-

Manufacturers

- ABB Advant OCS and Advant-800xA

- ABB Bailey

- ABB Drives

- ABB H&B Contronic

- ABB H&B Freelance 2000

- ABB Master

- ABB MOD 300, MOD 30ML & MODCELL

- ABB Procontic

- ABB Procontrol

- ABB Synpol D

- Allen-Bradley SLC 500

- Allen-Bradley PLC-5

- Allen-Bradley ControlLogix

- Allen-Bradley CompactLogix

- Allen-Bradley MicroLogix

- Allen-Bradley PanelView

- Allen-Bradley Kinetix Servo Drive

- Allen-Bradley PowerFlex

- Allen-Bradley Smart Speed Controllers

- 3300 System

- 3500 System

- 3300 XL 8mm Proximity Transducer

- 3300 XL NSV Proximity Transducer

- 990 and 991 Transmitter

- 31000 and 32000 Proximity Probe Housing Assemblie

- 21000, 24701, and 164818 ProbeHousing Assemblies

- 330500 and 330525 Piezo-Velocity Sensor

- 7200 Proximity Transducer Systems

- 177230 Seismic Transmitter

- TK-3 Proximity System

- GE 90-70 Series PLC

- GE PACSystems RX7i

- GE PACSystems RX3i

- GE QuickPanel

- GE VersaMax

- GE Genius I/O

- GE Mark VIe

- GE Series One

- GE Multilin

- 800 Series I/O

- Modicon 984

- Modicon Premium

- Modicon Micro

- Modicon Quantum

- Telemecanique TSX Compact

- Altivar Process

- Categories

- Service

- News

- Contact us

-

Please try to be as accurate as possible with your search.

-

We can quote you on 1000s of specialist parts, even if they are not listed on our website.

-

We can't find any results for “”.

