-

Manufacturers

- ABB Advant OCS and Advant-800xA

- ABB Bailey

- ABB Drives

- ABB H&B Contronic

- ABB H&B Freelance 2000

- ABB Master

- ABB MOD 300, MOD 30ML & MODCELL

- ABB Procontic

- ABB Procontrol

- ABB Synpol D

- Allen-Bradley SLC 500

- Allen-Bradley PLC-5

- Allen-Bradley ControlLogix

- Allen-Bradley CompactLogix

- Allen-Bradley MicroLogix

- Allen-Bradley PanelView

- Allen-Bradley Kinetix Servo Drive

- Allen-Bradley PowerFlex

- Allen-Bradley Smart Speed Controllers

- 3300 System

- 3500 System

- 3300 XL 8mm Proximity Transducer

- 3300 XL NSV Proximity Transducer

- 990 and 991 Transmitter

- 31000 and 32000 Proximity Probe Housing Assemblie

- 21000, 24701, and 164818 ProbeHousing Assemblies

- 330500 and 330525 Piezo-Velocity Sensor

- 7200 Proximity Transducer Systems

- 177230 Seismic Transmitter

- TK-3 Proximity System

- GE 90-70 Series PLC

- GE PACSystems RX7i

- GE PACSystems RX3i

- GE QuickPanel

- GE VersaMax

- GE Genius I/O

- GE Mark VIe

- GE Series One

- GE Multilin

- 800 Series I/O

- Modicon 984

- Modicon Premium

- Modicon Micro

- Modicon Quantum

- Telemecanique TSX Compact

- Altivar Process

- Categories

- Service

- News

- Contact us

-

Please try to be as accurate as possible with your search.

-

We can quote you on 1000s of specialist parts, even if they are not listed on our website.

-

We can't find any results for “”.

-

-

Get Parts Quote

One-Stop Procurement Solutions for Industrial Parts: A Veteran Integrator’s Playbook

This is my linkedin:

As a seasoned expert in the field of automation spare parts, Sandy has dedicated 15 years to Amikon, an industry-leading company, where she currently serves as Director. With profound product expertise and exceptional sales strategies, she has not only driven the company's continuous expansion in global markets but also established an extensive international client network.

Throughout Amikon's twenty-year journey, Sandy's sharp industry insights and outstanding leadership have made her a central force behind the company's global growth and sustained performance. Committed to delivering high-value solutions, she stands as a key figure bridging technology and markets while empowering industry progress.

When you run an industrial plant or build control systems for a living, you quickly learn one truth: production does not care that purchasing is “working on it.” If a $40 sensor or a non-stock contactor is missing, the line is down, labor is idle, and suddenly everyone wants to know why the part was not on the shelf or on the truck.

I have spent much of my career as a systems integrator and project partner, sitting between maintenance teams who live and die by uptime and procurement teams who live and die by budgets and compliance. Over the last decade, the most reliable plants I work with have converged on a similar model: a one-stop procurement solution for most of their industrial parts and MRO (maintenance, repair, and operations) needs, backed by solid digital tools and a clear strategy.

Done well, this model cuts downtime, simplifies projects, and gives finance accurate visibility without turning procurement into a bottleneck. Done poorly, it can leave you over-dependent on a single supplier and blind to better options. This article lays out how to get it right, grounded in both hands-on experience and what leading procurement research and industrial vendors are proving at scale.

