in programs are engineered with these principles, they provide several concrete advantages to operations, engineering, and finance.

The most obvious benefit is capital efficiency and cash flow. In construction and OPE dealerships, trade-ins are routinely used as down payments on new machines, lowering up-front cash requirements and sometimes unlocking better financing terms. The same approach can fund standardized PLC upgrades, new safety systems, or an agile assembly platform. Guidance from Ideal Computer Systems stresses that trade-ins should be structured to support new sales while protecting gross margins, rather than becoming uncontrolled discounts. In practice, that means balancing trade-in allowances with reduced direct discounts on the new solution and moving traded units quickly so they do not sit on your books.

Second, trade-ins accelerate modernization while controlling operational risk. Motoman’s data shows that retrofitting existing robot cells can extend their usable life by roughly five to ten years, especially when safety and process changes are incorporated. Trade-in programs extend that thinking: instead of waiting for catastrophic failure of fully obsolete hardware, you can identify high-risk assets and fold them into structured swap-out campaigns with credits attached. These campaigns can be staged around shutdowns and production priorities, rather than emergency replacements.

Third, trade-ins support supply chain resilience and technical standardization. Supply chain automation analyses from Appian and case studies from ATS show how automation helps manufacturers keep up with volatile demand, including just-in-time and high-mix, low-volume production. However, that agility is undermined when your installed base consists of niche or end-of-life components that you cannot source quickly. By using trade-in credits to consolidate on a smaller number of supported PLC, drive, and robot platforms, you reduce part shortages, simplify training, and make future changes faster. Qviro’s comparison of local generalist integrators versus specialized international providers reinforces that aligning on the right standardized components reduces both cost and risk.

Fourth, a well-run program generates valuable data. Smartphone trade-in programs using IMEI-level tracking and automated grading have shown that granular data on traded models, fault patterns, and upgrade frequency feeds better pricing, inventory, and product decisions. Platforms like CADDi demonstrate similar effects in procurement automation, where cleaned and structured spend data supports more strategic sourcing. If you track automation trade-ins at serial-number level with associated failure modes, you can identify problematic model families, harsh applications, and even training gaps. That intelligence should feed back into your design standards and vendor selection.

Finally, trade-in programs contribute directly to ESG and compliance goals. Device trade-in research highlights that programs which clearly promote reuse, refurbishment, and responsible recycling resonate with sustainability-minded customers. OCR’s work on trade compliance automation and the U.S. Single Window initiative shows that regulators increasingly expect electronic, auditable records for cross-border trade. A trade-in program backed by automated compliance tools and transparent environmental reporting can satisfy both expectations: lower waste and fully documented export, import, and recycling flows.

Risks, Trade-Offs, and Common Failure Modes

For every plant that has used trade-ins to good effect, I have seen another deal that quietly became a headache. The patterns are consistent across industries.

The first risk is treating trade-ins as ad hoc discounts rather than a structured system. Ideal Computer Systems warns that unstructured trade-ins can strain dealership cash flow and morph the business into a de facto used-equipment shop. In automation, this looks like taking back old drives or controllers on generous terms without a clear downstream plan. They sit in a cage for a year, depreciating and consuming space, while finance wonders why the expected margin never materialized.

The second risk is a clumsy, slow customer journey. Pandas’ research on device trade-in programs notes that many existing schemes suffer from roughly three-week lags between trade-in and payment because of poor coordination between warehouses and stores. In practice, that delay drives abandonment and disputes. Automation trade-ins are more complex, but the same principle applies. If your team takes months to confirm values, schedule decommissioning, and issue credits, stakeholders will revert to simple discounting or avoid the program.

Third, a weak partner can damage your brand. Ingram Micro Lifecycle advises buyers to look for trade-in partners with strong reputations, positive customer feedback, and clear environmental stories. They explicitly warn against partners who are notorious for bad practices. For an automation supplier or integrator, the reputation of your trade-in partner is effectively your own; if your customer’s old equipment vanishes without documentation or ends up associated with questionable recycling practices, it reflects on you.

Fourth, depreciation and process delays quietly erode value. In the consumer device market, Ingram Micro emphasizes that traded-in devices lose value every day they remain on the books, so partners must process them quickly. Automation hardware behaves similarly, with the added twist that component obsolescence and regulatory changes can sharply reduce value once a platform crosses a support threshold. Slow grading, long repair queues, and weak resale channels turn attractive trade-ins into write-downs.