-

-

Get Parts Quote

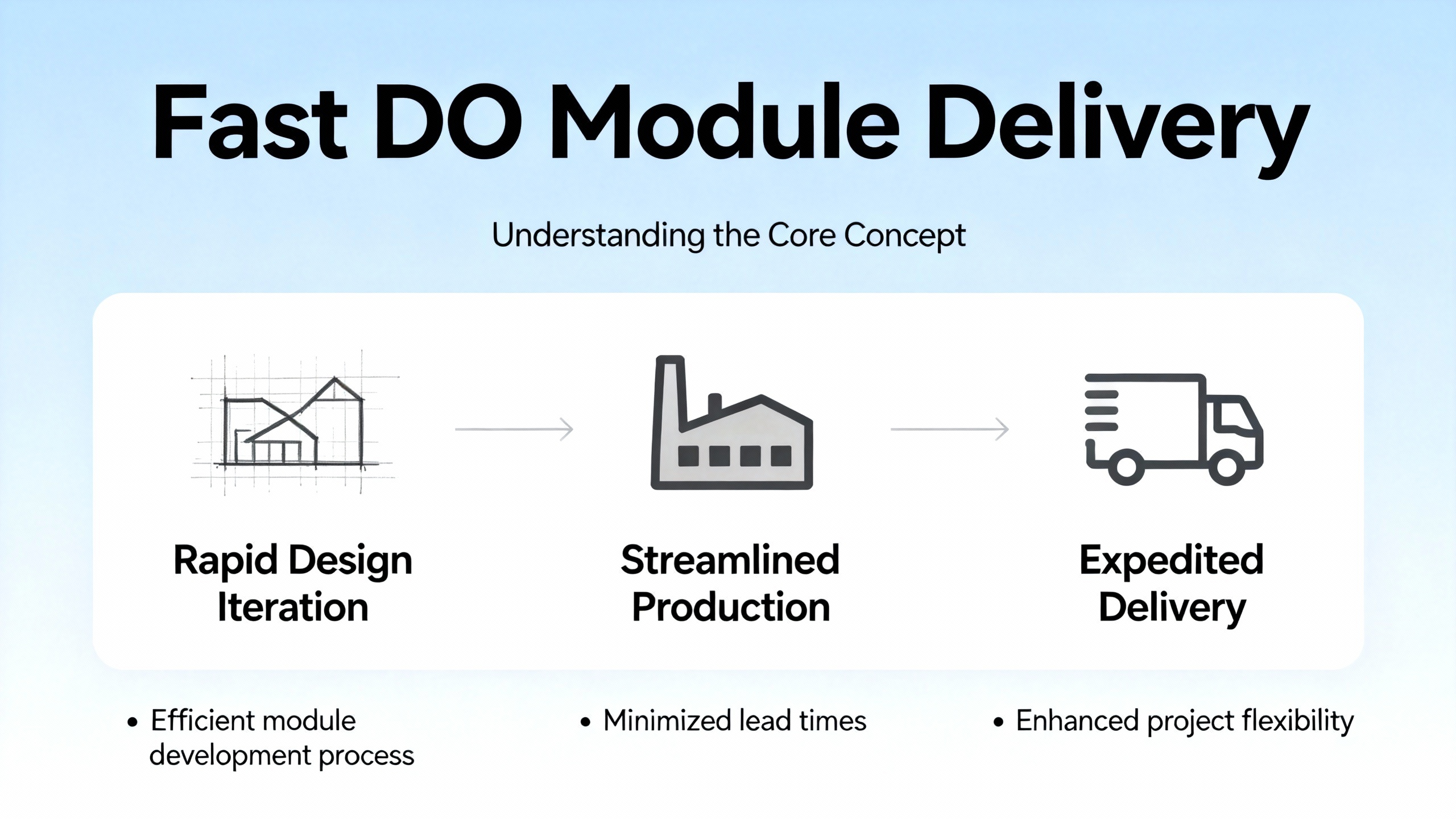

Urgent Digital Output Card Shipping: Fast DO Module Delivery Service

When a digital output (DO) card dies at 2:00 AM, it rarely does you the favor of failing in a training rig. It usually takes down a real line, with operators standing idle and management asking one question: how fast can you get the module here?

I have sat on concrete floors in front of dead panels more times than I care to count, waiting on a single output card. That is why I treat urgent DO card shipping as part of the control system design, not an afterthought. A fast DO module delivery service, done properly, can be the difference between an inconvenient maintenance window and a very expensive outage.

This article walks through what “fast shipping” really means for DO modules, how other industries have solved similar logistics problems, and how to design or choose an urgent DO card shipping service that actually holds up under real plant conditions.

Why DO Cards Turn Into 2:00 AM Problems

A digital output card is the hardware bridge between PLC logic and the real world. It drives contactors, solenoids, valves, lamps, interlocks, and safety devices. Lose the CPU and you lose brains; lose the DO card that feeds your main motor starters and you lose production.

In practice, DO cards tend to fail at the worst moments. You see blown channels from field wiring mistakes, shorted loads, or long-term heat stress. You see intermittent faults that only show up at high ambient temperatures, or when a specific bank of outputs is loaded. In plants that run 24/7, you usually cannot just wait until next week’s truck from the central warehouse.

What turns a minor hardware issue into a real crisis is not usually the replacement itself. Swapping a card is straightforward. The real pain is the gap between “we know which module has failed” and “the replacement is in my hand.” That gap is dominated by logistics.

Shipping experts on the retail side have been hammering on this for years. Analysis summarized by MyFBAPrep notes that only about a quarter of online shoppers say they are fully satisfied with delivery, and more than half have abandoned orders because of shipping costs or options. Brightpearl reports that fast, reliable shipping is now a primary reason customers pick one retailer over another. The same pattern is obvious in industrial environments: once a line is down, the only acceptable answer is “it is already on its way.”

For DO cards, urgent shipping is not a customer-experience nice-to-have. It is a core part of your uptime strategy.

What “Fast DO Module Delivery” Actually Means

Many vendors advertise “fast shipping” without defining it. In a real plant environment, you need clearer language. Based on what I have seen work, there are a few distinct components you should pay attention to.

