-

Manufacturers

- ABB Advant OCS and Advant-800xA

- ABB Bailey

- ABB Drives

- ABB H&B Contronic

- ABB H&B Freelance 2000

- ABB Master

- ABB MOD 300, MOD 30ML & MODCELL

- ABB Procontic

- ABB Procontrol

- ABB Synpol D

- Allen-Bradley SLC 500

- Allen-Bradley PLC-5

- Allen-Bradley ControlLogix

- Allen-Bradley CompactLogix

- Allen-Bradley MicroLogix

- Allen-Bradley PanelView

- Allen-Bradley Kinetix Servo Drive

- Allen-Bradley PowerFlex

- Allen-Bradley Smart Speed Controllers

- 3300 System

- 3500 System

- 3300 XL 8mm Proximity Transducer

- 3300 XL NSV Proximity Transducer

- 990 and 991 Transmitter

- 31000 and 32000 Proximity Probe Housing Assemblie

- 21000, 24701, and 164818 ProbeHousing Assemblies

- 330500 and 330525 Piezo-Velocity Sensor

- 7200 Proximity Transducer Systems

- 177230 Seismic Transmitter

- TK-3 Proximity System

- GE 90-70 Series PLC

- GE PACSystems RX7i

- GE PACSystems RX3i

- GE QuickPanel

- GE VersaMax

- GE Genius I/O

- GE Mark VIe

- GE Series One

- GE Multilin

- 800 Series I/O

- Modicon 984

- Modicon Premium

- Modicon Micro

- Modicon Quantum

- Telemecanique TSX Compact

- Altivar Process

- Categories

- Service

- News

- Contact us

-

Please try to be as accurate as possible with your search.

-

We can quote you on 1000s of specialist parts, even if they are not listed on our website.

-

We can't find any results for “”.

-

-

Get Parts Quote

Allen Bradley 2711P-T10C4D9 PanelView Price Comparison: Market Analysis and Quotes

This is my linkedin:

As a seasoned expert in the field of automation spare parts, Sandy has dedicated 15 years to Amikon, an industry-leading company, where she currently serves as Director. With profound product expertise and exceptional sales strategies, she has not only driven the company's continuous expansion in global markets but also established an extensive international client network.

Throughout Amikon's twenty-year journey, Sandy's sharp industry insights and outstanding leadership have made her a central force behind the company's global growth and sustained performance. Committed to delivering high-value solutions, she stands as a key figure bridging technology and markets while empowering industry progress.

As a systems integrator who has lived through more than one “line down, HMI dead” weekend, I can tell you the Allen Bradley 2711P‑T10C4D9 is one of those catalog numbers that refuses to go away. It sits at the heart of countless machines, and when it fails, everyone suddenly discovers how opaque the pricing really is.

This article walks through what you are actually buying with a 2711P‑T10C4D9, how different channels frame their pricing, what the captured quotes tell us about the market, and how to approach sourcing in a way that protects uptime as much as it protects the project budget.

