-

Manufacturers

- ABB Advant OCS and Advant-800xA

- ABB Bailey

- ABB Drives

- ABB H&B Contronic

- ABB H&B Freelance 2000

- ABB Master

- ABB MOD 300, MOD 30ML & MODCELL

- ABB Procontic

- ABB Procontrol

- ABB Synpol D

- Allen-Bradley SLC 500

- Allen-Bradley PLC-5

- Allen-Bradley ControlLogix

- Allen-Bradley CompactLogix

- Allen-Bradley MicroLogix

- Allen-Bradley PanelView

- Allen-Bradley Kinetix Servo Drive

- Allen-Bradley PowerFlex

- Allen-Bradley Smart Speed Controllers

- 3300 System

- 3500 System

- 3300 XL 8mm Proximity Transducer

- 3300 XL NSV Proximity Transducer

- 990 and 991 Transmitter

- 31000 and 32000 Proximity Probe Housing Assemblie

- 21000, 24701, and 164818 ProbeHousing Assemblies

- 330500 and 330525 Piezo-Velocity Sensor

- 7200 Proximity Transducer Systems

- 177230 Seismic Transmitter

- TK-3 Proximity System

- GE 90-70 Series PLC

- GE PACSystems RX7i

- GE PACSystems RX3i

- GE QuickPanel

- GE VersaMax

- GE Genius I/O

- GE Mark VIe

- GE Series One

- GE Multilin

- 800 Series I/O

- Modicon 984

- Modicon Premium

- Modicon Micro

- Modicon Quantum

- Telemecanique TSX Compact

- Altivar Process

- Categories

- Service

- News

- Contact us

-

Please try to be as accurate as possible with your search.

-

We can quote you on 1000s of specialist parts, even if they are not listed on our website.

-

We can't find any results for “”.

-

-

Get Parts Quote

Finding an Authorized Siemens Distributor: Verification Guide

Why Authorization Matters More Than Ever

In industrial automation, the Siemens logo on a box is not enough. When you build a control panel around a Siemens PLC, motor starter, or safety relay, you are implicitly betting your uptime, your warranty, and sometimes your process safety on that supply chain. Over the years, I have seen plants lose weekends of production because a “great deal” on Siemens hardware came from a seller who turned out to be neither authorized nor interested in helping once things went wrong.

Siemens’ portfolio is broad and technically demanding, from SIMATIC PLCs and SIRIUS motor control to process analytics and building technologies. The company relies on a structured ecosystem of distributors, value‑added resellers, solution partners, and its own branches to get that technology to you. Selecting an authorized distributor and verifying that status is not a formality; it is a risk management step on par with a proper FAT.

This guide walks through what “authorized Siemens distributor” actually means in practice, how Siemens’ own tools help you verify a partner, and how to evaluate a distributor’s competence once authorization is confirmed. The focus is on real‑world, project-driven decisions rather than abstract channel marketing.

What “Authorized Siemens Distributor” Really Means

From Siemens’ side, “authorized” is not just a badge on a website. It describes a contractual relationship with defined territories, product scopes, and obligations.

On the Siemens Digital Industries Software side, distributor terms are spelled out in a Distributor Model Addendum. There, Siemens appoints a partner as a non‑exclusive distributor of specific “Authorized Offerings” in a defined territory. The distributor is allowed to sublicense, distribute, and maintain those offerings, but Siemens explicitly retains ownership and intellectual property, and reserves the right to sell directly and to appoint additional channel partners. The distributor must maintain trained sales and application engineering staff, participate in Siemens training and certification programs, and operate within agreed business plans and performance targets. Although those terms are written for software, they give a clear window into how Siemens thinks about authorized partners in general: trained people, scoped territory, documented performance expectations, and Siemens oversight.

In the industrial hardware space, Siemens describes “Approved Partners” such as value‑added resellers on its global partner pages. These companies resell Siemens industrial technologies while adding engineering, integration, customization, and local support. The call to action on those pages is to use Siemens’ Global Partner Finder to locate appropriate approved partners, reinforcing that authorization is verified centrally rather than being whatever a local sales rep claims.