Fifth, security and compliance cannot be an afterthought. Pandas underlines that data security is a top concern for smartphone owners, noting that evaluation tools should avoid risky cable-based connections and must not access sensitive user data. SmekDigital highlights the twin risks of privacy breaches and fraud in automated trade-in models. Industrial assets may not hold family photos, but modern PLCs, industrial PCs, and edge gateways certainly hold intellectual property, credentials, and network details. At scale, cross-border movement of these assets also raises export control questions. OCR’s analysis of trade compliance automation and global regulators’ push for electronic filing through systems like ACE make it clear that manual, spreadsheet-based approaches are no longer acceptable.

The final risk is cultural. If your plant teams see the program as something “corporate” is doing to them, rather than a tool that helps them get better equipment faster, they will slow-roll participation, hide marginal equipment, or try to game valuations. That is why transparency and fairness matter as much as the math.

Designing a Trade-In Program for Automation Assets

The plants that get the most value from trade-ins treat them as a designed process, not a marketing campaign. Several design decisions make the difference.

Start With Clear Objectives

Before you draft a single policy, define what you are trying to optimize. Some manufacturers use trade-ins primarily to support adoption of a new automation platform or standard safety architecture. Others care most about freeing up floor space and simplifying inventory. Still others place ESG and compliance front and center. The priorities will determine how aggressive your allowances are, which assets you target first, and how you measure success.

If your primary goal is modernization and risk reduction, you may focus initially on obsolete safety systems and controls with poor support. If cash flow and margin protection dominate, you will be more selective about which assets qualify and how credits are structured.

Map and Segment the Installed Base

An objective view of your installed base is essential. Heavy equipment trade-in guides stress understanding a machine’s age, hours, condition, and market demand before making decisions. For automation, the equivalent is an asset register that includes hardware revision, firmware level, criticality to production, support status, and recent failure history.

From there, segment equipment into buckets such as “run and maintain,” “retrofit in place,” and “trade-in and replace.” Motoman’s retrofit guidance shows that many robot cells are good candidates for targeted upgrades that add several years of life. Conversely, controllers with no current support, spares shortages, or chronic failures may be better candidates for trade-in. Dealers in other sectors often recommend accepting trade-ins only for brands they already sell and support; applying that rule to automation reduces technical and parts risk.

Engineer the Customer Experience

Research on device trade-ins from Pandas is blunt: programs succeed when they are intuitive, seamless, and clearly better than the alternatives. The same holds for automation, even if your “customers” are internal plants and engineering teams.

In practice, this means minimizing steps, offering multiple entry points, and using automation wherever possible. It should be simple for a site to nominate assets for trade-in, whether through a portal, a structured spreadsheet upload, or during scheduled audits with your integrator. Clear guidance on what qualifies, documentation required, and how credits are calculated prevents misunderstandings.

Speed is critical. Pandas highlights that long delays between device handover and payment are a major source of dropout. Set expectations for evaluation timelines, and stick to them. For smaller components, emulate the Pandas model by running standardized tests and returning a quote quickly. For larger cells, provide a preliminary range and refine it after inspection, rather than going dark for weeks.

Build a Robust Evaluation and Grading Engine

Earlier, I described how construction equipment dealers use checklists and how device processors like Apkudo use automated grading to remove subjectivity. Automation trade-in programs should combine both approaches.

Define standard tests by asset type: for drives, checks on power stages, control logic, and communication; for PLCs, CPU health, memory integrity, I/O module operation, and communication ports; for robots, controller status, safety circuits, and mechanical performance. Use structured forms to capture results, attach photos, and record serial numbers.

Where volume justifies it, automate repetitive parts of the process. RPA case studies collected by Nividous show how bots can take over high-volume, rule-based tasks such as reading semi-structured documents, posting data into ERP, and reconciling records, freeing staff from spreadsheet work. The same techniques can push trade-in intake data into your ERP or GTM system, generate standard offers, and keep status dashboards current without manual rekeying.

Close the Loop With Analytics

Trade-in programs generate valuable data, but only if you decide up front what you will measure. Work on trade promotion management in the consumer goods sector shows that companies that invest in post-promotion analytics see substantial improvements in promotional efficiency. Boston Consulting Group reports double-digit gains in some cases when post-event analytics are used systematically. The analogy applies directly: treat your trade-in program as a recurring campaign, not a one-off.