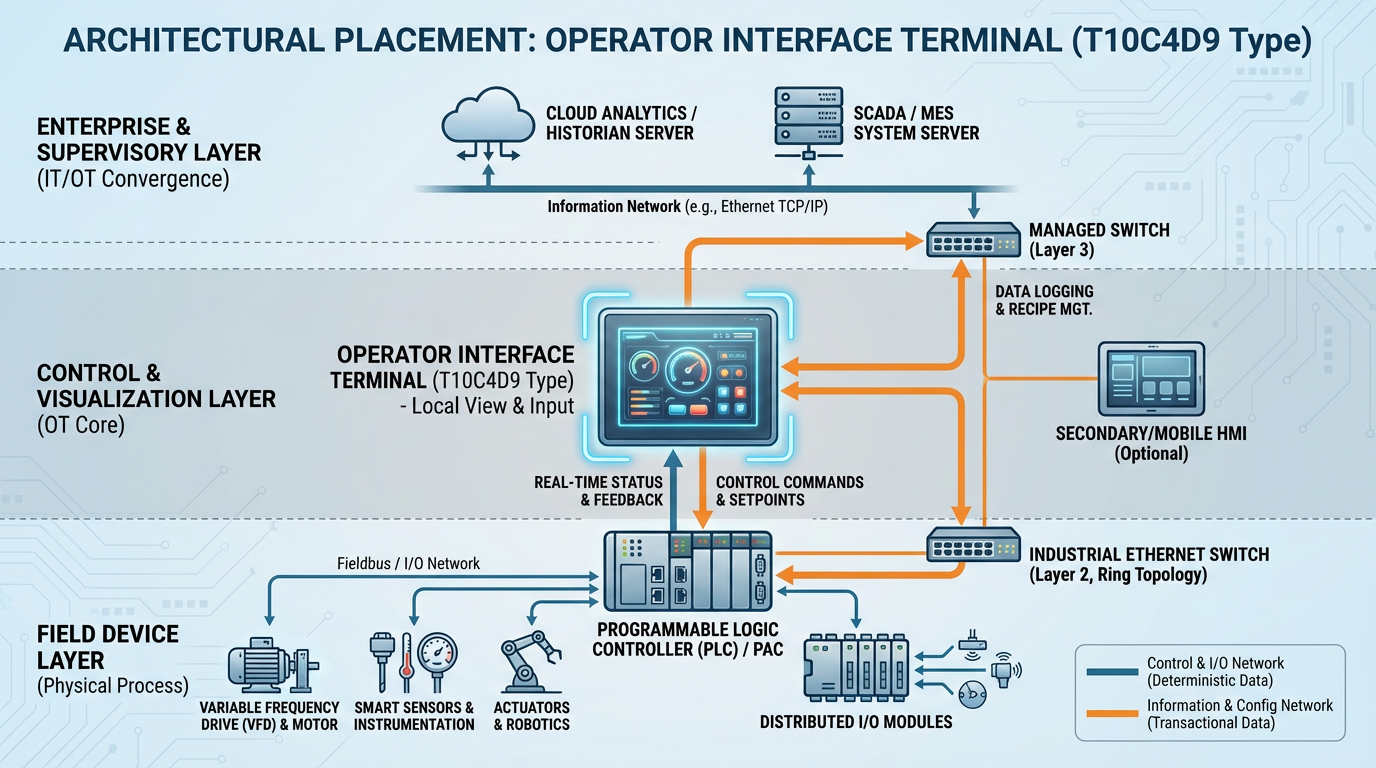

Where The 2711P‑T10C4D9 Fits In Your Architecture

The 2711P‑T10C4D9 is a PanelView Plus 6 1000 operator terminal from Allen‑Bradley, part of Rockwell Automation’s long‑running PanelView Plus family. It is a machine‑level HMI used to display process graphics, alarms, and diagnostics, and to send commands to PLC or PAC based control systems.

Descriptions from industrial distributors such as PLC Parts Solution, MROSupply, DO Supply, and Radwell all position this unit as a mid‑range, general‑purpose HMI. It is not an entry‑level text display, and it is not a high‑end industrial PC. Instead, it occupies that sweet spot most plants rely on: enough screen real estate for decent P&ID graphics, trending, and alarm summaries, without the complexity of a full SCADA node.

Display and Operator Interface

Across the technical descriptions, certain core facts are consistent. The 2711P‑T10C4D9 has a color active‑matrix TFT LCD with a 10.4‑inch diagonal display and a VGA‑class resolution of 640 × 480 pixels in 18‑bit color. The defined active display area is about 8.3 × 6.2 inches, which is a comfortable size for typical machine‑level layouts: one main process graphic, a status banner, and a row of soft buttons or navigation tabs.

Brightness is around 300 nits, which is adequate for indoor plant‑floor use as long as you avoid direct sunlight. The touch screen is an analog resistive membrane, rated in the DO Supply description for roughly a million actuations at a fairly wide operating force range. In practice, that means operators can use gloved fingers and still get reliable input, but it also means very high‑traffic areas will eventually wear the membrane. Many of us in the field plan on replacing a heavily used touch overlay or the entire front module at least once in the lifecycle of the machine.

Several sources highlight a field‑replaceable backlight with an expected life of about 50,000 hours at typical room temperature. In continuous duty, that translates to several years of operation before brightness becomes objectionable. For a plant with 24/7 operation, it is worth treating the backlight as a consumable and aligning its replacement with scheduled outages rather than waiting for an operator to complain about a dim screen.

Performance and Connectivity

Under the hood, the PanelView Plus 6 generation runs Windows CE 6.0. The 2711P‑T10C4D9 is specified with 512 MB of non‑volatile flash and 512 MB of RAM. For FactoryTalk View Machine Edition applications, that capacity is well matched to small and mid‑size projects with reasonable tag counts, localized data logging, and a moderate number of screens. It is not intended for plant‑wide historian workloads or complex multi‑PLC supervision, but it performs well as a dedicated machine HMI.

From the communication side, the model provides Ethernet, an RS‑232 serial port, and USB host/device ports. Ethernet supports EtherNet/IP, which gives you straightforward integration with ControlLogix, CompactLogix, and many MicroLogix controllers. The RS‑232 interface supports DF1 for point‑to‑point links, which helps when you are supporting older SLC or MicroLogix hardware that has not been migrated to Ethernet. The USB ports let you add a keyboard/mouse during commissioning and provide an easy way to move runtime applications or log files via removable storage. Some descriptions also mention an SD card slot for one or two gigabytes of non‑volatile storage, which is useful for recipes, logs, or backup copies of the application.

One important architectural detail is the modular design. The PanelView Plus 6 series uses separate display and logic modules, with an optional communication module depending on the exact catalog variant. That means you can sometimes replace a failed logic module while reusing the existing front display, or vice versa, which is part of why this family remains attractive even as it ages.

Power, Form Factor, and Environment

Power is an area where the research notes illustrate a real‑world sourcing challenge. The PLC Parts Solution and MROSupply descriptions explicitly describe the 2711P‑T10C4D9 as a DC‑powered unit, with a nominal 24 V DC supply and an operating range in the neighborhood of 18 to 32 V DC, which matches Rockwell’s broader catalog conventions. A DO Supply narrative, however, attaches an AC range of 85 to 264 V AC to this catalog number, which is typical for other PanelView variants but not consistent with the “D” suffix many of us know indicates DC.