For building technologies, Siemens’ Branch and Partner Locator explicitly distinguishes between “Siemens” (direct branches), “Solution Partner,” and “Distributor.” It also allows filtering by solution domain such as fire safety, building automation, critical environments, HVAC, and security. That distinction matters. A Siemens branch is the manufacturer itself. A solution partner typically delivers engineered solutions, such as turnkey building automation systems. A distributor focuses on availability, logistics, and component-level support. All three can be legitimate ways to access Siemens technology, but they play different roles and appear differently in official Siemens tools.

From the end‑user side, an authorized Siemens distributor is the entity that sits between you and Siemens for ordering, logistics, and often first‑line technical support. In the NMA Group article on Siemens PLC dealers, distributors are described as intermediaries who not only supply hardware but also provide application-specific selection support, technical knowledge, and lifecycle assistance. Authorized status is important there because it underpins genuine product supply, valid warranties, access to current firmware and software, and formal training paths.

That is why authorization is the starting point. It means Siemens knows this company, has defined what it is allowed to sell and where, and expects it to uphold Siemens’ standards.

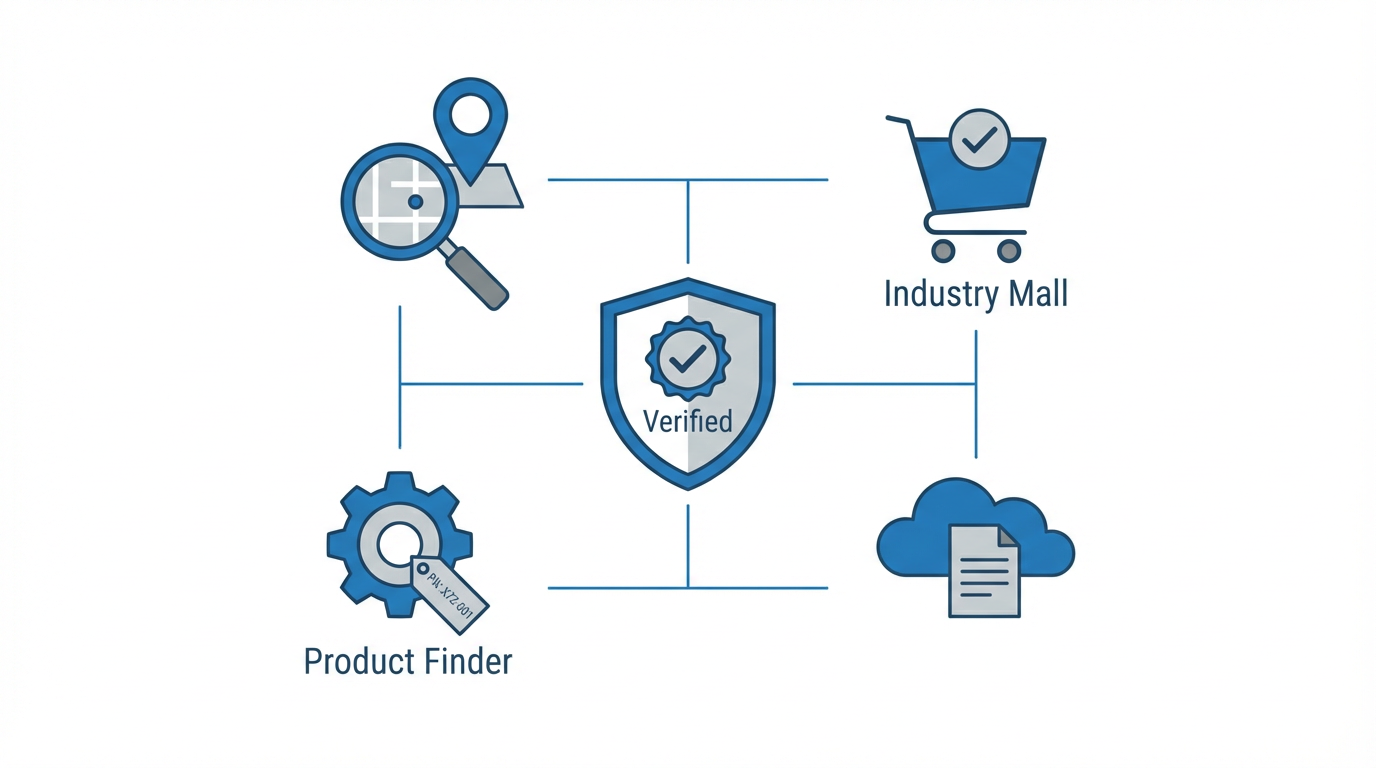

Core Siemens Tools For Validating Distributors

Siemens does not expect you to take a distributor’s word at face value. It provides several locator and catalog tools that let you verify partners and cross‑check products. These tools serve different segments, but together they form a practical verification toolkit.

Geographic and Segment Locators

On the Siemens USA website, the Distributor Locator is presented under the Company and Partners section. Its purpose is straightforward: help users find Siemens distributors in their local area. Instead of listing channel partners in static text, Siemens funnels you to this locator so that information stays current. When a company claims to be an authorized Siemens distributor for a plant in, say, the Gulf Coast, you should expect to see that company appear when you search your region in this locator.

For industrial partners globally, Siemens’ Approved Partners overview for value‑added resellers points to a Global Partner Finder. Siemens positions this as a simple, self‑service search tool to locate the right approved partner in just a few clicks. It is intended for organizations planning industrial or automation projects that require help selecting the right Siemens‑authorized reseller or solution partner. If a firm presents itself as an “Approved Siemens Partner,” the Global Partner Finder is where you confirm that claim.