Track metrics such as average evaluation cycle time, percentage of submitted assets that are accepted, write-down rates on processed equipment, realized resale values against expected, and the impact of trade-in campaigns on adoption of target platforms. Combine that with environmental metrics and compliance indicators from your GTM and trade-compliance tools. Over time, this feedback will sharpen your eligibility criteria, allowances, and partner choices.

Choosing and Managing Trade-In Partners

Some manufacturers run trade-in programs entirely in-house; others lean on OEMs, distributors, or specialized lifecycle partners. Either way, you need to think like a risk manager.

Financial strength and funding capability come first. Ingram Micro Lifecycle underscores that a credible trade-in partner must have the cash flow to buy devices on your behalf and to pay end customers quickly. Trade-in programs can be capital-intensive. You do not want to discover mid-program that your partner cannot fund buybacks, leaving your plants holding decommissioned equipment without credits.

Technical depth and OEM credentials matter just as much. Partners with in-house repair and refurbishment capability and OEM accreditations can access original parts and approved procedures, enhancing the value of traded assets. Motoman’s retrofit data shows that about half of manufacturers install new components themselves, but having supplier guidance and upgrade paths matters. For complex automation assets, work with partners who understand your applications, not generalists who treat everything as a black box.

Environmental and geographic responsibility should be explicit criteria. Ingram Micro recommends asking detailed questions about where devices go and what environmental successes the partner can demonstrate. Avoid arrangements that ship equipment to opaque destinations purely for cost reasons. Reputable partners can provide environmental statistics and explain how they calculate them, allowing you to incorporate this into ESG reporting.

Process speed and transparency complete the picture. As Ingram Micro notes, devices depreciate daily, so partners must have streamlined processes. Ask for typical timelines from receipt to grading, from grading to resale, and from resale to credit. Verify that they can provide end-to-end tracking and, where relevant, buyer and auction data. Apkudo’s work shows how automation can standardize grading and data capture at scale; a good partner does not rely entirely on manual spreadsheets.

Finally, consider alignment with your own brand and customer base. Volvo Construction Equipment emphasizes that warranties, guides, and stories about successful customers shape how trade-in and used-equipment practices are perceived. If you are an OEM or integrator offering trade-ins as part of your project delivery, you are staking your reliability and reputation on the partner’s conduct. Choose accordingly.