What “One-Stop” Procurement Really Means For Industrial Parts

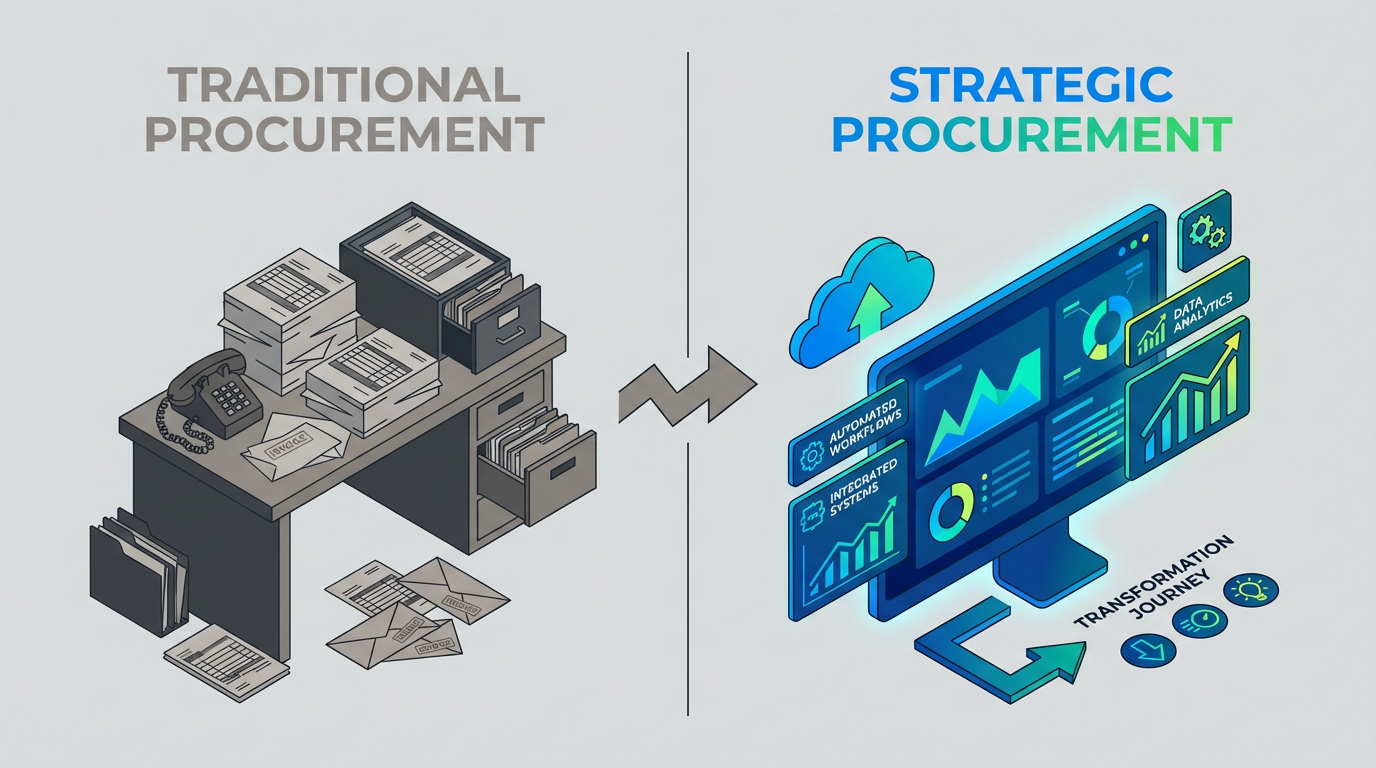

Before talking about one-stop solutions, it is worth being precise about procurement itself. Research from universities and procurement experts describes procurement management as the end-to-end, strategic process of acquiring goods and services, from identifying needs and forecasting, through sourcing and contracting, to purchase orders, receiving, payment, and ongoing supplier performance management. Purchasing is just one slice of that lifecycle: the transactional act of ordering and paying.

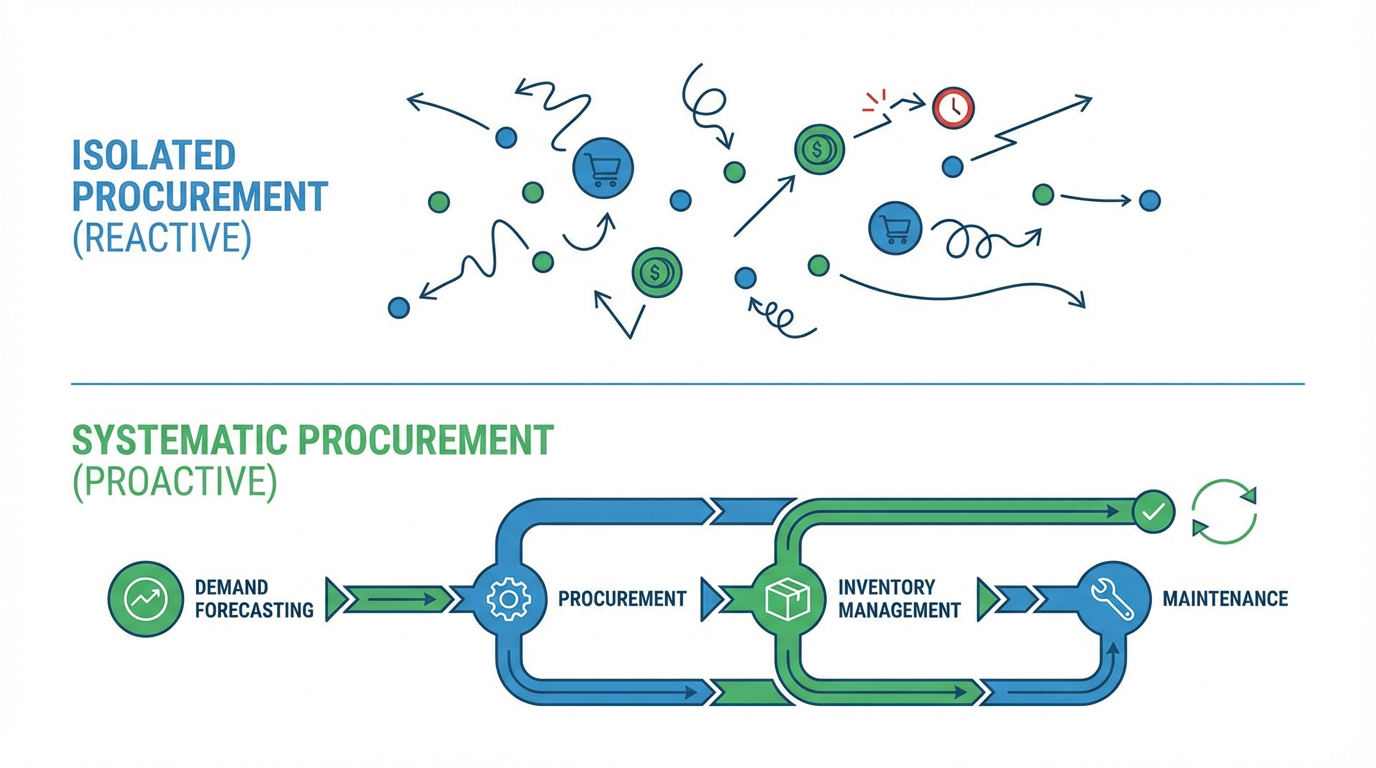

In the industrial world, SmartEquip draws a similar line between parts purchasing and parts procurement. Traditional parts purchasing is reactive and short-term. A pump fails, a tech fills out a request, purchasing gets three quotes, and the cheapest acceptable part wins. You fix today’s problem but you do not necessarily improve the system. Parts procurement is broader. It looks at the total value over time: uptime, wrench time, error reduction, how quickly technicians find the right part, and how well the internal supply chain performs overall.