In building technologies, Siemens operates a Branch and Partner Locator that specifically supports domains such as fire safety, building automation, HVAC, critical environments, and security. This locator distinguishes between Siemens branches, solution partners, and distributors. When you are sourcing building‑automation or fire safety hardware and integration, this distinction tells you whether you are dealing directly with Siemens, with a solution partner engineering a complete system, or with a distributor providing components and local support.

Siemens Digital Industries Software runs its own Find a Siemens Partner page. There, Siemens positions its collaboration with SAP and promotes integrated software solutions that support product development, manufacturing, supply chain, and asset lifecycles. This is the place to verify partners for software and digitalization projects rather than for physical hardware alone.

Product and Catalog Tools

Beyond partner locators, Siemens provides product‑level tools that implicitly validate whether a seller is aligned with Siemens’ catalog and documentation.

The Siemens Industry Mall has historically served as the online catalog and ordering portal for industrial automation and drive technology. In the United States, Siemens has upgraded this to the SiePortal platform, explicitly stating on its legacy Industry Mall welcome page that the old interface is no longer supported and that SiePortal is now the active replacement. For process analytics, a Siemens USA sales locator routes buyers to Industry Mall for detailed product and ordering information. Whether you see Industry Mall or SiePortal referenced, the message is the same: Siemens expects industrial customers to treat this digital catalog as the primary place to view the industrial automation and drive technology portfolio and to place orders.

For industrial controls in the SIRIUS family, Siemens provides an online Product Finder. According to Siemens’ own description, this tool helps users locate industrial parts by entering a part number or product name and emphasizes that the SIRIUS modular system offers one of the largest switching device portfolios on the market, with more than 50,000 tested and approved device combinations across seven physical sizes. Access to technical documentation, certificates, CAD data through the CAx-Download-Manager, and project documentation through MyDocumentationManager is integrated into this ecosystem. When you check the MLFB (part number) your distributor proposed against the SIRIUS Product Finder, you are grounding your bill of materials in Siemens’ own catalog rather than in a salesperson’s spreadsheet.

These tools do not replace a conversation with the distributor, but they are the baseline. If a company is absent from the appropriate Siemens locator, or routinely quotes parts that do not reconcile cleanly with Industry Mall or the SIRIUS Product Finder, you have not verified them yet.