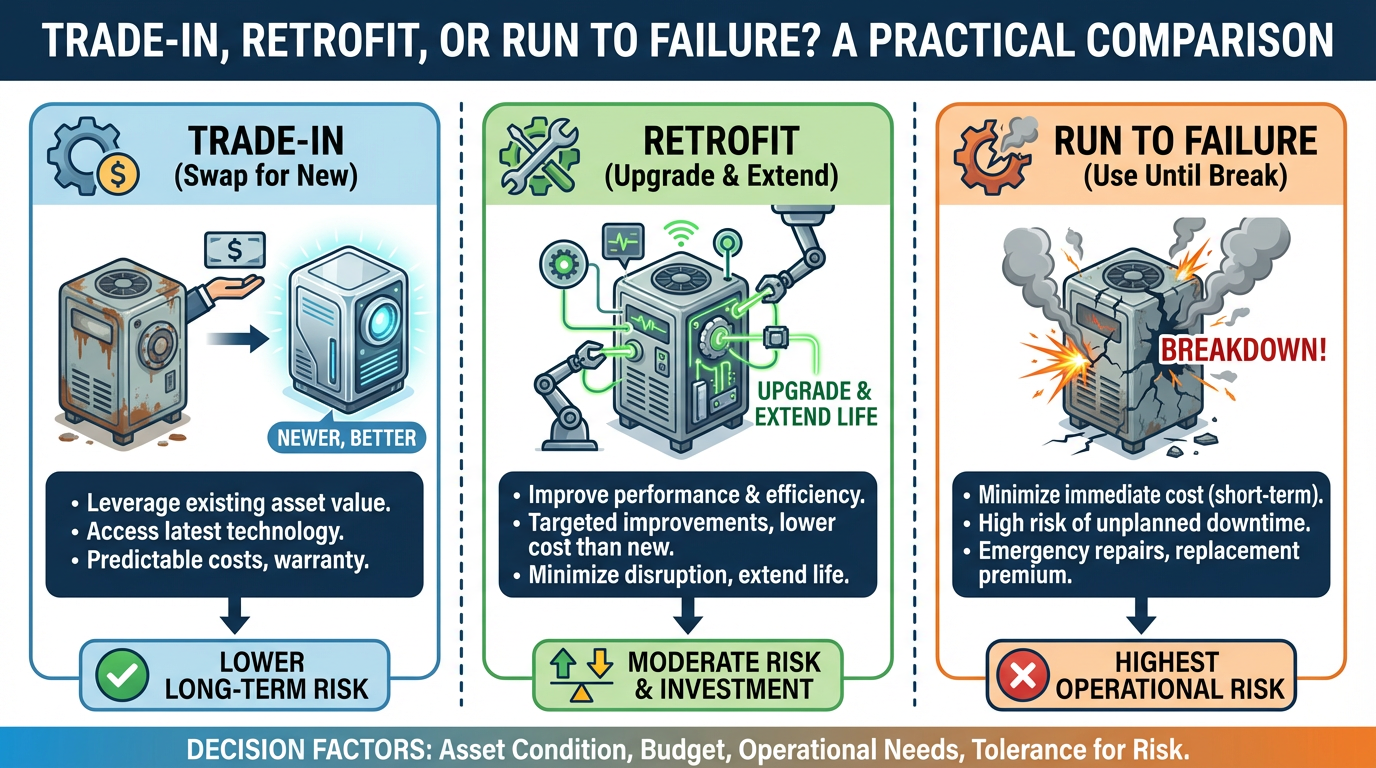

Trade-In, Retrofit, or Run to Failure? A Practical Comparison

Trade-in programs sit alongside two other lifecycle strategies: retrofitting existing automation and simply running equipment to failure. Each has its place.

Motoman’s retrofit guidance makes a compelling case for upgrading existing cells when the mechanical platform is sound but controls, safety, or process requirements have evolved. Retrofitting can add several years of life and is often more cost-effective than full replacement, especially when downtime windows are tight and floor layouts are fixed.

Trade-ins shine when platform obsolescence, supportability, or standardization are the primary concerns. They are especially powerful when tied to larger modernization programs or reshoring efforts. ATS’s case studies on agile automation show how moving to high-speed, configurable platforms like Symphoni enabled dramatic throughput gains and floor-space savings. Trade-in credits can help finance those kinds of step changes.

Running to failure has its place for noncritical, low-value assets with readily available replacements, but it is a poor strategy for safety-related controls, core network infrastructure, or platforms that are approaching official end-of-support. As trade-compliance and supply chain automation work from OCR and Appian shows, regulators and customers expect higher levels of reliability and traceability. A failed controller that triggers a shipment miss or compliance issue can cost much more than a modest trade-in allowance would have.

The decision is rarely binary across an entire plant. In practice, smart teams blend all three approaches. They retrofit where it makes financial and technical sense, fold clearly obsolete hardware into trade-in campaigns, and consciously choose run-to-failure only where the risk and replacement logistics are acceptable.

Here is a simplified way to think about the options:

| Approach | Best suited for | Key risks if overused |

|---|---|---|

| Trade-in and replace | Obsolete or unsupported platforms, standardization initiatives, major reconfigurations | Overpaying for marginal assets, inventory build-up if partner is weak or slow |

| Retrofit in place | Mechanically sound cells needing control, safety, or process upgrades | Underestimating scope, missing safety implications, incomplete lifecycle planning |

| Run to failure | Noncritical, low-value, easily replaced components | Unexpected downtime, safety exposure, and expensive emergency replacements |

FAQ: Practical Questions From Plant Teams

Can we get more money by selling old automation equipment ourselves instead of using a trade-in program?

Sometimes, particularly for high-demand robots or controllers in short supply. However, research into equipment trade-ins and dealership practice consistently points out that private sale comes with effort, risk, and delay. You take on marketing, negotiations, inspection disputes, and, in some cases, warranty expectations. A well-structured trade-in program trades some theoretical upside for speed, simplicity, and reduced risk, which is often the right balance for production-critical assets.

How do we ensure refurbished controllers and robots are safe and reliable?

Look for the same signals that Motoman and Qviro emphasize for retrofits and refurbished robots: OEM or integrator certification, documented testing and inspection processes, clear warranty terms, and support commitments. Partners with OEM accreditations, as highlighted by Ingram Micro for device trade-ins, can use original parts and approved procedures, which directly impacts safety and reliability. For safety-related equipment, ensure that any retrofit or refurbished unit is accompanied by a risk assessment aligned with applicable standards.