When I see conflicting power information like this, my standard practice is simple: I do not trust the marketplace description alone. I confirm power type against the manufacturer datasheet and, ideally, against a photo of the actual nameplate. For a replacement on a live machine, ordering an AC unit into a DC panel (or vice versa) is an expensive delay.

Physically, the DO Supply write‑up lists the unit at about 5.7 lb with approximate dimensions of 9.8 × 13.0 × 2.2 inches. Those dimensions line up with a typical PanelView Plus 1000 cutout and bezel, and they match what you see in the field. The enclosure ratings are NEMA Type 12 and 13, with an indoor 4X rating when properly mounted, so the front face is suitable for dust, oil mist, and washdown when the panel is designed correctly. The commonly cited operating temperature range of 32 to 131 °F covers most plant environments; if you are mounting on a hot enclosure in a non‑air‑conditioned area, you still need to consider sun load and internal panel heat.

How It Compares To A Modern PanelView Plus 7

In the research set, there is also information about a PanelView Plus 7 Performance terminal with a 10‑inch SVGA display and Ethernet DLR, sold under a catalog such as 2711P‑T10C22D9P. While that is not the same device, it is the natural evolutionary step from a system architecture standpoint.

That PanelView Plus 7 Performance unit uses a 10‑inch color TFT screen with SVGA‑class resolution, runs on 24 V DC, and includes integrated Device Level Ring Ethernet. It is explicitly positioned as a performance‑tier HMI for more demanding applications, and it ships with a Windows CE license in a configuration Rockwell markets as more capable than the basic Machine Edition terminals.

In practical terms, that means the Plus 7 can offer more memory, higher resolution, better network redundancy, and longer strategic support from the manufacturer. The Plus 6 model, including the 2711P‑T10C4D9, remains perfectly capable for many machines, but it is on the legacy path in Rockwell’s portfolio. That reality matters when you interpret pricing: you are often paying not just for hardware, but for avoiding a larger migration project on a mature machine.

A simple comparison of the two roles looks like this:

| Aspect | 2711P‑T10C4D9 PanelView Plus 6 1000 | PanelView Plus 7 Performance 10‑inch example |

|---|---|---|

| Screen size | 10.4‑inch color TFT | 10‑inch color TFT, SVGA class |

| Resolution | 640 × 480 | SVGA class (higher than basic VGA) |

| Power | Commonly specified as 24 V DC (verify per unit) | 24 V DC |

| OS | Windows CE 6.0 (standard, no extended features) | Windows CE with Pro license |

| Communications | Ethernet, RS‑232, USB; SD card support | Ethernet DLR for resilient ring networks |

| Lifecycle position | Legacy but widely deployed | Current performance‑tier family |

| Typical role | Machine‑level HMI with moderate graphics | High‑demand applications, standardized plant platforms |

From a project perspective, knowing this comparison helps frame the purchasing discussion: do you pay today for a like‑for‑like legacy unit, or do you take the opportunity to start introducing Plus 7 hardware into your installed base?