Summary Table: Where To Check What

| Siemens resource | Scope and focus | What it confirms | How it helps verification |

|---|---|---|---|

| Siemens USA Distributor Locator | US hardware channels and locations | That a distributor is officially listed for your local area | Confirms local Siemens-backed sales and support presence |

| Global Partner Finder for Approved Partners | Global industrial partners and value‑added resellers | That a company is an “Approved Partner” in Siemens’ ecosystem | Validates claims of Approved Partner or specialized VAR status |

| Branch and Partner Locator (Building Technologies) | Building technologies: fire, building automation, HVAC, security | Whether you are dealing with Siemens, a Solution Partner, or a Distributor | Clarifies role and capabilities in building-related projects |

| Siemens Digital Industries Software Find a Partner | Software and Siemens–SAP integrated solutions | That a company is an authorized software or digital partner | Aligns software integration partners with Siemens’ ecosystem |

| Industry Mall or SiePortal | Industrial automation and drive product catalog and ordering | That catalog items and configurations are legitimate Siemens offerings | Cross‑checks part numbers, availability, and configurations |

| SIRIUS Product Finder and CAx tools | SIRIUS industrial controls and combinations | That device combinations and MLFBs are valid and documented | Verifies that quoted SIRIUS assemblies are standard and tested |

A Practical Verification Workflow

In practice, verifying a Siemens distributor usually happens under schedule pressure. The plant needs a S7 controller this week, a project team wants a local training class, or a new vendor appears with aggressive pricing. In those scenarios, follow a structured workflow rather than reacting to the loudest sales pitch.

Start From Siemens, Not From The Seller

Begin on Siemens’ side. If you are in the United States, look up your region in the Siemens USA Distributor Locator and note which companies Siemens lists. Globally, run the company name through the Global Partner Finder and, for building technologies, through the Branch and Partner Locator. For digital projects, check the Digital Industries Software partner page. You are trying to answer a simple question: does Siemens recognize this company in the role they claim?

If the company appears as a distributor or approved partner in the right geography and segment, you have a baseline confirmation. If they appear in the locator but under a different category, such as solution partner rather than distributor, clarify what they are actually offering you. If they do not appear at all, treat any “authorized” language in their marketing as unverified.

Confirm The Company, Then The People, Then The Products

Once you have basic confirmation from Siemens’ tools, focus on the humans behind the logo. Siemens’ own distributor terms for software require at least one trained salesperson and one trained application engineer in each authorized location, along with participation in Siemens training and certification programs. While those conditions are not published verbatim for hardware distributors, the pattern is clear: Siemens expects its partners to be staffed with people who know the products.

Ask who on their team is Siemens‑trained on the platforms you care about. In the NMA Group article on Siemens PLC dealers, dealer experience and technical competence are highlighted as critical factors because selecting the wrong PLC or configuration can undermine performance and reliability. Experienced Siemens dealers understand not only which SIMATIC CPU to propose but also how it will integrate with drives, HMI, and existing networks.

Then move to product-level confirmation. Take the Siemens MLFB numbers from the distributor’s quote and verify them in the SIRIUS Product Finder for industrial controls or in the Industry Mall or SiePortal for other automation components. This check ensures that the quoted items exist in Siemens’ catalog, that their descriptions align, and that device combinations (for example, contactor and overload relay sets) match Siemens’ own tested assemblies rather than improvised pairings.

Check How They Handle Returns and Claims

Returns, warranty claims, and DOA situations are where the difference between authorized and gray‑market distributors becomes painfully obvious.

A detailed guide for Siemens distributors published by Continuum describes how Siemens expects returns and claims to be managed. It outlines four main claim types: warranty, defective product, customer satisfaction, and damaged goods. Each type requires specific documentation such as serial and MLFB numbers, original purchase order data, fault descriptions, system configuration information, error logs, photos of damage, and software version details. Eligibility checks include verifying warranty status, product authenticity, licensing, and correct application. The claim itself is submitted through the Siemens Industry Mall portal, where the distributor selects the claim type, uploads documentation, obtains an RMA, and follows defined shipping and credit processes.