First, there is order-to-ship time. This is the gap between your purchasing team placing the order and the module leaving the warehouse. That is entirely under the control of the supplier or logistics partner. Consumer-facing fulfillment specialists like those profiled by MyFBAPrep and noissue emphasize same-day picking: orders received before a fixed cutoff are picked, packed, and handed to the carrier that same day. For urgent DO cards, this is non‑negotiable. “Ships in three business days” is not urgent; it is a normal stock order.

Second, there is transit time. Synctera’s card-shipping documentation gives a useful view into practical shipping tiers for physical cards. In their model, basic local mail might take five to seven business days at very low cost with no tracking, while USPS Priority typically delivers in two to three business days with tracking. Beyond that, they note air services from major carriers that reach domestic destinations in about two days or overnight, with per-item shipping costs moving from well under a dollar for untracked mail to tens of dollars for express and international options.

Even though those numbers come from payment card programs, the pattern is exactly what I see with industrial hardware. Economy services are cheap but too slow for downtime scenarios. Two‑day services give a workable balance between cost and speed. Overnight air is the safety valve when every hour truly counts.

Third, there is reliability and communication. Research summarized by Brightpearl shows that buyers care not only about speed but about clear options, accurate delivery dates, and proactive updates. Another shipping study outlined by MyFBAPrep found that nearly a quarter of buyers abandon carts if they do not see delivery dates. When you translate that to maintenance and engineering, it means that a vague “we will send it out” is not enough. You want a tracking number, a realistic arrival window, and someone who will call you if it slips.

Put differently, a serious DO module delivery service is not just “fast shipping.” It is predictable lead time, well-chosen transport modes, and disciplined communication.

Lessons from High‑Velocity Shipping Sectors

Industrial automation does not exist in a vacuum. Other sectors ship high‑value, high‑impact items every day and have already learned some painful lessons. It is worth borrowing from them.

E‑commerce Fulfillment: Speed and Choice

E‑commerce has made “Amazon‑like” shipping the reference point for everyone. Brightpearl highlights that a large majority of buyers gravitate to retailers that combine fast and free shipping, and they cite data showing strong preference for same‑day or very rapid delivery when available. Another analysis summarized by MyFBAPrep points out that more than half of shoppers have abandoned carts because delivery costs were too high, while about seventy percent rate free shipping as the most important factor, ahead of pure speed.

The takeaway is simple. People care about both cost and urgency, and they appreciate clear choices. In an industrial context, that translates to offering a menu of shipping options for DO cards: a standard option for non‑critical replenishment, a two‑day option for high‑importance but not catastrophic events, and an overnight or same‑day option for actual line‑down emergencies.

E‑commerce operators have also learned to invest in packaging and process. Crown Packaging emphasizes automated packaging, right‑sized boxes, and integrated labeling as ways to accelerate shipping without destroying margins. Those same tools apply to DO modules: if the supplier has to hunt for the right carton, improvise dunnage, and hand‑write labels, you will not get consistent speed.

Payment Card Programs: Shipping as a Controlled Process

Card issuers are a surprisingly good analog for industrial OEMs shipping DO cards. Synctera’s documented card shipping setup shows a discipline that many automation parts suppliers would benefit from copying. They define multiple shipping methods with clear target transit times, associate average per‑card costs with each method for billing and analysis, and produce cards within a fixed production window, typically a maximum of about three business days from order to shipment.

They also distinguish carefully between individual shipments and bulk shipments. Individual cards ship directly to end users with their own labels and tracking, while bulk orders go to one or more locations in consolidated boxes that can hold hundreds of cards but are limited by a weight threshold of about thirty‑three pounds per box. That same split is very natural for DO cards: you need individual emergency shipments to plant sites for breakdowns, and periodic bulk replenishment to central storerooms.

Just as important is their stance on tracking and events. When a card ships, the status flips to “shipped” and, for most methods, a tracking number is recorded and exposed through systems and notifications. In a DO module service, you want the same level of integration with your own CMMS and purchasing tools.