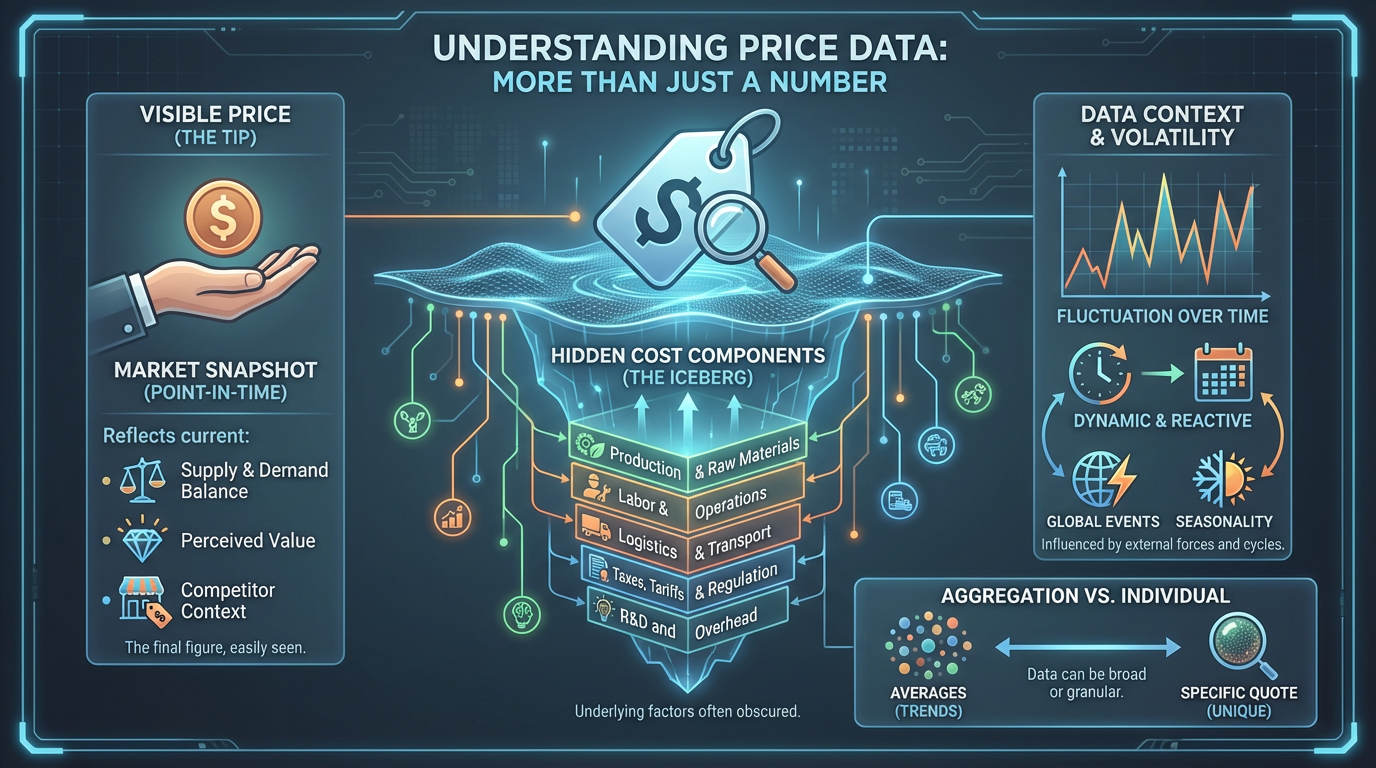

What The Price Data Actually Shows

The research set intentionally captured a mix of distributor and marketplace listings. That gives a more realistic view than looking at a single catalog. Many pages hide their actual prices behind login, human verification, or “call for quote,” but a few e‑commerce listings expose explicit numbers that are useful as historical markers.

Two eBay listings, in particular, provide concrete price points. One listing for “Allen Bradley 2711P‑T10C4D9 PanelView Plus 1000 FNIP” shows a final price of $3,848.40 at the time the listing ended. Another listing, for “Allen Bradley 2711P‑T10C4D9 /A PanelView Plus 10.4 Assembled Terminal NEW 1PC,” records a price of $2,032.00 before it ended. Both are single sample points, but they clearly demonstrate that even in secondary channels the hardware commands a four‑figure price.

A concise way to visualize these sample quotes is:

| Source example | Condition phrase from listing | Sample price (USD) | Notes |

|---|---|---|---|

| eBay marketplace | “PanelView Plus 1000 FNIP” | $3,848.40 | Ended listing; FNIP is a seller code not defined in text |

| eBay marketplace | “2711P‑T10C4D9 /A … NEW 1PC” | $2,032.00 | Ended listing; explicitly described as new |

Other eBay entries in the notes describe units as used with new overlays, or surplus items, but do not show the price in the captured snippet. Several distributors such as Radwell, DO Supply, and MROSupply position themselves as sources for both new and surplus units, or as repair providers, but they treat price as dynamic and either hide it behind logins or display it only in the live web session.

The important conclusion is not that any single number represents “the” price of a 2711P‑T10C4D9. Instead, taken together, these quotes confirm that this is a high‑value industrial component whose cost sits comfortably in the thousands of dollars, and that the spread between different offers can be significant.