An authorized distributor should be instantly familiar with this structure, even if they describe it in their own words. They should be comfortable discussing warranty coverage, RMA processes, and the exact information they will ask from you when a claim arises. If a seller cannot articulate how they process Siemens returns, or if they rely on vague promises instead of a structured workflow, you are almost certainly not dealing with a full Siemens‑authorized channel.

Test Their Technical Depth And Value Add

Beyond authorization, the real value of a Siemens distributor is in applied engineering help. Siemens‑focused distributors such as IES position themselves not just as suppliers but as advisors. They promote application assistance, detailed product information, live demonstrations, and “exclusive pricing” as part of helping customers identify cost‑effective solutions. This is exactly what you need when you are choosing among several possible PLC families, HMI platforms, or motor‑starter schemes.

Similarly, AWC’s authorized Siemens support center and distribution hub in Houston illustrates what a mature partnership can look like. AWC highlights local stocking of Siemens automation and control products, 24/7 inventory access, hotshot delivery and pickup, and same‑day shipments to keep complex projects on schedule. Beyond logistics, they run a Siemens‑focused training center with hands‑on labs, a Solutions Incubator Design Lab for prototyping Siemens‑based solutions, and a Digital Technology Lab where engineering teams can test Siemens PLCs, drives, and control strategies before going live. That combination of inventory, expertise, and lab access is exactly what a plant or OEM needs from a long‑term Siemens partner.

When you evaluate a distributor, look for evidence of similar value‑add: access to labs or demo systems, structured training offerings, local or regional inventory, and a history of supporting projects similar to yours. Those traits matter at least as much as the logo on the business card.

Red Flags And Risk Tradeoffs

Not every seller of Siemens‑branded hardware is an authorized distributor. In the Siemens PLC dealer guidance from NMA Group, one of the clearest warnings is against prices that look unusually low compared with other dealers. Extremely aggressive discounts can signal counterfeit or diverted product, especially when combined with poor documentation and limited willingness to talk about warranty.

Availability and delivery capability are also highlighted there as key evaluation criteria. Reliable dealers maintain reasonable inventory or have proven fast sourcing, because they understand project timelines. A vendor who promises incredible discounts but shows no track record of on‑time delivery is usually shifting risk onto your schedule.

Reputation matters as well. NMA Group recommends checking online reviews and testimonials for evidence of service quality, authenticity, technical competence, and overall customer satisfaction. In my own projects, I consider repeated reports of warranty disputes, unexpected firmware levels, or inconsistent packaging as clear signals to pause.

Online marketplaces require special caution. The NMA Group article suggests using major marketplaces as one search channel but stresses the need for seller verification. In practice, this means differentiating between Siemens‑authorized distributors who also sell on marketplace platforms and anonymous third‑party sellers. Large, established distributors such as RS present Siemens as a strategic brand and emphasize authorized supply and technical reliability on their own sites; when they appear as marketplace sellers, they bring that same channel credibility with them. Unknown marketplace storefronts do not.

The tradeoff is straightforward. Unauthorized or weakly vetted sellers might save a few dollars in the short term, but they routinely cost much more in engineering time, downtime, and lost warranty support. Authorized distributors who understand Siemens’ portfolio, follow the official returns and claims processes, and maintain solid logistics will rarely be the cheapest on paper, but they are usually the most economical over the lifecycle of a project.

Moving Beyond “Authorized” To Choose The Right Partner

Once you have verified authorization, the next question is whether this distributor is the right partner for your specific automation landscape.

The Siemens PLC dealer guidance from NMA Group stresses factors such as dealer experience with Siemens’ range of PLC models and configurations, strong after‑sales support, responsiveness in troubleshooting and maintenance, and the ability to support version upgrades and evolving project requirements. Authorized status gives you access to Siemens; these qualities determine whether the relationship actually helps your plant.

Look for distributors whose strengths align with your needs. If you are modernizing a process plant with complex motor control, a distributor heavily invested in SIRIUS motor‑control hardware and familiar with more than 50,000 tested device combinations is a better fit than one who mostly sells low‑voltage switchgear. If cybersecurity and lifecycle management of automation software are priorities, a partner that appears both in Siemens’ software partner finder and in hardware locators may be ideal.

