-

Manufacturers

- ABB Advant OCS and Advant-800xA

- ABB Bailey

- ABB Drives

- ABB H&B Contronic

- ABB H&B Freelance 2000

- ABB Master

- ABB MOD 300, MOD 30ML & MODCELL

- ABB Procontic

- ABB Procontrol

- ABB Synpol D

- Allen-Bradley SLC 500

- Allen-Bradley PLC-5

- Allen-Bradley ControlLogix

- Allen-Bradley CompactLogix

- Allen-Bradley MicroLogix

- Allen-Bradley PanelView

- Allen-Bradley Kinetix Servo Drive

- Allen-Bradley PowerFlex

- Allen-Bradley Smart Speed Controllers

- 3300 System

- 3500 System

- 3300 XL 8mm Proximity Transducer

- 3300 XL NSV Proximity Transducer

- 990 and 991 Transmitter

- 31000 and 32000 Proximity Probe Housing Assemblie

- 21000, 24701, and 164818 ProbeHousing Assemblies

- 330500 and 330525 Piezo-Velocity Sensor

- 7200 Proximity Transducer Systems

- 177230 Seismic Transmitter

- TK-3 Proximity System

- GE 90-70 Series PLC

- GE PACSystems RX7i

- GE PACSystems RX3i

- GE QuickPanel

- GE VersaMax

- GE Genius I/O

- GE Mark VIe

- GE Series One

- GE Multilin

- 800 Series I/O

- Modicon 984

- Modicon Premium

- Modicon Micro

- Modicon Quantum

- Telemecanique TSX Compact

- Altivar Process

- Categories

- Service

- News

- Contact us

-

Please try to be as accurate as possible with your search.

-

We can quote you on 1000s of specialist parts, even if they are not listed on our website.

-

We can't find any results for “”.

-

-

Get Parts Quote

Best Alternatives to Allen‑Bradley 1769‑L33ER CompactLogix PLC Controllers

This is my linkedin:

As a seasoned expert in the field of automation spare parts, Sandy has dedicated 15 years to Amikon, an industry-leading company, where she currently serves as Director. With profound product expertise and exceptional sales strategies, she has not only driven the company's continuous expansion in global markets but also established an extensive international client network.

Throughout Amikon's twenty-year journey, Sandy's sharp industry insights and outstanding leadership have made her a central force behind the company's global growth and sustained performance. Committed to delivering high-value solutions, she stands as a key figure bridging technology and markets while empowering industry progress.

As a systems integrator who has lived in Rockwell and non‑Rockwell plants for many years, I know the 1769‑L33ER class of CompactLogix controllers is a solid workhorse. Industrial Automation Co. describes CompactLogix as a premium‑priced platform tightly integrated with the Logix architecture and Studio 5000, delivering very good performance and strong results in real plants, such as a food and beverage site that increased efficiency by about 25% and cut energy use by roughly 15%.

That performance and ecosystem come with tradeoffs: cost, licensing, and vendor lock‑in. In supply‑constrained or cost‑sensitive projects, or when a corporate standard points toward a different vendor, teams start asking the same question you are asking now: what are the best alternatives to an Allen‑Bradley 1769‑L33ER CompactLogix‑class PLC, and how do they compare in the real world?

This article walks through that decision the way we do on actual projects. I will frame the requirements, highlight proven alternatives from Siemens, Mitsubishi, Schneider Electric, Omron, ABB, and Emerson, and draw on field results cited by sources such as Industrial Automation Co., RealPars, DoSupply, and others.

Where a CompactLogix 1769‑L33ER Typically Sits in a System

Before you pick an alternative, it helps to be clear about what you are replacing. Various sources, including RealPars and C3 Controls, define a PLC as a rugged industrial computer that repeatedly scans inputs, executes user logic, and updates outputs to control electromechanical processes. PLCs have replaced relay panels in almost every modern plant because they are more flexible, easier to maintain, and more reliable.