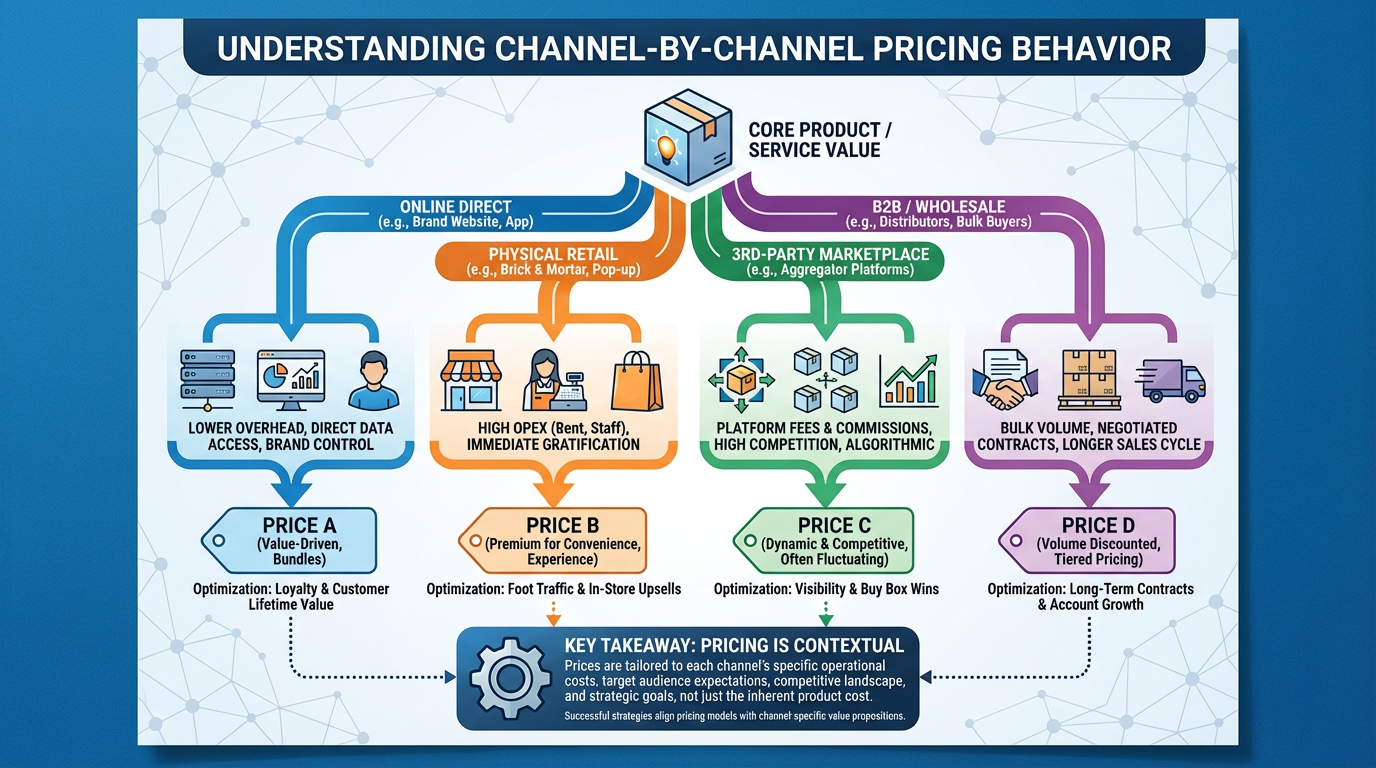

Channel‑By‑Channel Pricing Behavior

When you actually start sourcing these units, the price you see is tightly linked to where you are buying and what condition you are willing to accept. The research notes highlight three broad channels: industrial parts distributors, secondary marketplaces, and global online sellers.

Industrial Parts Distributors and MRO Specialists

Radwell, DO Supply, MROSupply, PLC Parts Solution, and similar firms operate in the familiar MRO space. Their product pages for the 2711P‑T10C4D9 emphasize availability, testing, and warranty rather than raw discounting. Radwell’s write‑ups, for example, talk about providing units in multiple conditions such as new, surplus, or repaired, combined with functional testing and a Radwell‑backed warranty intended to reduce downtime risk. DO Supply promotes “in stock, ships overnight” messaging around the part, along with detailed technical descriptions that are clearly tailored to maintenance teams trying to identify a matching replacement.

In my experience, when you need a PanelView overnight because a line is down, this is the tier you end up calling first. You are paying for more than the piece of hardware; you are paying for a tested unit, a defined warranty, and someone who will actually pick up the phone when the freight carrier misses a connection. The notes also show that some of these sites use human‑verification or region filters before you can even see the catalog details, which is another reminder that automation‑friendly price scraping rarely reflects the real experience of buying one of these under pressure.

Secondary Marketplaces

The eBay listings in the research show a different slice of the market. One listing clearly advertises a unit as used but with a new front overlay. Another marks the unit as new, but the actual condition code is buried in the seller’s language and not standardized. Some sellers are in the United States; others are in Asia. Several listings explicitly mention shipping restrictions, such as “does not ship to Hong Kong,” and there are long notes about duties, taxes, and brokerage fees for international buyers.

From a pricing standpoint, these listings can be attractive, and the historical numbers in the notes show serious money changing hands. The flip side is that you are accepting more variability in how “new,” “used,” “surplus,” or codes like “FNIP” are defined by each seller. You are also dealing with customs risk, import VAT or similar taxes, and longer transit time for international shipments.

If the HMI is one of multiple redundant operator stations, or you are buying a spare to sit on a shelf, a well‑reviewed marketplace seller can be a reasonable way to stretch the budget. For a single point of control on a critical machine, you need to factor the cost of an unexpected DOA unit or a mis‑labeled power variant into your decision.

Global Online Sellers

The research also includes product pages from global sellers such as NexAuto and DHGate. These pages position the 2711P‑T10C4D9 as a rugged industrial HMI and emphasize low cost, broad application fit, and long‑term reliability. They highlight general environmental ranges, resistance to dust and vibration, and strong marketing claims about efficiency and downtime reduction, but they often defer exact specifications back to the official datasheet.

These channels are particularly common when the part is scarce in a local region. You can assemble an entire automation bill of materials from one of these sellers, but you should be clear about tradeoffs: warranty enforcement across borders, response time for technical questions, and the risk of receiving a clone or non‑genuine unit if the deal seems too good to be true. The notes mention that such sellers often stress their willingness to support setup and troubleshooting, but they rarely publish the same level of quantitative detail you see from Rockwell‑centric distributors.