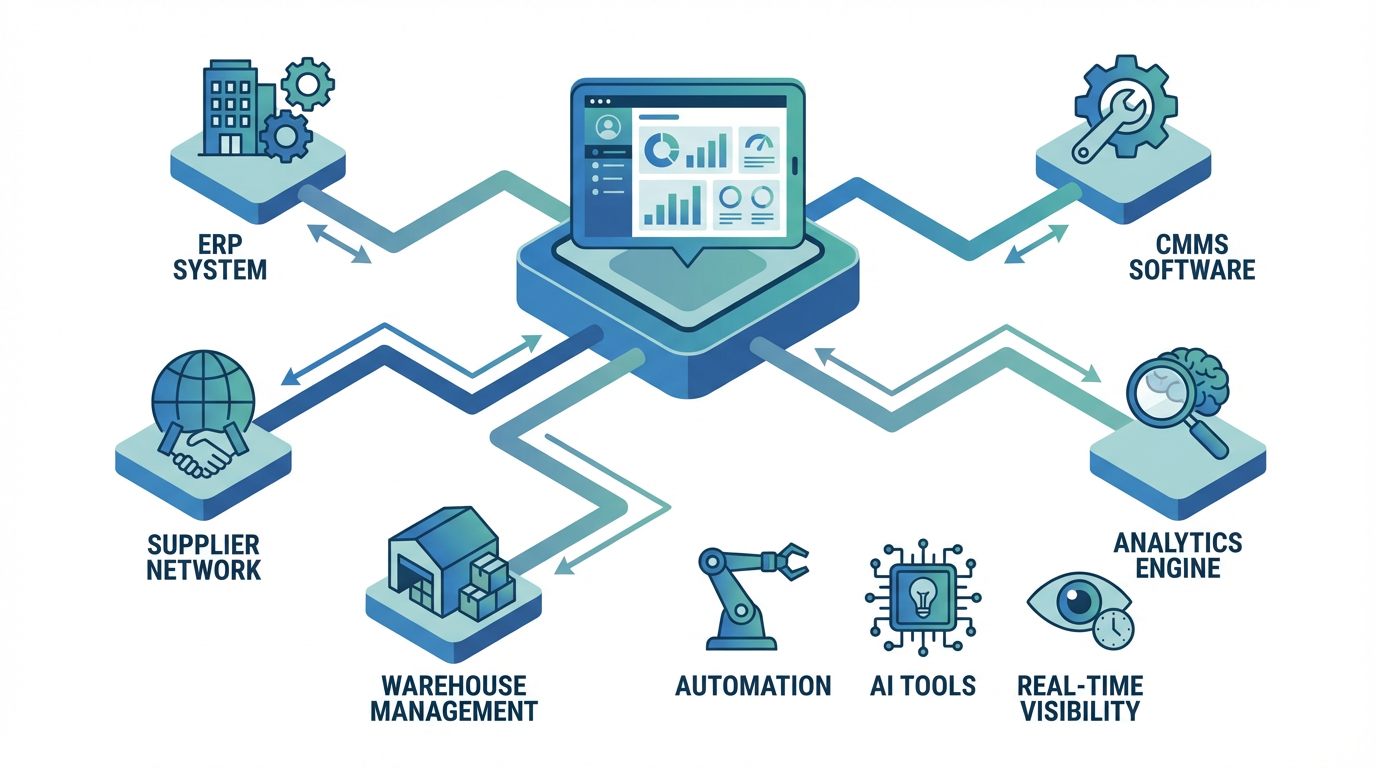

A one-stop procurement solution for industrial parts, in that context, is not just a vendor with a big catalog. It is a strategic partner and platform that can meet most of your recurring parts and MRO needs through a single, integrated channel. That channel should combine three things: a broad, reliable product range for your plant and control systems; the logistics and stock to get those items to you fast and consistently; and digital tools that integrate with your ERP, CMMS, or maintenance platforms so the process from request to receipt is predictable and visible.

Modern procurement content emphasizes that procurement is now a strategic function, not a back-office cost center.

When you consolidate spend with the right one-stop partner, that strategy becomes real: your parts pipeline starts to function like a designed system instead of a series of heroic expedites.