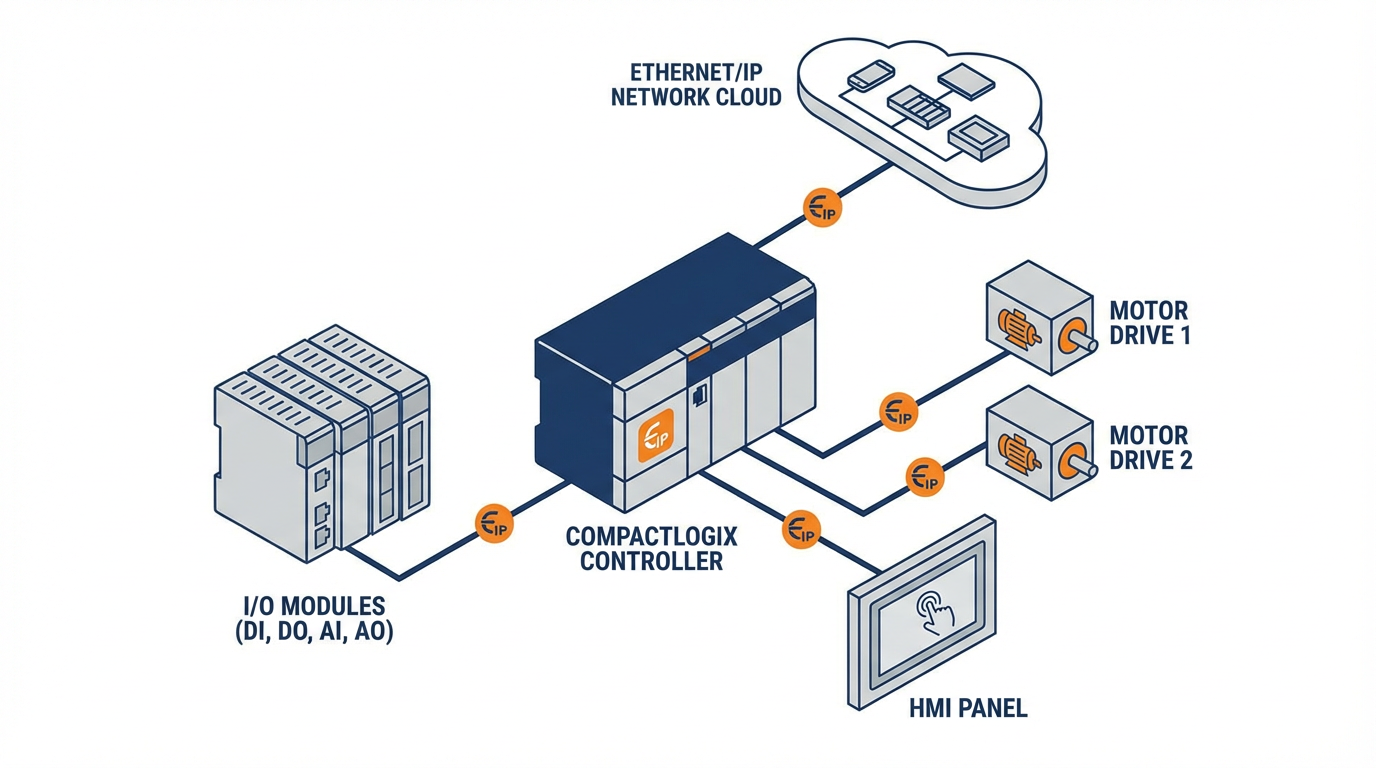

Within that universe, CompactLogix sits as a mid‑range, modular controller in the Allen‑Bradley line, usually driving a machine, a cell, or a mid‑size process area. Industrial Automation Co. notes that CompactLogix and ControlLogix share the same Logix platform and Studio 5000 software and are widely used in applications where performance, integrated motion, and tight Rockwell ecosystem alignment are priorities.

DoSupply highlights Rockwell’s ControlLogix 5580 family for high‑performance, multi‑discipline control with integrated motion and safety up to SIL3/PLe, and Industrial Automation Co. positions CompactLogix as a premium‑priced but very capable controller. In practice, a typical CompactLogix deployment gives you: modular I/O, good motion and drive integration, an IEC 61131‑3 language toolset centered on ladder logic, and native EtherNet/IP connectivity into a Rockwell HMI, SCADA, and drive ecosystem.

Any alternative should be evaluated against that role, not just against the part number.

The question is not “what looks most like a 1769‑L33ER on paper?” but rather “what platform best fits the control, communication, and lifecycle needs that this CompactLogix currently serves?”

How to Evaluate Alternatives Pragmatically

The most common mistake I see when replacing a PLC platform is focusing on CPU benchmarks or spec‑sheet trivia. A long‑running thread on Control.com about benchmarking PLCs makes the opposite case: start with application requirements, then work outward to hardware, software, and ecosystem. That advice lines up with RealPars, Maple Systems, and other training sources.

Clarify the job before the brand

Control.com’s guidance is straightforward. First, build a requirements list that covers functions, I/O types and counts, scan‑time needs, networking, diagnostics, and safety. Only then compare vendors. Maple Systems adds compatibility and scalability to the top of the list, stressing that a new PLC must integrate with your existing HMIs, drives, other controllers, and protocols, and should give headroom for future expansion.

RealPars groups the main PLC selection criteria into performance, ease of programming, scalability, integration, and total cost of ownership. That translates to a few practical questions:

If your existing CompactLogix project is dominated by high‑speed discrete logic, motion, and some analog, you need a controller family that handles tight scan times and motion well. If it is a process application with many loops and heavy data integration to MES or ERP, you care more about communications, data handling, and redundancy than microseconds per ladder instruction.

Never ignore I/O and ecosystem

The Control.com discussion also emphasizes that I/O capabilities are at least as important as the CPU. This agrees with C3 Controls and Empowered Automation, which describe the PLC as the coordinator of thousands of inputs and outputs, feeding and controlling drives, valves, sensors, vision systems, and HMIs. When you move away from CompactLogix, the practical obstacles often appear at the I/O and ecosystem layers, not the CPU.

So it is crucial to understand your mix of analog and digital points, specialty modules, safety I/O, remote racks, and third‑party devices. If you have EtherNet/IP drives, for example, moving to a vendor where EtherNet/IP is not a first‑class citizen can increase your integration work.

Non‑technical factors matter more than most spec sheets

Control.com’s experts also advise weighting local availability, vendor support, documentation quality, training, software usability, and price alongside technical capabilities. Vista Projects’ review of PLC brands makes a similar point: reliability, scalability, support, and total cost of ownership should all drive brand choice, not just the sticker price.