Training and workforce development are another differentiator. AWC’s Siemens training center and workforce optimization team in Houston demonstrate how a distributor can support the full lifecycle of Siemens automation systems from design and build through operation and maintenance, with a focus on resilient, secure, and maintainable systems. If your internal team is still climbing the Siemens learning curve, a distributor that can provide hands‑on training and ongoing mentoring is far more useful than one that only processes orders.

Finally, consider how the distributor engages with Siemens itself. Siemens’ distributor model for software describes joint business planning, quarterly business reviews, revenue targets, and defined Partner Benefits. Even if you never see those documents, a distributor that mentions a structured business plan with Siemens, participates regularly in Siemens training, and stays ahead of product roadmaps is signaling that it treats the partnership seriously. That usually translates into earlier awareness of product changes, better support during migrations, and more honest conversations when something is not a good fit.

Field Example: Vetting A New Siemens Distributor Under Deadline

To see how this plays out, consider a typical situation. Your plant is adding a packaging line controlled by Siemens PLCs and drives. The EPC hands you a bill of materials that includes several Siemens SIMATIC CPUs, SIRIUS motor starters, and a stack of networking components. A new distributor you have never worked with appears with very attractive pricing and assurances that they are “fully authorized by Siemens.”

Rather than taking that at face value, you start with Siemens. On the Siemens USA Distributor Locator, you search your state and find a shortlist of distributors. The new company is listed, but only in a neighboring city; they are a legitimate Siemens channel, but not the only one. On the global partner pages, you confirm that they are not listed as an Approved Partner with special vertical expertise; they are a general distributor.

Next, you verify the products. You punch the MLFB numbers for the SIRIUS starters into the Siemens Product Finder and confirm that the combinations proposed are standard tested assemblies, not unusual pairings. You use SiePortal or Industry Mall to check that the PLC and drive part numbers, firmware levels, and options exist exactly as quoted.

You then ask about returns and warranty. The distributor’s technical sales lead explains how they process Siemens returns: diagnosing issues, capturing system information, submitting claims through the Industry Mall portal, obtaining RMAs, and keeping you informed through credit processing. They talk comfortably about warranty versus satisfaction returns, and about the documentation they will expect from your team. That matches the process described in Continuum’s guide for Siemens distributors.

Finally, you test their value add. They offer to host a short session in their lab to walk your engineers through the proposed control architecture and simulate basic I/O, and to enroll your technicians in an upcoming hands‑on Siemens PLC course at their training center. Their pricing is competitive but not abnormally low, and they can show a track record of supporting similar projects in your industry.

At that point, you are no longer choosing blindly. You have verified authorization through Siemens’ own tools, cross‑checked products against Siemens catalogs, confirmed that their returns process aligns with Siemens guidance, and assessed their engineering depth. If another distributor clears the same bar but has better local support or labs, you may still choose differently, but you are making a deliberate tradeoff instead of a gamble.

Short FAQ

How can I quickly confirm if a Siemens distributor is genuine?

The fastest path is to use Siemens’ own locators. In the US market, start with the Siemens USA Distributor Locator to see who Siemens lists in your area. For global and vertical projects, check the Global Partner Finder for Approved Partners and, for building technologies, the Branch and Partner Locator that distinguishes Siemens branches, solution partners, and distributors. If a company claiming to be a Siemens distributor does not appear in any relevant Siemens locator, treat that claim as unverified until Siemens or a trusted partner can clarify it.

Is it safe to buy Siemens hardware from online marketplaces?

It depends entirely on who the seller is. NMA Group’s guidance on Siemens PLC dealers suggests using major online marketplaces as one search option, but only when the seller can be verified and has a strong reputation. If the marketplace seller is a known authorized distributor or well‑established industrial supplier that also operates its own Siemens brand page, you can usually treat it as an extension of their normal channel. Anonymous storefronts offering deep discounts with little history, unclear warranty terms, and weak documentation are a different story. In those cases, insist on verifying the company through Siemens’ own tools before placing critical orders.