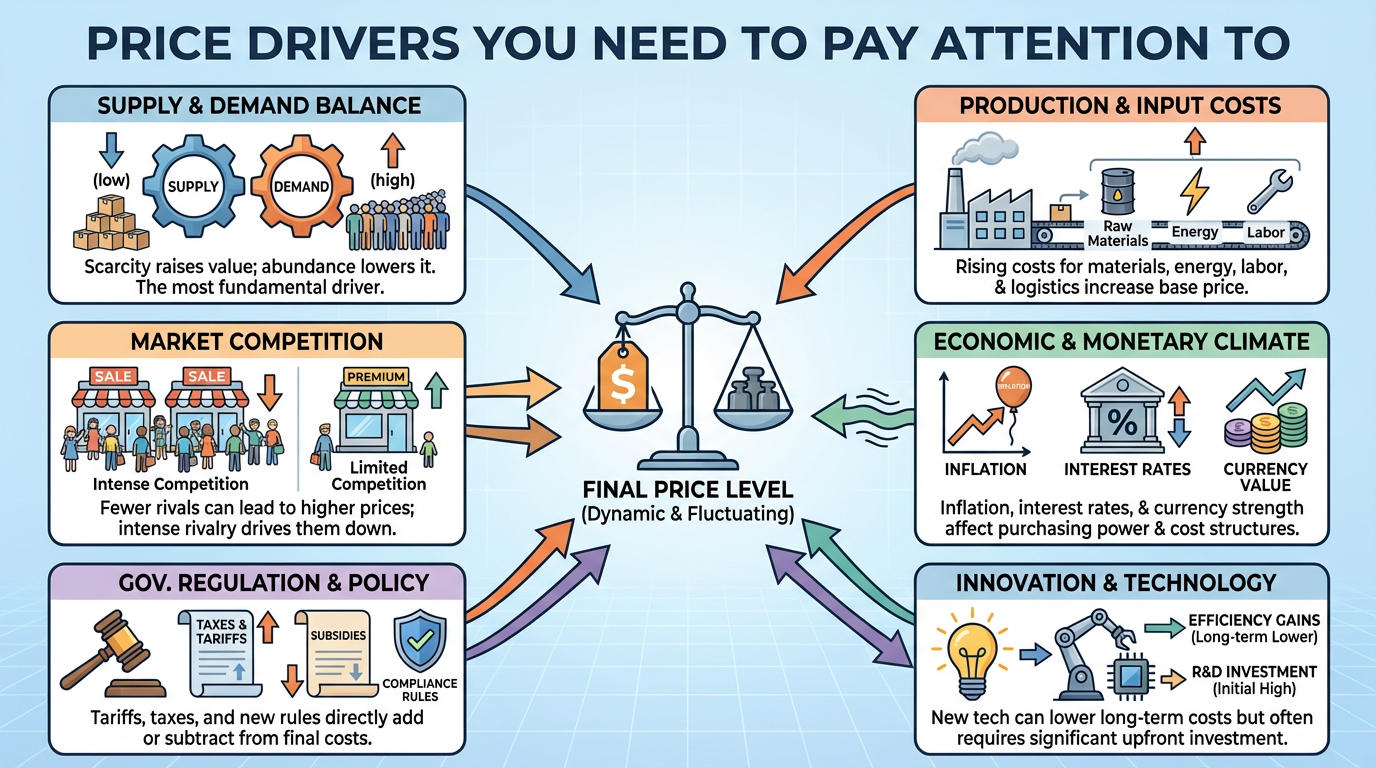

Price Drivers You Need To Pay Attention To

When you peel away the marketing language, the patterns behind 2711P‑T10C4D9 pricing are straightforward. The specific numbers move week by week, but the drivers are stable.

Condition is the most obvious one. A unit described as unused or new in box, from a seller who handles industrial hardware routinely, commands a premium. A used unit with a new overlay, or a refurbished unit, will typically cost less but requires more scrutiny of test practices and return policies. The presence of codes like “FNIP” in one of the eBay listings, without a definition in the text, is a good example of why you should not assume you know what a seller means. Ask for clarification and photos of the actual part and its nameplate.

Power variant and communication configuration are equally important. The research notes specifically call out the confusion created when one description attaches an AC power range to a catalog number that other sources list as DC. If you have ever opened a panel to find a DC supply feeding a device you thought was AC, you know why I insist on part‑number‑level matching and photo verification from the seller before committing to a purchase, especially in secondary channels.

Firmware compatibility and software environment are another subtle driver. If your existing runtime application is built for a particular firmware level or a specific Windows CE build, you want either a like‑for‑like terminal or a clear migration plan. Some distributors will pre‑load a tested image for you; others simply ship the hardware. That support level affects both price and risk.

Finally, geographic factors matter. Several marketplace listings in the research emphasize customs value declarations, import duties, taxes, and brokerage fees. Those costs can easily push an apparently cheap cross‑border purchase into the same total landed cost as a domestic distributor, especially once you include the risk and time value of money during a long transit.