Industrial Automation Co.’s brand comparison shows why. Siemens, Allen‑Bradley, Mitsubishi, Schneider Electric, ABB, and Omron all have credible PLCs, but they differ in cost, support footprint, and ecosystem. Siemens and Rockwell sit at the higher end of the cost spectrum but bring powerful tools and global support. Mitsubishi and Omron come in at lower prices, but integration and engineering effort can be different. PDF Supply even notes that an Omron system can be roughly one‑tenth the cost of an equivalent Allen‑Bradley system in some cases, but warns that additional engineering time and configuration effort can erode those savings.

When I guide a plant away from CompactLogix, I start with that holistic view, not with a benchmark spreadsheet.

With that context, let’s look at the most credible alternatives by category.

Siemens SIMATIC S7‑1200 and S7‑1500: High‑End, Scalable Alternatives

Siemens SIMATIC S7 controllers are one of the strongest direct alternatives when you need performance and scalability comparable to or beyond what a CompactLogix system delivers. RealPars describes the SIMATIC S7 line as robust, modular, and highly scalable, with strong Ethernet and OPC UA interoperability.

Industrial Automation Co. notes that Siemens S7‑1200 and S7‑1500 PLCs are paired with the TIA Portal engineering environment, offer high‑speed processing and large memory, and are priced around $500 for an S7‑1200 and above $2,000 for an S7‑1500, plus accessories typically in the $300 to $1,000 range. A global automotive manufacturer cited in that same review used S7‑1500 controllers to cut production downtime by roughly 30% and improve quality control with advanced analytics.

DoSupply highlights the S7‑1500 as Siemens’ fastest PLC, with modular I/O and PROFINET networking, and command processing times down into the nanosecond range. That kind of performance makes it suitable for high‑availability, motion, and precise timing tasks normally associated with Rockwell’s high‑end controllers.

In practical terms, Siemens is a very strong alternative when your CompactLogix application is large, complex, or data‑intensive. You get modular hardware, powerful diagnostics, extensive networking, and a global support footprint. The tradeoffs are well documented. Industrial Automation Co. and RealPars both point to higher system cost and a learning curve with TIA Portal, particularly for teams coming from Studio 5000.

From an integrator’s perspective, S7‑1200 is a good candidate where you might otherwise use a smaller CompactLogix or MicroLogix, while S7‑1500 is the closest Siemens counterpart to a high‑end CompactLogix or even a lower‑end ControlLogix in larger systems.

Mitsubishi MELSEC FX5U and iQ‑F: Cost‑Effective Machine‑Level Alternatives

If your 1769‑L33ER is driving a single machine or a compact line, and cost reduction is a priority, Mitsubishi’s MELSEC family is a serious contender. RealPars describes Mitsubishi MELSEC as a cost‑effective and reliable PLC line well suited to small and mid‑sized systems, with the caveat that scalability and integration with non‑Mitsubishi protocols can be more limited than some higher‑end platforms.

DoSupply profiles the MELSEC iQ‑F series as a next‑generation compact PLC with a high‑speed CPU, ladder instruction execution in tens of nanoseconds, support for multiple IEC 61131‑3 languages, high‑speed counters, and built‑in networking such as RS‑232, RS‑485 or RS‑422, and CC‑Link. This profile matches many CompactLogix applications where scan time and machine throughput are critical.

Industrial Automation Co. notes that Mitsubishi Electric PLCs emphasize compact modular design and high‑speed processing, with base systems starting around $300 and expanding with I/O up to about $1,500. They cite a packaging company that adopted Mitsubishi FX5U PLCs, scaled out packaging lines using modular expansion, and achieved an output increase of roughly 20% within six months.

Compared with a CompactLogix 1769‑L33ER, Mitsubishi FX‑class controllers often deliver more performance than the application truly needs at a lower purchase cost. Where they differ is in ecosystem. Rockwell’s Logix environment offers a tightly integrated world of Allen‑Bradley drives, safety, and HMI. Mitsubishi offers strong integration with its own drives and motion, but if you rely heavily on third‑party EtherNet/IP devices or Rockwell‑specific features, you will need to plan for protocol gateways and different engineering workflows.

In projects where I have replaced mid‑range CompactLogix controllers with MELSEC for cost reasons, the transitions have gone best when the machines were relatively self‑contained and the surrounding plant systems did not depend on deep Rockwell integration.

Schneider Electric Modicon M221, M241/M251, and M580: Connectivity and Energy Focus

Schneider Electric’s Modicon line is one of the original PLC families, with more than five decades of history. RealPars describes Modicon as versatile, scalable, and easy to integrate with other systems, though it notes that raw performance may be only moderate compared with the very fastest platforms.

Industrial Automation Co. characterizes Schneider Modicon PLCs as focusing on reliability, energy efficiency, and connectivity, with strong Ethernet and Modbus support and deep integration into the EcoStruxure IoT platform. They note that base Modicon units start near $400, while IoT‑enabled systems can exceed $2,000. In a renewable energy application, a company using Modicon M580 PLCs on wind turbines increased energy output by about 12% and reduced downtime through predictive maintenance.