Why Industrial Plants Struggle With Parts Procurement Today

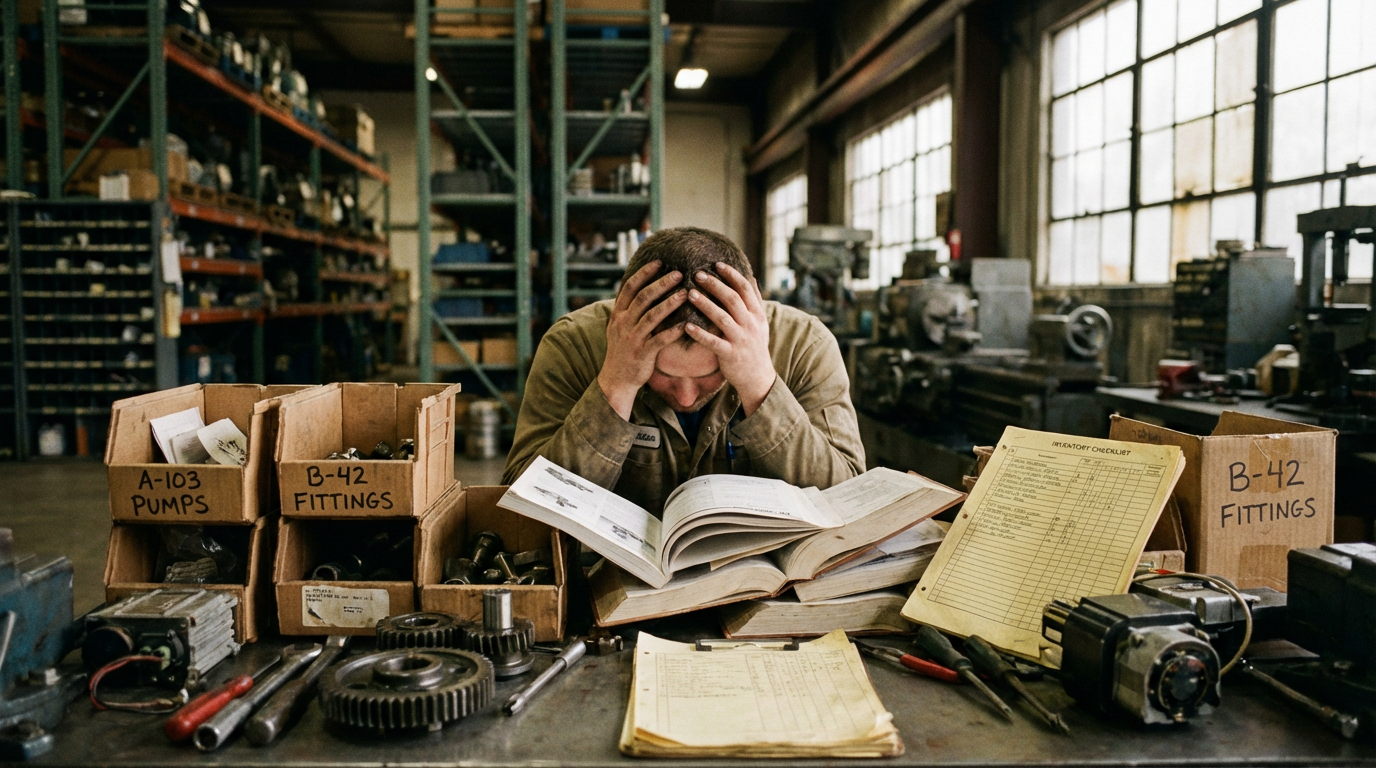

Most plants do not start with a clean slate. They grow a supplier base the way a control cabinet grows extra terminal blocks: bit by bit, under pressure. Flexaust notes that poor MRO purchasing leads to duplicate stock, obsolete inventory, shortages, and unplanned downtime. In practice, that looks like shelves full of parts nobody trusts and empty bins for the ones you actually need.

Several recurring issues show up across research and in day-to-day plant life.

Spare parts and MRO management are often fragmented. Tractian defines spare parts management as everything related to sourcing, storing, tracking, and distributing parts within the facility. When those activities are split across spreadsheets, personal notes, and different vendors chosen by each supervisor, you create blind spots. Maintenance walks to the crib and cannot trust the counts. Procurement cannot see what is really critical versus nice-to-have. Finance cannot tell whether you are carrying smart safety stock or dead inventory.

Process inefficiency and manual work drag everyone down. Procurement efficiency studies highlight that many organizations still rely heavily on manual requisitions, paper or email approvals, and separate systems for purchasing and accounting. Ramp and SDI both emphasize that these fragmented workflows waste time, introduce errors, and block procurement from acting as a strategic partner. Jabil notes that by 2025, the overwhelming majority of companies use AI-powered tools for parts of the procurement process, which tells you where the competitive bar is heading.

Risk and disruption are rising while visibility lags. Procurement research from large consultancies points out that nearly four out of five global supply chains have faced disruptions in recent years, and that procurement fraud now ranks among the most disruptive economic crimes alongside cybercrime and corruption, according to PwC. GEP’s manufacturing analysis reminds us that a single delayed part can shut down an assembly line and that excess or obsolete inventory traps capital you could have invested in new equipment or product launches.

Finally, suppliers are too often treated as interchangeable. Procurement strategy content from Gartner and procurement magazines stresses that supplier relationship management is now a structured discipline. If your plant is still bouncing between vendors based on whoever answers the phone first, you are leaving resilience, innovation, and better terms on the table.

When you overlay these realities, it is not surprising that a one-stop approach looks attractive.

The question is not whether to simplify, but how to do it without creating new risks.

The Case For A One-Stop Partner

Operational And Financial Benefits

From an operations standpoint, the first advantage of a one-stop solution is simple: fewer moving parts in your supply chain. Flexaust explicitly links consolidating to a “one-stop-shop” supplier with smoother operations, less disorder, and faster product movement. When you cut the number of vendors, you also cut the number of purchase orders, invoices, and vendor records that your team needs to manage.

Research on procurement best practices backs this up. Amazon Business notes that standardized, centralized, and automated procurement workflows reduce errors, enforce policy compliance, and free teams from manual tasks. Case studies show multi-site organizations using guided buying, consolidated invoicing, and spend analytics to cut manual delivery and accounts payable effort across hundreds or thousands of locations. Those are the same mechanics that make it easier for a maintenance planner in one plant and a project engineer in another to get parts through the same channel without reinventing the wheel.

Cost is another angle. Many sources emphasize that consolidating spend with fewer, more capable suppliers increases negotiation leverage and enables better pricing and terms. Una and other procurement advisors describe how rationalizing the supplier base reduces what they call “maverick” and “tail” spend: the scattered, low-value purchases and off-contract buys that eat up disproportionate administrative time. Ramp frames procurement efficiency as not just an exercise in cost cutting but a way to make procurement itself more scalable and strategic, reporting significant vendor savings and time reductions by using its own software.

Automation and digitalization amplify those gains. Jabil notes that by 2025, almost all companies will use AI-powered procurement tools. Amazon Business cites that well over half of procurement teams have budgeted for automation or AI and that many leaders expect double-digit percentage cost savings from automating non-strategic spend. Those savings do not come from squeezing suppliers on unit price alone. They come from compressing cycle times, reducing errors, and making it easier for people to buy correctly the first time.

In a one-stop model, your ability to exploit those tools in a coordinated way goes up. Rather than integrating several smaller catalogs and vendor portals, you invest in deeper integration with one primary partner and align your internal processes accordingly.