Expedited Shipping Strategies: Cost and Logistics

Shipping specialists at EasyPost discuss expedited shipping as a set of tradeoffs, not a magic switch. They point out that two‑day shipping has effectively become the standard expectation, largely driven by Amazon Prime, and that same‑day is often out of reach for smaller operations. They highlight two main constraints: the logistics capability to physically move goods quickly, and the cost of high‑end carrier services.

To make expedited shipping sustainable, they emphasize three levers. One is enforcing minimum order thresholds so that free or discounted expedited shipping is only offered above a certain basket value, which protects margins. Another is distributing inventory across multiple fulfillment centers so goods are physically closer to customers and can reach them quickly with less expensive ground or regional services. The third is partnering with competent third‑party logistics providers (3PLs) that already operate networks of warehouses and use automation, forecasting, and experienced staff to keep turnaround times low.

All three levers translate directly to DO module logistics. You decide when it is worth eating the premium on freight, you position stock closer to likely demand, and you lean on specialized logistics partners rather than trying to build everything in‑house.

Designing a Fast DO Card Delivery Service

Once you accept that urgent shipping is part of your control strategy, you can design it with the same rigor you apply to safety or cybersecurity.

Inventory Placement: Keep DO Cards Close to the Risk

Fulfillment platforms like WareIQ emphasize the simple principle that the closer inventory is to the customer, the faster and cheaper it is to ship. They describe using networks of regional and hyper‑local facilities to keep stock near demand rather than in a single central warehouse. That same principle applies when your “customer” is a production line.

In practical terms, that usually means a tiered approach. High‑volume and high‑criticality DO modules live at or near the plant: in the main storeroom, in a maintenance cage, or in a nearby regional warehouse. Lower‑volume modules that still have serious downtime impact can sit in a regional distribution center with guaranteed two‑day service. Rare or legacy cards can be central but must still be in a location that can feed your plants with air freight when needed.

From a systems integrator’s perspective, the goal is to categorize DO modules by risk profile and help your customer align stock placement and shipping SLAs with that risk.

Shipping Methods and When to Use Them

Not all urgent shipping is the same. For DO cards, a simple framework drawn from payment card programs and retail fulfillment is often enough.

Here is a representative way to think about it, using the tiers that Synctera and others describe as a reference point. The costs shown come from payment card examples and illustrate relative magnitude, not hard quotes for DO hardware.

| Service type | Typical transit time (domestic) | Tracking available | Relative cost per shipment | Typical use case for DO cards |

|---|---|---|---|---|

| Economy mail | About 5–7 business days | No | Very low (well under $1 in card programs) | Non‑urgent replenishment where spare stock is already on site |

| Priority mail | About 2–3 business days | Yes | Low to moderate (around single‑digit dollars in card programs) | Moderate urgency, line is safe but redundancy is reduced |

| Two‑day air | About 2 business days | Yes | Higher (tens of dollars for heavier items) | High urgency, but downtime can be managed for a day |

| Overnight air | Next business day | Yes | Highest (can be many tens of dollars) | Line‑down events where every hour counts |

The exact carriers and price points will differ, but the pattern holds. The key is to work with a supplier who defines these tiers explicitly for DO modules, gives you the option to choose based on the situation, and actually hits the promised transit times in practice.

Same‑Day Picking and Cutoff Times

Shipping speed is useless if your order sits in a queue for a day. Noissue’s shipping guidance for e‑commerce highlights the importance of same‑day picking windows: for example, orders placed before mid‑afternoon get picked and handed to the carrier before the daily pickup.

For a DO card service, the same principle applies. You want clearly defined cutoffs such as “orders placed before 4:00 PM local warehouse time ship the same business day” and you want those cutoffs aligned with the carriers’ pickup schedules. In my own projects, I strongly prefer partners who can handle emergency orders by phone or a dedicated portal and escalate picking so that truly critical modules can go out even if they arrive just before the truck leaves.

Packaging DO Modules So They Survive the Trip

I have had replacement DO cards arrive in worse shape than the failed units they were meant to replace. Most of those failures came down to poor packaging. Interestingly, the trading card world offers a lot of practical detail about how to protect thin, fragile, high‑value items in the mail.