DoSupply adds detail on the Modicon M221, which targets small machine control with onboard digital and analog I/O, relay outputs, USB, SD card, serial ports, and Ethernet, plus support for safety I/O and expansion modules. That makes M221 a practical alternative for compact machines currently running smaller CompactLogix units.

In the mid‑range, M241 and M251 models, described by PLC Department and Schneider sources, are aimed at a variety of industrial applications and small‑scale automation projects, with powerful processors, broad I/O options, and advanced diagnostics. At the upper end, M580 platforms handle larger and more connected systems.

If your CompactLogix application needs strong Ethernet and Modbus connectivity, energy monitoring, and an IoT‑ready framework, Schneider is a logical candidate. The cost range overlaps with CompactLogix depending on configuration, but Modicon’s focus on connectivity and energy performance can tip the lifecycle economics in its favor, especially in energy‑intensive plants.

When we move a Rockwell‑based cell into a Schneider‑standard plant, the biggest adjustment is usually the software environment and diagnostics philosophy, not the capabilities themselves. The Modicon lineup covers the same broad ground from small machines to large systems that CompactLogix and ControlLogix do in Rockwell’s world.

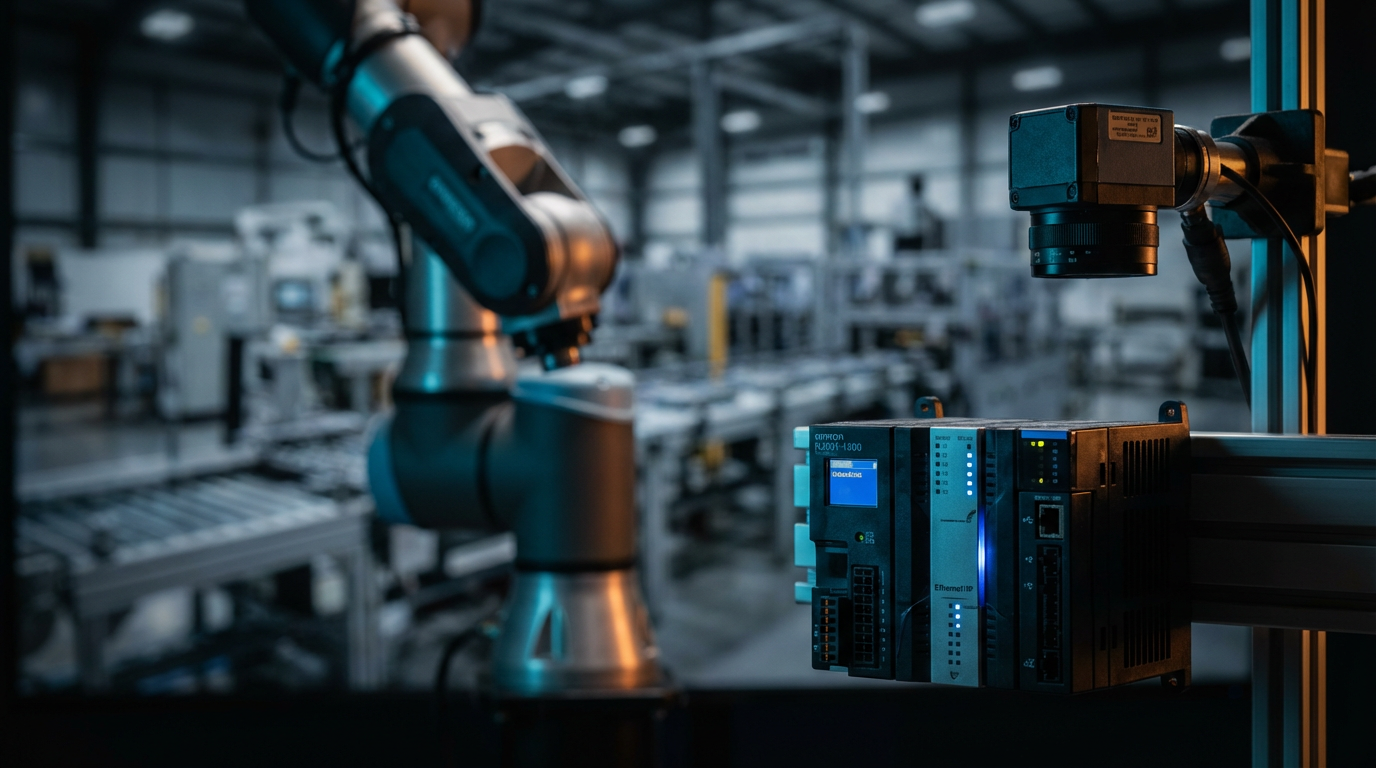

Omron CP, CJ, CS, NX, and NJ: Strong for Motion, Robotics, and Vision

Omron is often overlooked in North American plants that have standardized on Rockwell or Siemens, but several sources make a strong case for Omron as an alternative in machine‑centric and motion or vision‑heavy applications.