Strategic Value Beyond Price

Price still matters, but procurement strategy research is very clear: the function that wins long term is the one that focuses on total cost of ownership, risk, and value creation. ProcurementMag and others emphasize strategic sourcing and supplier relationship management as ways to drive innovation, improve quality, and open new markets, not just shave pennies off each part.

A strong one-stop partner can act as a gateway to that broader value. Advanced Technology Services, for example, positions its MRO and industrial procurement services as part of a larger asset management offering that includes intra-site logistics, warranty tracking, and sourcing hard-to-find parts to cut downtime and waste. In other words, they are not just selling you parts; they are helping manage the entire lifecycle of those parts in your operation.

Digital maturity is part of the strategic story. Ivalua describes modern procurement as being anchored in integrated platforms that span source-to-contract and procure-to-pay. Veridion shows how AI-enriched supplier databases can drastically cut supplier discovery time and improve risk screening. Sievo lays out procurement strategy as a medium-to-long-term roadmap that links data, technology, user experience, skills, and operating models into a coherent whole.

When you align with a one-stop partner that has invested in these capabilities, you leverage their scale and tooling instead of building everything from scratch.

That is particularly powerful for mid-sized manufacturers and integrators who cannot justify a large internal procurement technology team but still want the benefits of digital procurement.

Risks And Tradeoffs Of One-Stop Procurement

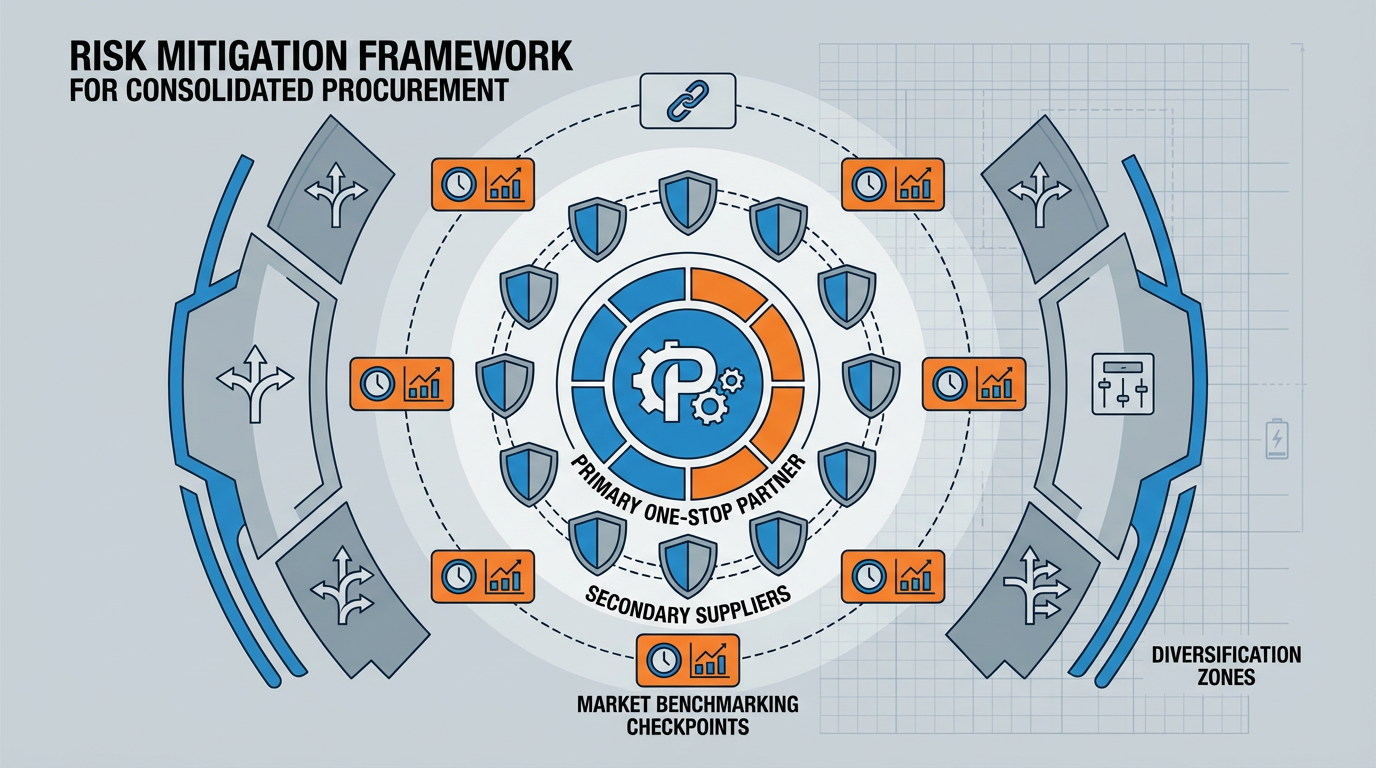

No strategy is free of tradeoffs. A one-stop model consolidates risk as well as spend. That needs to be acknowledged and managed frankly.

One obvious concern is over-reliance on a single supplier. GEP’s work on manufacturing procurement highlights that supply disruptions, raw material price swings, and geopolitical events can hit suddenly and hard. If most of your critical parts flow through one channel and that channel has a regional disruption, a system outage, or a financial problem, your exposure is significant.

Another concern is price complacency. When most of your volume goes through one partner, it becomes easy to assume their price is “the market.” Without regular benchmarking and competitive sourcing for key categories, you may slowly drift above best-available pricing or miss innovative alternatives that a more diverse supplier ecosystem might surface.

There is also a softer but real risk of innovation blind spots. Supplier diversity, which procurement research shows most organizations are trying to maintain or increase, is not only about social responsibility. It is also about getting exposure to different technologies, materials, and approaches. Relying on a single channel for everything can narrow your peripheral vision.