Card Kingdom, Fulfyld, Ludex, Just Collect, and others all stress a few consistent points. The item should be immobilized inside a rigid container, protected from bending, moisture, and abrasion. Packaging materials should not themselves pose a risk; reusing personal items, scented materials, or anything that can transfer ink, residue, or pressure marks is strongly discouraged. Excessive tape that makes the package hard to open increases the risk of damage during unpacking.

Translating that to DO cards, a robust packaging approach looks something like this. The module is placed in an anti‑static bag or other suitable protective sleeve. It is then supported by rigid inserts or foam that prevent it from moving inside a box sized correctly for the module. Empty space is filled with proper dunnage rather than improvised materials. For heavier sets of modules, a double‑boxing strategy similar to what trading‑card dealers use is wise: the modules go into a strong inner box, which is then suspended in cushioning inside a larger shipping carton.

Just Collect and PSA both emphasize labeling and documentation: include names, addresses, and any order or reference numbers inside the package, not just on the label. That advice applies equally to DO cards so that receiving teams can reconcile parts quickly, even if labels are scuffed.

Finally, consider environmental conditions. Card shippers talk about avoiding perishable or scented packing materials because they can damage collectibles. For DO cards, the equivalent concern is humidity, conductive debris, and extreme temperatures. Good packaging not only protects against mechanical shock but also shields the electronics from the worst of the environment they will see in the back of a truck or on a loading dock.

Tracking, Communication, and Terms

Brightpearl stresses that the “shipping experience” starts before checkout and runs through to proof of delivery. They recommend clear options, upfront costs, and proactive status communication. MyFBAPrep echoes that customers appreciate tracking numbers, status updates, and clear expectations, and notes that a meaningful share of buyers abandon carts when they cannot see delivery dates.

For DO modules, that translates to a few practical habits. When you place an urgent order, you should receive the tracking number promptly, usually within a few hours once the carrier has it. The supplier should give a realistic estimated delivery date based on service level and destination, and they should be transparent about disruptions. During peak seasons or known bottlenecks, they should update terms and conditions and communicate changes so you are not blindsided.

Responsibility boundaries also matter. Sports card graders like PSA clearly state that they take responsibility for items only once they arrive in their facility and that issues during inbound shipping must be handled with the carrier. Many DO card suppliers operate the same way. That is not unreasonable, but it means you should take tracking and insurance seriously, especially for high‑value orders. Trading card platforms and collectors almost universally recommend tracked shipping and insurance for expensive items; that is exactly how you should treat critical DO cards.

For international shipments, Card Kingdom’s policies around Delivered Duty Paid versus Delivered Duty Unpaid are a good cautionary tale. They require international sell orders to be shipped DDP and refuse DDU shipments because unpaid duties create delays and returns that no one controls. When sending DO modules across borders, the same principle applies: prepaid duties and taxes, clear declared values, and avoiding “gift” labels keep parts from sitting in customs while your line stays down.

Pros and Cons of Leaning on Urgent DO Card Shipping

As a systems integrator, I do not want my customers to believe that a fast shipping service replaces sound spares management. It does not. It complements it. There are clear upsides and real tradeoffs.

On the positive side, a well‑designed urgent DO card service reduces exposure when you have not yet fully optimized spares or when equipment is spread across many smaller sites. Instead of each plant holding large quantities of rarely used modules, you can centralize a portion of that stock and rely on fast, predictable shipping to bridge the gap. It also buys time during migrations and retrofits. When you standardize on a new platform, you may not yet have a perfect spares profile; urgent shipping cushions early mistakes.

Fast delivery also builds confidence. When maintenance teams know that if they misjudge demand there is a realistic path to a replacement in a day rather than a week, they are more willing to decommission questionable hardware instead of nursing it along. Over time, that improves reliability.

On the downside, premium shipping is not free. EasyPost and other logistics specialists are very clear that expedited services can chew into margins quickly. In the industrial world, that means you should reserve overnight air for genuine line‑down or safety‑critical events and rely on two‑day or priority ground for most other cases. You also need to watch out for a false sense of security. If people believe “we can always overnight a card,” they may underinvest in basic spares, only to find that weather, customs, or carrier disruptions make that assumption unreliable.