The Facebook‑based PLC Programmer Automation Engineer resource highlights Omron platforms such as CP1E, CJ2, NX1P, and NJ as emphasizing easy integration with sensors, safety systems, and vision or robotics, with support for networks like EtherCAT, EtherNet/IP, Modbus TCP/IP, and PROFIBUS. PEKO Precision notes that Omron PLCs are recognized for durability and accuracy across series like NX, NJ, CX, CP, CJ, and CS, and are frequently used in custom machinery.

DoSupply’s review of Omron’s CS1 series describes a modular, rack‑mounted PLC for medium to large systems, with fast CPU options, extensive digital and analog I/O capacity into the thousands of points, and broad communications including EtherNet/IP and EtherCAT via couplers, making it suitable for complex motion, robotics, machine vision, and Industry 4.0 deployments.

PDF Supply compares Omron with Allen‑Bradley and points out that Omron’s portfolio spans compact brick PLCs, modular controllers, and high‑end motion platforms. It notes that Omron systems can cost as little as roughly one‑tenth of an equivalent Allen‑Bradley solution when you include hardware and software, though it warns that this apparent savings can be offset by added engineering time and configuration effort using tools such as CX‑Programmer.

For teams coming from CompactLogix, Omron offers several advantages. It supports standard IEC 61131‑3 languages, including ladder and structured text, integrates tightly with Omron’s own robots, safety, and vision hardware, and offers cost‑effective hardware. The tradeoffs are primarily in engineering familiarity and regional support expectations. In regions where Allen‑Bradley is dominant, Rockwell’s training and support ecosystem is very strong. With Omron, you need to ensure that your internal team or integration partner has the experience to avoid that hidden engineering cost PDF Supply calls out.

In my experience, Omron is an excellent CompactLogix alternative when you are already using Omron sensors, safety components, or robotics, or when you are building new machine designs and can standardize on Omron across the stack.

ABB AC500: Harsh‑Environment and Heavy‑Industry Alternative

ABB’s AC500 family is designed for industrial environments where robustness, wide temperature and vibration tolerances, and integration with heavy equipment are more important than a particular programming environment. The PLC Programmer Automation Engineer resource and PEKO’s brand survey both note ABB as a long‑standing automation vendor with a scalable AC500 PLC series widely used in utilities, robotics, and marine applications.

Industrial Automation Co. places ABB in the mid‑to‑high cost bracket, from roughly $800 to more than $3,000 for heavy‑industry systems, but emphasizes its strong diagnostics and suitability for harsh environments. They highlight a mining operation using ABB PLCs, where equipment failures were reduced by about 40%. DoSupply echoes this characterization by pointing out that AC500 provides broad I/O, networking, and performance options intended to cover small, medium, and high‑end automation, including high availability, condition monitoring, motion, and integrated safety.

If your 1769‑L33ER is deployed in a demanding environment, such as mining, oil and gas, or marine systems, and reliability under harsh conditions is your primary concern, ABB AC500 is a serious rival. It is also a good fit when your plant already employs ABB drives, robots, or power systems, because integration and support align naturally.

Emerson RX3i: High‑Availability Alternative for Process and Hybrid Plants

Emerson’s RX3i PACSystem is another alternative when the CompactLogix is part of a larger process or hybrid automation system that needs high availability and integrated control. DoSupply describes RX3i as a rack‑based PLC platform emphasizing high availability and flexibility, using reflective memory for integrated logic, process, motion, and HMI, hot‑swappable modular I/O, advanced diagnostics, and high‑speed Ethernet protocols with bump‑less switchover for critical applications.

In a scenario where a CompactLogix controller is currently performing both process and discrete control with high uptime requirements, RX3i can offer a more process‑centric control layer while still handling discrete tasks. It becomes especially attractive in plants where Emerson DCS or SCADA infrastructure is already in place.

From a project perspective, the decision to move from CompactLogix to RX3i is usually driven by a plant‑wide architecture strategy more than by one‑for‑one CPU replacement. If your corporate standard is shifting toward Emerson, this platform is the natural endpoint for a phased migration.

Side‑by‑Side Comparison

The following table summarizes how these alternatives stack up against a CompactLogix‑class controller, based on the cited sources.

| Platform family | Typical role vs CompactLogix | Notable strengths from sources | Primary cautions from sources |

|---|---|---|---|

| Siemens S7‑1200/S7‑1500 | High‑end alternative for complex, large, or data‑intensive systems | High performance, modularity, large memory, powerful TIA Portal tools; real deployments report downtime reductions around 30 percent | Higher hardware and tool cost; TIA Portal learning curve, especially for teams steeped in Studio 5000 |

| Mitsubishi MELSEC FX/iQ‑F | Cost‑effective alternative for machines and compact lines | High‑speed CPU, compact form factor, built‑in networking; case studies show output gains around 20 percent at lower entry cost | Scalability and non‑Mitsubishi protocol integration can be more limited; engineering team must be comfortable with MELSOFT tools |

| Schneider Modicon M221/M241/M251/M580 | Flexible alternative for connected machines and energy‑focused plants | Strong Ethernet and Modbus support, EcoStruxure IoT integration; documented energy output gains about 12 percent with predictive maintenance | Raw performance only moderate compared with the very fastest PLCs; software environment and diagnostics differ from Rockwell standards |

| Omron CP/CJ/CS/NX/NJ | Alternative with strong motion, robotics, and vision integration | Tight integration with Omron sensing, safety, and robotics; broad network support; significantly lower hardware and software cost in some comparisons | Potentially higher engineering and configuration effort; support depth and familiarity vary by region and partner |

| ABB AC500 | Alternative for harsh environments and heavy industry | Rugged hardware, advanced diagnostics, broad networking and safety; reductions in equipment failures around 40 percent in documented cases | Hardware cost in the mid‑to‑high range; ecosystem and tools differ sharply from Rockwell, so training and migration planning are essential |

| Emerson RX3i | Alternative for high‑availability process and hybrid systems | Reflective memory, hot‑swappable I/O, advanced redundancy and diagnostics; strong fit with Emerson ecosystems | Typically chosen as part of a plant‑wide architecture shift rather than a simple drop‑in replacement; higher engineering and migration overhead |