The way to address these risks is not to abandon consolidation but to surround it with good strategy.

That includes maintaining secondary sources for critical items, keeping some categories deliberately multi-sourced, running periodic market checks, and treating your one-stop partner as a strategic collaborator who is expected to bring options and data, not just parts.

Spare Parts And MRO: The Backbone Of Any One-Stop Model

Why Spare Parts Management Comes First

In most plants I work with, the fastest wins from a one-stop procurement solution come in spare parts and MRO. Tractian describes spare parts management as everything from sourcing to storage to distribution of parts. Done right, it reduces downtime, avoids production disruptions, and supports swift response to breakdowns.

Effective spare parts management involves several elements. Inventory control techniques such as ABC analysis by consumption value and XYZ analysis by demand variability help you decide which parts justify higher stock levels and which can be ordered on demand. Lead time analysis and criticality analysis ensure that items that are both slow to obtain and essential to equipment operation are protected.

Digital tools are crucial here. Tractian, Flexaust, and others point to Computerized Maintenance Management Systems and Enterprise Asset Management Systems as the backbone for real-time stock visibility, automated reordering, and error reduction. Tractian also highlights the role of QR labels and unique identifiers in streamlining parts tracking and retrieval. When you put that together and use preventive and predictive maintenance strategies to anticipate parts demand, some industrial operators have reported maintenance cost reductions on the order of thirty percent.

This is exactly where a good one-stop partner should plug in. Instead of treating your crib as a black box, the partner’s catalog and your CMMS should speak the same language. That allows you to standardize part numbers, streamline reorders, and move toward just-in-time replenishment on selected items without sacrificing reliability.

Moving From Reactive Purchasing To Strategic Parts Procurement

SmartEquip’s comparison of parts purchasing and procurement is particularly relevant for industrial automation and controls. In a reactive model, a failed drive or I/O card triggers a scramble: calls to several vendors, ad-hoc price comparisons, often a rush shipping fee. The process is paperwork-heavy and prone to ordering errors, especially on complex assemblies or where superseded part numbers are involved.

In a strategic model, you shift from “What do I need today?” to “What is the lifecycle and risk profile of this class of components?” Maple Sourcing’s procurement guidelines, while aimed at global component sourcing, emphasize requirement analysis, clear specifications, and multi-stage quality control. Those principles apply equally when you are buying locally: ambiguous specifications and fuzzy demand forecasts are a direct path to the wrong component, redesigns, and delays.

A one-stop solution, supported by e-procurement tools, can provide serial-number-specific parts information, diagrams, and supersession management, as SmartEquip describes. This shortens the time technicians and planners spend identifying the right part and reduces ordering errors. It also enables proactive maintenance by making it easier to schedule replacements based on known failure modes or predictive condition data instead of waiting for breakage.

The key is that you are no longer optimising each purchase in isolation.

You are optimising a supply system designed to keep your automation and control hardware running with minimal friction.

What To Look For In A One-Stop Industrial Parts Partner

If you treat one-stop procurement as a strategic decision rather than a convenience, your selection criteria sharpen quickly.

First, breadth and depth of catalog matter, but they must be relevant. You want a partner that can cover your core automation and control hardware along with general MRO: sensors, controllers, circuit protection, panel components, mechanical drives, pneumatics, and the consumables that keep your technicians moving. Procurement research stresses that industrial procurement spans both direct inputs to production and indirect MRO; a good partner needs credibility in both.

Second, inventory strategy and logistics capability are non-negotiable. Flexaust highlights the value of suppliers who can ship many products within twenty-four hours from multiple U.S. locations. In practice, that means the vendor has distributed warehouse capacity, clear shipping policies, and enough inventory visibility that they are not guessing when you place an urgent order. Programs such as just-in-time delivery and automatic restocking are especially valuable for critical spares, because they let you reduce on-site inventory without flirting with stockouts.

Third, digital maturity is a core differentiator. Jabil, Amazon Business, Ivalua, and others describe a technology landscape that has moved well beyond simple online ordering. Look for capabilities such as e-procurement integration, punchout or hosted catalogs that tie into your ERP or procurement system, user-friendly portals, and robust spend analytics. Product information management tools and mobile apps, like those cited by Flexaust, are worth attention because they centralize current product data and make it easier for technicians to identify and request the correct parts.

Fourth, supplier relationship and service model are critical. Procurement literature on supplier relationship management underlines the value of regular communication, shared goals, and joint problem solving. In industrial practice, that means a partner who will sit down with maintenance, engineering, and procurement to review consumption patterns, lead times, and pain points, then adjust stocking strategies and service levels accordingly. It also means responsive technical support when specifications are unclear or alternatives are needed.

Fifth, risk, compliance, and security should be visible and verifiable. Tractian’s emphasis on certifications like SOC 2 Type II and ISO 27001 for its platform is an example of the bar you should expect from any digital vendor handling your data. Procurement best practice sources stress robust audit trails, clear approval workflows, and tools for monitoring vendor reliability and geopolitical risk. Given the documented rise in procurement fraud, it is not enough for a partner to be convenient; they must help you strengthen, not weaken, your control environment.

Finally, cultural and operational fit matter more than most RFPs acknowledge. One-stop procurement requires collaboration across maintenance, engineering, procurement, finance, and IT. If your chosen partner’s team does not engage well with your people or cannot support the way your plants operate, the relationship will remain transactional no matter how advanced their tools are.

Designing Your One-Stop Procurement Model

Selecting a partner is only half the job. The other half is shaping how one-stop procurement fits into your overall procurement strategy and plant operations.

Aligning With Your Procurement Strategy

Sievo describes a procurement strategy as a medium-to-long-term roadmap backed by policies and processes that drive cost optimization, value creation, and resource management. A solid one-stop approach needs to live inside that roadmap, not beside it.