Lastly, every additional logistics flow adds complexity. Warehouses, 3PLs, and multi‑node networks are powerful, but only when supported by solid systems. Lexicon Tech Solutions and others stress the importance of integrated warehouse management, barcode scanning, and automation to avoid errors. If your urgent shipping provider is running on spreadsheets and manual label printing, you will eventually feel it in missed shipments or wrong parts.

Practical Guidance for Plant and Engineering Teams

From the plant side, the question becomes how to use an urgent DO module delivery service wisely.

Start by categorizing your DO cards by criticality and availability. Some modules are unique to key safety or process loops; if they fail, you cannot run at reduced capacity. Others are used in parallel on non‑critical equipment. Work with your integrator or vendor to flag the modules whose loss would halt production or compromise safety. Those belong either in local stock or covered by the fastest realistic shipping tier from a nearby warehouse.

Next, align purchasing and maintenance on what constitutes an “emergency shipment.” In the same way that retail brands set minimum order thresholds for free expedited shipping, you can set rules for when it is acceptable to pay for overnight air. Maybe any part that is single‑sourced and on a critical path qualifies, while cosmetic or non‑critical items must wait for standard service. The point is to avoid case‑by‑case arguments at midnight when everyone is under pressure.

Payment friction is another overlooked bottleneck. Several sources on virtual cards and digital payment, including Wex and Kodo, explain how organizations use virtual cards to control spend while enabling fast, auditable purchases. The courier sector is beginning to use virtual cards for fuel, vendor payments, and regional branches because they can be issued instantly with tight limits and tracked in real time. The same technique can help maintenance teams buy urgent DO cards from approved suppliers without waiting for new vendor setup or one‑off approvals.

Finally, push for decent integration between your urgent shipping provider and your own systems. Lexicon Tech Solutions and others highlight the advantages of tying shipping systems into warehouse management, barcode scanning, and analytics. For you, that might mean having tracking numbers automatically attached to work orders in your CMMS, or having a dashboard that shows which critical DO cards are in transit and to which site. The goal is to keep tribal knowledge out of someone’s email inbox and inside systems everyone can see.

A Note on International and Multi‑Site Operations

If you are responsible for plants across borders or over long distances, shipping strategy becomes even more important. WareIQ’s experience with a broad network of fulfillment centers shows that spreading stock across a country can sharply reduce transit time. For DO cards, that could mean regional depots on both coasts rather than a single central storeroom.

For cross‑border moves, pay attention to customs, duties, and carrier capabilities. Card Kingdom’s insistence on DDP for international orders is rooted in hard experience with DDU shipments being refused or returned. When you are sending DO cards to a plant in another country, you do not want a customs officer holding the part while your team waits. Prepaid duties, correct declarations, and carriers that actually understand the route matter.

Also recognize that not every shipping service makes sense everywhere. Synctera, for example, notes that some ground methods they support work only between specific countries and that methods suitable for domestic shipments are automatically swapped for international equivalents by their fulfillment provider. For DO cards, you want the same pragmatic behavior: if a requested method does not fit the destination, the system should choose a sensible alternative, not reject the order.

FAQ: Making Urgent DO Card Shipping Work in the Real World

How much should I rely on urgent shipping versus holding local spares? In my experience, you want a blend. For the truly critical DO cards that can stop an entire unit, local spares are still the safest choice. Urgent shipping is your second line of defense when multiple failures happen, when you misjudge spares, or when you are in the early stages of a migration. For less critical modules, it is often more economical to hold minimal local stock and rely on two‑day or priority shipping, provided your logistics partner has a track record of hitting those windows.

Is overnight shipping always worth the premium when a line is down? Not always. Brightpearl’s research on consumer shipping shows that people value a combination of speed, cost, and reliability, not just the fastest option. The same applies to plants. If you can safely run at reduced capacity for a day, two‑day air or priority ground may be a smarter financial choice than overnight, especially once you factor in overtime, receiving constraints, and the reality that “overnight” can still slip due to weather or network congestion. Overnight shipping makes sense when there is a clear, immediate cost to every hour of downtime and when the supplier can genuinely ship the part the same day.