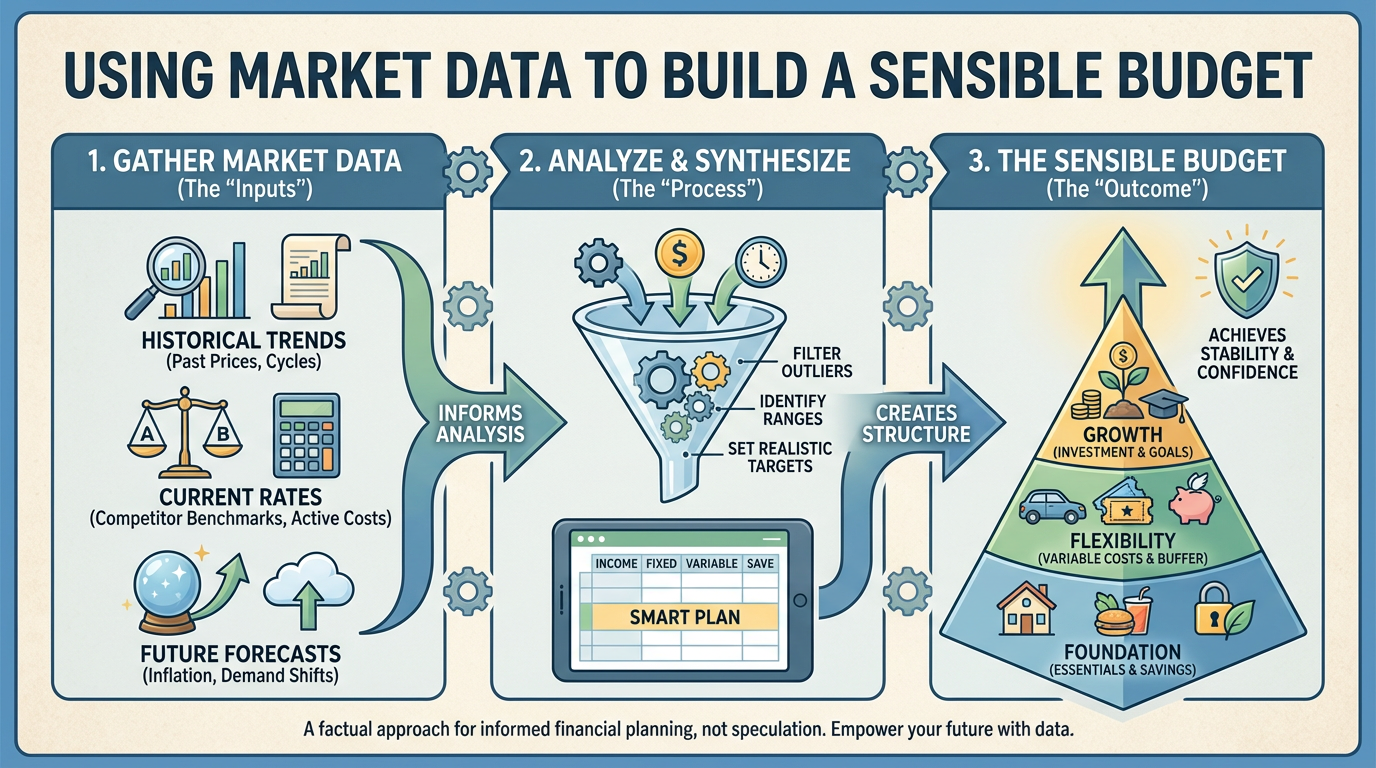

Using Market Data To Build A Sensible Budget

Given that so many sites hide live prices, you will rarely be able to build a perfect spreadsheet of current offers. What you can do, and what I recommend, is to use sample data points like the historical eBay prices together with qualitative information from distributors to set a realistic budget band instead of a single figure.

If the sample marketplace prices cluster in the low‑to‑mid four figures and distributor quotes come back somewhat higher for fully tested units, that is not a surprise. The key is to treat the lower end as an opportunity, not an assumption. As a project partner, when I present options to a plant, I usually frame them like this in plain terms: a higher‑priced but warrantied replacement from an MRO specialist, a lower‑priced marketplace option with more integration and quality‑control work on our side, and, where appropriate, a modernization path using a PanelView Plus 7 terminal and a small engineering scope to convert the runtime application.

The research notes from Radwell’s listing explicitly recommend considering long‑term migration to newer Rockwell HMI platforms while using surplus and repair offerings to support the legacy installed base. That is the same strategy many of us in integration roles apply: stabilize the line with like‑for‑like replacements where risk is low, and schedule structured migrations where the business case justifies it.

When you request quotes, you will get better, more comparable responses if you include exact catalog number, preferred revision if known, required power type, target firmware family, and whether you will accept used or repaired units. Several of the sources in the research mention revision codes such as “/A” in the catalog number; those suffixes can affect compatibility, so it is worth including them in your RFQs.

Practical Sourcing Advice From The Field

Looking across the specifications and the pricing behavior, a few pragmatic guidelines emerge that I apply whenever a project touches the 2711P‑T10C4D9.

First, treat power and communication as non‑negotiable match points. Do not assume a listing is correct if it contradicts manufacturer conventions; cross‑check power input and ports against official Rockwell Automation documentation and the label on your existing unit. This is especially important given the conflicting AC and DC descriptions present in the research notes.

Second, decide upfront whether you are buying a production spare or a tactical fix. For a spare that will live on a shelf, a carefully vetted marketplace unit may be acceptable. For a single HMI that is the only interface to a critical machine, the additional cost of a new or thoroughly tested unit from an MRO specialist is often trivial compared to the plant‑wide cost of downtime or a failed installation.

Third, do not underestimate the value of lifecycle alignment. If your facility is already standardizing on PanelView Plus 7 Performance HMIs, then continuing to invest in legacy Plus 6 hardware like the 2711P‑T10C4D9 may be a short‑term convenience that prolongs long‑term fragmentation. The PanelView Plus 7 example in the research notes, with its Ethernet DLR support and performance‑tier positioning, is a reminder that the manufacturer’s roadmap is moving on even if your installed base has not yet caught up.