The strategy work typically starts with a current state analysis of spend. That means understanding where your money actually goes by category, supplier, plant, and project. Spend cube analysis and similar techniques can reveal where fragmentation is highest and where consolidation with a one-stop partner would bring the most benefit.

Engaging stakeholders early is crucial. Sievo stresses that without stakeholder engagement, strategies fail. Maintenance teams may worry about losing access to preferred niche suppliers. Engineers may fear delays in getting unusual components approved. Finance may focus on invoice consolidation and payment terms. Bringing these concerns into the design phase allows you to shape the one-stop model in a way that reflects real operational needs.

Alignment with organizational goals is the next check. If your company is pursuing aggressive growth, your one-stop strategy should emphasize scalability and speed. If sustainability or supplier diversity is a priority, you may decide that the one-stop partner should handle standard catalog items while certain categories remain with specialized or diverse suppliers to meet broader ESG commitments.

Deciding What Belongs In The One-Stop Channel

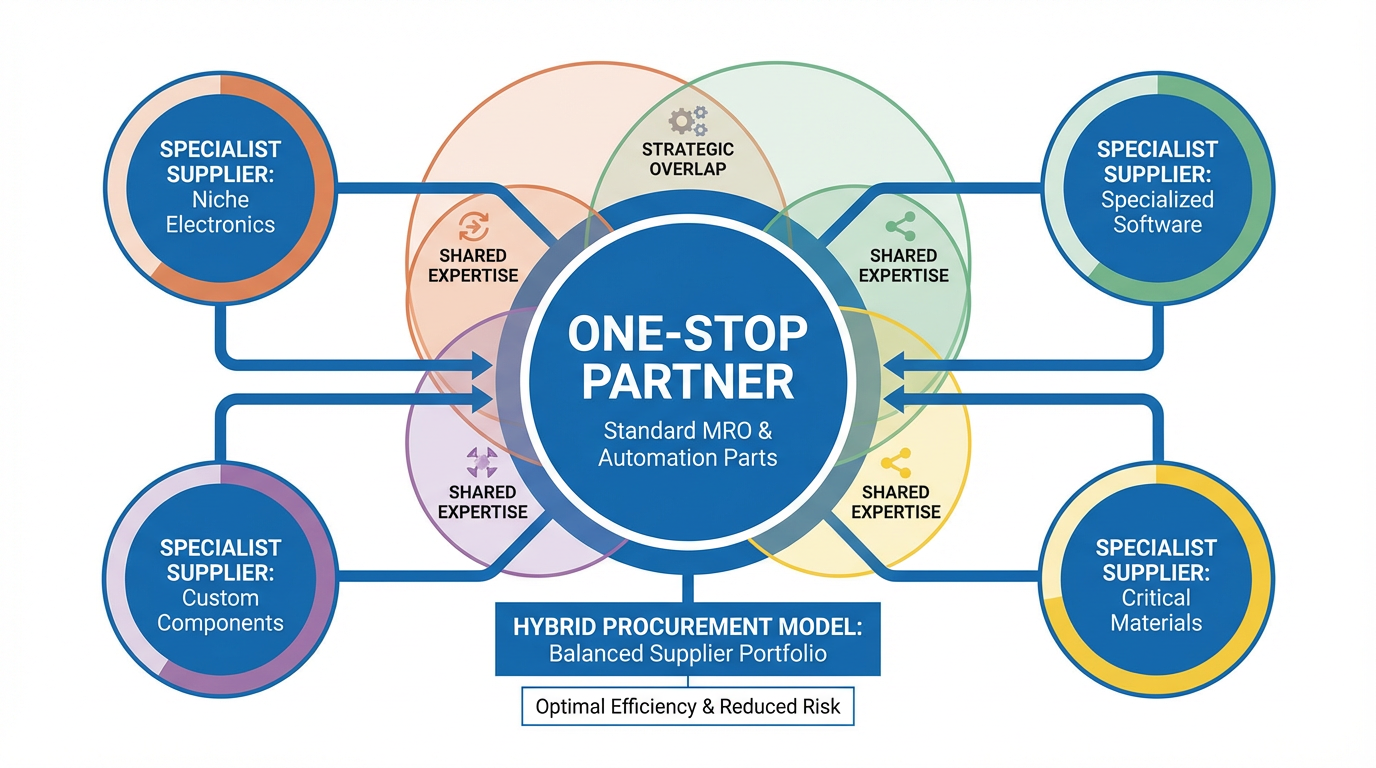

One of the most practical design decisions is scope. Trying to force every part and every supplier into a single channel is neither realistic nor wise. Procurement strategy content from Ivalua and FocalPoint distinguishes between direct and indirect procurement and between goods and services. The same lens helps here.

For many manufacturers, the one-stop channel is best suited to standard, repeatable parts and MRO items that do not differentiate your product but do impact your uptime and labor efficiency. Custom engineered systems, highly specialized process equipment, and strategic raw materials often remain under direct, category-specific management with tailored supplier relationships.

A concise way to think about the tradeoffs is laid out in the table below.

| Model | Strengths | Limitations | Typical Use Cases |

|---|---|---|---|

| Many individual suppliers | Flexibility, niche expertise, easy experimentation | High admin load, limited visibility, weaker leverage | Unique equipment, early-stage R&D parts |

| One-stop consolidated partner | Simpler processes, better data, stronger volume leverage | Over-reliance risk, potential innovation blind spots | Standard MRO, common automation and control parts |

The answer is rarely all or nothing.

Most resilient organizations use a hybrid approach: a dominant one-stop channel for standard parts, complemented by carefully managed specialist suppliers where they add clear value.