What should I look for when choosing a DO card supplier from a shipping perspective? Look for a combination of stock availability, clearly defined service levels, and operational maturity. You want a supplier that actually carries the DO modules you use, operates multiple stocking locations if your footprint is wide, and can show documented performance on same‑day picking and on‑time delivery. Their packaging needs to treat modules like the sensitive electronics they are, borrowing proven techniques from high‑value trading card shippers and industrial packagers. And their systems should give you fast access to tracking and status, ideally integrated into your own maintenance and purchasing tools. If they are vague on these topics, you can expect that vagueness to appear when you most need clarity.

In the end, urgent DO card shipping is not glamorous work. It is careful inventory placement, disciplined packaging, pragmatic carrier choices, and boringly reliable processes stitched together. From the perspective of a systems integrator who has lived through too many late‑night outages, that quiet reliability is exactly what you want. Design your DO card logistics with the same seriousness you bring to your control logic, and the next time a card fails at 2:00 AM, the answer to “how fast can you get it here?” will be measured in hours, not in anxious guesswork.

References

- https://www.99minds.io/blog/a-comprehensive-guide-to-digital-gift-cards

- https://www.brightpearl.com/blog/how-to-drastically-improve-your-online-buyers-shipping-experience

- https://crownpack.com/3-essential-technologies-to-improve-your-shipping-speed/

- https://www.easypost.com/blog/2022-01-07-3-proven-strategies-to-make-expedited-shipping-possible

- https://www.giftbit.com/blog/instant-gift-card-delivery

- https://www.justcollect.com/how-to-package-your-sports-cards-for-shipping/

- https://www.kodo.com/blog/understanding-virtual-cards-benefits

- https://www.linkedin.com/pulse/practical-guide-using-virtual-cards-courier-industry-7lv2c

- https://www.psacard.com/info/shipguide

- https://docs.synctera.com/docs/card-shipping-overview

Keep your system in play!

Related articles Browse All

-

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu...

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu... -

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ...

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ... -

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

Need an automation or control part quickly?

- Q&A

- Policies How to order Part status information Shipping Method Return Policy Warranty Policy Payment Terms

- Asset Recovery

- We Buy Your Equipment. Industry Cases Amikong News Technical Resources

- ADDRESS

-

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

Copyright Notice © 2004-2026 amikong.com All rights reserved

Disclaimer: We are not an authorized distributor or distributor of the product manufacturer of this website, The product may have older date codes or be an older series than that available direct from the factory or authorized dealers. Because our company is not an authorized distributor of this product, the Original Manufacturer’s warranty does not apply.While many DCS PLC products will have firmware already installed, Our company makes no representation as to whether a DSC PLC product will or will not have firmware and, if it does have firmware, whether the firmware is the revision level that you need for your application. Our company also makes no representations as to your ability or right to download or otherwise obtain firmware for the product from our company, its distributors, or any other source. Our company also makes no representations as to your right to install any such firmware on the product. Our company will not obtain or supply firmware on your behalf. It is your obligation to comply with the terms of any End-User License Agreement or similar document related to obtaining or installing firmware.

Cookies

Individual privacy preferences

We use cookies and similar technologies on our website and process your personal data (e.g. IP address), for example, to personalize content and ads, to integrate media from third-party providers or to analyze traffic on our website. Data processing may also happen as a result of cookies being set. We share this data with third parties that we name in the privacy settings.

The data processing may take place with your consent or on the basis of a legitimate interest, which you can object to in the privacy settings. You have the right not to consent and to change or revoke your consent at a later time. This revocation takes effect immediately but does not affect data already processed. For more information on the use of your data, please visit our privacy policy.

Below you will find an overview of all services used by this website. You can view detailed information about each service and agree to them individually or exercise your right to object.

You are under 14 years old? Then you cannot consent to optional services. Ask your parents or legal guardians to agree to these services with you.

-

Google Tag Manager

-

Functional cookies

Leave Your Comment