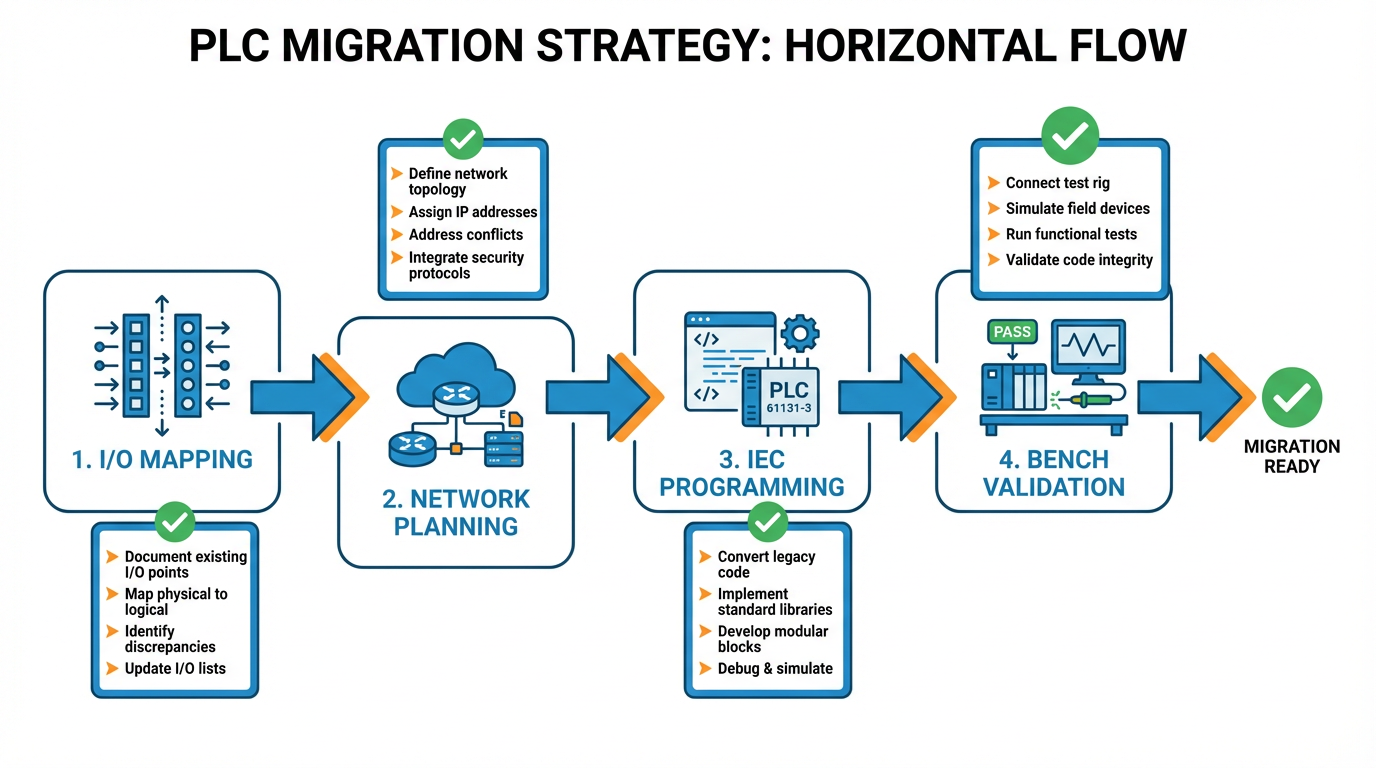

Migration Strategy: How to Move Off CompactLogix without Regret

Choosing an alternative PLC family is only half the battle. The way you execute the migration determines whether your first non‑Rockwell project becomes a success story or a cautionary tale.

Protect your I/O and field devices

Maple Systems emphasizes that I/O strategy should be driven by the application, and C3 Controls reminds us that PLCs are largely about orchestrating vast numbers of inputs and outputs. When replacing a CompactLogix, I always start with the I/O map and field devices. You need to verify that the new platform supports the analog ranges, digital signal levels, high‑speed counters, and specialty modules your process uses.

Where possible, keep field wiring intact and adapt at the rack level through I/O modules or remote I/O nodes. This reduces downtime and risk. If your existing system uses safety I/O or integrated safety logic, pay particular attention, because Rockwell’s GuardLogix and CompactLogix safety architectures may not map directly to a new vendor’s safety model. DoSupply’s description of redundant and safety‑rated architectures in both Rockwell and Omron is a reminder to match not just functionality but also certification and response behavior.