Integrating Systems, Not Just Suppliers

Centralizing spend with one partner while leaving data scattered defeats much of the purpose. Procurement efficiency research from Ramp, Veridion, and others consistently points to data centralization and digital workflows as core levers.

In practice, that means integrating your one-stop partner’s catalog and ordering system with your ERP or procurement platform, and integrating your spare parts and asset data in your CMMS or EAMS. Automated workflows for requisitions, approvals, purchase orders, receiving, and invoice matching should feed a single source of truth for contracts, pricing, and supplier performance.

Key performance indicators such as cost savings, procurement cycle time, on-time delivery, percentage of spend under management, and procurement ROI are not academic. Ramp and FocalPoint point to these metrics as the way you turn procurement from a cost center into a measurable contributor to competitive advantage. With a one-stop partner, you should be able to instrument and track these metrics more easily because the data flows through fewer pipes.

Governing And Improving Over Time

Finally, treat your one-stop procurement model as a living system. Sievo emphasizes that strategy execution requires ongoing adjustment as circumstances change. Amazon Business notes that procurement teams are increasingly using AI-powered analytics to detect anomalies and monitor tail spend. SDI and other practitioners stress continuous improvement and adaptability as key to handling market volatility and disruptions.

Practically, that means holding regular business reviews with your one-stop partner, using data rather than anecdotes. It means auditing compliance with the preferred channel, investigating why people go off-contract, and fixing process pain points rather than blaming users. It means periodically scanning the market for new suppliers or technologies, not because you plan to switch, but because you want to keep your primary partner honest and your options open.

Short FAQ

Does moving to a one-stop procurement partner mean I have to drop all my existing suppliers? No. The most robust implementations use a one-stop partner for the bulk of standard industrial parts and MRO while retaining a curated set of specialist suppliers for unique equipment, highly engineered components, or strategic categories that need direct oversight. The goal is to reduce unnecessary complexity, not eliminate all variety.

Is one-stop procurement only worth it for large manufacturers? The research and case studies often feature large or multi-site organizations because their numbers are easy to quantify, but the underlying benefits apply just as much to mid-sized plants and integrators. In smaller organizations, the same staff often wear multiple hats, so reducing supplier and system complexity can free up meaningful time for maintenance planning, engineering, or project work.

How do I justify the change to leadership? Frame it in terms that matter at the executive level: risk reduction, uptime, and financial control. Use your own data on stockouts, emergency orders, and invoice volume, then connect those to the documented benefits of consolidated spend, digital workflows, and better supplier relationships. Reference external sources that highlight cost savings, fraud reduction, and resilience gains from modern procurement practices, and present one-stop procurement as an enabler of that broader transformation rather than a standalone purchasing initiative.

In the end, a one-stop procurement solution for industrial parts is not a catalog choice; it is a system design decision. When you structure it with clear strategy, strong digital integration, and disciplined supplier management, it becomes one more engineered subsystem of your plant: predictable, maintainable, and tuned for uptime. That is the kind of procurement model you can depend on when the line is hot and the clock is ticking.

References

- https://www.maplesourcing.com/best-practices-for-industrial-component-procurement.html

- https://directsourcing.com/Blogs/Spare-parts-management.aspx

- https://blog.flexaust.com/blog/mro-purchasing-best-practices

- https://www.getfocalpoint.com/defining-procurement-management-key-concepts-and-essential-processes/

- https://procurementmag.com/procurement-strategy/top-10-procurement-strategies

- https://ramp.com/blog/procurement-efficiency

- https://sievo.com/blog/procurement-strategy

- https://www.tradogram.com/blog/guide-to-procurement-in-manufacturing

- https://www.advancedtech.com/blog/industrial-procurement-strategies/

- https://business.amazon.com/en/blog/procurement-best-practices

Keep your system in play!

Related Products

Related articles Browse All

-

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu...

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu... -

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ...

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ... -

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

Need an automation or control part quickly?

- Q&A

- Policies How to order Part status information Shipping Method Return Policy Warranty Policy Payment Terms

- Asset Recovery

- We Buy Your Equipment. Industry Cases Amikong News Technical Resources

- ADDRESS

-

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

Copyright Notice © 2004-2026 amikong.com All rights reserved

Disclaimer: We are not an authorized distributor or distributor of the product manufacturer of this website, The product may have older date codes or be an older series than that available direct from the factory or authorized dealers. Because our company is not an authorized distributor of this product, the Original Manufacturer’s warranty does not apply.While many DCS PLC products will have firmware already installed, Our company makes no representation as to whether a DSC PLC product will or will not have firmware and, if it does have firmware, whether the firmware is the revision level that you need for your application. Our company also makes no representations as to your ability or right to download or otherwise obtain firmware for the product from our company, its distributors, or any other source. Our company also makes no representations as to your right to install any such firmware on the product. Our company will not obtain or supply firmware on your behalf. It is your obligation to comply with the terms of any End-User License Agreement or similar document related to obtaining or installing firmware.

Cookies

Individual privacy preferences

We use cookies and similar technologies on our website and process your personal data (e.g. IP address), for example, to personalize content and ads, to integrate media from third-party providers or to analyze traffic on our website. Data processing may also happen as a result of cookies being set. We share this data with third parties that we name in the privacy settings.

The data processing may take place with your consent or on the basis of a legitimate interest, which you can object to in the privacy settings. You have the right not to consent and to change or revoke your consent at a later time. This revocation takes effect immediately but does not affect data already processed. For more information on the use of your data, please visit our privacy policy.

Below you will find an overview of all services used by this website. You can view detailed information about each service and agree to them individually or exercise your right to object.

You are under 14 years old? Then you cannot consent to optional services. Ask your parents or legal guardians to agree to these services with you.

-

Google Tag Manager

-

Functional cookies

Leave Your Comment