Fourth, factor customs, taxes, and logistics into every cross‑border purchase. Multiple eBay entries in the research spend more space describing international shipping, customs value, import duties, and brokerage fees than they do on the hardware itself. Those are not theoretical concerns; they directly affect the total landed cost and the timing of your project.

Short FAQ

Why is the 2711P‑T10C4D9 still so expensive for a legacy HMI?

Because it is still heavily deployed and directly compatible with existing FactoryTalk View ME applications and Rockwell PLC architectures. The combination of ongoing demand, limited new production, and the cost of downtime when one fails keeps both distributor and marketplace prices firmly in the four‑figure range, as the historical eBay data points illustrate.

Is it safe to buy a 2711P‑T10C4D9 from online marketplaces?

It can be, but it requires more diligence. The research shows used units with new overlays, various condition codes such as “FNIP,” and explicit warnings about international duties and taxes. If you go this route, insist on clear photos of the nameplate, confirm the catalog and revision, and understand the seller’s test and return policy. For critical applications, I usually favor a tested unit with a strong warranty, even at a higher price.

When should I consider moving to a PanelView Plus 7 instead of buying another Plus 6 unit?

If you are planning a significant controls upgrade, standardizing on a newer family like PanelView Plus 7 Performance makes sense. The Plus 7 example in the research offers better network features, a current operating system, and a clearer future in Rockwell Automation’s roadmap. For ad‑hoc replacements where budget is tight and downtime is the primary concern, staying with a 2711P‑T10C4D9 or another Plus 6 unit remains a pragmatic choice, provided you recognize that you are investing further in a legacy platform.

In the end, the 2711P‑T10C4D9 is not just a part number; it is a proxy for how you manage risk and lifecycle in your automation assets. Approach its pricing with the same discipline you apply to safety and uptime, and it will behave like what it is meant to be: a reliable operator window into your process, not a surprise line item in your maintenance budget.

References

- https://lodgable.com/allen-bradley-2711p-t10c4d9-ser-a-panelview-plus-6-1000-terminal-dc-power-10-4-XVlTUVNSXFYYU1ha

- https://www.quicktimeonline.com/2711p-t10c4d2

- https://www.dhgate.com/goods/1005773707.html

- https://www.ebay.com/itm/126684099622

- https://eecoonline.com/shop/AB2711PT10C22D9P

- https://www.nex-auto.com/products/allen-bradley-2711p-t10c4d9-10-4-inch-industrial-hmi-display

- https://www.plchardware.com/Products/RA-2711P-T10C4D9.aspx?srsltid=AfmBOooO167dbDq-BYS9HeiTq6xAi7bSTYaqXNMt8A9TmEywmUMdab1a

- https://plcpartssolution.com/products/allen-bradley-2711p-t10c4d9-panelview-plus-6-1000-hmi?srsltid=AfmBOopfpojExXLPz3XaIrTa1_J0QTzzp56t3-vaHSIspoDsf39AJn4o

- https://www.stateelectric.com/products/allen-bradley-2711p-t10c22d9p

- https://www.frommelectric.com/2940165/product/rockwell-automation-2711p-t10c4d9

Keep your system in play!

Related Products

Related articles Browse All

-

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu...

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu... -

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ...

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ... -

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

Need an automation or control part quickly?

- Q&A

- Policies How to order Part status information Shipping Method Return Policy Warranty Policy Payment Terms

- Asset Recovery

- We Buy Your Equipment. Industry Cases Amikong News Technical Resources

- ADDRESS

-

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

Copyright Notice © 2004-2026 amikong.com All rights reserved

Disclaimer: We are not an authorized distributor or distributor of the product manufacturer of this website, The product may have older date codes or be an older series than that available direct from the factory or authorized dealers. Because our company is not an authorized distributor of this product, the Original Manufacturer’s warranty does not apply.While many DCS PLC products will have firmware already installed, Our company makes no representation as to whether a DSC PLC product will or will not have firmware and, if it does have firmware, whether the firmware is the revision level that you need for your application. Our company also makes no representations as to your ability or right to download or otherwise obtain firmware for the product from our company, its distributors, or any other source. Our company also makes no representations as to your right to install any such firmware on the product. Our company will not obtain or supply firmware on your behalf. It is your obligation to comply with the terms of any End-User License Agreement or similar document related to obtaining or installing firmware.

Cookies

Individual privacy preferences

We use cookies and similar technologies on our website and process your personal data (e.g. IP address), for example, to personalize content and ads, to integrate media from third-party providers or to analyze traffic on our website. Data processing may also happen as a result of cookies being set. We share this data with third parties that we name in the privacy settings.

The data processing may take place with your consent or on the basis of a legitimate interest, which you can object to in the privacy settings. You have the right not to consent and to change or revoke your consent at a later time. This revocation takes effect immediately but does not affect data already processed. For more information on the use of your data, please visit our privacy policy.

Below you will find an overview of all services used by this website. You can view detailed information about each service and agree to them individually or exercise your right to object.

You are under 14 years old? Then you cannot consent to optional services. Ask your parents or legal guardians to agree to these services with you.

-

Google Tag Manager

-

Functional cookies

Leave Your Comment