Plan for networks and higher‑level systems

Inductive Automation and Empowered Automation both highlight the central role of PLCs in modern SCADA, MES, and ERP architectures. Many systems now expose PLC data into enterprise platforms, and the PLC communicates over protocols like EtherNet/IP, Modbus, PROFINET, and OPC UA. RealPars stresses integration as a key PLC selection criterion, and Vista Projects underlines the importance of compatibility with industry standards and communication protocols.

When you move away from CompactLogix, you must preserve these data flows. If your SCADA or MES talks to the PLC over EtherNet/IP, you can either choose a platform with native EtherNet/IP support, as some Omron and ABB devices offer, or plan for protocol conversion via gateways or supervisory software. If you are moving to a platform with strong OPC UA or PROFINET support, such as Siemens or Schneider, it may make sense to reshape the architecture at the same time instead of forcing a perfect emulation of the old communication patterns.

Leverage IEC 61131‑3 languages, not vendor‑unique tricks

C3 Controls and Inductive Automation both point to the IEC 61131‑3 standard and the major languages it defines, such as ladder logic, function block diagram, structured text, and sequential function charts. Most modern PLCs across the vendors described here support at least ladder and one or more of the other IEC languages.

That common ground is your friend. During migration, avoid relying on vendor‑specific instruction blocks or proprietary function blocks unless absolutely necessary. Instead, refactor control logic into standard IEC representations. This makes testing easier and reduces the next migration’s effort. Maple Systems notes that software capabilities such as online editing, simulation, cross‑referencing, and reusable function block libraries are major differentiators. Select a platform whose engineering tools support that modular, standard‑conforming style of programming.

Treat bench testing as a validation tool, not a selection crutch

The Control.com benchmarking discussion is clear that bench testing is rarely useful as the primary selection method. However, once you have chosen an alternative family based on real requirements, a limited bench setup is a good way to validate specific features that matter to your plant: particular motion profiles, safety responses, or communication behaviors.

Use that bench work to prove out the migration pattern, especially when you move a line that has been stable on CompactLogix for years.

Validate interlocks, safety behavior, and abnormal scenarios, not just the happy path.

When Staying with CompactLogix Still Makes Sense

Although this article focuses on alternatives, a balanced decision sometimes concludes that staying in the Rockwell ecosystem is the best option. Industrial Automation Co. and RealPars both point out that Siemens and Allen‑Bradley sit at the top end in performance and ecosystem maturity, with Rockwell particularly strong in North America. Vista Projects and the PLC Programmer Automation Engineer resource indicate that regional dominance and ecosystem fit are valid reasons to choose or retain a platform.

If your plant is heavily standardized on Rockwell, technicians are trained on Studio 5000, and your lines already use Integrated Motion over EtherNet/IP and Rockwell safety systems, the total cost of switching vendors can outweigh the savings from lower‑cost hardware. In that situation, it may be better to renegotiate pricing, optimize licensing, or reallocate CompactLogix hardware where it delivers the most value, rather than replacing it outright.

Short FAQ

How do I decide which alternative is “closest” to a 1769‑L33ER?

There is no single closest equivalent, because applications differ. Use RealPars’ criteria: focus on performance, programming ease, scalability, integration, and total cost. Siemens S7‑1200 or S7‑1500 often match or exceed CompactLogix in performance and scalability. Mitsubishi MELSEC and Omron platforms may match the functional needs at lower cost, especially for small and mid‑sized systems. Schneider and ABB shine when connectivity, energy performance, or harsh environments dominate your requirements.

Can I reuse my existing HMIs and SCADA when moving away from CompactLogix?

Often you can, but the details matter. Inductive Automation and Empowered Automation describe PLCs as data sources feeding higher‑level systems via industrial networks. If your HMI or SCADA can talk to the new PLC over a supported protocol such as Modbus, PROFINET, or OPC UA, integration is straightforward. When systems are tightly tied to EtherNet/IP and Rockwell‑specific tags, you may need protocol gateways or SCADA reconfiguration. Map out every connection to the existing CompactLogix and validate how each will be handled with the new platform before committing.

Is a lower hardware price always worth the switch from CompactLogix?

The research says no. Industrial Automation Co., RealPars, and PDF Supply all warn against judging solely on sticker price. PDF Supply notes that while Omron hardware and software can be dramatically cheaper than Allen‑Bradley in some comparisons, additional engineering and configuration time can offset those savings. Vista Projects emphasizes total cost of ownership, including installation, maintenance, and upgrades. A disciplined comparison must include engineering effort, downtime during migration, training, and long‑term support, not just hardware cost.

When is it better to move from a PLC like CompactLogix to a more DCS‑style system?

L&S Electric’s discussion of PLC versus DCS systems explains that PLCs excel at fast, discrete, sequence‑based control, while DCS architectures favor large, continuous processes with thousands of I/O points and plant‑wide coordination. If your CompactLogix is currently stretched across many process areas, handling numerous loops and heavy integration, it may be more appropriate to shift toward a DCS‑style or high‑availability PAC platform, such as Emerson RX3i or a full DCS, rather than simply swapping to another mid‑range PLC.