Can one authorized Siemens distributor support all my sites globally?

Siemens’ own distributor terms for software describe partners as non‑exclusive and tied to specific territories, and partners are prohibited from actively marketing outside those territories even though they may respond to unsolicited requests. In the hardware world, the principle is similar: Siemens uses regional distributors and partners to ensure local support and compliance. For a multi‑site or multi‑country operation, it is often practical to anchor the relationship around a small number of strategic Siemens partners while still respecting regional coverage. The key is to verify each partner through Siemens’ tools for the regions and product families they will actually serve, and to be clear about who is responsible for support and returns at each site.

Closing

In a Siemens‑based automation project, an authorized distributor is not a box‑moving convenience; it is part of your system architecture. When you verify partners through Siemens’ own locators, cross‑check products in official catalogs, and insist on structured returns and real engineering support, you are doing the same thing you do in your PLC code and safety design: managing risk with discipline. That is how you keep projects on track and plants running, and it is exactly how a seasoned systems integrator should approach every Siemens purchase.

References

- http://ftp.cerias.purdue.edu/pub/doc/rfc/pdfrfc/rfc4230.txt.pdf

- https://do-server1.sfs.uwm.edu/search/V77891M008/text/V97033M/siemens-hit-7020_manual.pdf

- https://tcfoverseer.cc.vt.edu/aisb_webapp/help/engineeringhelp/en-us/15056326667.html

- https://www.ssi-locator.com/

- https://siemensproductfinder.tracerapp.com/

- https://www.awc-inc.com/authorized-siemens-support-center-troubleshooting-houston-tx/

- https://resources.gocontinuum.ai/distributor-return-guides/managing-siemens-returns-and-claims-a-comprehensive-guide-for-distributors

- https://mall.industry.siemens.com/goos/WelcomePage.aspx?regionUrl=/us&language=en

- https://theautomationblog.com/how-to-find-your-local-siemens-automation-distributor/

- https://elioplus.com/profile/channel-partners/siemens

Keep your system in play!

Related articles Browse All

-

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu...

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu... -

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ...

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ... -

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

Need an automation or control part quickly?

- Q&A

- Policies How to order Part status information Shipping Method Return Policy Warranty Policy Payment Terms

- Asset Recovery

- We Buy Your Equipment. Industry Cases Amikong News Technical Resources

- ADDRESS

-

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

Copyright Notice © 2004-2026 amikong.com All rights reserved

Disclaimer: We are not an authorized distributor or distributor of the product manufacturer of this website, The product may have older date codes or be an older series than that available direct from the factory or authorized dealers. Because our company is not an authorized distributor of this product, the Original Manufacturer’s warranty does not apply.While many DCS PLC products will have firmware already installed, Our company makes no representation as to whether a DSC PLC product will or will not have firmware and, if it does have firmware, whether the firmware is the revision level that you need for your application. Our company also makes no representations as to your ability or right to download or otherwise obtain firmware for the product from our company, its distributors, or any other source. Our company also makes no representations as to your right to install any such firmware on the product. Our company will not obtain or supply firmware on your behalf. It is your obligation to comply with the terms of any End-User License Agreement or similar document related to obtaining or installing firmware.

Cookies

Individual privacy preferences

We use cookies and similar technologies on our website and process your personal data (e.g. IP address), for example, to personalize content and ads, to integrate media from third-party providers or to analyze traffic on our website. Data processing may also happen as a result of cookies being set. We share this data with third parties that we name in the privacy settings.

The data processing may take place with your consent or on the basis of a legitimate interest, which you can object to in the privacy settings. You have the right not to consent and to change or revoke your consent at a later time. This revocation takes effect immediately but does not affect data already processed. For more information on the use of your data, please visit our privacy policy.

Below you will find an overview of all services used by this website. You can view detailed information about each service and agree to them individually or exercise your right to object.

You are under 14 years old? Then you cannot consent to optional services. Ask your parents or legal guardians to agree to these services with you.

-

Google Tag Manager

-

Functional cookies

Leave Your Comment