What should we do before handing over old automation equipment?

The advice from construction equipment trade-ins applies almost verbatim. Clean the equipment, address obvious minor issues, and gather service records and documentation. A “good bath and servicing,” in the words of one construction guide, materially improves perceived value. For automation specifically, make verified backups of programs and configurations, wipe or securely erase any storage that may hold credentials or proprietary data, and remove or document any licenses tied to the hardware. Finally, make sure your teams understand the handover process so nothing leaves the site without the right approvals and records.

Closing

Trade-in programs for old automation equipment are not magic. They will not fix weak standards, poor maintenance, or unclear strategy. But when they are designed with the same care you apply to a new cell or control system, they become a powerful lever: freeing capital, reducing risk, and accelerating modernization while supporting your sustainability and compliance goals.

As a systems integrator and project partner, my recommendation is simple. Treat your trade-in strategy as an engineering project, not a sales promotion. Define what you are optimizing, choose partners who can stand behind the hardware they touch, and insist on data, transparency, and clear lifecycle thinking. Do that, and your old automation equipment stops being a liability and starts funding your next wave of improvements.

References

- https://legacy.trade.gov/td/services/oscpb/supplychain/acscc/Meetings/2015January/January2015/Single%20Window%20Recc.pdf

- https://blog.pandas.io/how-to-structure-a-trade-in-program-that-meets-the-users-needs

- https://www.apkudo.com/post/how-automation-improves-secondary-device-processing

- https://www.assemblymag.com/articles/88401-automated-assembly-a-practical-guide-to-low-cost-automation

- https://www.idealcomputersystems.com/resources/trade-ins-that-work-turning-used-equipment-into-profitable-deals

- https://www.indataipm.com/streamlining-trading-operations-from-manual-processes-to-automation-with-ai/

- https://www.ingrammicrolifecycle.com/blog/top-factors-choosing-trade-in-program-partner

- https://katprotech.com/the-ultimate-guide-to-trade-promotion-management-in-the-cpg-industry/

- https://www.linkedin.com/pulse/understanding-construction-equipment-trade-ins-step-by-step-6kfkc

- https://nividous.com/blogs/rpa-case-study

Keep your system in play!

Related Products

Related articles Browse All

-

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu...

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu... -

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ...

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ... -

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

Need an automation or control part quickly?

- Q&A

- Policies How to order Part status information Shipping Method Return Policy Warranty Policy Payment Terms

- Asset Recovery

- We Buy Your Equipment. Industry Cases Amikong News Technical Resources

- ADDRESS

-

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

Copyright Notice © 2004-2026 amikong.com All rights reserved

Disclaimer: We are not an authorized distributor or distributor of the product manufacturer of this website, The product may have older date codes or be an older series than that available direct from the factory or authorized dealers. Because our company is not an authorized distributor of this product, the Original Manufacturer’s warranty does not apply.While many DCS PLC products will have firmware already installed, Our company makes no representation as to whether a DSC PLC product will or will not have firmware and, if it does have firmware, whether the firmware is the revision level that you need for your application. Our company also makes no representations as to your ability or right to download or otherwise obtain firmware for the product from our company, its distributors, or any other source. Our company also makes no representations as to your right to install any such firmware on the product. Our company will not obtain or supply firmware on your behalf. It is your obligation to comply with the terms of any End-User License Agreement or similar document related to obtaining or installing firmware.

Cookies

Individual privacy preferences

We use cookies and similar technologies on our website and process your personal data (e.g. IP address), for example, to personalize content and ads, to integrate media from third-party providers or to analyze traffic on our website. Data processing may also happen as a result of cookies being set. We share this data with third parties that we name in the privacy settings.

The data processing may take place with your consent or on the basis of a legitimate interest, which you can object to in the privacy settings. You have the right not to consent and to change or revoke your consent at a later time. This revocation takes effect immediately but does not affect data already processed. For more information on the use of your data, please visit our privacy policy.

Below you will find an overview of all services used by this website. You can view detailed information about each service and agree to them individually or exercise your right to object.

You are under 14 years old? Then you cannot consent to optional services. Ask your parents or legal guardians to agree to these services with you.

-

Google Tag Manager

-

Functional cookies

Leave Your Comment