In every CompactLogix replacement I have seen succeed, the team treated the 1769‑L33ER not as a commodity part number to swap, but as a bundle of requirements to understand and improve. If you start from that mindset, use the selection criteria described by Control.com, RealPars, and Maple Systems, and choose among the proven platforms from Siemens, Mitsubishi, Schneider Electric, Omron, ABB, and Emerson, you can move off CompactLogix confidently and end up with a system that is easier to support, better aligned with your standards, and ready for the next decade of automation demands.

References

- https://www.nrc.gov/docs/ml0635/ml063530382.pdf

- https://www.automationdirect.com/programmable-logic-controllers?srsltid=AfmBOopIlCVNiDRiJ-0LvNFKWn0v934nKUsn9p1KZKoC2ZfzcyG66gX0

- https://www.empoweredautomation.com/the-role-of-automation-plc-in-modern-industrial-systems

- https://www.c3controls.com/white-paper/back-to-plc-basics-guide-programmable-logic-controller?srsltid=AfmBOoo8U342eiGuoMq_z1KB1cJvqjlcAdlMRkfKD7GvzX9Oz30S46Vc

- https://www.inf-ind.com/post/comparing-major-plc-brands-allen-bradley-vs-schneider-electric-for-control-solutions

- https://maplesystems.com/10-things-to-consider-when-choosing-new-plc/?srsltid=AfmBOoo-iH7n4RpC22UVHx3PGXpT5jUilbaQNpLzsOcFWIfheSwhDDts

- https://www.realpars.com/blog/right-plc-for-process-control

- https://www.vistaprojects.com/best-plc-brands-for-industrial-automation/

- https://inductiveautomation.com/resources/article/what-is-a-PLC

- https://industrialautomationco.com/blogs/news/top-10-plc-features-every-engineer-should-know?srsltid=AfmBOorwJG5tZLru29HQoVVY3yNmfr6Tq1JKkPIMecSxjFlsqb7lw1--

Keep your system in play!

Related Products

Related articles Browse All

-

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu...

amikong NewsSchneider Electric HMIGTO5310: A Powerful Touchscreen Panel for Industrial Automation2025-08-11 16:24:25Overview of the Schneider Electric HMIGTO5310 The Schneider Electric HMIGTO5310 is a high-performance Magelis GTO touchscreen panel designed for industrial automation and infrastructure applications. With a 10.4" TFT LCD display and 640 x 480 VGA resolution, this HMI delivers crisp, clear visu... -

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ...

BlogImplementing Vision Systems for Industrial Robots: Enhancing Precision and Automation2025-08-12 11:26:54Industrial robots gain powerful new abilities through vision systems. These systems give robots the sense of sight, so they can understand and react to what is around them. So, robots can perform complex tasks with greater accuracy and flexibility. Automation in manufacturing reaches a new level of ... -

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

BlogOptimizing PM Schedules Data-Driven Approaches to Preventative Maintenance2025-08-21 18:08:33Moving away from fixed maintenance schedules is a significant operational shift. Companies now use data to guide their maintenance efforts. This change leads to greater efficiency and equipment reliability. The goal is to perform the right task at the right time, based on real information, not just ...

Need an automation or control part quickly?

- Q&A

- Policies How to order Part status information Shipping Method Return Policy Warranty Policy Payment Terms

- Asset Recovery

- We Buy Your Equipment. Industry Cases Amikong News Technical Resources

- ADDRESS

-

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

32D UNITS,GUOMAO BUILDING,NO 388 HUBIN SOUTH ROAD,SIMING DISTRICT,XIAMEN

Copyright Notice © 2004-2026 amikong.com All rights reserved

Disclaimer: We are not an authorized distributor or distributor of the product manufacturer of this website, The product may have older date codes or be an older series than that available direct from the factory or authorized dealers. Because our company is not an authorized distributor of this product, the Original Manufacturer’s warranty does not apply.While many DCS PLC products will have firmware already installed, Our company makes no representation as to whether a DSC PLC product will or will not have firmware and, if it does have firmware, whether the firmware is the revision level that you need for your application. Our company also makes no representations as to your ability or right to download or otherwise obtain firmware for the product from our company, its distributors, or any other source. Our company also makes no representations as to your right to install any such firmware on the product. Our company will not obtain or supply firmware on your behalf. It is your obligation to comply with the terms of any End-User License Agreement or similar document related to obtaining or installing firmware.

Cookies

Individual privacy preferences

We use cookies and similar technologies on our website and process your personal data (e.g. IP address), for example, to personalize content and ads, to integrate media from third-party providers or to analyze traffic on our website. Data processing may also happen as a result of cookies being set. We share this data with third parties that we name in the privacy settings.

The data processing may take place with your consent or on the basis of a legitimate interest, which you can object to in the privacy settings. You have the right not to consent and to change or revoke your consent at a later time. This revocation takes effect immediately but does not affect data already processed. For more information on the use of your data, please visit our privacy policy.

Below you will find an overview of all services used by this website. You can view detailed information about each service and agree to them individually or exercise your right to object.

You are under 14 years old? Then you cannot consent to optional services. Ask your parents or legal guardians to agree to these services with you.

-

Google Tag Manager

-

Functional cookies

Leave Your Comment